Can Trump Increase Productivity Without Increasing Inflation?

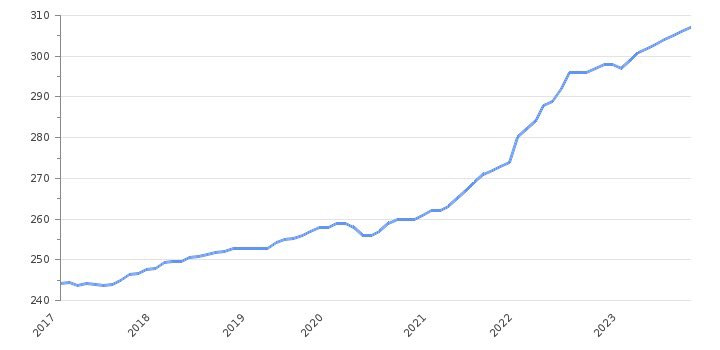

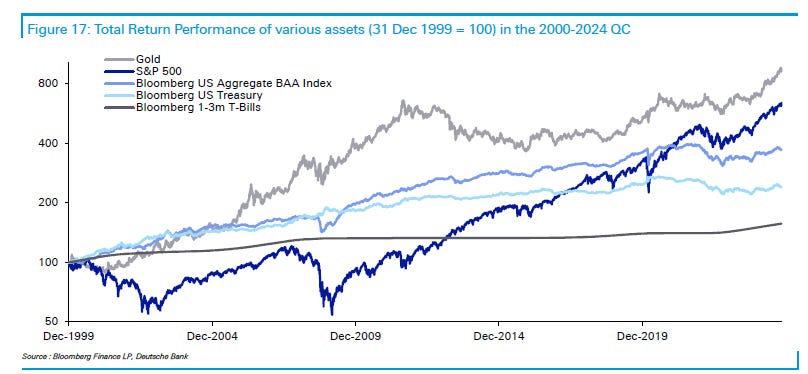

To investors, Inflation has been one of the most important determining factors for financial returns over the last 5 years. I expect that it will be the single most important thing over the next decade as well. We are going to get the latest CPI report later today, but before we dig into that I want to give some context that is worth understanding. First, everyone focuses on the CPI number that measures year-over-year growth of inflation. The average consumer doesn’t care about this number because it is not indicative of what the consumer feels in their life day-to-day. To understand the real impact to the consumer we must look at the cumulative inflation metric. This cumulative measurement is showing an increase of more than 21% in consumer goods from 2020 till today. Economists like to claim victory when the year-over-year number is dropping, but consumers know prices never come back down. Grocery bills stay high and so does any other consumer good that saw prices increase in the last 5 years. Inflation doesn’t only hurt the consumer. Investors can see their real returns diminish when inflation pushes higher. Bloomberg’s Market Daily team sounded the alarm this morning by writing:

Why does this matter now? Why should investors pay attention to the current inflation environment? Today’s CPI report is expected to come in at 2.6%, which is an increase from the 2.4% that was reported last month. This increase in inflation would signal the Fed’s challenge with claiming victory on the inflation fight at the moment. You don’t get a trophy if inflation is 30% higher than your started target of 2% inflation. In addition, critics of incoming President Donald Trump’s economic policies worry that his proposed plan could help to reignite inflation to higher levels. If this was to happen, Trump’s plan could be the gasoline on top of an inflation fire that is already burning. The good news is that inflation can be solved, regardless of how bad it is. Dr. Eli David points to Argentina as a great example — “In under a year, Javier Milei reduced Argentina's inflation from 25% to under 3%. This is what happens when you aggressively and mercilessly cut public sector spending. Elon Musk will do the same to the US.” So the big hope for consumers and investors is that Trump’s administration can simultaneously spur economic growth with pro-business policies, while aggressively cutting government spending. We heard promises on the campaign trail from him on both fronts. Yesterday Trump acted on one important promise — he nominated Vivek Ramaswamy and Elon Musk to lead the newly created Department of Government Efficiency (DOGE). The promise of the organization is to ruthlessly slash government waste and force the political class to more intelligently spend taxpayer dollars. If you are looking for concrete plans of action, Elon tweeted last night “all actions of the Department of Government Efficiency will be posted online for maximum transparency. Anytime the public thinks we are cutting something important or not cutting something wasteful, just let us know! We will also have a leaderboard for most insanely dumb spending of your tax dollars. This will be both extremely tragic and extremely entertaining.” Elon is right on one thing — based on the early decisions, the new administration is going to be entertaining. We will see how effective they can be. America is in a precarious position. We need to spur economic growth and prevent inflation from returning. Cut government spending, increase private sector production. The balancing act is difficult. But it looks like the new administration is going to take their best shot at achieving success. Regardless of who you voted for, all Americans should rally around the administration to do our best to have them succeed. It is time to build. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management Anthony & Polina Pompliano Discuss Bitcoin To $100,000 and Various Current Events Affecting The Economy Polina Pompliano, Author of ‘Hidden Genius’ and Founder of The Profile, and Anthony Pompliano, Author of ‘How To Live An Extraordinary Life’ and CEO of Professional Capital Management, discuss bitcoin hitting all-time highs, where it is heading, Elon Musk, Trump tax cuts, balancing the budget, Kamala Harris campaign spending, Gary Gensler, and regulatory environment. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. Invite your friends and earn rewardsIf you enjoy The Pomp Letter, share it with your friends and earn rewards when they subscribe. |

Older messages

What Is Bitcoin Telling Us As It Goes Higher?

Tuesday, November 12, 2024

Listen now (3 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Podcast app setup

Tuesday, November 12, 2024

Open this on your phone and click the button below: Add to podcast app

Bitcoin Hits New All-Time High & Wall Street Is More Interested

Monday, November 11, 2024

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Podcast app setup

Friday, November 8, 2024

Open this on your phone and click the button below: Add to podcast app

Stocks, Energy, Bitcoin, and Degenerate Economy Are Up Big With Trump Incoming

Thursday, November 7, 2024

Listen now (2 mins) | 🚨 READER NOTE: Next Tuesday, I am hosting a free webinar for anyone who wants to learn more about Bitcoin self-custody. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these