10 Sets of Data to Understand Hyperliquid

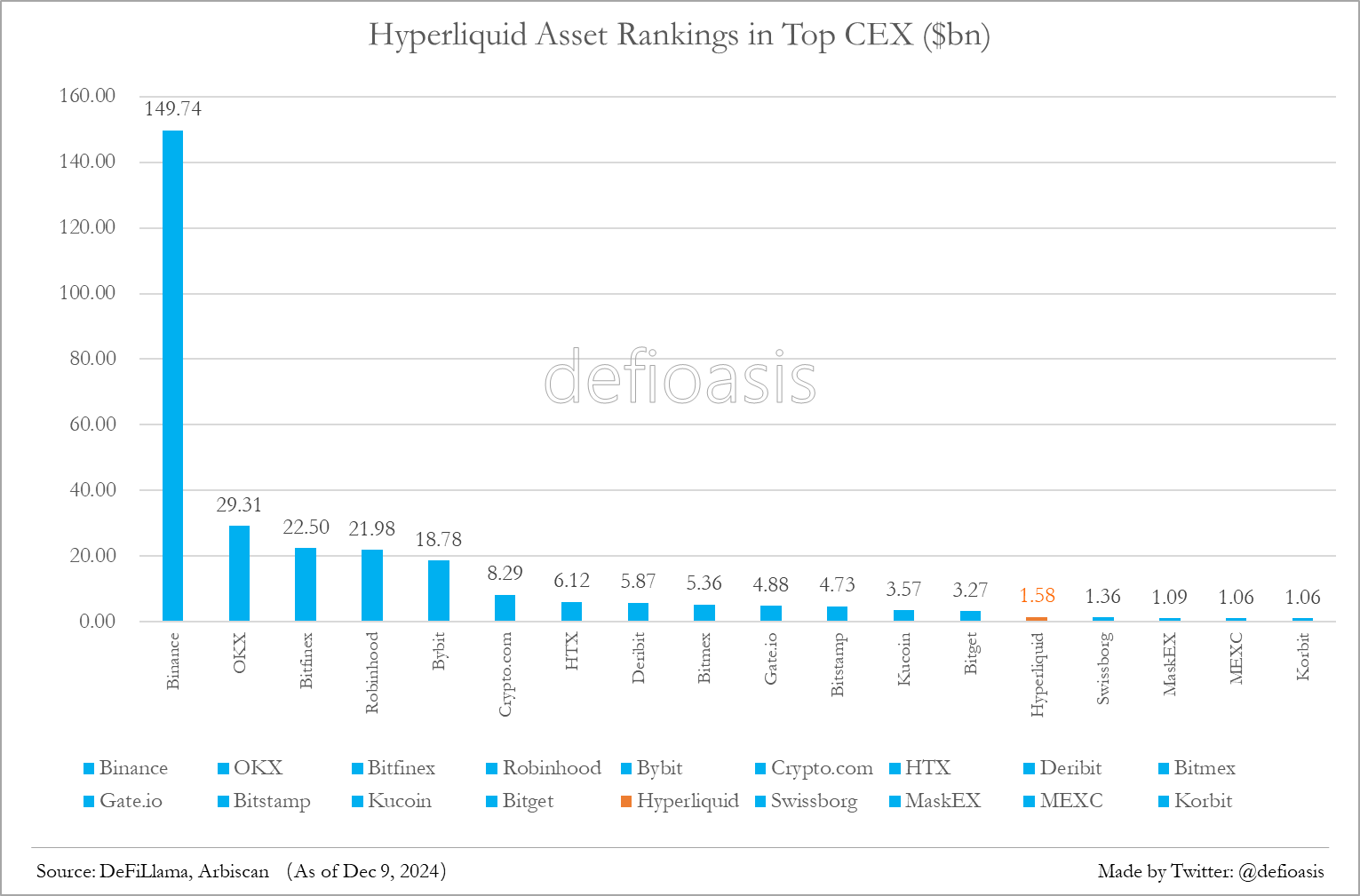

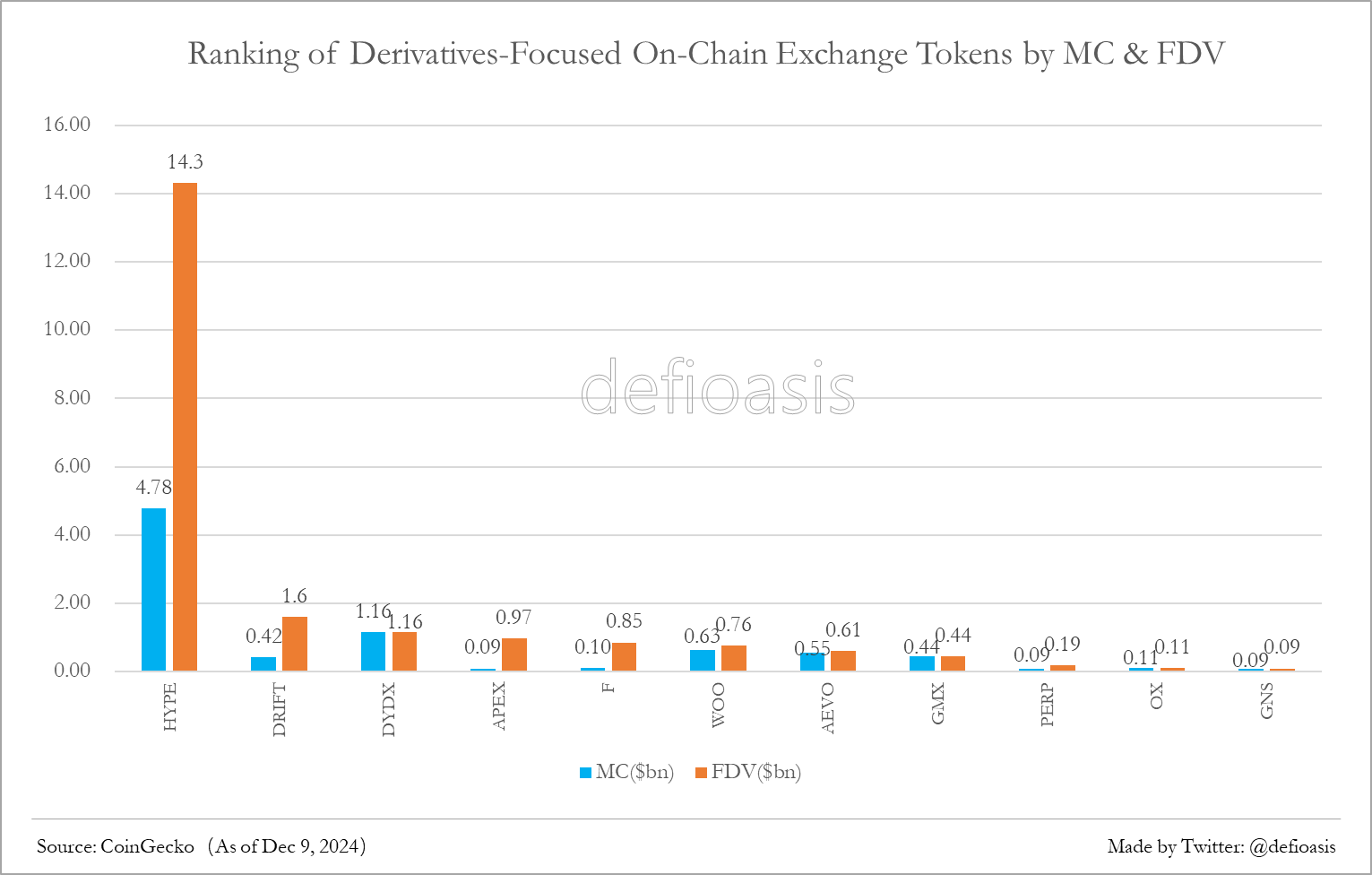

Author | defioasis From perpetual contract trading to the eye-catching on-chain exchange, Hyperliquid has quickly risen in the Crypto space. Recently, Hyperliquid conducted a large-scale airdrop of HYPE tokens, which not only boosted community engagement and user participation but also broke the undervaluation status of the on-chain derivatives sector, raising the ceiling for the entire track. (1) Hyperliquid has accumulated over 1.5 billion USDC in assets, comparable to the 14th largest cryptocurrency exchange in the world Hyperliquid is a high-performance derivatives exchange built on Layer 1, compatible with EVM. Assets are primarily deposited into Hyperliquid through the Arbitrum Bridge, which currently supports USDT, USDC.e, and USDC on Arbitrum, but only USDC is accepted as collateral. As of December 9, assets in the Hyperliquid Deposit Bridge contract: 0x2D...3dF7 have reached 1.58 billion USDC and are still growing. When comparing Hyperliquid's assets with the clean assets of CEXs, Hyperliquid ranks as the 14th largest exchange globally, surpassing MEXC (approximately $1.09 billion). Its next target is Bitget (approximately $3.27 billion). (2) Hyperliquid has single-handedly raised the valuation of on-chain exchanges focused on derivatives to over $10 billion Before Hyperliquid's TGE, the FDV of on-chain derivatives exchanges was never higher than $1.5 billion. Well-known projects like DYDX and GMX had an FDV of less than $1 billion, which had long left investors puzzled about the on-chain derivatives sector—despite over a dozen protocols competing in this space, the ceiling for on-chain derivatives seemed so low, while centralized exchanges still generated massive trading volume and fee revenue, indicating a huge untapped potential. With Hyperliquid's TGE and a community airdrop of up to 31% of its token supply, HYPE, as a project that doesn't rely on VC funding and doesn't need to be listed on CEXs, has seen its price more than triple since being launched on Hyperliquid's own exchange. As a result, HYPE's market cap surged to $4.75 billion, and its FDV reached $14.2 billion. Compared to previous on-chain derivatives exchange tokens, Hyperliquid has single-handedly increased the valuation of this sector by tenfold. (3) The wealth effect of the HYPE airdrop is significant, but there may be a few large-value distributions that have significantly inflated the average airdrop amount According to the Hyperliquid Explorer, the total supply of HYPE is capped at 1 billion tokens, with approximately 33% currently in circulation. Based on the HYPE TGE airdrop rules, 31% of the total supply is theoretically allocated for airdrops. Therefore, the circulating supply in the market should largely consist of tokens distributed through the airdrop. According to ASXN Data cited by PANews, due to some users not signing the Genesis Event terms, they missed the opportunity to claim the airdrop. As a result, the actual number of HYPE tokens distributed in the TGE airdrop is approximately 274 million, with an average amount significantly higher than the median by dozens of times. This suggests that there are extreme or outlier values, with a small number of airdrop recipients receiving very large amounts, which has considerably inflated the average. Due to difficulties in obtaining accurate data on the Hyperliquid Airdrop, a secondary verification is currently not possible. However, from the intuitive perception of the airdrop distribution and statistics from dozens of community airdrop samples, it can be inferred that there are indeed a few extreme values. The median, representing the central tendency of the data, is less affected by these outliers and is more representative of the broader base of ordinary users. Based on the current median, with the value of HYPE having increased more than 3x since the TGE, each token is now worth over $900, making it one of the most wealth-effect driven airdrops of the year. (4) The Huge Driver Behind HYPE's Surge: Hyperliquid Assistance Fund, which has already made over $82 million in profits The Hyperliquid Assistance Fund's capital primarily comes from the contract trading revenue on the Hyperliquid platform. A portion of the USDC fees is allocated to this fund to support various platform activities, mainly including the repurchase of HYPE tokens. According to the hypurrscan browser, from December 5 to December 9, 19:00 UTC+8, the Assistance Fund repurchased 567,083.22 HYPE tokens from the secondary market, with a total value of $7,364,369.45, at an average price of approximately $12.99. In fact, HYPE can be seen as having a dual deflationary mechanism. On one hand, HYPE is burned from the transaction fees to reduce the supply (currently, 666,361.1 HYPE have been burned). On the other hand, the repurchases made through the Assistance Fund further decrease the number of tokens in circulation. This redistribution of platform revenue enhances the value and liquidity of the platform's token, while also benefiting the healthy development of the platform ecosystem. As of now, the Hyperliquid Assistance Fund holds approximately 10.65 million HYPE, accounting for over 1% of the total supply, making it the fourth-largest holder of HYPE. (Note: Due to potential synchronization delays on the hypurrscan browser, some repurchase data since the TGE may be missing. The Hyperliquid Assistance Fund has received 53.3 million USDC, a portion of which comes from the platform's transaction fees. However, as of December 9, only 1,397.96 USDC remains, with the majority likely used for repurchasing HYPE. Based on this, the average cost of the 10.65 million HYPE tokens currently held by the Assistance Fund is calculated to be $5 per token, with a profit of over $82 million.) (5) Hyperliquid Spot Market Status: 92% of the daily trading volume is concentrated in HYPE, with very few tradable assets available There are over 100 spot assets available on Hyperliquid, but approximately 92% of the daily trading volume is concentrated in the platform's native token, HYPE, with 3% in Hyperliquid's largest native memecoin, PURR. The remaining hundreds of assets account for only about 5% of the volume. Hyperliquid's asset reserves are not small—it is the largest USDC-held dApp on Arbitrum. However, more high-quality tokens from major projects are still needed to be listed on the platform to drive further trading and speculation. (6) Token Ticket Auction for Spot Trading Seats: Solv Protocol may become the first major project to take the plunge Projects wishing to launch on Hyperliquid need to obtain the right to issue new tokens through a Dutch auction mechanism called Token Ticket, which is typically held every 31 hours. Historically, Hyperliquid has focused more on derivatives trading, and most of the Token Ticket auctions have been dominated by meme projects, with auction prices rarely exceeding $20,000. However, with the wealth effect and increased attention following the HYPE TGE, as well as the opening of Hyperliquid EVM, it is expected that more types of projects will consider launching tokens on Hyperliquid. Additionally, some key Token Tickets that were previously auctioned at low prices may later be selected by formally established projects, becoming shells for launching on Hyperliquid, with the tokens being bought back at a higher price by the original project team. In recent auctions, the prices have been rising significantly. On December 6, the Token Ticket for "SOLV" was sold for $128,000, setting a new auction record for Hyperliquid. Given that Solv Protocol is about to launch its TGE, this "SOLV" is highly likely to be the token for Solv Protocol. If this happens, Solv Protocol will become the first major project to launch on Hyperliquid. (7) No trading incentives or reward programs, yet Hyperliquid's derivatives trading volume and futures open interest continue to grow Since the TGE on November 29, Hyperliquid's futures open interest has increased from $2.24 billion to $3.55 billion, a growth rate of 58.5%. Moreover, on December 5, during a period of high volatility when BTC first broke the $100,000 mark, Hyperliquid's daily derivatives trading volume hit a record high of $9.79 billion. Even after the airdrop was completed and without any trading or reward incentives, Hyperliquid has continued to see growth in both derivatives trading volume and futures open interest. This can be attributed to Hyperliquid's fast execution, low-latency product performance, and liquidity and order depth comparable to centralized exchanges, which provide a superior user experience. With the brand recognition gained from the airdrop wealth effect, Hyperliquid is expected to attract more users to try trading on its platform. (8) Hyperliquidity Provider (HLP) has generated approximately $45 million in PnL gains Hyperliquid Provider (HLP) is a protocol vault open to all users, primarily responsible for market making and liquidation in the platform's derivatives market, while collecting a portion of the USDC trading fees. The market-making strategy of HLP is rooted in the extensive experience of the core contributors at Hyperliquid, with profits and losses distributed based on each depositor's share in the vault. Currently, HLP’s market-making strategy operates off-chain, but users can review HLP’s positions, orders, and trading history on-chain. With increased market visibility and community discussions after the HYPE TGE, more external market makers are expected to join, and Hyperliquid also allows any institutions or individuals to run User Vaults to execute strategies. For HLP, the risks it has previously borne will gradually shift to various User Vaults, improving the risk-return profile of HLP itself. Currently, the HLP TVL is $206 million, with cumulative PnL gains nearing $45 million, and a return of 34% APR over the past month. (9) Compared to mainstream CEXs, Hyperliquid offers higher funding rates Since October 1, Hyperliquid's average annualized funding rate for BTC has been 23.23%, while Binance's was only 4.52% over the same period. On December 5, when BTC broke the $100,000 mark, Hyperliquid's annualized funding rate for BTC surged to 106.16%. Compared to mainstream CEXs, Hyperliquid lacks a larger number of arbitrageurs and major market makers to control or stabilize funding rates, resulting in more aggressive market-driven pricing. Such high funding rates may gradually attract more arbitrageurs to enter for arbitrage opportunities or to establish their own market-making strategy vaults. (10) From the beginning of the year to date, Hyperliquid's estimated fee revenue could reach as high as $94.41 million, making it one of the most profitable crypto protocols or applications of the year, surpassing both Uniswap and Bitcoin Hyperliquid's revenue comes from Token Ticket auction fees and trading fees denominated in USDC. The USDC trading fees are allocated to both the HLP Vault (including liquidation fees) and the Hyperliquid Assistance Fund. According to ASXN Data, from the first HFUN auction on May 16 to the BUBZ auction on December 8, a total of 156 Token Ticket auctions were held, generating a combined fee of $2.22 million. As of December 9, the PnL gains of the HLP Vault is approximately $43.89 million (although the exact proportion of USDC fees contributing to the HLP Vault's PnL is unclear, this figure can be used to estimate the maximum value). Since the HYPE TGE, the Hyperliquid Assistance Fund has received 53.3 million USDC, representing the portion of the USDC trading fees that did not flow into the HLP Vault. Therefore, as of December 9, Hyperliquid's total fee revenue for the year to date is estimated to reach a maximum of $99.41 million. Reference Links: https://www.panewslab.com/zh/articledetails/cdxgyb62.html https://x.com/stevenyuntcap/status/1863643374567194962 Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

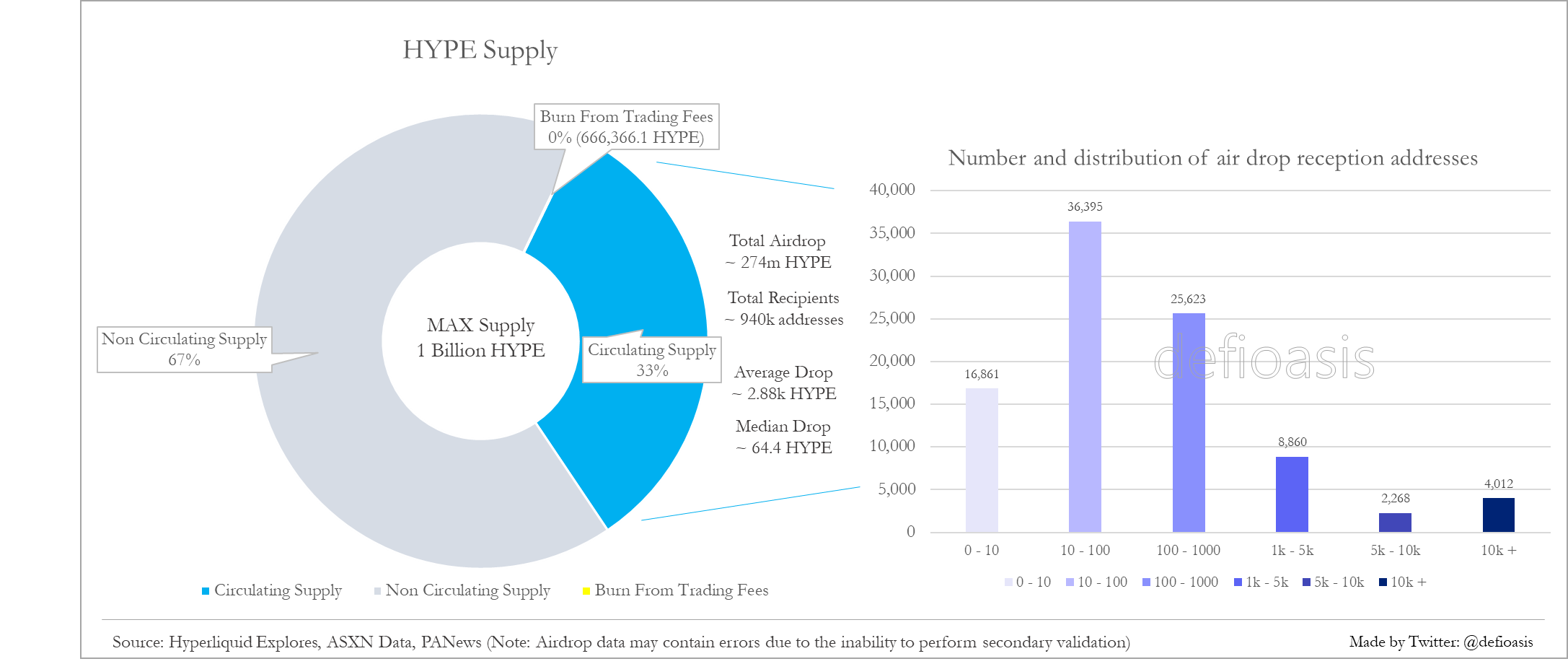

WuBlockchain x Vitalik, Part 2: Addressing Concerns About EF's Token Sales, Personal Influence, Memecoin Developme…

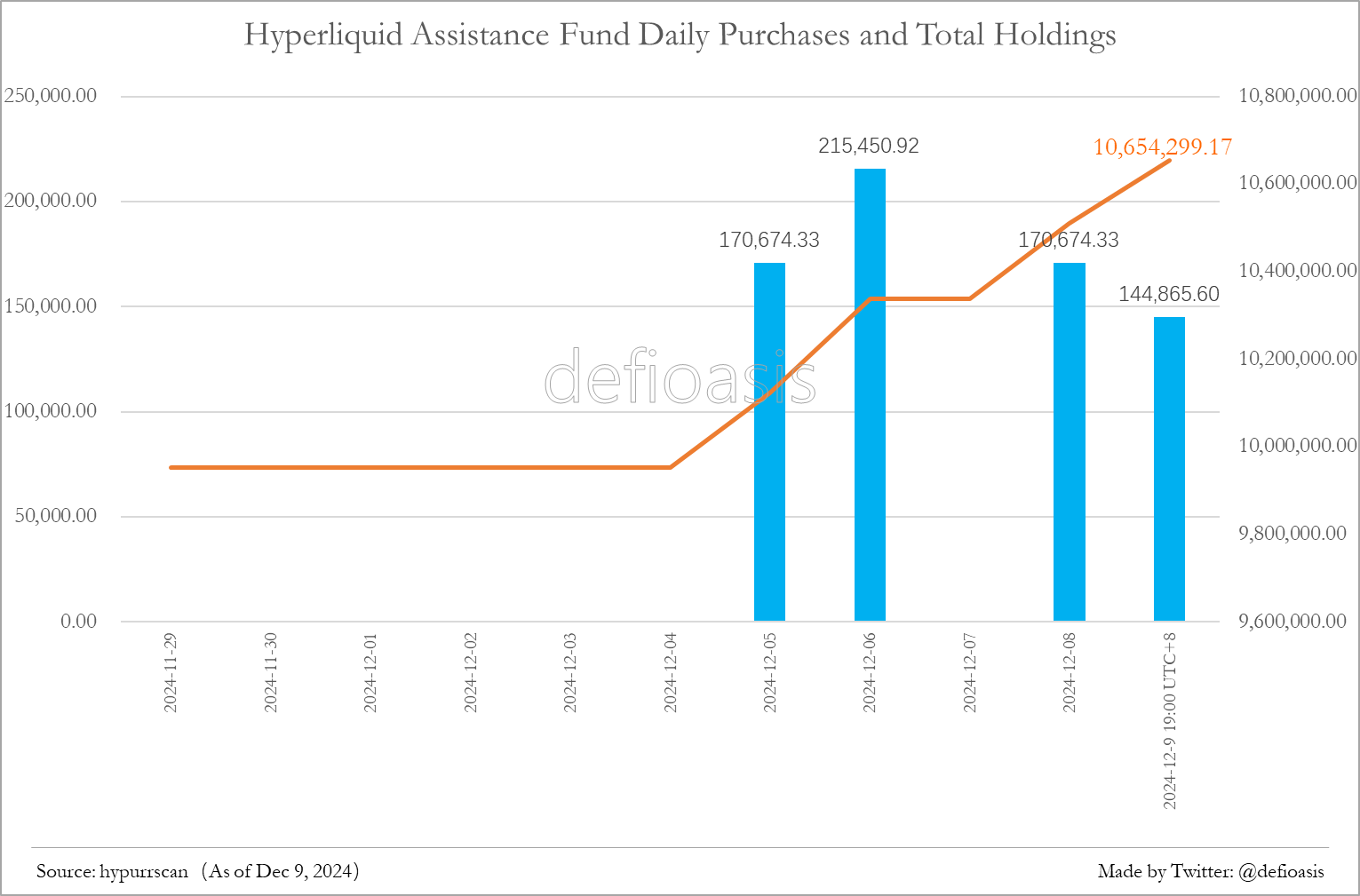

Tuesday, December 10, 2024

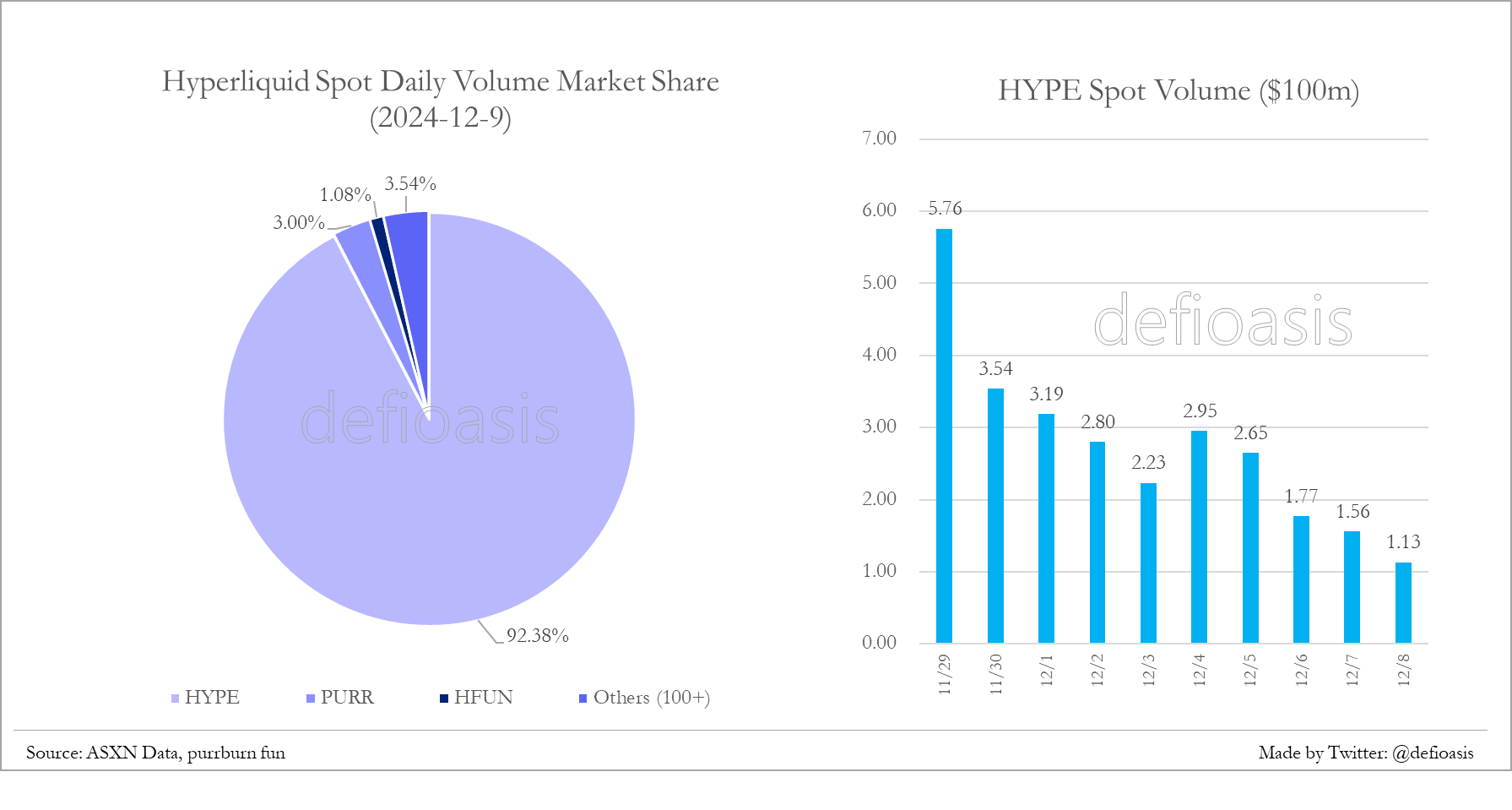

This podcast is the second part of the conversation between WuBlockchain founder Colin Wu and Ethereum co-founder Vitalik Buterin. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

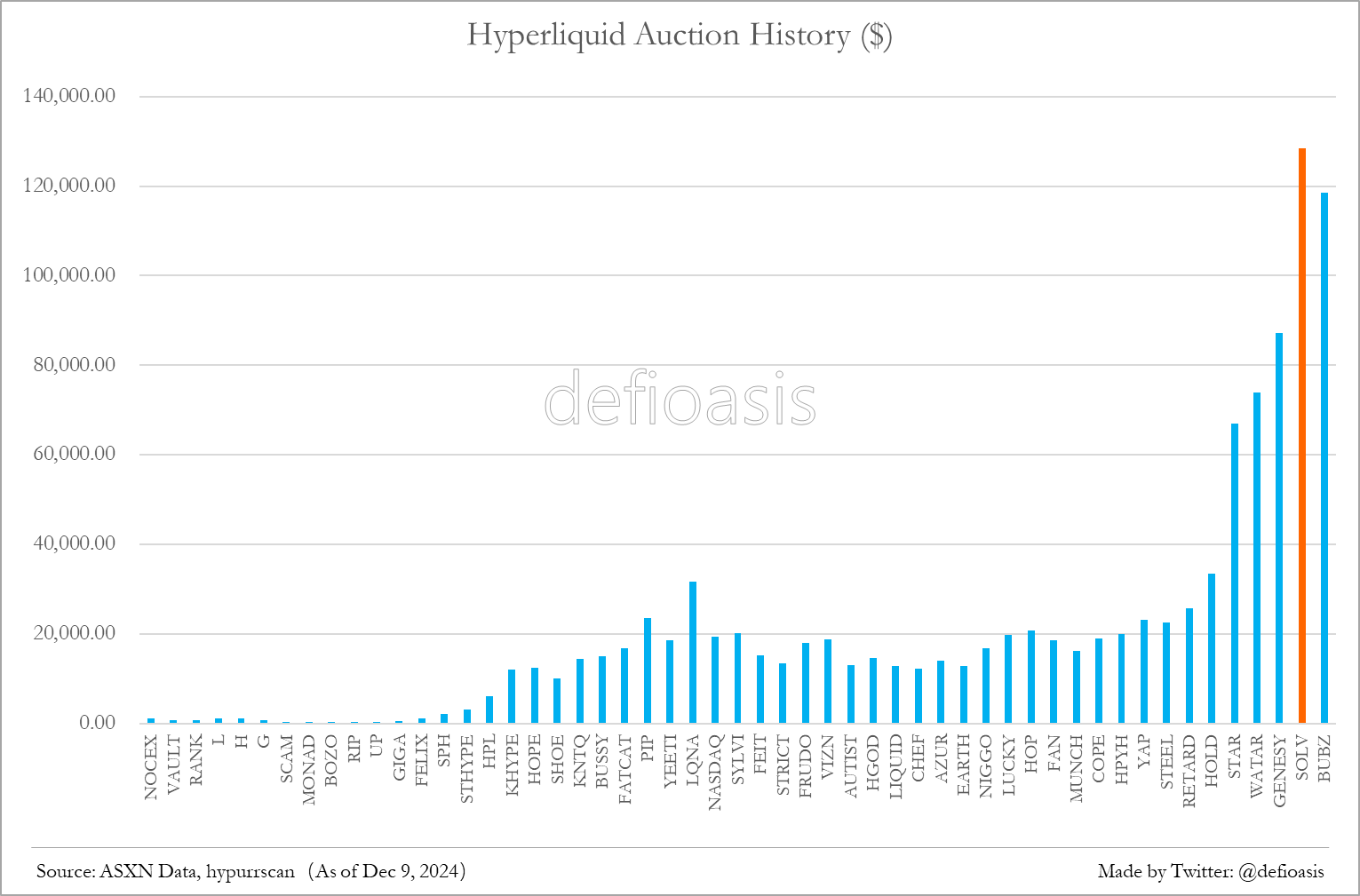

Mining News in November:Deutsche Telekom Enters Mining, Bhutan Mining Holds Large Amounts of Bitcoin, Russia Impro…

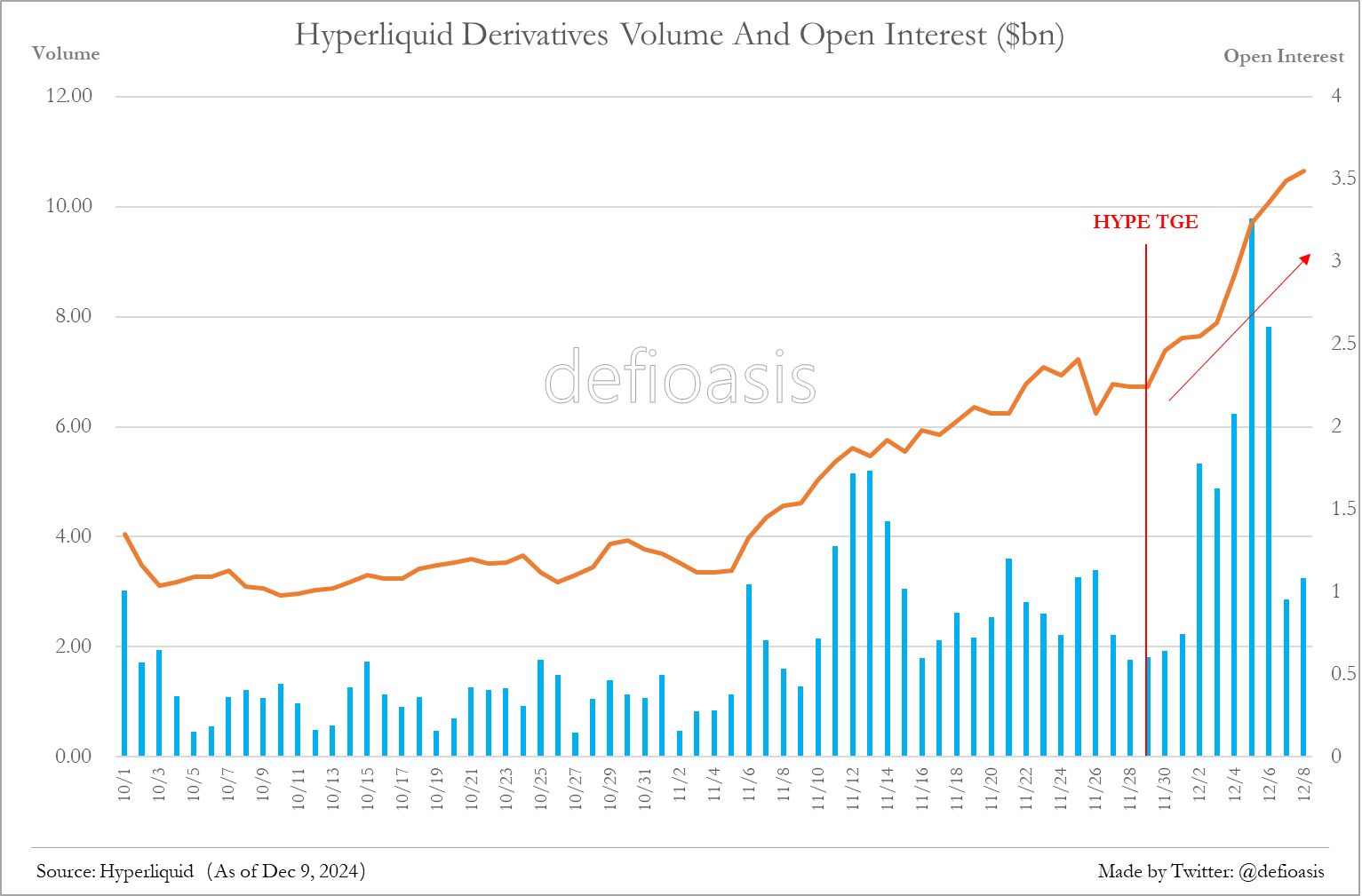

Tuesday, December 10, 2024

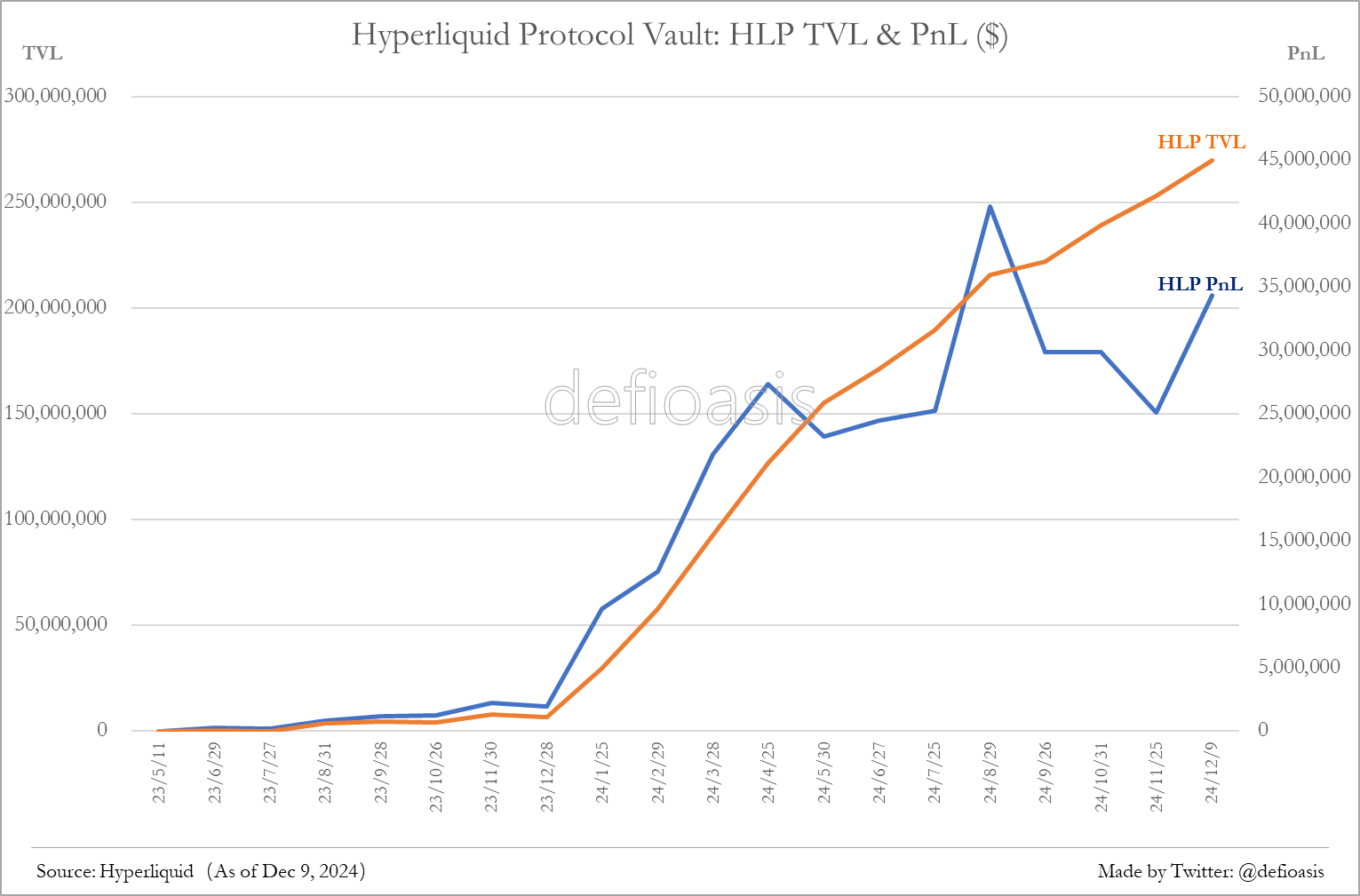

Title sponsored by Bitdeer, a NASDAQ-listed mining company. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

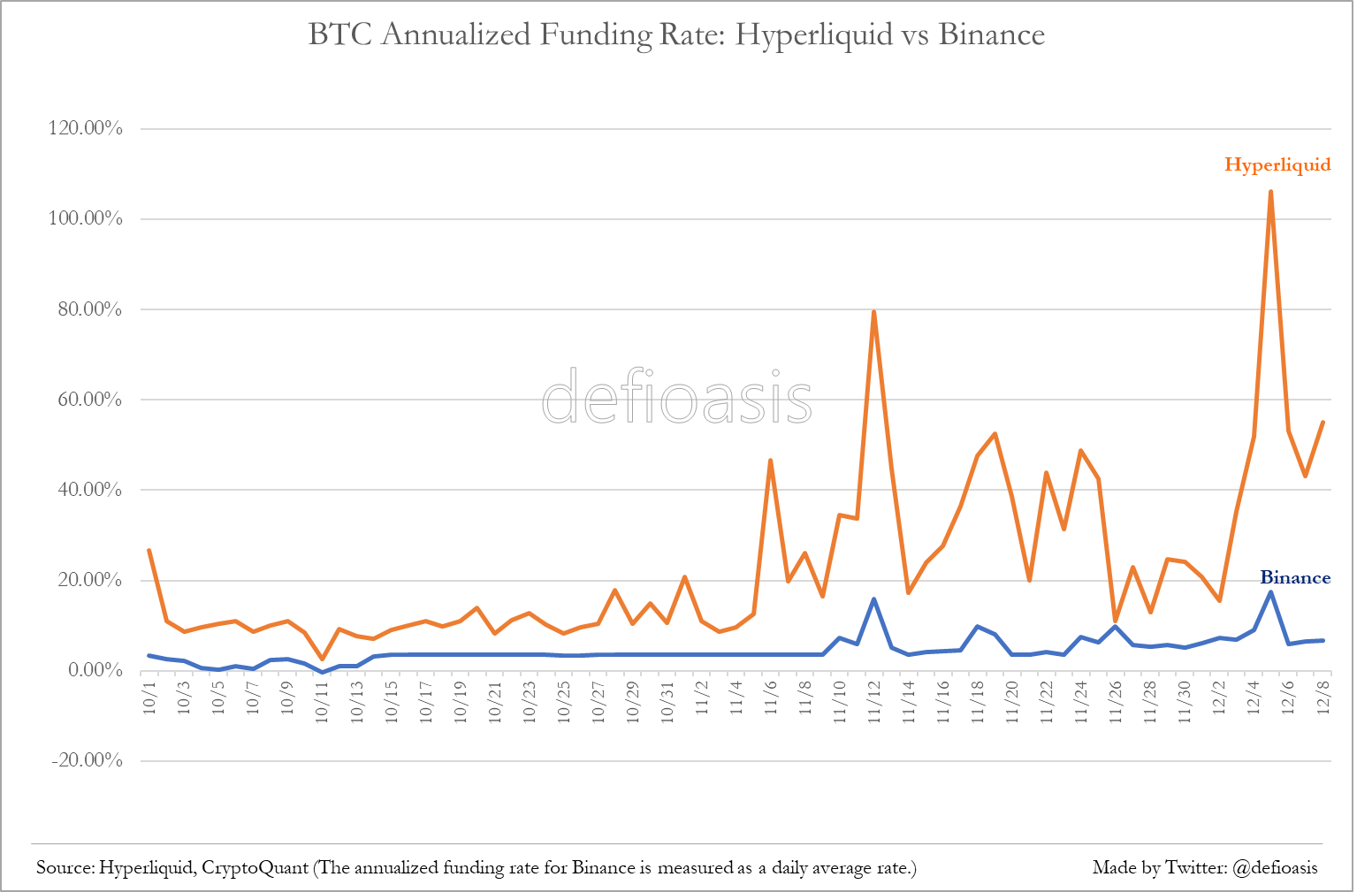

WuBlockchain Weekly: Bitcoin Surpasses $100,000, Trump Nominates SEC Chairman and Cryptocurrency Chief, Powell Ack…

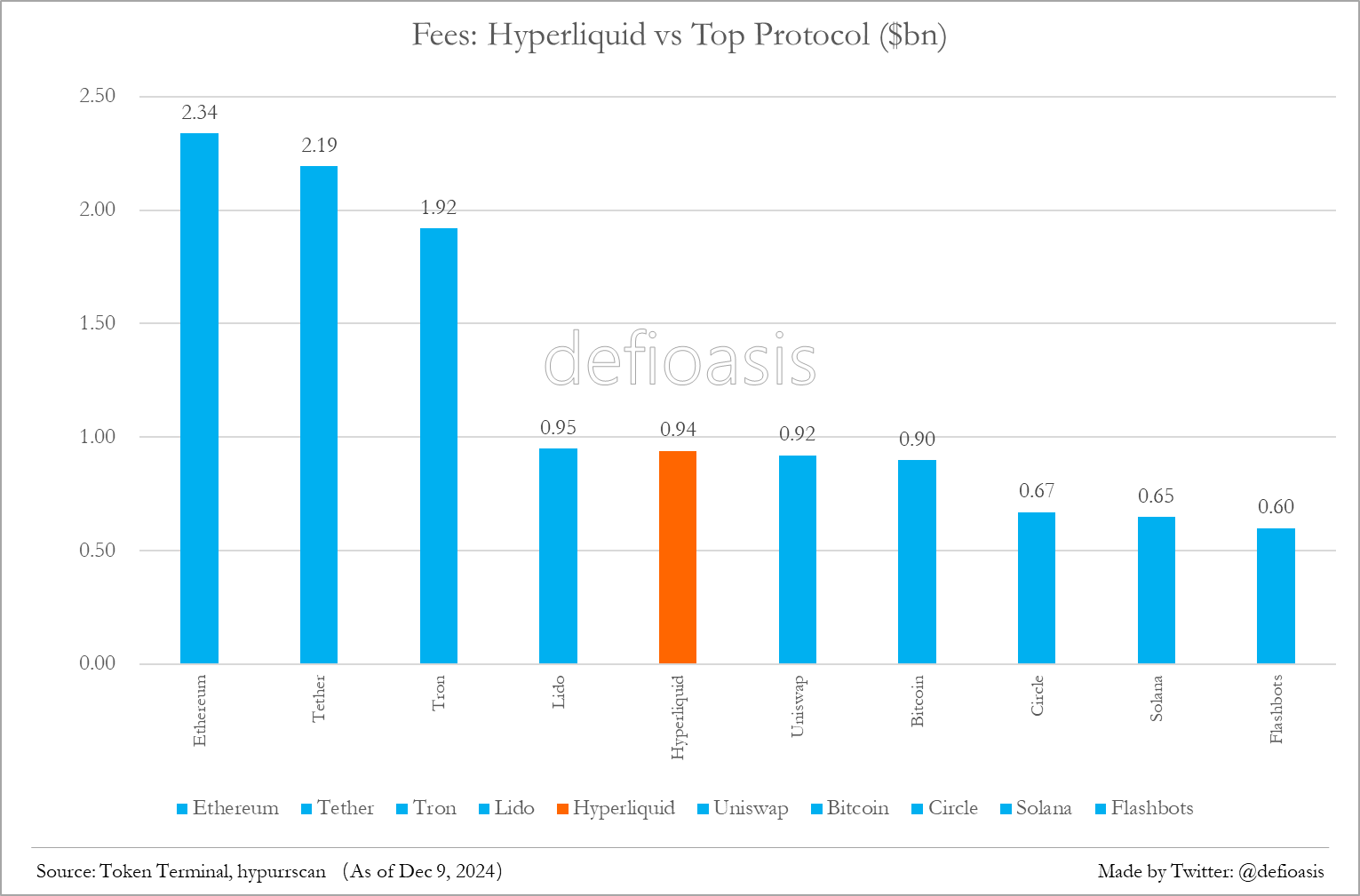

Tuesday, December 10, 2024

On Thursday, OKX market data showed that Bitcoin (BTC) surged past $100000, reaching an all-time high of $104056. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Movement Launches Mainnet, Pudgy Penguins Announces Token, PancakeSwap Introduces Springbo…

Tuesday, December 10, 2024

FOX Business journalist Eleanor Terrett reported that the US Securities and Exchange Commission (SEC) has informed at least two applicants for SOL spot ETFs that their submitted 19b-4 filings will be

Asia's weekly TOP10 crypto news (Dec 2 to Dec 7)

Tuesday, December 10, 2024

Russian President Vladimir Putin, speaking at the Russia Calling Investment Forum, stated, “Who can ban Bitcoin? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏