| | | | | | Streamline compliance, focus on growth. | | As a startup founder, finding product-market fit is your top priority. But landing bigger customers requires SOC 2 or ISO 27001 compliance—a time-consuming process that pulls you away from building and shipping. That’s where Vanta comes in.

Join over 9,000 companies, including hundreds of Y Combinator-backed startups like Supabase, Newfront, and Fern who streamline compliance with Vanta’s automation and trusted network of security experts.

Try them out so you can spend less time on compliance and more time growing your business. | | Interested in sponsoring these emails? See our partnership options here. |

| |

| | |

| | HOUSEKEEPING 📨 | Today’s interview is a fun one team. I have spent a lot of time lately with larger company, companies that have raised huge funding rounds and/or are at or close to the vaunted unicorn status. But I want to make sure I am learning from people on the early side, and/or those that are doing business a bit differently. | Benjamin, who we are interviewing today is one of those cases. He is a young founder, who scaled his first business that he founded at 15 to $1M in ARR. With his second business, Vesto, he has chosen the scrappy past for building, having a very small—he didn’t specify but I believe it’s sub ten—and only one report.

He has been able to scale to 100+ clients, with some great logos, and ‘around Series A’ in scale, all while staying as lean as Christian Bale in The Machinist. |

| |

| One of his earliest investors is a guy I respect that I quite admire, Andrew Wilkinson from Tiny. Some of you may know him, if not, he’s worth a follow (or a read). Some people call Andrew the ‘Warren Buffet of the internet’ for his love of profitable companies with good fundamentals. So it all checks out.

Anyway, I really enjoyed meeting Benjamin and am looking forward to bringing you more insights from companies large and small, funded and bootstrapped, legal and illegal. Enjoy! |

|

| |

LEADER OF THE WEEK 🎙️

| Benjamin Döpfner, Founder and CEO at Vesto | Benjamin Döpfner is the founder and CEO of Vesto, a treasury management platform that helps businesses connect and view their entire cash footprint in one place. He specialises in building software that simplifies treasury operations for companies with multi-entity and multi-bank operations. | With a background in entrepreneurship, Benjamin launched his first company at 15, scaling it to over a million dollars in revenue. His experience navigating cash management challenges led to the creation of Vesto, which is now redefining how companies manage their finances. By blending technology with financial strategy, he helps businesses maximize efficiency and growth. |  | The man, Ben. |

| Tell me about founding your first company? | I started my first company while I was still in high school, initially as a hobby. We developed software for photographers and filmmakers, which is a completely different field from what I'm doing now. I began that venture at a very young age and managed to scale it for many years. It was profitable from day one, so I never needed to raise any venture capital. We pretty quickly reached a run rate of about a million a year, while being a nicely profitable business. |  | Stop Overthinking and Just Start Now l Vesto, Benjamin Döpfner |

|

| As the business grew though, I was increasingly confronted with financial management challenges, such as dealing with a lot of idle cash, and having it spread across various countries and accounts. These experiences led me to establish Vesto, which has evolved significantly since its inception. The previous company was a rewarding journey, but not one I wanted to pursue for the rest of my life. I was about 15 or 16 when I started the company, and scaled it for a few years, before ultimately deciding to start Vesto. | What problem are you solving and why? | The company has evolved a bit since we started, with the initial vision for Vesto being really focused on cash allocation and idle cash management. We actually helped companies invest their cash and put it to work. We scaled that for probably a little over a year and a half, and through working with many customers and understanding their pain points, we realized what we were doing was useful, but we were competing with big banks and investment houses.

That’s not a great vector to compete on because we’re never going to beat them at their own game, but we realized we can beat them in software since pretty much every bank is terrible at software. The problem we’re solving now is similar in some respects but quite different in terms of the end product. | Pretty much every company, especially large enterprises and those in a few specific verticals (real-estate, private equity, global businesses), have this problem where they’ve got cash spread out across various places—multiple legal entities, bank accounts, often in different countries and currencies. |

|  | The Vesto way. |

|

|

| As that cash footprint expands, it becomes very hard for finance teams to really understand what’s going on in the business. Simple things like knowing your cash position, last month’s cash flow, or seeing all your transactions get complex because instead of logging into one bank, you have to access multiple bank portals, download statements, consolidate them, and even manage multiple currencies if it’s global. | What Vesto does now is we integrate all of those financial accounts—bank accounts, payment processors, credit cards, loans—to give companies one real-time view where they can see everything in one place. It sounds like a boring problem, but it's at the core of many key financial workflows. | What was the most difficult thing in going from zero to one? | I think the hardest part was building a product that people truly loved and were willing to pay for—consistently. In the early days, people really liked the first version of the product, but they weren’t necessarily willing to pay much for it or use it long-term. | Last year we’ve reached a point where customers see real value in the product, they want to pay for it, and they stick around. They’re building long-term relationships with us, which has been the key challenge to solve. Of course, team building and sales are tough, but at the core, if you create a product that genuinely solves a major problem and customers are happy to pay for, everything else starts to fall into place. |  | The early Vesto office. |

| What steps did you go through to get to a product people wanted to pay for? | Frankly, it started with a lot of customer conversations. Our initial 'aha' moment came when a customer, who operates a talent marketplace, detailed their daily financial challenges to me. They were dealing with numerous payments going in and out daily because they had to pay freelancers globally in various currencies, and they also managed payments from companies that hired these freelancers. | This customer had around 15 to 20 different legal entities, and they used several banks and payment processors. On a call, he shared his screen and walked me through his operations team's morning routine—they would log into about 50 different accounts, gather the data into a spreadsheet, and then compile a report. This task took two to three hours every morning and was essential for managing their payments and making other operational decisions. | This was an extreme case, but it illuminated a significant pain point that we aimed to address with Vesto. We started by building a very basic MVP for this client and a few others we found. We launched it, solicited continuous feedback for improvements, and began to sell it—even though we weren't sure they were ready to pay for it. We tapped into the market, kept the dialogue open with more people, and did a lot of experimentation. | What is your main day-to-day job as CEO? | My job involves a couple of key areas. A significant portion of my time these days is devoted to sales. I’m still heavily involved in talking with both current and potential customers. Although we’ve scaled up and brought in more team members to help, I continue to handle many of these conversations myself. That’s a major part of my role. | Additionally, I make it a point to stay hands-on with our customer base. Rather than just providing support, I regularly check in with each customer every few weeks to ensure they are deriving value from our product. | The other half of my time is spent on the product side, working closely with our engineering team. I act as a conduit, relaying customer experiences and pinpointing pain points, improvements, and gaps in our offering.

This involves aligning these details with our long-term product vision and collaborating daily with engineers to develop the product. |

| |

| What does your team structure look like? | We have a very lean team structure. It primarily consists of a small engineering team. I work closely with our head of engineering on the product side daily. Additionally, we have someone who handles operations and assists with some aspects of sales. In the past, we've worked extensively with contractors, but we're now transitioning to more full-time roles. | Which marketing channels have worked for you? | For us, it’s actually a mix of a few things. Outbound is still a big part of our strategy—we do a lot of classic B2B SaaS outbound. It’s not the most efficient channel, but if you reach out to the right people at the right time, it works. I like to think about it this way: we have to sell to customers 365 days a year, but on just one of those days, they’ll be frustrated enough with their problem to take action. Our job is to make sure that when that moment comes, they think of us. |  | Benjamin Döpfner @bendopfner |  |

| |

Huge thanks to our friends and partners at @tryramp for featuring Vesto on Times Square! | |  | | | 3:46 PM • Aug 2, 2023 | | | | | | 35 Likes 3 Retweets | 0 Replies |

|

| Another big channel has been finding what I’d call 'under-tapped' business influencers—people who aren’t traditional social media influencers but have strong credibility in their niche, like podcasters and newsletter writers. We’ve run a few small-scale partnerships with them, and it’s worked really well. Since our target audience is fairly niche, we’re not competing with massive brands paying top dollar for sponsorships, which keeps it cost-effective. | Who is the ICP and how did you identify them? | Our ideal customer profile (ICP) includes companies that have multiple entities, multiple bank accounts, and even better—operate globally with multi-currency needs. The more complex their financial structure, the more value they get from Vesto. | Right now, we primarily serve three main verticals. The first is real estate companies, where every property they acquire is structured as a separate legal entity with its own bank accounts and loans. If a firm owns 50 properties, they can easily have hundreds of accounts, making this a huge pain point. | The second group is holding companies and lower mid-market private equity firms — Tiny Capital, Merit Holdings and Enduring Ventures are just a few of our recent customers in this space. These firms own multiple businesses, each with its own banking setup, so they face similar challenges in managing cash across different entities. | The third segment is fast-growing global companies that expand into multiple regions and start running into the complexity of managing money across countries and currencies. While this category is broader, the pain point remains the same—financial fragmentation that makes it hard to see and manage cash in real time. |

|

| | | | | | Prepare for your next business move with our International Hiring Guide | At Deel, we've simplified a world's worth of global hiring information. Our expert teams can help you navigate quick and compliant hiring in 150+ countries and so much more. | Download our guide | Interested in sponsoring these emails? See our partnership options here. |

| |

| | |

| | How do you manage 100 clients with a small team? | With great difficulty! It’s not always easy, but the key is knowing what truly matters and optimizing for that. A lot of software companies set up recurring check-ins—monthly or quarterly calls—but I’ve always found those to be a waste of time for most businesses. Instead, we focus on what’s actually important: Are our customers getting value from the product? Are they running into issues? If they are, we tackle those with intensity. | We also make sure that the processes we do have in place are scalable. Not every customer needs the same level of attention, so we prioritize the ones where engagement is most critical. Anything that doesn’t directly improve the customer experience or the product, we either streamline or eliminate. | How do you decide which customer feedback to act on? | It’s something we’ve struggled with in the past, but we’ve developed a solid approach. Different industries have different needs—as an example, some of our customers rely heavily on checks, while others do everything via ACH, changing their reporting needs a lot. Those kinds of technical nuances affect how they use the product, but at the core, they all share a common pain point. | Whenever we get feature requests or feedback, we don’t just ask ‘Is this useful for this one customer?’ Instead, we look deeper: ‘Is this a fundamental problem that others are experiencing too?’ If it’s just a nice-to-have for one company, we usually say no or push it to the backlog. But if it points to a deeper issue that affects multiple customers, we prioritize solving it in a way that benefits everyone. | What is your North Star metric? | I’d say there are two key metrics. The first is revenue—at the end of the day, that’s the core driver of any business. But beyond that, a big focus for us is how much time and money we’re saving our customers. | It’s not always easy to quantify, but we’re working on ways to measure it more precisely. If we can save finance teams an extra hour or two a day, that’s incredibly valuable. |

| |

| In some cases, that efficiency translates into revenue growth for us down the line. Even if a feature doesn’t immediately boost revenue, if it significantly reduces customer workload, it’s still a worthwhile investment. | How do you set goals? | We don’t have a rigid, repeatable process for goal-setting, but our approach is to set really ambitious targets—ones that might seem slightly out of reach at first. I find that aiming high is far more motivating than setting easy goals and hitting them every time. | If we fall short, it’s not a failure; it just gives us a clearer picture of where we need to adjust. I’d rather shoot for something big and course-correct along the way than play it safe with predictable milestones. | Are you profitable or still burning cash? | We are still burning cash, though very minimally, and are almost at the break-even point. We raised about ~$3M in venture funding, with Tiny Capital being our first investor. They wrote the initial check and have also become a customer and daily user of the product since. |  | Vesto @getvesto |  |

| |

We're honored to be serving Tiny! 🤝 |  Andrew Wilkinson @awilkinson Andrew Wilkinson @awilkinson

At Tiny, we manage over hundreds of bank accounts across 40 odd businesses. That's a lot of cash to keep track of. Our finance team used to spend hours every week logging into hundreds of accounts just to copy/paste balances into Excel. Manually. One misplaced decimal and… x.com/i/web/status/1… |

| | | 7:11 PM • Sep 7, 2024 | | | | | | 12 Likes 0 Retweets | 0 Replies |

|

| In terms of growth strategy, I don't see a significant trade-off between staying lean and driving growth. Ideally, I envision building a company that is lean and efficient in the short term while remaining focused on significant growth. I think it’s very possible for us to achieve a substantial venture-scale outcome. If the opportunity arises to optimize further and invest heavily in growth, we might pivot to prioritize expansion over short-term efficiency and profitability. Currently, we are not in a position where an influx of capital, like $100 million, would be necessary or optimally utilized. We could efficiently use about $5 to $10 million, but there's no immediate need for hyperscale operations at this moment. | If you were to raise a Series A, what would need to happen? | I think in terms of fundraising goals and metrics, we’re already close—if not already there—depending on who you ask. From an investor’s perspective, we likely meet the typical benchmarks for raising a Series A. | That said, for us, it’s not just about hitting metrics; it’s about having a clear, repeatable way to deploy capital efficiently. Sure, we could hire five more engineers and two more salespeople and that would be awesome, but before raising a large round, we want to be confident that for every dollar we put in, we’re getting much more out. If we don’t see that level of efficiency, then raising a massive amount of money wouldn’t make much sense. | How do you get the best out of yourself personally and professionally? | For me, the biggest factor is working with really great people—people who push me to be better and work harder. If you’re surrounded by the right team, it naturally elevates your performance. | The other key thing is being genuinely interested in what I’m working on. I don’t think it’s possible to operate at a high level if you’re not excited about what you’re building. If I ever feel disengaged, I take a step back and ask: Am I working with the right people? Do I look up to them? If the answer is no, something needs to change. | Outside of work, it’s about optimizing for good relationships and making time for the people who matter. That balance helps me stay sharp both personally and professionally. | Is there anything at Vesto you do particularly well? Anything unique to your early success? | One thing I’ve always been deeply involved in—and something I think I do well—is product design. My first company was in a creative space, selling software for photographers, so I’ve always had an eye for design. |  | In a zone. |

| Early on at Vesto, I was heavily involved in shaping the product experience, but as we’ve grown, I’ve had to delegate more of that. It’s something I really enjoy, though, and I try to stay as involved as possible in designing product interfaces, user experiences, and even our website. Having that creative input has been a big part of our early success. | Extra reading | | And that’s it! You can also follow Ben on LinkedIn, and check out more about Vesto on their website. |

|

| | BRAIN FOOD 🧠 | This week I'm bringing something a little more sciencey, an interview with Yann LeCun, one of the godfathers of modern AI. In this episode, he explains exactly why today’s AI is still kind of dumb despite all the hype, how we’re nowhere near real reasoning or planning, and why physics might hold the key to AI’s next big leap. Definitely worth a listen. |  | Father of AI: AI Needs PHYSICS to EVOLVE | prof. Yann LeCun |

|

|

|

| | HIRING ZONE 👀 | Today we are highlighting AI talent available through, Athyna. If you are looking for the best bespoke tech talent, these stars are ready to work with you—today! Reach out here if we can make an introduction to these talents and get $1,000 discount on behalf of us. | |

|

| | TWEETS OF THE WEEK 🐣 |  | Shaan Puri @ShaanVP |  |

| |

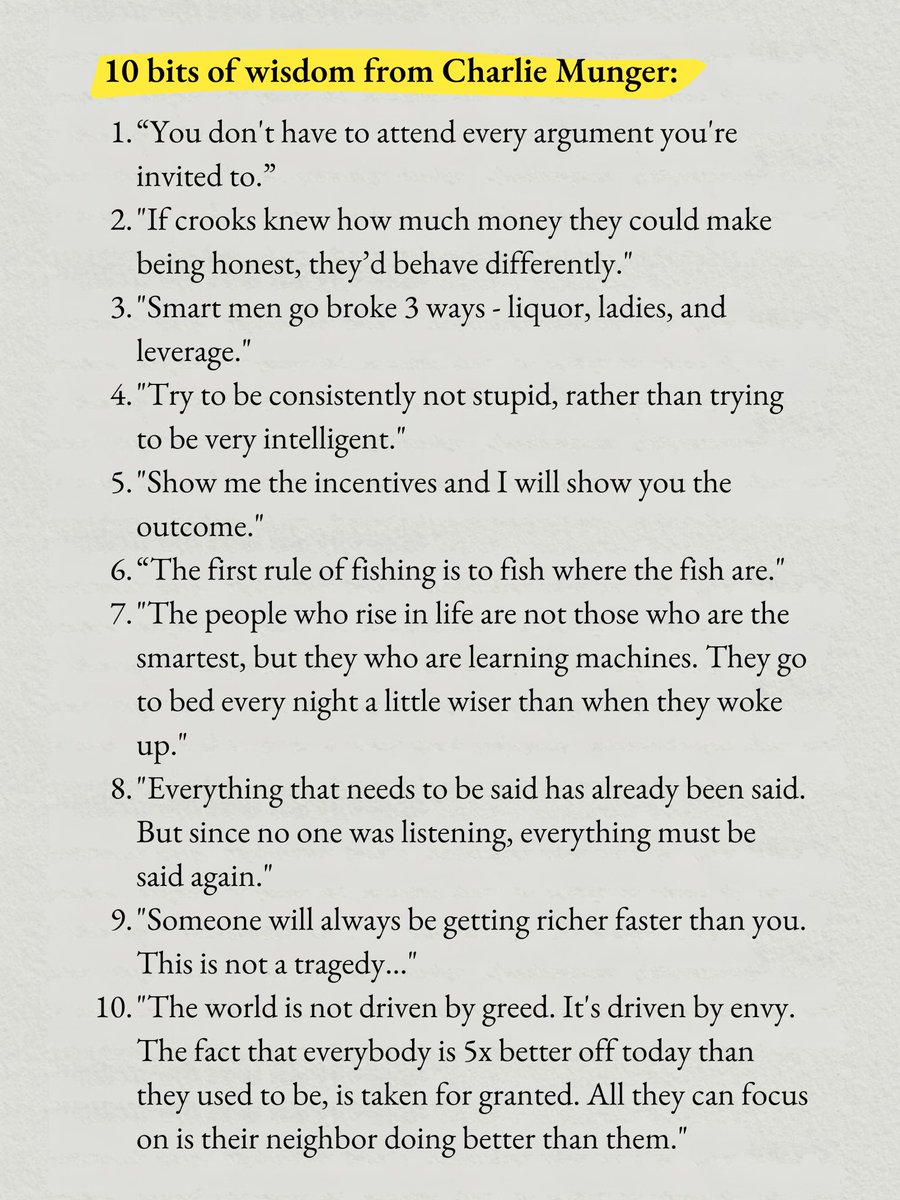

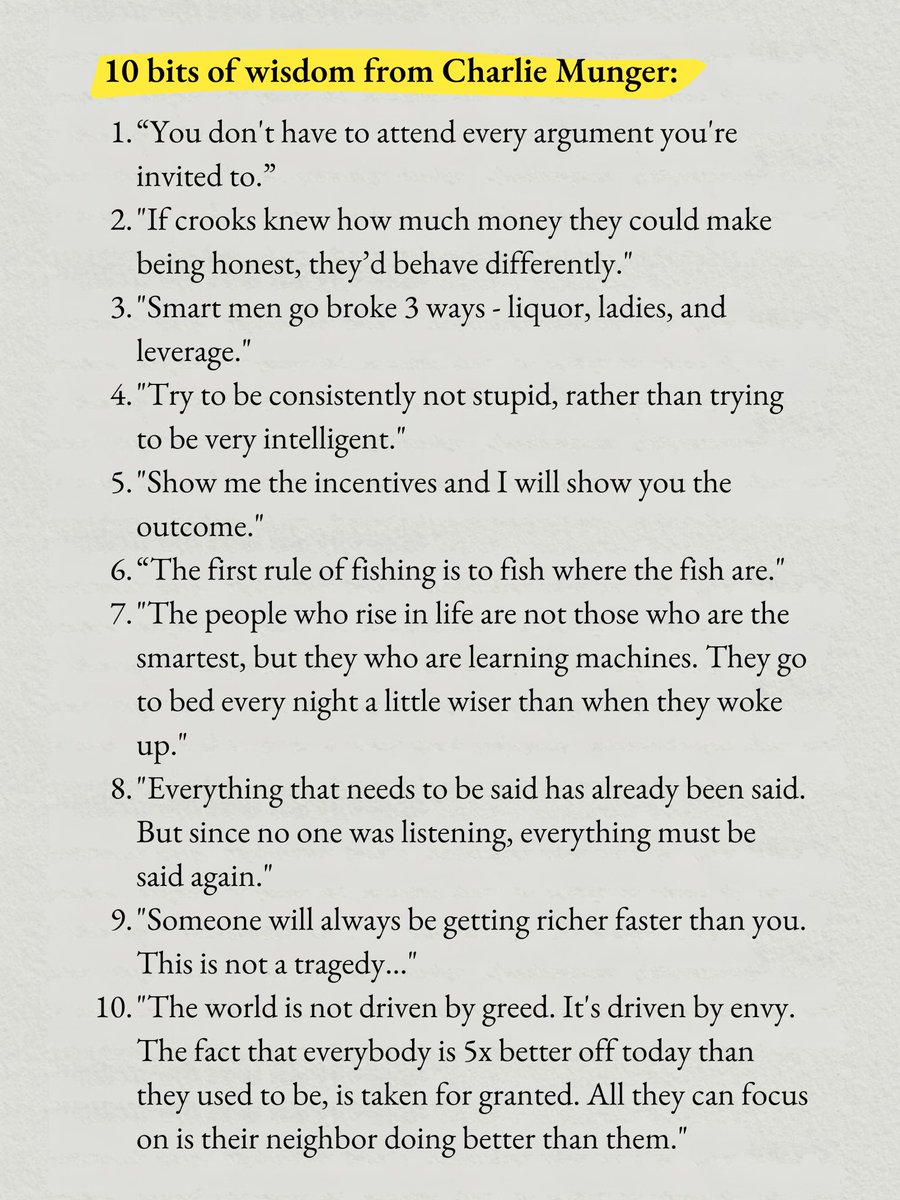

10 bits of wisdom from Charlie Munger: | |  | | | 5:25 PM • Mar 14, 2025 | | | | | | 15 Likes 1 Retweet | 3 Replies |

|

|  | John Coogan @johncoogan |  |

| |

Duo Lingo is done for when Apple releases this in 2041. | |  | | | 3:06 AM • Mar 14, 2025 | | | | | | 1.64K Likes 43 Retweets | 97 Replies |

|

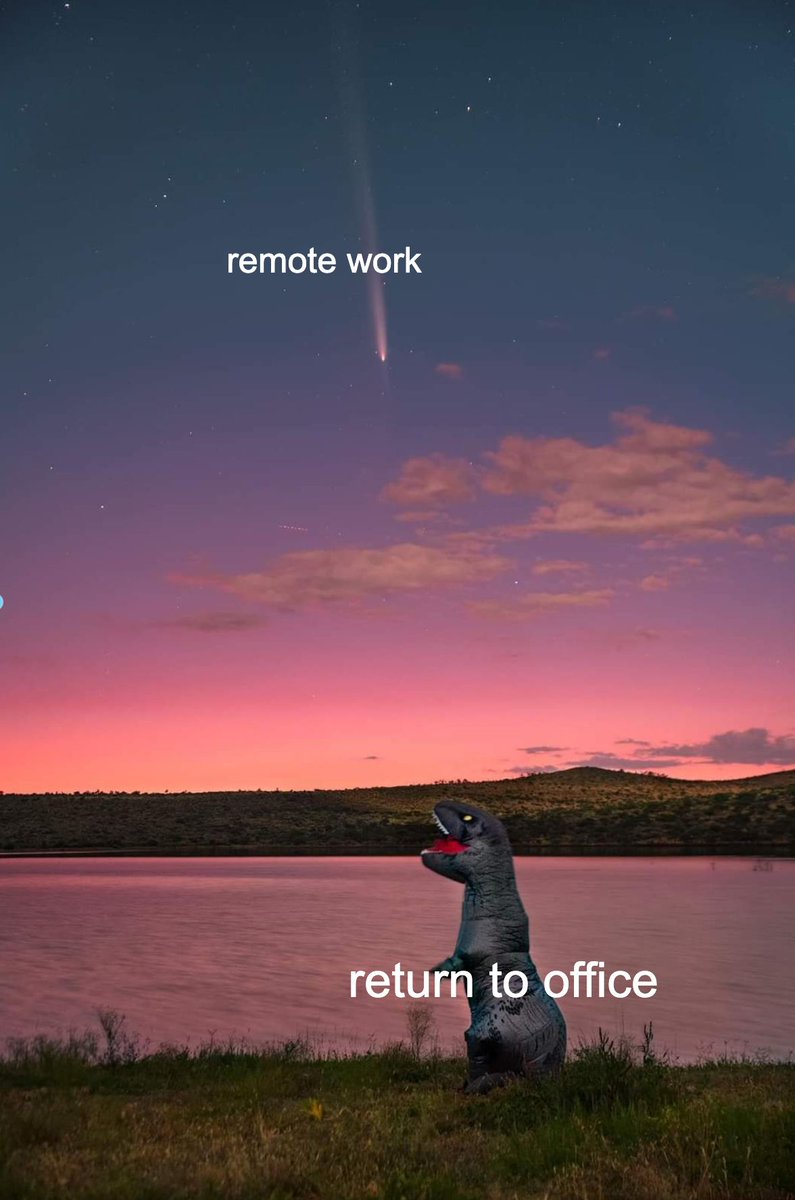

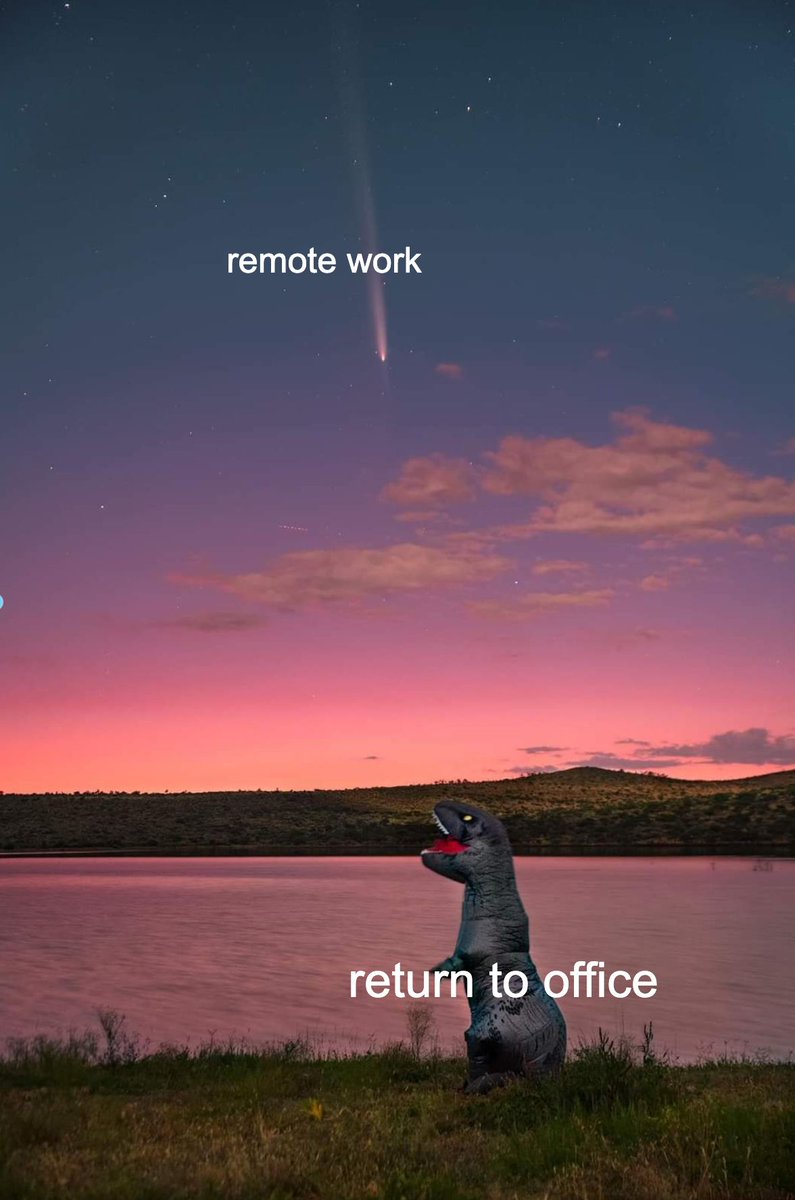

|  | Bill Kerr @bill_kerrrrr |  |

| |

Choose life. Choose remote work. lnkd.in/eRzQsAHV | |  | | | 3:21 AM • Oct 24, 2024 | | | | | | 0 Likes 0 Retweets | 0 Replies |

|

|

|

| | TOOLS WE USE 🛠️ | Every week we highlight tools we actually use inside of our business and give them an honest review. Today we are highlighting Paddle—a merchant of record, managing payments, tax and compliance needs—we use their ProfitWell tool. | | See the full set of tools we use inside of Athyna & Open Source CEO here. |

|

| | | | | | P.S. Want to work together? | | | That’s it from me. See you next week, Doc 🫡

P.P.S. Let’s connect on LinkedIn and Twitter. |

|

|

| |

| | |

|

|