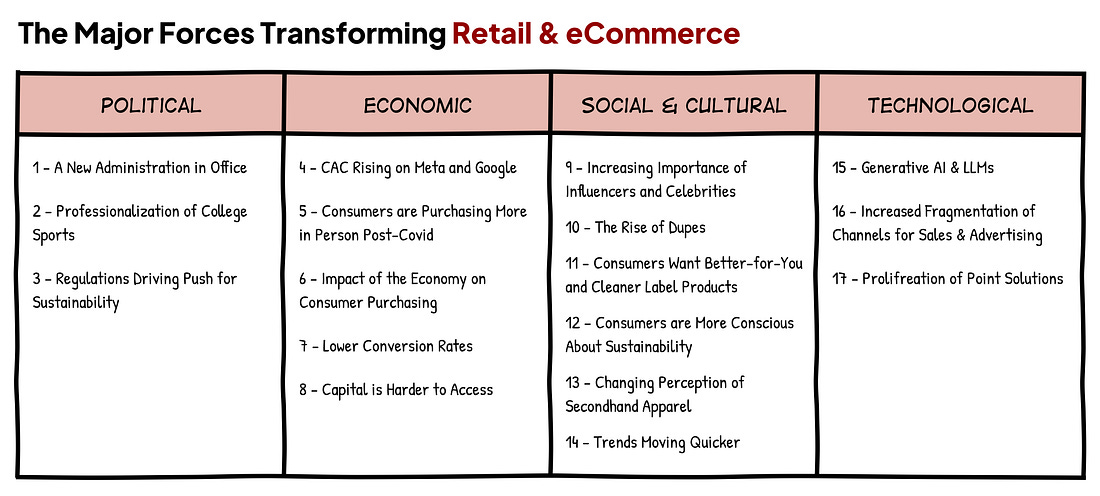

A couple of weeks back, we highlighted the major problems and opportunities in the retail & eCommerce industry that investors and operators would love to see more innovation around.

This week, we’ll share some of the transformational shifts in play that insiders are seeing across the sector. These shifts are creating new tailwinds for certain startups, while others are creating challenges for industry players. These challenges, in turn, can create whitespace for startups to help players manage the coming shifts.

Tracking these shifts, and others across sectors, can be paramount to spotting and capitalizing on new market opportunities.

In business, you can mess up a lot of things, but if you get the main trend right, you’re going to make a lot of money. And conversely, if you don’t get the main trend right, you’re swimming upstream.

– Brad Jacobs, Founder of 7 separate $1B+ companies

Similar to the previous post, this collection is not an exhaustive list but rather meant to serve as a starting point. If you see an angle we’ve missed, drop a comment below!

Are you an industry insider or tech operator with an interest in advising or angel investing in transformative startups? Join our Startup Expert Squad

A huge thank you to Marshall Porter (GP at AlleyCorp; ex-US CEO at Gympass, CSO at ShopRunner), Tehmina Haider (Partner at L Catterton; ex-Chief Growth Officer at Harry’s), Adrian Alfieri (CEO at Verbatim; Angel), Alex Malamatinas (Founder of Melitas Ventures), Brian Sugar (M.P. @ Sugar Capital; Founder of POPSUGAR), Chaz Flexman (CEO at Starday Foods, Angel), Chelsea Zhang (Principal at Equal Ventures), Jodi Kessler (Venture Partner at 3L Capital), Jordan Buckner (Founder of Foodbevy & Joyful Co.), Qasim Mohammad (Director at Wittington Ventures), Sib Mahapatra (CPO at Branch; Angel), Simran Suri (Investor at Maveron), Sophia Dodd (Investor at Equal Ventures), and Yuriy Dovzhansky (Partner at Visible Ventures).

With a new President in office, policy changes are already creating new opportunities and challenges for market players.

I think the election is going to probably change a lot of things. I don't think it'll remove any of the major categories, but I think the way that consumers spend across those categories could look very different…The changes remain to be seen. I don't think that we'll know in the next quarter. It'll probably be six to nine months.

– Simran Suri, Investor at Maveron

These impacts are expected to be seen across many areas, as officials such as RFK Jr. take leadership over critical Departments.

One of the important areas to watch across the retail segment that has already gotten a lot of attention is the Section 321 trade provision, which has become an increasingly popular trade “loophole” in recent years. This provision allows goods valued under $800 to enter the U.S. free of customs taxes and duties – allowing merchants like Shein and Temu to offer much lower rates and now accounts for >4 million shipments per day. The Trump administration announced they would eliminate the provision, but then announced they would delay doing so.

Many brands and retailers now use 321 as a way to manage imports and duties. The smart ones have realized the savings that can come from that, but we need to see what happens with this space.

– Marshall Porter, GP at AlleyCorp

Historically, NCAA rules prohibited college athletes in the U.S. from earning an income from their personal brands or by promoting products. However, recent legislative rulings now allow college athletes to monetize their name, image, and likeness (NIL), and even earn income directly from their schools.

This shift is driving the professionalization of college sports, creating new opportunities for companies that can enable college athletes to scale and monetize their personal brands, offer new experiences to fans, and help universities manage this massive shift.

College athletics is transitioning away from traditional amateurism and into a rapidly evolving professional ecosystem. This change is largely driven by three major class-action lawsuits, which have received preliminary approval and are projected to deliver more than $2.5 billion in back-pay to former athletes (dating back to 2016). Starting this year, annual direct-pay revenue sharing (currently capped at $20.5 million and subject to annual increases) is also expected to take effect.

Beyond financial settlements, schools will be subject to more stringent reporting of significant NIL deals and enhanced compliance measures, though the details of how this will actually happen are extremely murky. They will also gain greater flexibility in roster management by shifting from traditional scholarship limits to broader roster-size caps. Concurrently, the transfer portal emerges as a quasi-free agency, as athletes can move with fewer restrictions and often seek the most advantageous financial opportunities in the form of NIL deals. This dynamic is creating increased pressure for athletic departments to secure more capital to remain competitive in attracting and retaining top athletes.

Over time, this could lead to athletes being classified as employees, granting them rights such as collective bargaining and standard employment benefits. Such clarity in legal and regulatory structures may attract private equity or other forms of outside investment into collegiate athletics, bolstering the capital needed to sustain the shift toward professionalized student-athlete compensation.

– Sophia Dodd, Investor at Equal Ventures

New regulations are paving the way and pushing industry operators to adopt more sustainable practices. Europe is particularly leading the charge here:

Regulations are helping to accelerate the adoption of more sustainable practices. We are paying particularly close attention to regulations like the Extended Producer Responsibility Act (and versions of it) that are being led out of the EU. These regulations do not, in our mind, serve as a foundation for business building or success, but they offer opportunities to accelerate business growth, especially in areas like fashion/apparel and plastic alternatives in domains like packaging.

We see an opportunity for B2B2C players to leverage an ability to support reporting requirements and mitigate fees as a source of competitive advantage. For example, we’ve been working with [a port co] on their go-to-market strategy and critical narratives as their ICP expands. Enhancing their own understanding and connectivity with KOLs [Key Opinion Leaders] in the space has the potential to help them create a wedge in with new customers by demonstrating not just the economic value of their core service, but of the reporting capabilities they bring alongside those services.

– Tehmina Haider, Partner at L Catterton

For years, Meta and Google were the go-to channels for new upstarts to scale their marketing efforts and reach relevant customers at a low cost. However, as these platforms have matured and competition has intensified—further impacted by privacy changes from companies like Apple and regulatory changes in Europe—they are no longer as efficient or cost-effective as they once were. In response, companies are exploring new channels or revisiting legacy platforms that they may have previously de-prioritized.

The biggest [problem in the industry] has been distribution and CAC broadly. It kind of goes back to the decades-long arms race in social media marketing and search marketing when these [were the only] options.

It was pretty inevitable that these channels were going to get more expensive over time as more brands onboarded to them because they are auctions. And of course, the privacy regulations and the technical barriers to effective targeting have not been helpful. They've definitely made it worse.

So you have this generation of brands that grew up online, that know how to market online with direct-response that are used to very immediate feedback as input into their scaling of spend and marketing. And all of a sudden, they're not able to do that as well as they could.

– Sib Mahapatra, Co-Founder of Branch

There was just this playbook for years of taking VC money, giving it to Meta and Google, and really being a price taker on what it costs to acquire a customer and then trying to make that work. I think that's taken the creativity out of where you find that customer for free or nearly free. And you think about this continuum from zero CAC to infinity CAC – infinity CAC is more the Meta/Google type world. The free CAC is partnerships and press releases and any sort of tie-ins you can do with other brand collabs. There are a million things a brand can do.

There are still ways to acquire customers via paid that are really, really effective. But those two channels I think have played out.

– Marshall Porter, GP at AlleyCorp

Consumers are increasingly returning to in-person shopping post-Covid, following the rapid acceleration of eCommerce during the pandemic. With this shift, many are expecting new types of experiences and fresh formats for in-person shopping. This presents opportunities for brands and merchants to meet evolving customer expectations and redefine in-store experiences.

In parallel, a large number of digital-first brands are navigating the complexities of expanding into wholesale and retail channels. This transition, while bringing its own challenges, also opens new opportunities for enablers to support these brands in optimizing their presence across physical retail environments.

We're in the process of getting back to brick-and-mortar retail. I think it'll look different. I don't think it'll be the typical pop-ups that we've seen over the last many years. I don't know how technology might change things but I'd like to see more [innovation] because I think that is where a lot of consumers are looking and where they'll be going down the line.

– Simran Suri, Investor at Maveron

The big box retailers are really kind of falling flat. You're seeing it in their financial performance. I think there's just been very little innovation there, and the consumer is just looking for a new way to engage with physical retail, given that we now spend so much of our time online. So we'll see what happens with those big ones, but I certainly wouldn't be upset to see a new kind of retail experience.

– Jodi Kessler, Venture Partner at 3L Capital

McKinsey’s consumer team recently shared survey data that revealed consumers across all income levels and generations are restraining spending habits despite general optimism. This trend is poised to impact companies across the value chain.

A large part of what drove this interest in dupes was people looking for deals. TikTok made it seem less like, “Oh, I can't afford the real thing”, and more so like, “Oh, I can be really cool and get a bunch of followers and make money by not buying the real thing. I can discover something that nobody else knows and I can get a lot of attention for it.”

And so they have rewrote that narrative. I think the economic [considerations] of it are big.

– Simran Suri, Investor at Maveron

Many of the factors mentioned above have led to buyers being more hesitant to purchase new technologies or solutions. This has increased the length and effort needed in sales cycles to effectively close customers.

Framing this in the lens of buyers, they are much more hesitant. They'll still buy from you, but they're much more hesitant. They're usually selling across multiple stakeholders internally.

I think there is an increased focus and need for social proof and sales enablement specifically. Probably product marketing as well. If you have a more technical product or a multi-product platform, the TLDR is that people have a lot more questions and a lot more hesitancy and there's a lot more uncertainties and questions that they're going to bring up.

There's just a lot more scrutiny around the workflow, especially within the context of a longer sales funnel.

– Adrian Alfieri, CEO at Verbatim

Upstarts are finding it increasingly difficult to access both equity and debt financing as investors tighten their criteria in the current environment. In the retail sector, investors have shifted their focus from rewarding pure growth to prioritizing operational efficiency and sustainable financials. This changes how companies plan and develop strategies for how to scale.

Everybody has been so excited to chase growth because that's what was rewarded by the investment market. They lost track of what's happening on the efficiency, the cost side, the operation side.

– Marshall Porter, GP at AlleyCorp

I wish there was more innovation around creating accessible financing options for emerging brands. While CDFIs and alternative lenders like Aion Financial are helping fill some gaps, many founders still lack the resources to scale efficiently. I wish to see more financing options for brands along their entire lifecycle.

– Jordan Buckner, Founder at Foodbevy and Joyful Co.

The United States is experiencing a significant generational shift as Baby Boomers retire in the "silver tsunami" and Gen Z enters the workforce, bringing about substantial changes in the labor market and consumer spending patterns.

Consumers spend an incredible amount of time on social media, with most estimates putting the average time for users to be over two hours daily. Creators and influencers on these platforms can have immense leverage in driving awareness, and sales, for brands and products.

The rise of platforms like TikTok, Instagram and YouTube for direct purchases is creating a really, really high ROI environment for brands and for consumer engagement. That area has had a lot of investment but I think we are still in inning 2 of how big that can be. If you talk to agencies, that budget is shifting quickly away from Meta and Google. That's creating a lot of opportunity there on both the consumer-facing brand side and also on the tools and enablement side.

– Jodi Kessler, Venture Partner at 3L Capital

Creators could become even more important in a world with more AI-driven shopping experiences:

Perplexity recently announced that they're now integrating Shopify. Basically, you search for a product, and it provides a listing and then a little button to buy now. That is massively going to change the way people buy. You can have an AI agent just complete that transaction — so you're taking that consumer interaction with the brand out of it. I think that creates a ton of implications for both merchants and consumers.

…So if I'm no longer interacting with a brand on their website, where else am I interacting and hearing about them? That creates a real opportunity for creators and influencers and even consumers themselves to be a voice for brands.

– Jodi Kessler, Venture Partner at 3L Capital

"Dupes" are products that closely mimic the appearance and quality of high-end brands, often at a fraction of the price. Their popularity has skyrocketed, largely driven by social media influencers who passionately promote these budget-friendly alternatives to their followers. According to Wired, 50% of Gen Z shoppers and 44% of millennials have intentionally purchased a dupe.

I've been paying a lot of attention to this concept of dupes. 5 or 6 years ago, it was taboo to talk about owning a fake, carrying a fake bag or buying a dupe. That was seen as a massive social negative and it was something that was very hidden, not talked about.

However, now, there is a massive culture around buying dupes and finding dupes to the point that there are content creators out there who have quit their full-time jobs and are able to support themselves entirely by showing people dupes, and helping find them. That's kind of a crazy shift. It started off as this consumer purchasing pattern, but it's actually since then expanded into this very existential crisis for brands where now you have all these Chinese retailers and manufacturers that are coming in. And any time a brand launches a new SKU, within weeks you can go find that SKU on Temu and you can actually see there are even local manufacturers that are launching those same dupes of things.

So I think there are more businesses to be built around that, which is more of a mid-term sort of thing. I think it's a 2-4 year opportunity to build something. You could build a big business around that.

Longer term, I think the pendulum actually swings back and away from dupes, where all of this focus will ultimately give consumers an appreciation for the real thing. I think we're starting to actually see that in food & beverage ahead of apparel, jewelry, and handbags.

– Simran Suri, Investor at Maveron

New generations, or even people of the same generation, are increasingly looking for better-for-you clean label alternatives to the established brands. And so there are certain subcategories and categories that are ripe for disruption. We were early in prebiotic soda with OLIPOP. We were early in cereal with Magic Spoon. An area I think is interesting right now is household cleaning products and detergent. One of our recent investments is in that space. Fragrance is interesting. There are several categories where I still think there's opportunity to innovate and challenge the established brands. Some key emerging themes we are focused on include gut health, fem care, and global foods.

…There's an opportunity for brands and companies that appeal to Gen Z and Gen Alpha both in terms of being cleaner label but also in terms of just the branding, positioning, and maybe price point.

– Alex Malamatinas, Founder of Melitas Ventures

As always, consumers are looking for more from brands and products, which includes cleaner labels, higher quality ingredients/raw materials, and the like. Right now, we see that consumers continue to be focused on increased fiber and protein consumption (due in part to GLP1 proliferation) as well as lower sugar intake, but more so we need a desire for a return to whole, less processed ingredients. Shorter ingredient panels are winning for the health-minded consumer. For the big CPG food companies, it’s hard to retain consumer appeal and even trust when products don’t align with those shifting preferences, and long innovation cycles make change slow.

– Tehmina Haider, Partner at L Catterton

As information on brands and merchants becomes more readily available, many consumers are becoming more conscientious about who they purchase from:

Consumers have become really conscious about what they're buying. So whether that's quality-driven, price-driven, or sustainability-driven, the consumer is making more considered choices in how and where they're spending. I think that creates a lot of opportunities in areas like resale and the circular economy.

– Jodi Kessler, Venture Partner at 3L Capital

Customers are increasingly drawn to brands that align with their values, especially those led by underrepresented founders or committed to sustainability.

– Jordan Buckner, Founder at Foodbevy and Joyful Co.

Consumers are increasingly embracing the purchase of secondhand apparel, with the global market for such products estimated at over $230B in 2024. This is expected to grow quickly to $350B by 2028. The expanding opportunities within the booming resale segment create a significant opportunity for growth and innovation.

The data shows this, and there's no disputing it. Resale is a massive market and the growth rates are huge. I think we've seen a lot of consumer sentiment shifting in that direction and pushing that trend, as well as top-down from the retailers, brands, and even government legislation, particularly in Europe lately.

– Yuriy Dovzhansky, Partner at Visible Ventures

Now you see trends can die and get hot very quickly and you see that there are some brands that can keep up with the speed and react in a way that is productive for them versus brands that are trying to come to the moment but they're not doing it in a way that is timely and/or additive to their brands. So I think you are actually seeing this struggle on the brand side and the retailer side of, “Okay, how do we embrace this new speed of consumerism?”

And before – I think because most brands are bad at this – you actually got away with a little bit more. But now you actually see some entities that can move really, really quickly. Shein is the perfect example. They are able to move at the speed of a TikTok trend. So because you actually have competitors who are moving very quickly, I think some of these traditionally structured brands are really feeling the pressure of how do we live up to that.

– Chelsea Zhang, Principal at Equal Ventures

If you think of the European brands, and the Italian and French in particular, they're building brands to last a century or more. So many brands today, in the West and the US in particular, are being built to last a year or two, and just sort of hockey-stick growth without real thought of what this looks like. Is this a brand that we want to stick around or am I trying to make money really fast? I’m curious to see how that plays out.

– Marshall Porter, GP at AlleyCorp

Gen AI is expected to have a major impact across the commerce landscape. Investors and operators alike highlighted excitement around the upcoming wave.

It's hard to ignore AI in everything, but especially the implications of AI in retail and commerce. If you consider how companies like Perplexity are now trying to disrupt Google search, there's real potential that you're going to build a new monetization engine and really change customer acquisition dynamics for brands.

– Jodi Kessler, Venture Partner at 3L Capital

Although early, the impact is already being seen across operations for companies in the space.

I've seen AI be impactful already on sales and marketing for scaling content. I've seen it be impactful for knowledge management. A lot of what I've seen being worked on is helping to retrieve either the insights of top employees or the information that we have and making it more readily available to everybody else.

I know there's an ongoing need by a lot of them on the source mapping side of things for your supply chain. There is a need around automation for the logistics and fulfillment part of the value chain as well.

Beyond that, I continue to hear about HR related use cases around recruiting. In our case, being such a large employer, how do we get better at retaining and making sure we constantly have human capital to keep our business running smoothly?

– Qasim Mohammed, Director at Wittington Ventures

To be better positioned for the coming transformation, many in the industry have been willing to jump in early to work with upstarts:

Today, a lot more of what I'm seeing is that resellers and brands are becoming design partners for a lot of the AI solutions that are coming to market. They want to be the first ones to integrate or use the functionality or, in an exclusive way, capitalize on the benefits that that solution may bring. Whereas again, historically, I think that they were much more passive in their approach of how they work with newer service providers.

…there have been a lot of examples in retail where companies that were either slow to adopt or weren't active participants in those technological advancements were oftentimes left in the dust by their competitors. I think that is probably a small part of [the motivation].

The benefit that a lot of these solutions claim to provide—whether it is just a claim or whether they're actually making headway on it—is pretty transformational to a business.

– Yuriy Dovzhansky, Partner at Visible Ventures

The previous post in this series highlighted several of the areas where investors and operators are initially excited about the impact of AI in the space.

We’re seeing an increased fragmentation in the channels that merchants can advertise and sell on online in the U.S.

Next-Gen marketplaces – the non-Amazon marketplaces of the world – are starting to gain traction. There is a fairly obvious opportunity there. Anything that enables people to be successful from a Third-party perspective has an opportunity. I'm not sure which marketplaces are going to win, but there are clearly going to be a few more that reach scale over the next five years, and it seems extremely logical to think that an Amazon-like cottage industry is going to evolve around each of them and they are going to be different.

The big one obviously is Walmart.com, which seems to be the most obvious choice. TikTok Shop was looking good, but now maybe not so much. Target.com, BestBuy.com, and HomeDepot.com – these are all ones with significant GMVs in their primary channels that seem to have decent potential for third-party marketplaces.

– Chelsea Zhang, Principal at Equal Ventures

Several of our experts shared insights on some of the opportunities that are arising from this shifting dynamic in the previous post.

A recurring theme in many of the conversations was the proliferation of point solutions in the sector, each offering best-in-class capabilities for one-off problems. However, these specialized solutions can result in higher integration costs, increased coordination challenges, and the creation of data silos.

There are a lot of point solutions, but the question you always have to ask yourself is, that of the many features out there, which ones have the prospect of becoming a platform?

…There are a hundred different problems, but I would never invest in a one-problem feature point solution.

– Qasim Mohammed, Director at Wittington Ventures

As an investor, I get excited about seeing somebody with a vision of how the world should be, what they're going to do to make that happen, and how it's really different. So if we talk about Portless and their competitors, they're trying to enable brands to go from the manufacturer straight to the consumer and really reinvent that supply chain.

I think that's better than the 26 last-mile logistics carriers that we've seen that have tried to pop up with lanes between Los Angeles → Dallas and Los Angeles → Seattle. I just think it completely reinvents the supply chain. Not just for the purpose of reducing logistics costs, but there are really material impacts on the P&L of a brand.

– Marshall Porter, GP at AlleyCorp

Merchants run into many issues when they have to go to use a whole slew of systems, rather than being able to manage their work off a single product.

Why is [Klaviyo’s] SMS capability so much worse than Attentive? Why do I need [both] Klaviyo and Attentive? Why isn't there one super app that does both perfectly? There are benefits that arise from combining flows and data sharing, and you can hack it all together. It's definitely possible to do with separate tools, but I don’t want to also add a CDP on top of all this!

– Sib Mahapatra, Co-Founder of Branch

What people actually want is to have their whole problem solved. And they're willing to pay up for it.

…One of the recent deals I did is Haven—it's a tax and accounting firm. They're using a lot of their services revenue to build out really interesting software tools. They do a combination of services plus software. And I think that is really, really compelling because if you think about tax and accounting, you just want it solved. You do not just want a strategy component. You also don't want to just use a software tool that can replace something like Xero or QuickBooks. You want the whole thing done. You don't want to just use a software tool that's going to refer you to other vendors. You want someone that can do it all in one. And so I think increasingly, things are going to move that direction again. It’s TBD on whether VC appetite is there to fund those things, but that's definitely something I'm seeing more and more.

– Adrian Alfieri, CEO at Verbatim

…the challenge that's presented when you're selling to a brand is that they have to make the difficult decision of choosing well, which one of these six providers do I choose? Is it someone who serves me as an SMB and fulfills my need for peer-to-peer? But in three years, as my business grows and becomes more logistically complex, I may need repair functionality, I may need inventory take-back functionality and the initial provider won't be well suited for these. And after all this [effort to integrate], I'll have to ultimately switch or worry that that provider is going to run out of funding and won't exist tomorrow.

– Yuriy Dovzhansky, Partner at Visible Ventures

Leveraging many point solutions ultimately also drives sub-optimal experiences for end customers.

Customers expect to move seamlessly between online and offline channels, but siloed systems make this difficult. When inventory isn’t synced across channels, or when customer service teams can’t access order histories, customers are left frustrated, impacting brand loyalty.

– Brian Sugar, Managing Partner at Sugar Capital

Marshall Porter is a GP at AlleyCorp where he leads the Diversified Technology team. AlleyCorp invests across sectors and stages but has a particular focus on companies from Pre-Seed through Series A. Marshall was previously US CEO at Gympass, President of Spring, CSO at ShopRunner, and GM & SVP at Gilt Groupe.

Tehmina Haider is a Partner focused on consumer investing at L Catterton. Founded in 1989, L Catterton is the only global private equity firm focused on consumer growth investments. L Catterton has made over 275 investments to date, leveraging deep category insight, operational excellence, and a broad network of strategic relationships to help build many of the world's most iconic consumer brands. Tehmina was previously the Chief Growth Officer of Harry’s Inc.

Adrian Alfieri is the Founder & CEO at Verbatim. Verbatim is a growth agency that specializes in generating demand through best-in-class content engines. Adrian is also an active angel investor.

Alex Malamatinas is Founder of Melitas Ventures. The firm invests in early stage (Seed and Series A) opportunities with a primary focus on better-for-you branded consumer products.

Brian Sugar is Founder & Managing Partner of Sugar Capital. Sugar Capital invests in seed-stage companies at the intersection of technology and commerce. Brian was previously the founder of POPSUGAR.

Chaz Flexman is Co-Founder & CEO of Starday Foods. Starday is leveraging an AI-driven approach to building the next great food conglomerate. Prior to Starday, Chaz was a part of the founding team of Pattern Brands, VP at PCH International, and a Partner at A16Z.

Chelsea Zhang is a Principal at Equal Ventures, where she leads the firm’s focus on retail & supply chain investments. Equal writes $2-3m checks at the Seed stage in companies transforming retail, supply chain, insurance, and climate.

Jodi Kessler is a Venture Partner at 3L Capital, a growth equity firm backing companies across Commerce, Enterprise Software, and tech-enabled services. The firm typically invests in companies after Series B and writes checks of $10-30M.

Jordan Buckner is the Co-Founder of Foodbevy and Joyful Co. Foodbevy is a leading community for emerging F&B founders to navigate the complexities of growing a brand. Joyful Co. develops gift boxes that connect people through thoughtful, high-quality products.

Qasim Mohammad is a Director at Wittington Ventures focused on venture investing. Wittington is the private family office of the controlling shareholder of some of Canada's largest businesses across retail, real estate, and more. He runs a publication called Fire Ant focused on the future of commerce.

Sib Mahapatra is Co-Founder & Chief Product Officer at Branch. Branch makes it easy for teams of every size to create an office they’ll love – from ordering and assembly to space planning and pickup.

Simran Suri is an investor at Maveron, an early-stage Venture Capital firm focused on investing in consumer businesses. Maveron writes checks of up to $10m with a sweet spot of investing in Series A rounds.

Sophia Dodd is an investor at Equal Ventures, where she takes a generalist lens to investing. Equal writes $2-3m checks at the Seed stage in companies transforming retail, supply chain, insurance, and climate.

Yuriy Dovzhansky is a Partner at Visible Ventures. Visible invests in early-stage companies that make the everyday extraordinary, with a particular focus on 3 verticals: eComm Software, Healthcare, and Consumer AI.

Credit to Lenny Rachitsky who inspired the format of this post with his expert insight series around growth and product management.