Hot in Enterprise IT/VC - What’s 🔥 in Enterprise IT/VC #421

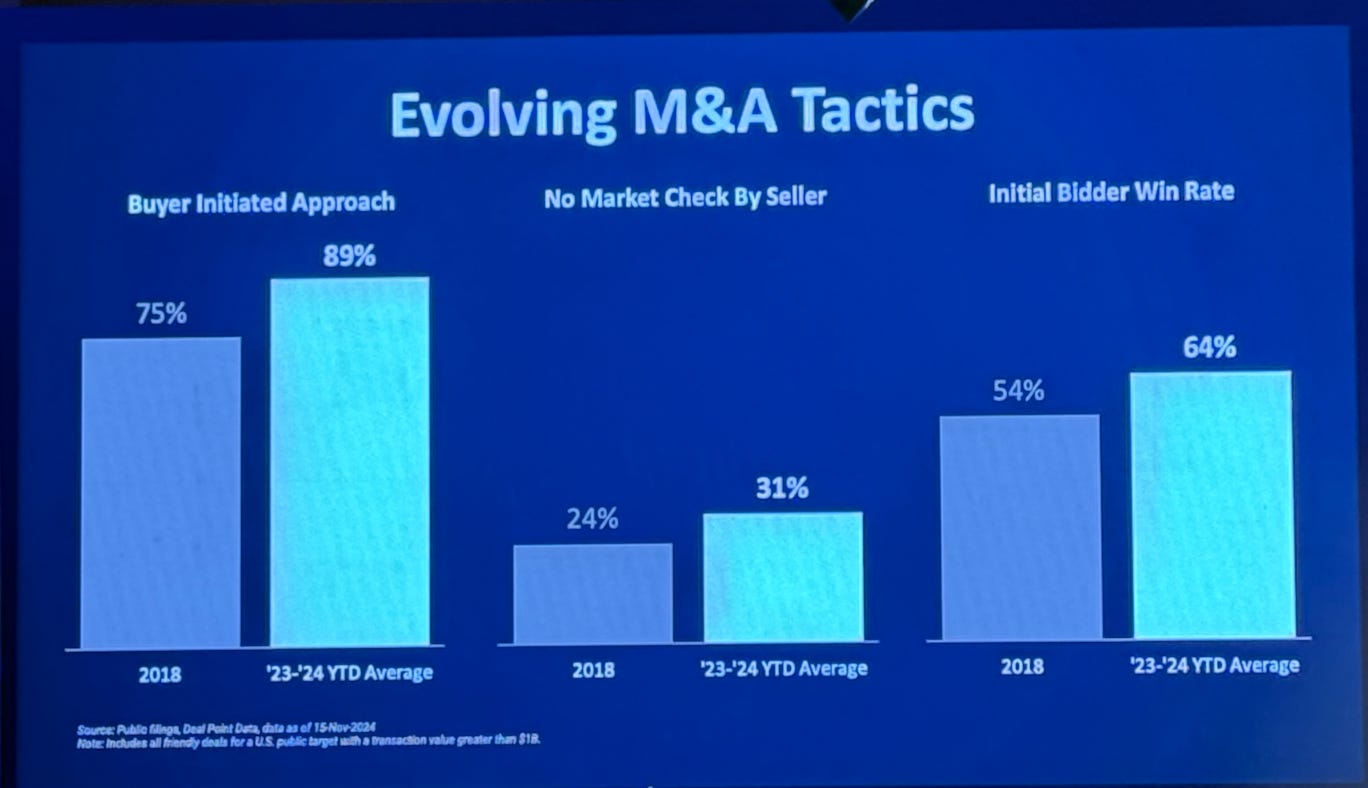

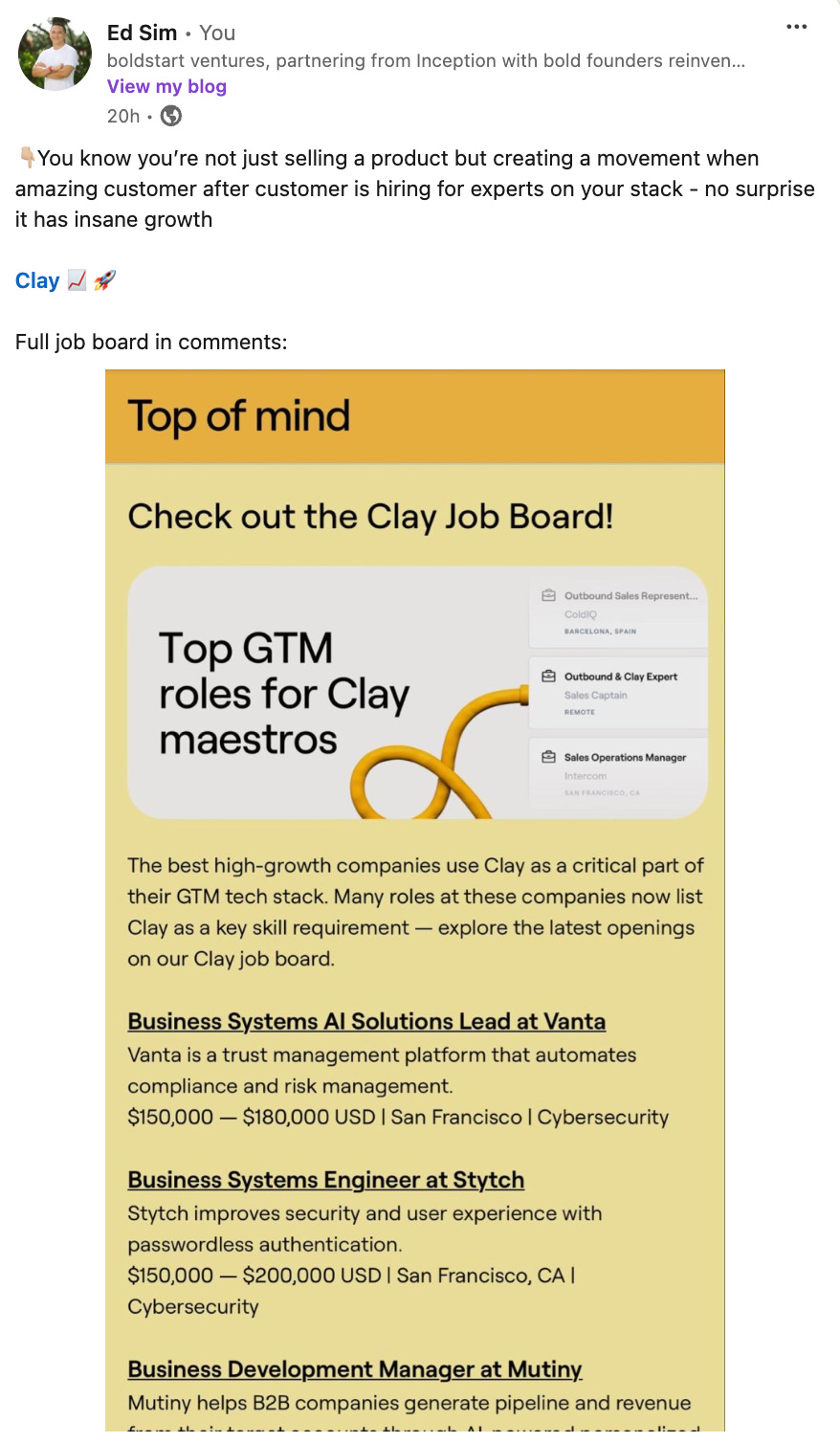

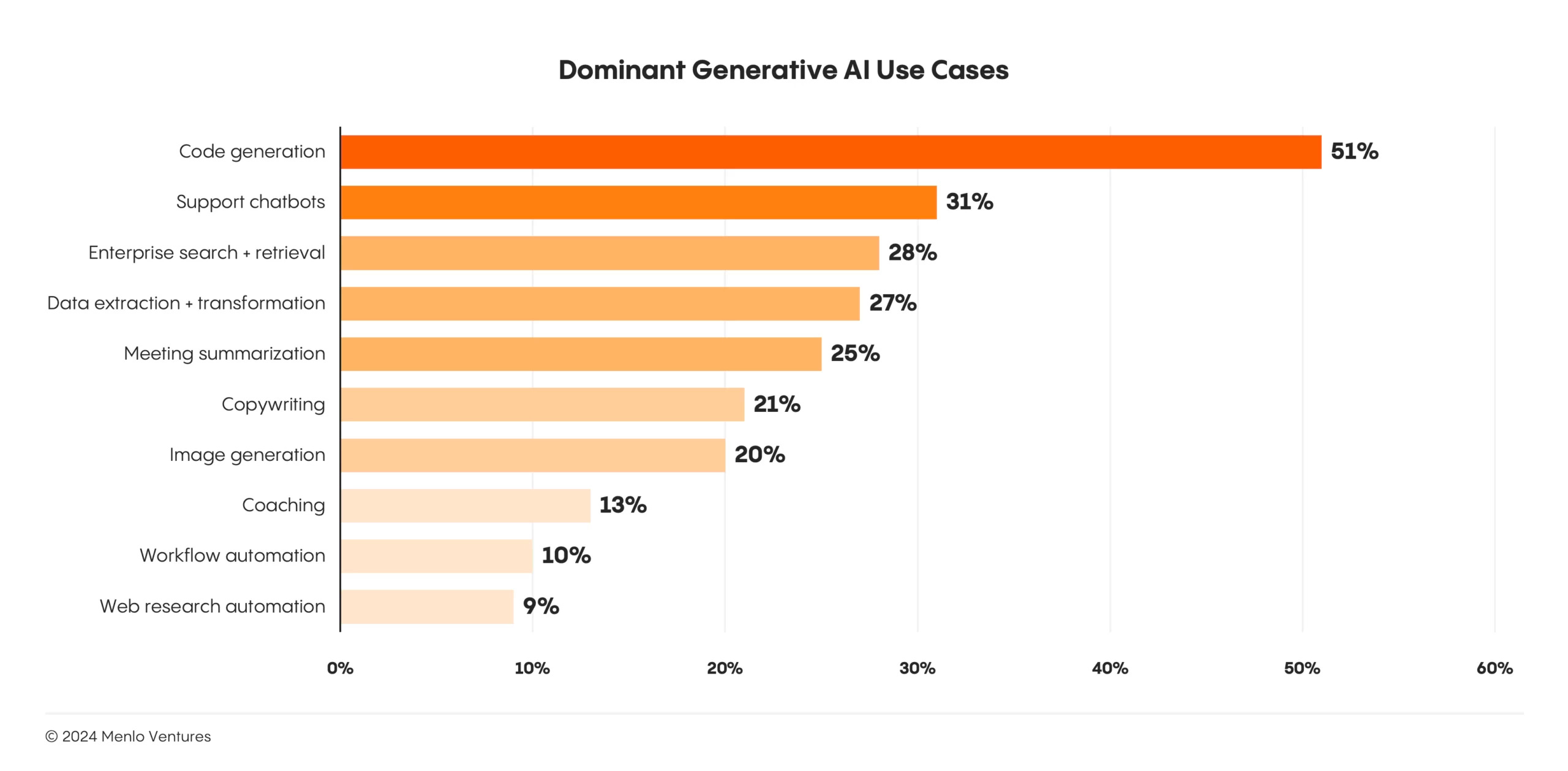

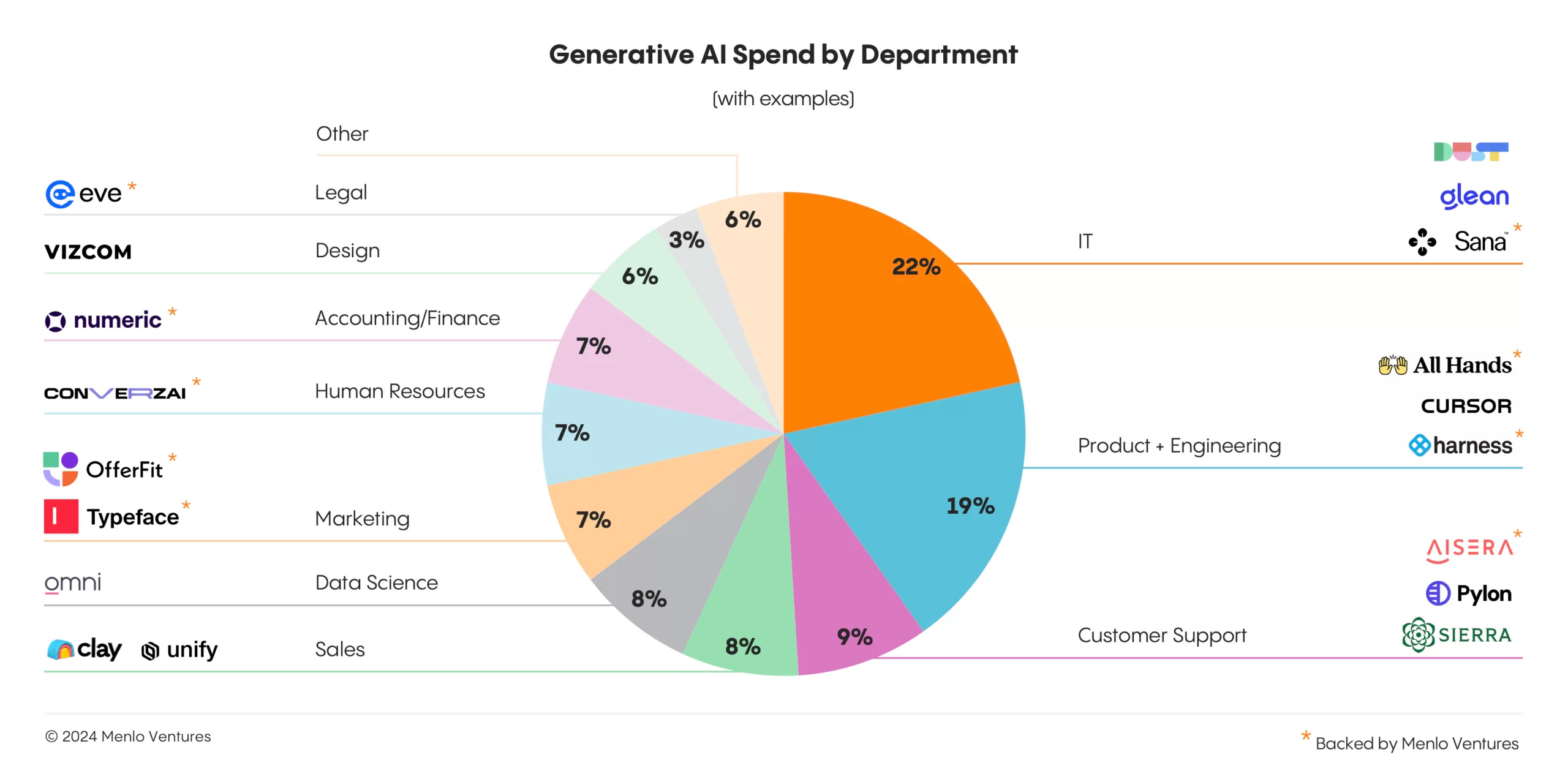

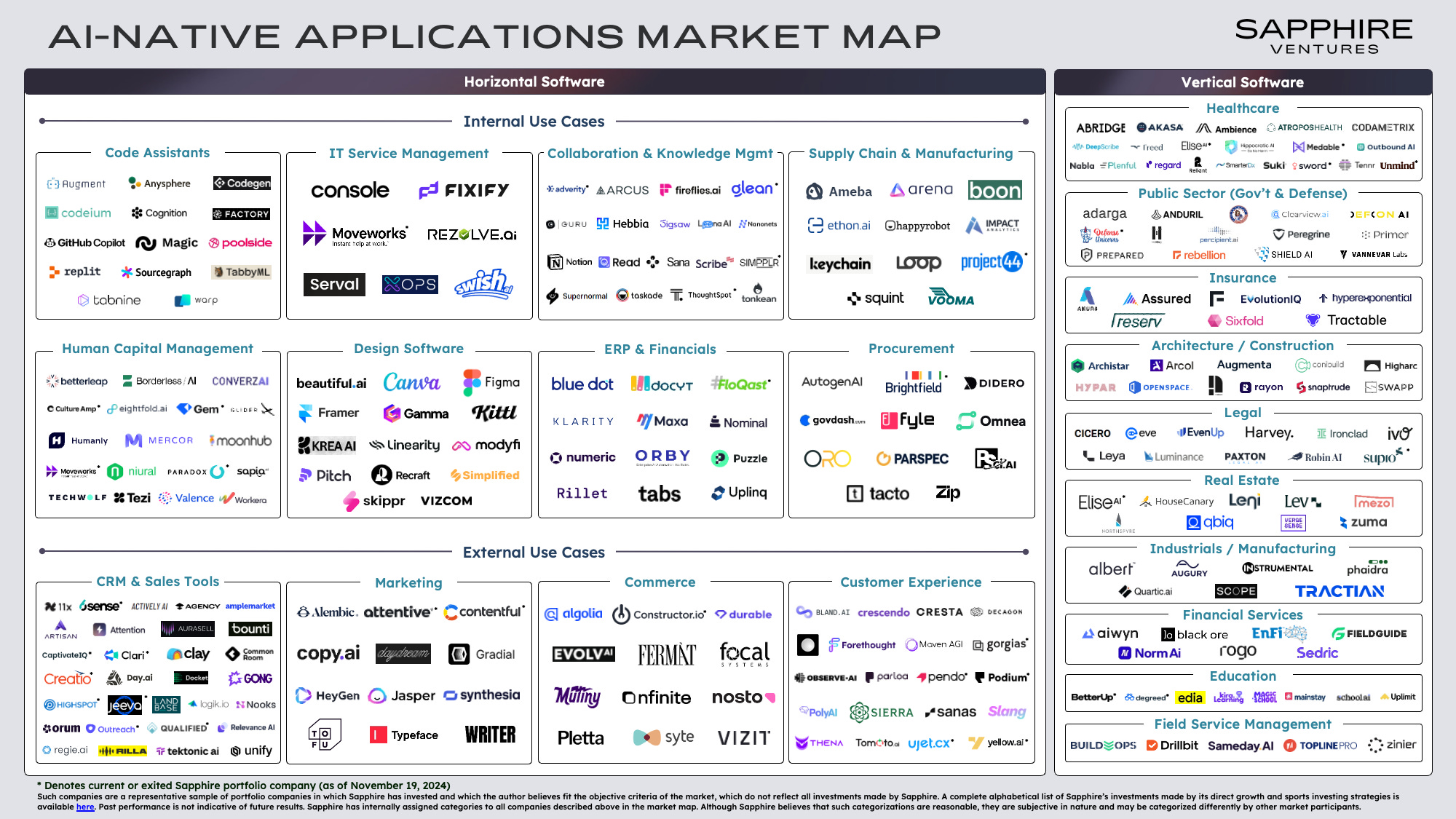

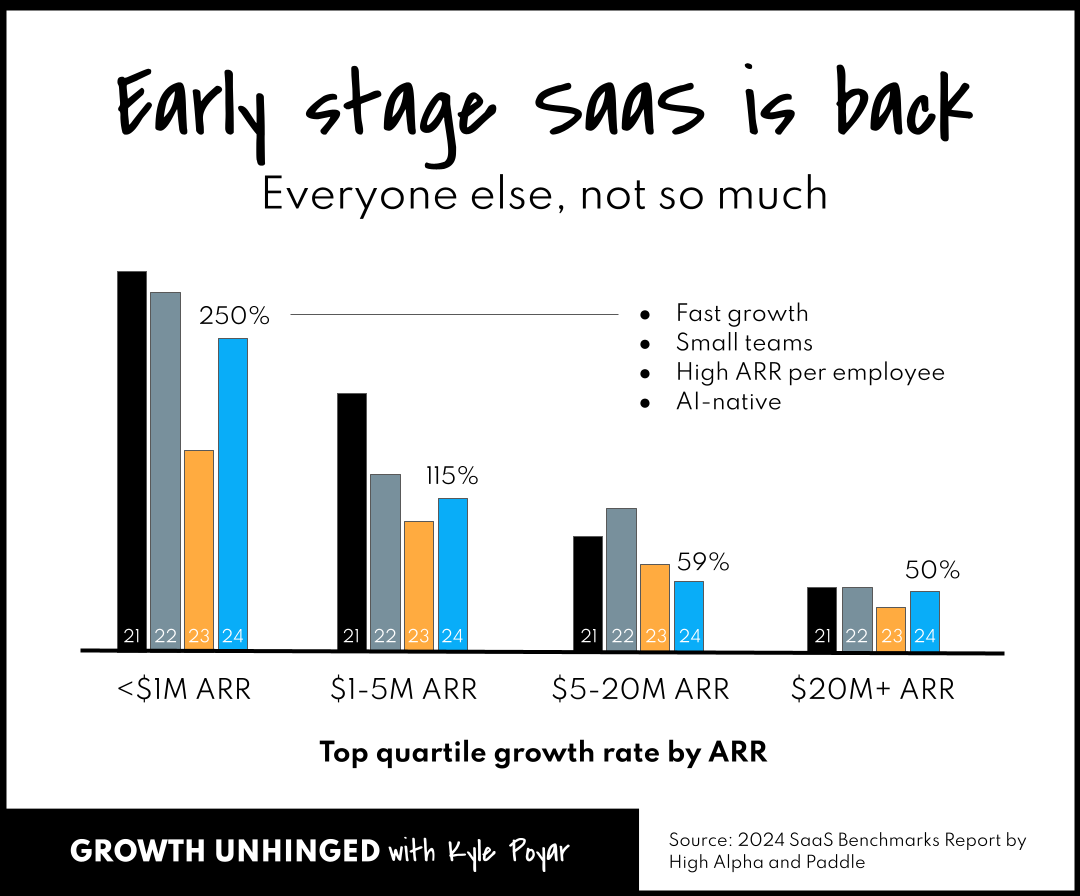

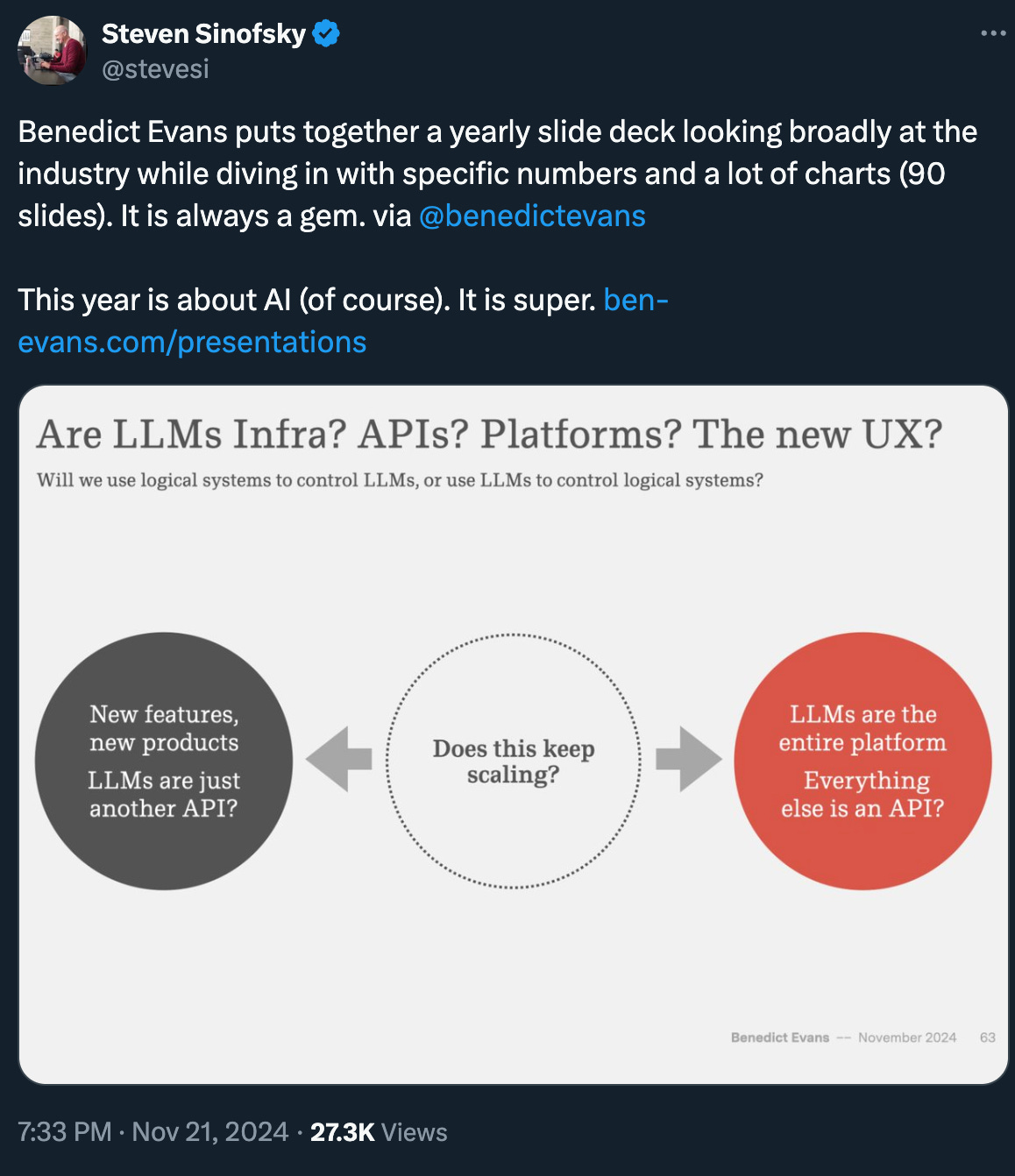

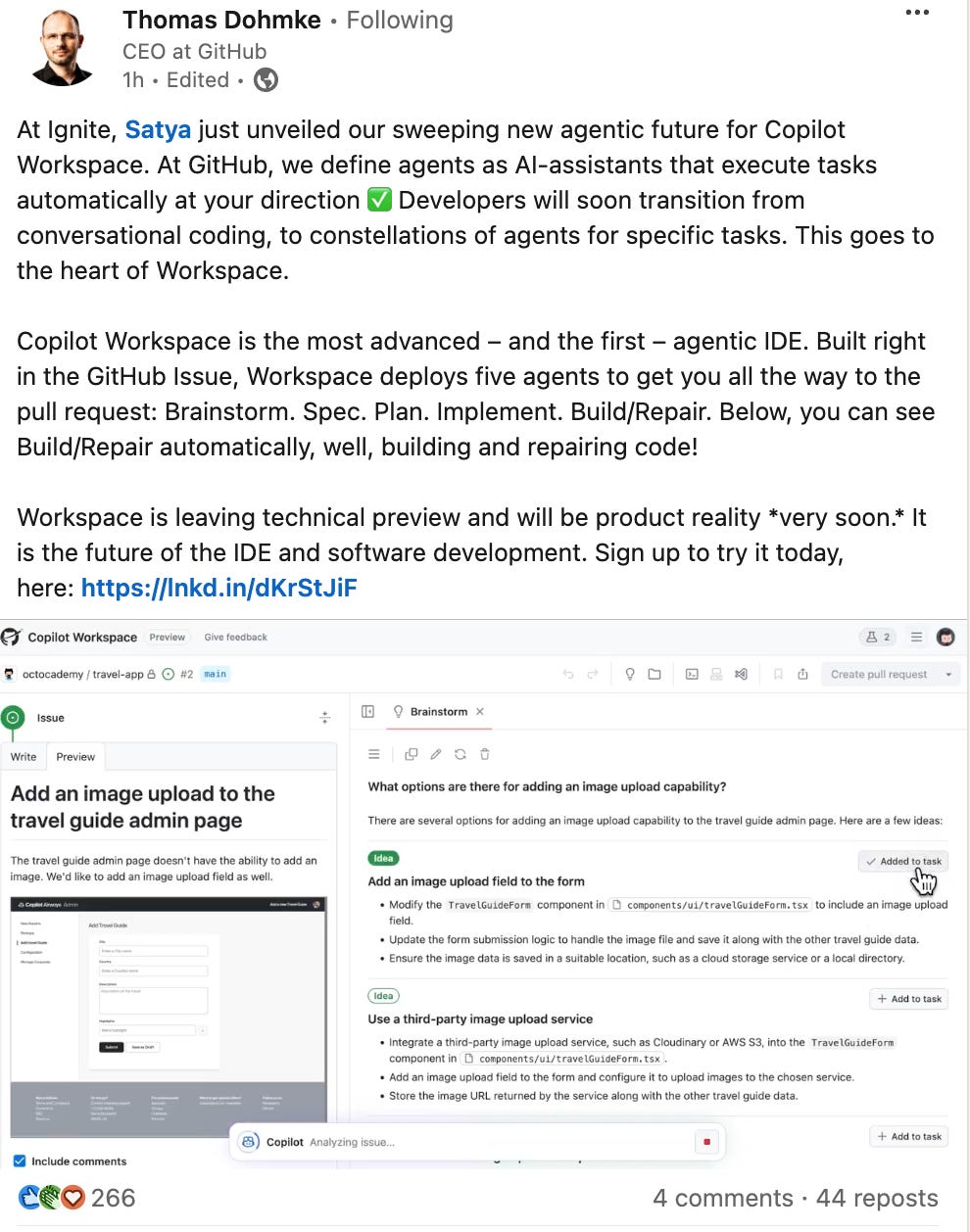

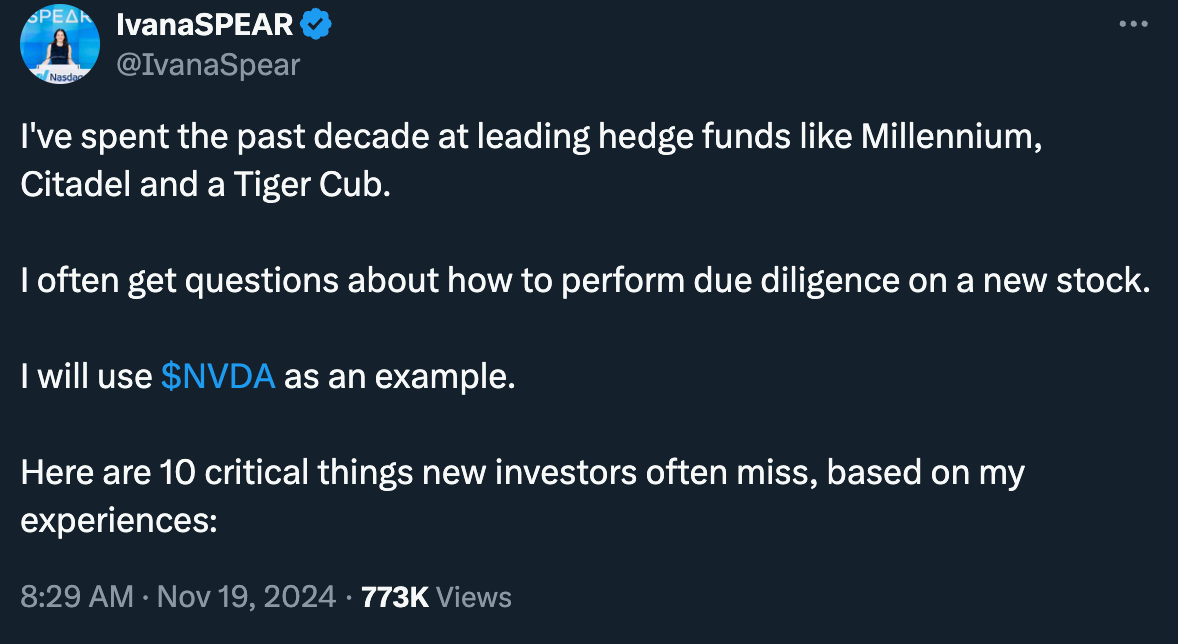

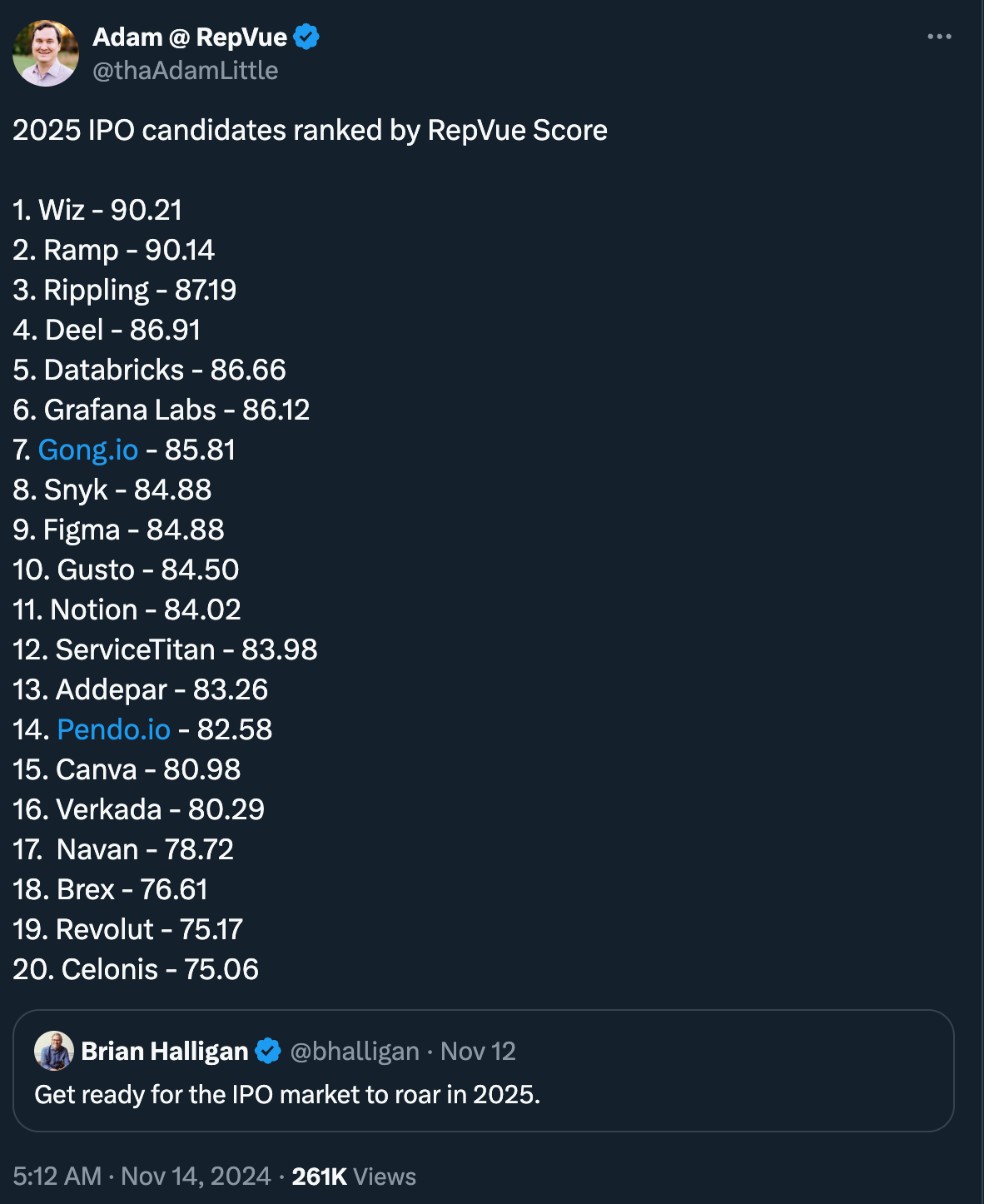

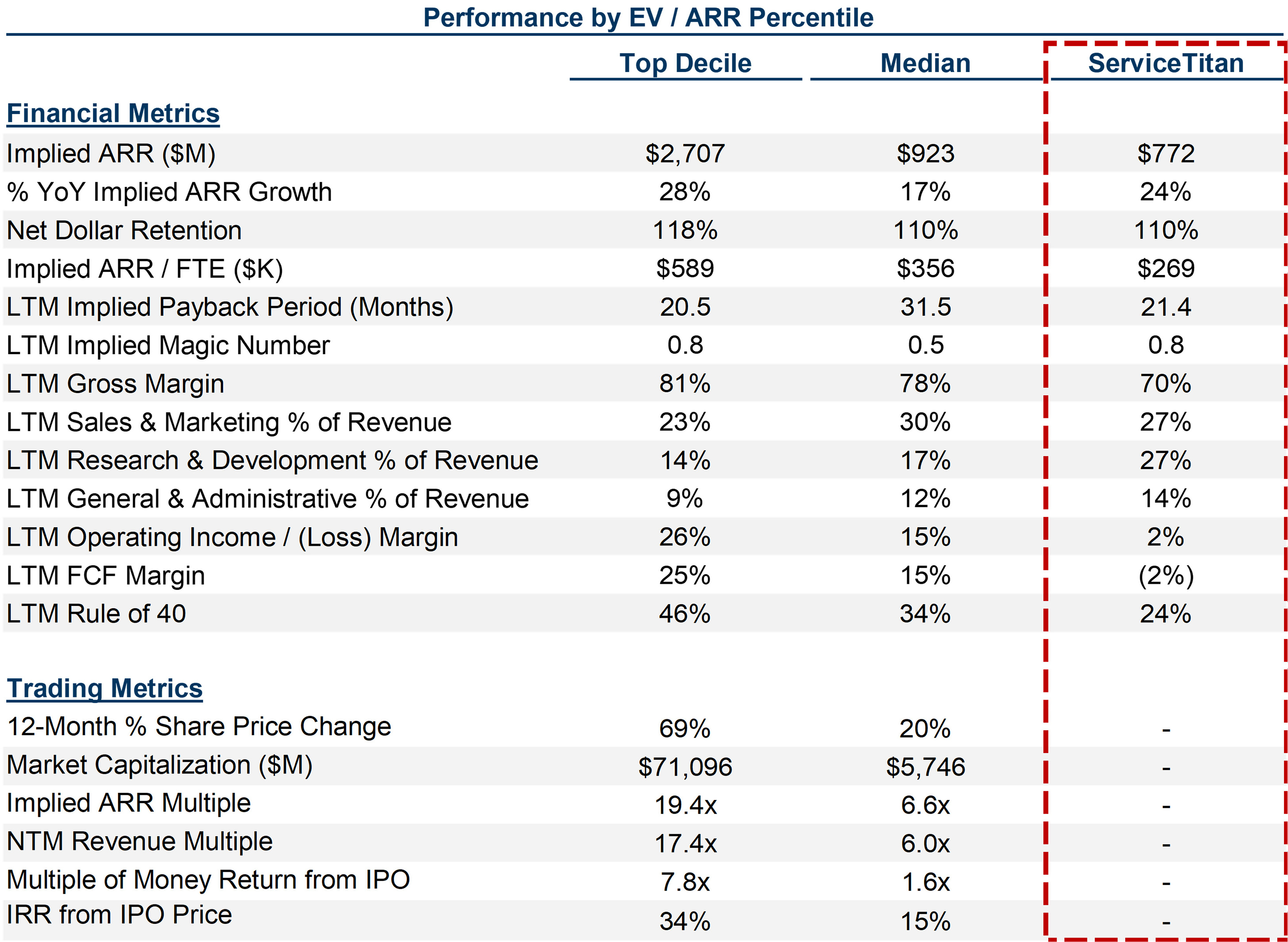

I’m finally back from Vegas from a couple of intense and fun days of networking, learning, and hanging out with friends at the Goldman PICC (Private Innovative Company Conference). If you’ve never been, I highly suggest you figure out how to go next year as it’s all about the people. Goldman assembled a world class group of founders, investors from seed to publics, and corporate development leaders from the large publics to share market insights, network, and to get deals done. The highlight for many is who the PICC names are and as you can imagine many are private household names like Anduril and Perplexity, along with a mix of mid-stage 🦄 like Kong and Harness and BigID (a port co) and earlier names like Protect AI, also a port co. If there is one word to summarize the current state of tech, it would be “optimism” but still scattered with some disbelief at valuations for some of these AI companies. Regarding the exit environment for 2025, these two slides capture what’s potentially ahead. +100% YoY for strategic acquisitions and how buyers are initiating more of the M&A discussions with a better win rate versus 2018. In other words, this chart says the more forward thinking and aggressive buyers have a better chance of buying that prized asset and the bankers tell me they are busier than ever so we should expect to see a significant uptick in M&A in 2025. FWIW, many still think that swapping out Lina Khan will be advantageous to getting deals done but are still skeptical of how that evolves for the mega cap names as the Trump admin still does not like cos like Google. One other topic of conversation I had with friends from several venture funds was the bubble-like environment for many momentum AI companies. When businesses are priced in the billions of dollars with 200% YoY growth with multiples of 100X forward, eventually gravity does set in as these companies can’t continue to grow at that pace, especially as everyone eventually competes with one another. Which means, the only opportunity to return 2-3X from those prices is to hope for a strategic buyer as public offerings require much more scale than what these companies have today and those multiples are 10-20x NTM. This is all the more reason why everyone is racing to be first, the first investor of record for startups and why valuations at the Inception/seed stage continue to rise as round sizes get bigger and bigger. This phenomenon is not going away - the multistage firms with their multi-billion 💰 bazookas are here to stay clearly aimed in my direction. Finally, every venture investor told me it felt like ZIRP again as pacing of new founders building new companies and the speed at which rounds are getting done is unlike what they have seen in the last couple of years. FWIW, our pacing at boldstart in Q4 from net new founders we backed to existing port cos raising new capital has been the busiest quarter in 2 years. This pacing is sure to continue or even accelerate into Q4 especially as a number of venture firms gear up to raise significantly more capital. It’s going to be an interesting December for sure. As always, 🙏🏼 for reading and please share with your friends and colleagues. I also hope you find time to be with friends and family as we enter the Thanksgiving 🦃 holidays. Scaling Startups#founders make sure to hire your engineers carefully! #don’t just sell software, start a movement and make your product so loved it becomes part of the job spec - 👇🏼 one of reasons why Clay, a portfolio co, is growing so fast 📈 Enterprise Tech#congrats Spectro Cloud (a boldstart portfolio co) on its $75M Series C led by Goldman Sachs. Spectro Cloud is a a leader in modern multi-cluster Kubernetes management at scale across a variety of deployment environments, including on-premises hardware, single and multi-cloud, and the edge To fully understand how far Spectro Cloud has come since we announced our investment in March 2020 (investment in 2019) at Inception, read our Why We Invested post on the team and vision and idea #Menlo Ventures State of AI 2024 - MUST READ report - here are a couple charts that summarized what’s happening in enterprises (top use cases and spend by department (❤️ seeing portfolio co Clay on that last pie chart) #AI-native application market map from Cathy Gao at Sapphire Ventures - ok, it’s small, read the full post here at Sapphire #so much infra will need to be built for agents - also who’s building the equivalent for internal only? (comments interesting - click through below) #use cases for agents with desktop vision - scroll through list And Anthropic now with $4B more cash from AWS to spend back on AWS #2024 SaaS Benchmarks Report from High Alpha along with breakdown and highlights from Kyle Poyar #💯 game on as models move from API to app layer even more aggressively - value continues to move up stack to app layer as bottom of stack continues to get commoditized #to the above, check out these slides from Ben #great interview on Runtime with ServiceNow President, CPO and COO - on AI - with the potential “Great Unbundling of SaaS” potentially ahead powered by agentic workflows, I still find it problematic that cos like ServiceNow and Salesforce think platform because these very same agents can relegate them as just a database and heterogeneity is going to win More on this from #410 - Speed mode + also, is the great unbundling of SaaS powered by agentic workflows? #coding moving from AI assistants to the first agentic IDE with 5 agents: brainstorm, spec, plan, implement, build/repair #The 5 next big technologies in security and privacy for 2024 (Fast Company) - great list and congrats to port co dope.security #Israeli cybersecurity on 🔥 as Cyera raises at $3B valuation and Wiz acquired Dazz for $450M Markets#how hedge fund analysts 🤔 #future IPO candidates? #Prescient as ServiceTitan, a venture-backed vertical software company for the trade industry, just filed - here’s a S-1 breakdown from Alex Clayton at Meritech. However are they really going public because of last round deal structure - a compounding ratchet from last round? What's Hot 🔥 in Enterprise IT/VC is free today. But if you enjoyed this post, you can tell What's Hot 🔥 in Enterprise IT/VC that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

What’s 🔥 in Enterprise IT/VC #420

Saturday, November 16, 2024

Why we wrote our largest initial Inception check of $12.5M in Tessl to build AI Native Software Development - what this means for Inception/seed fund sizing? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #419

Saturday, November 9, 2024

To believe or not to believe, that is the question - AI is eating software but will it also eat labor? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #418

Saturday, November 2, 2024

Who wins in AI? The Incumbent, the AI Native Startup, or...the Goldilocks Startup? The future is here: WORK BASED PRICING! No MORE SEATS - anatomy of the Kustomer relaunch ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #417

Saturday, October 26, 2024

What happens when hundreds of thousands of agents with read/write access run amok in an enterprise - "like hornets fleeing a nest" according to Bill McDermott ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What’s 🔥 in Enterprise IT/VC #415

Sunday, October 20, 2024

Old school enterprise sales + delivery needed to solve the last mile problem in the enterprise - yes, services needed! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

UK startups roll back hiring

Friday, March 28, 2025

+ Bending Spoons almost doubles in value; Web Summit legal drama View in browser Vanta_flagship Author-Amy by Amy Lewin Good morning there, If I were to take a bet on which of Europe's startups

🗞 What's New: Is Gemini 2.5 the new vibe coding standard?

Friday, March 28, 2025

Also: Vibe coding to $12K in 4 weeks ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⏰ 72 hours left - grab your seat and change your business forever

Thursday, March 27, 2025

We've taken the most game-changing, highly rated sessions and packed them into one powerful day. Hey Friend , The Ecommerce Product Sourcing & Manufacturing Summit Highlights goes live in just

SaaSHub Weekly - Mar 27

Thursday, March 27, 2025

SaaSHub Weekly - Mar 27 Featured and useful products todo.vu logo todo.vu todo.vu combines task and project management with time tracking and billing to provide a versatile, all-in-one productivity

81 new Shopify apps for you 🌟

Thursday, March 27, 2025

New Shopify apps hand-picked for you 🙌 Week 12 Mar 17, 2025 - Mar 24, 2025 New Shopify apps hand-picked for you 🙌 What's New at Shopify? 🌱 Draft Orders automatically removed after 1 year of

🧠 This Week in GrowthHackers: AI Advances, SEO Strategies & Market Shakeups

Thursday, March 27, 2025

Key updates from OpenAI, Databricks, and Tesla—plus tools and how-tos to sharpen your growth edge..

Investors Guides: The Full Series + Exclusive Cheat Sheet

Thursday, March 27, 2025

Tactics from 50 elite investors on finding breakout companies, winning deals, and constructing enduring firms. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

the drug R&D playbook

Thursday, March 27, 2025

AI is rewriting the rules across the entire R&D pipeline. here's what you need to know. Hi there, The drug R&D playbook is being rewritten. Join CB Insights' Senior Analyst, Ellen Knapp

Sneak Peak Of My Latest Podcast & PH Hunt

Thursday, March 27, 2025

Hey everyone 👋 how have you been? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

That magic moment

Thursday, March 27, 2025

Read time: 57 sec. You ever had a moment where something just clicks? Zach, one of our AI Build Accelerator members, dropped this message in Slack the other day: “Had a pretty surreal moment yesterday.