The Pomp Letter - Unpacking Bitcoin's CAGR & Volatility

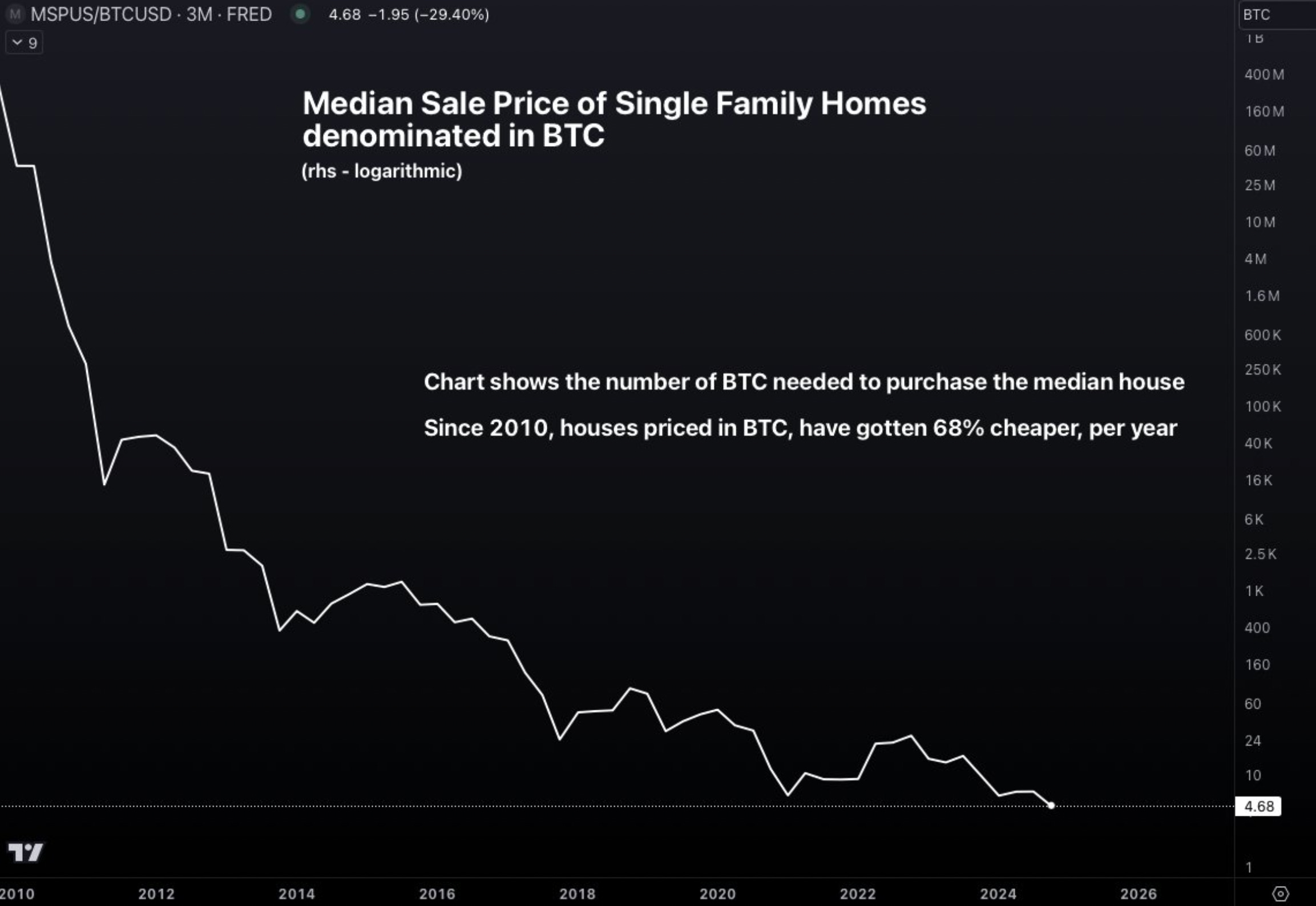

To investors, I was interviewed by Fox Business’ Charles Gasparino yesterday at the 10X Wealth Conference in Miami, Florida. One of the topics we spent time on was bitcoin’s volatility. This is a common critique used by traditional market participants, but those critiques led me to think more deeply about the pros/cons of bitcoin’s volatility. I should start by saying young investors today should be known as the Volatility Generation. They seek out volatility more than those who came before them, while also being blessed to live in a time where financial markets were highly volatile. Volatility is not good or bad. People like volatility when it goes in their favor (ex: you are holding a stock and the stock is volatile to the upside) and they hate volatility when it goes against them. Next, volatility can have a profound impact on individuals and their financial life. Take US housing priced in bitcoin — we have seen a 99% reduction in the last 8 years to home prices when they are denominated in the digital currency. A self-described “macro nerd” and “capital market enthusiast” shared this chart on Twitter, which hammers home how insane this price reduction has been (remember this is in log!): This chart is backwards looking, but what if we take the information and apply it to the future? Thankfully, we can take a look at Mark Harvey’s work for this exact answer. Mark writes:

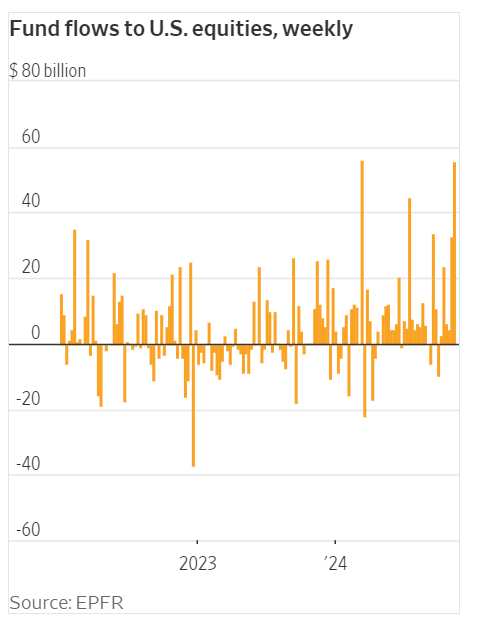

These numbers are wild to think about — bitcoin would end up between $782,000 - $5.2 million in the next decade according to the worst CAGR or the current CAGR. I am not predicting either of those prices, but rather explaining what the data says. Now here is the most interesting question — will the compound annual growth rate of bitcoin slow down or accelerate in the coming years? You can see in the chart above that the CAGR has been dropping since 2016. The easy answer is that an asset’s CAGR will drop as the asset gets bigger. But there are two data points that are worth considering for the counter-argument — investor interest and size of capital pools. On the investor interest side, Wall Street Journal’s Gunjan Banerji recently tweeted:

Record investor interest levels in stocks is bound to have an impact on bitcoin. Some of that exuberance will make its way to the more asymmetric asset, which could drive bitcoin’s CAGR higher in the short-term. Additionally, the size of capital pools allocating to bitcoin are changing. We used to see individuals and family offices as the main buyer. Last cycle we started to see corporations. And this cycle is already driven by large financial institutions such as Blackrock, Fidelity, Franklin Templeton, and others. Eventually we will see countries and central banks buying bitcoin as well. These large capital pools mean a strong tailwind for the asset, which could also drive the CAGR higher. So what do I think? The two points I bring up—investor interest and size of capital pools—are unlikely to accelerate bitcoin’s CAGR over the long-run. Instead, I could see those tailwinds helping to prevent the decay of the CAGR for longer than we would otherwise see. Crypto investors are jaded. They forget that a 50% CAGR in traditional markets would be INSANE. If we can keep that rate going for another 5-10 years, there will be material wealth generated for any bitcoin holder, regardless of how many bitcoin they hold. This is the best case scenario in my opinion. But my base case remains unchanged — I would expect bitcoin’s volatility to decrease, along with the compound annual growth rate, as we look out to the next 3-5 years. It is very hard for assets to gain substantial market cap and keep growing at the same growth rate. I don’t think bitcoin will be special in this department. So the good news is that bitcoin is going to do very well in the future. The asset is likely going to be worth hundreds of thousands of dollars in the next few years. The only thing investors need to do is buy some bitcoin and chill. Don’t outsmart yourself. Don’t try to trade. Don’t get cute. Just let the asset do what it was designed to do. Number Go Up technology is a real thing. I wouldn’t want to bet against it. Hope you all have a great start to your week. I’ll talk to everyone tomorrow. -Anthony Pompliano Founder & CEO, Professional Capital Management Anthony Pompliano on Fox Business Discussing The Bitcoin Strategic Reserve Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. Invite your friends and earn rewardsIf you enjoy The Pomp Letter, share it with your friends and earn rewards when they subscribe. |

Older messages

Podcast app setup

Sunday, November 17, 2024

Open this on your phone and click the button below: Add to podcast app

The Fed locked us out of the housing market, Satoshi gave us a new set of keys.

Saturday, November 16, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Can Trump Increase Productivity Without Increasing Inflation?

Friday, November 15, 2024

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What Is Bitcoin Telling Us As It Goes Higher?

Tuesday, November 12, 2024

Listen now (3 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Podcast app setup

Tuesday, November 12, 2024

Open this on your phone and click the button below: Add to podcast app

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these