If you're first out the door, it's not called panicking

So, I guess there are four possible scenarios here? Scenario One: the Trump economic gambit is a good strategy, but they’re executing badly Scenario Two: it’s a bad strategy, and they’re executing badly Scenario Three: It’s a bad strategy, but they’re executing well Scenario Four: it’s a good strategy, and they’re executing well These are entirely fake axioms, but over the past month I think there are four distinct narratives out in the world that each support one of these quadrants. In the interest of learning in public (and just sharing what we think is going on live in real time - I wish I’d done this at the start of Covid), I’m going to try and write down my understanding of “what are the storylines going on here.” These four scenarios are not mutually exclusive; the truth of the matter certainly contains elements of all four. If you’re following the news, then most of this won’t be brand new information or novel synthesis. It’s my attempt to organize my thoughts, with the full knowledge that a) I’m obviously out of my depth there, but hey, who isn’t; and b) new information is coming to light all the time, but we’re two months in so we do have something to work with. It should go without saying - but I’ll say it anyway - that this isn’t investing advice and if you trade based on anything I write in this blog, you’re a bozo. The starting assumption: we’re all working off the Miran paperI’m making one big assumption with all of these, which is that the Stephen Miran paper A user’s guide to restructuring the global trading system, the more-or-less consensus inspiration for a possible “Mar-a-Lago accord”, is what most people are looking at as their crib sheet for reading signals. (Miran now chairs Trump’s council of economic advisers, so this seems like a reasonable assumption around the table.) Miran is not a solo voice here; he’s a part of a recent chorus (including the thought-provoking book Trade Wars are Class Wars, which everyone should read, even if you don’t agree with it) that describes a bigger problem than American manufacturing decline. The problem is the US Dollar’s reserve currency status: “The root of the economic imbalances lies in persistent dollar overvaluation that prevents the balancing of international trade, and this overvaluation is driven by inelastic demand for reserve assets. As global GDP grows, it becomes increasingly burdensome for the United States to finance the provision of reserve assets and the defence umbrella, as the manufacturing and tradeable sectors bear the brunt of the costs.” Miran is describing a reflexive feedback loop:

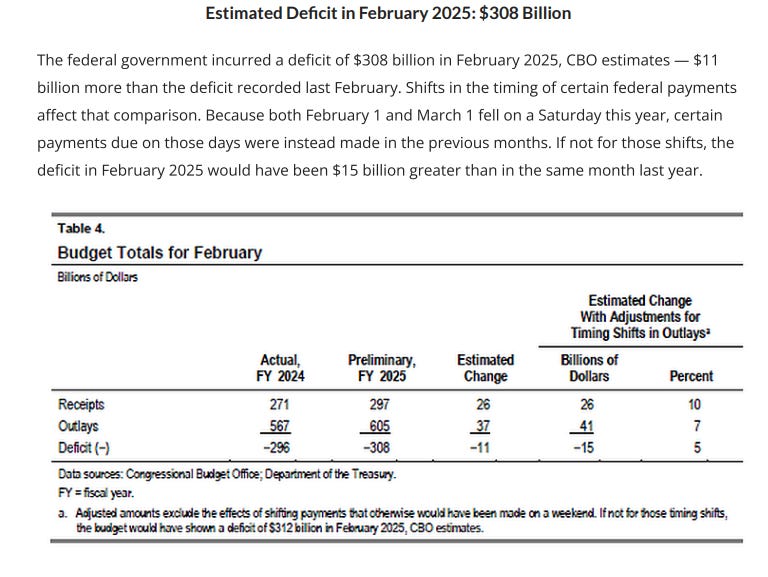

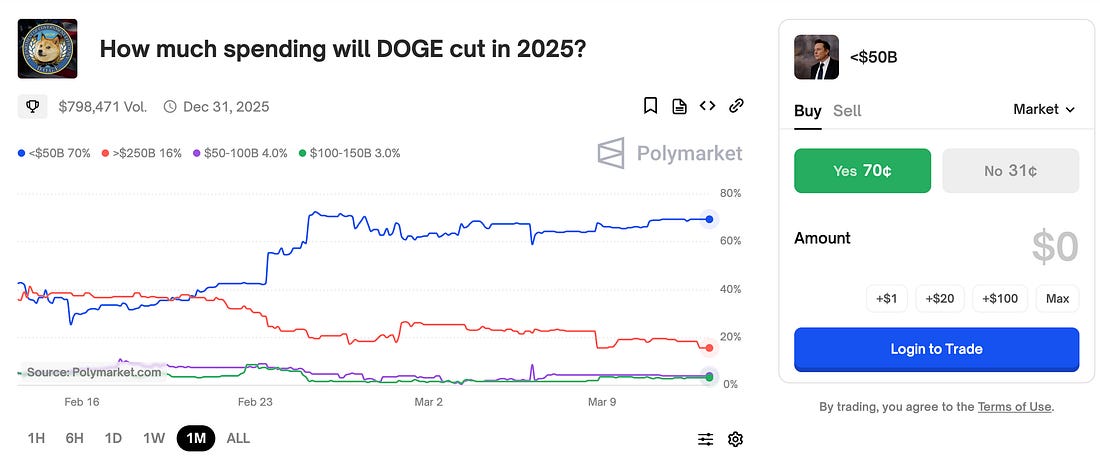

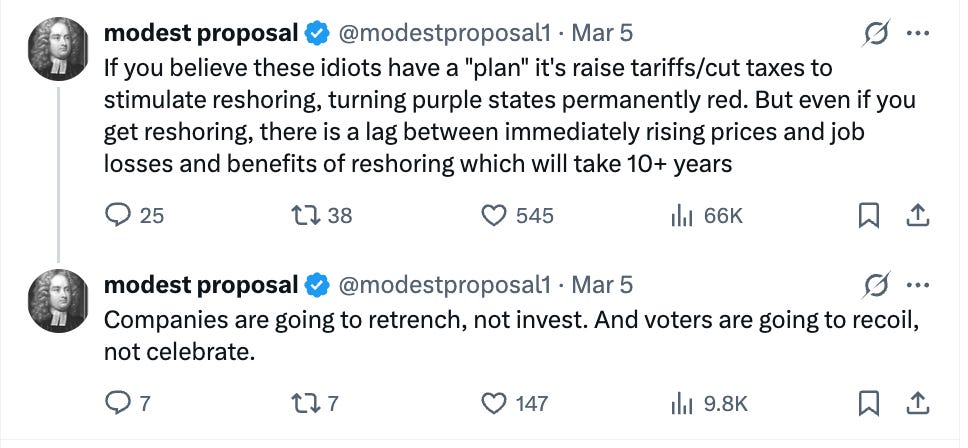

The Trump team believes that radical action needs to be taken to get us out of this cycle. Trump clearly authentically believes this; he’s been saying it since the 80s. That definitely puts it into the category of “too early is the same as wrong”, but maybe it’s finally right. This is also a team that really believes in the power of stories. They know how important it is to name things, label characters and plot devices, so that the voting public can track a narrative of their choice. What are the various storylines we’ve seen so far, and how are they going? “3/3/3” (Good Strategy, Bad Execution)The first story goes, okay, the first step to fixing this has to be fixing the deficit. Trump and the republicans have a mandate to make big moves here. We have a unique opportunity to freeze and reverse US Federal spending and bloat, Elon refactors the US civil service for a new generation, and the economy accelerates. If we can do those things, we can grow our way out of the debt problem and get the US back on better fiscal footing. This plan was memorably described in Bessent’s “3/3/3” plan: 3% real growth, 3% deficit, 3 million additional domestic barrels of oil. (I’ll brush by the fact that one of these can’t work if the Permian won’t cooperate. But the goal of “we want cheaper energy and cheaper input costs” is valid and possible, maybe they’ll get barrel-equivalents from natural gas liquids, they could get it pseudo-domestically from Canada, etc, so let’s forgive it for now and move on, since it’s not the point of this post.) The general idea of “grow revenues and cut costs” does actually work across a variety of situations! But the thing is, you have to do both of those things, fast. And so far there’s no sign of either. From Brendan Duke on Twitter: so far, DOGE’s impact on outlays has been imperceptible. During the earliest days of DOGE there was a tremendous “never bet against Elon, he is uniquely capable of getting this done” vibe out there that has, if not disappeared, at least attenuated. This blog is not about DOGE and I’m offering no takes on it here, other than stating what I think is obvious: other cabinet leaders (particularly Rubio) sound like they have had it with Elon, and Trump has started publicly walking back his authority and promises in recent days. On a pure dollars and cents basis it could still contribute real savings, and find a more moderate path to Jean Chretien style cuts. But betting markets are now forecasting that the overall impact will be modest. Meanwhile in congress, things aren’t exactly going to plan on the “3% deficit” front either. On the “what promises are we willing to break” front, it doesn’t look like congress collectively feels the need or the legitimacy to break any. The wild card could still be military cuts - in keeping with the theme of “Europe has to hire its own security now”, plus in a technology transition, budget cuts actually help you get off the old tired defence primes and onto Anduril, so this might actually go okay. Let’s assume for now they do get some military cuts. Still, they are a long, long way off from anything resembling fiscal balance, and if they can’t fix it now, they’re not going to find new political capital somewhere to fix it later. It’s now or never; so I guess never. You’re left with “Monetize the US balance sheet” style gimmicks, which (after a one-time gold mark-to-market, neat, great) basically means selling off US federal land at 10 cents on the dollar, which would be a sad thing indeed. Overall, this is the least intriguing of the four stories. New administration, new congress, new mandate to actually make progress on the deficit this time, and yet, it’s the same old story. If this were the only story, it’d be a letdown start to the Trump 2.0 economy. Don’t worry, though, we have three more to go. “Tariffs made America rich” (Bad strategy, bad execution)So far this has been the objectively funniest storyline of the four, although “funniest” has to be asterisked with “reputationally and progressively catastrophic.” It’s also probably the most authentic to Trump’s core character. He’s loved tariffs his entire life; he always thinks America is getting ripped off all the time, particularly by those damn Canadians. So this time around, a major pillar of the Trump platform is using protectionist tariffs to restore manufacturing back to America, in a way that simultaneously creates a lot of jobs, but also uses robots not people, since they were low paying jobs, which is why they went abroad in the first place. (???) Or something like that. The purpose of these tariffs, as outlined by Miran, is dual-use: as a durable trade balancing mechanism that can be put in place long-term, but also as a short-term whack on the head, from which you can prompt countries one at a time to take steps that America wants, like currency revaluation. As the world’s largest consumer market by far, America ought to be able to divide and conquer its trading partners, reshore a bunch of domestic manufacturing, and win so much we get sick of winning, etc. Not everyone is buying it: Yes, if you stick with this policy for a long time, you might live to see the benefits - I am sympathetic to the idea of “if you can’t make steel, you aren’t a country” in some form. But the costs of this knee-jerk protectionism are immediate, and they sting, so you’d better be prepared to stay the course and stick it out. If fully implemented, you’re going to raise something like 100 Billion dollars a year. Which is real money, but nowhere close to what you’d need for any kind of sustained major tax cut, let alone replacing the income tax altogether, as Trump initially spitballed as a way to drum up enthusiasm. And in exchange, you’re going to drag GDP growth by a half a percent or so, and in a particularly regressive way. (50 basis points of GDP, compounded annually, is an enormous cost.) That’s not a great trade. Moreover, you make the west as a whole less competitive, which should be the main point to all of this. Living in Canada, I’m getting a fairly Canadian-skewed lens on what the tariff rollout has looked like so far. And from my vantage point, it looks like a comic book disaster. They’re putting on tariffs, but now they’re delayed; now they’re back, now they’re all mostly exempt, now the ones that hurt the US the most are on double. (Seriously - tariffs on aluminum, they day they’re declaring a national electricity grid emergency? Do any of them know how you make aluminum?) The other problem with this strategy is Howard Lutnick. My working model of Lutnick - “the final boss of sell-side guys” - is that he is a genie of some sort, summoned out of a lamp, and determined to grant Trump’s wish of psychologically overcoming the jealousy of seeing the Biden guys actually succeed at some amount of manufacturing restoring. He has a supernatural gift to make things feel personal, not business. You can imagine an alternate scenario where Trump ran the same tariff plan through a different messenger, and it’d be doing a whole lot better than it is now. What should’ve happened was Trump himself being chief bad cop, and a charming lead negotiator. In a recent David Remnick interview with historian Stephen Kotzin, they reminded us of Trump’s “Good cop bad cop” dynamic that he repeatedly set up in his first term: with our enemies, Trump cozies up as good cop, and lets his staff make the threats. With allies, he’s the bully, while his staff got productive work done. He could’ve run that here, and had it work great! Instead, Lutnick has just gotten everyone to hate him, and they’ve burned through a lot of credibility. The other thing here is, just a regular recession, combined with some reshoring incentives, might’ve actually done a lot of help on the trade balance front. But these tariffs, if carried through, make inflation worse, make cutting rates harder, hurt your manufacturers in the short term as they have to pay more for all of their imported components… yeah I’m out on this one. Tariff policy, as carried out so far, officially rings the bell for “bad idea, worse execution.” So those were the two “bad execution” categories. We’re failing to cut spending or get in fiscal shape; we’re failing at the “tariffs made America rich” McKinley story. What’s more interesting - and anxiety-provoking - is the framing in which it’s being executed well. “If you’re first out the door, it’s not called panicking.” (Bad strategy, good execution)This is the interesting one. So, let’s go back to the principal Miran assertion, “we have to take action right now to get the dollar lower.” The problem with the current setup is that the US dollar and US assets have gone up when the global economy is strong (because we run a big deficit, other countries accumulate a lot of dollars, and keep them in dollars because that’s where they can invest them safely and profitably), but the US dollar also goes up when the global economy is weak (it’s the safe asset), so there’s no mechanism to get the dollar down. Unless - and here’s where the Joker plan comes into view - the purpose of the plan is to throw things into complete chaos. Not garden variety recession fears, where people flee into the dollar. But chaos around “We can’t trust the United States anymore.” Sam Hammond has a thread around possible sequencing here; alternately, Yanis Varoufakis has a simplified version. We’ve already seen some early steps:

I think the big problem with this approach is that it leaves US businesses pretty vulnerable to a shock that is both bigger and less controllable than anyone in the White House is bargaining for. The problem is that the current system has two reflexive feedback loops in place:

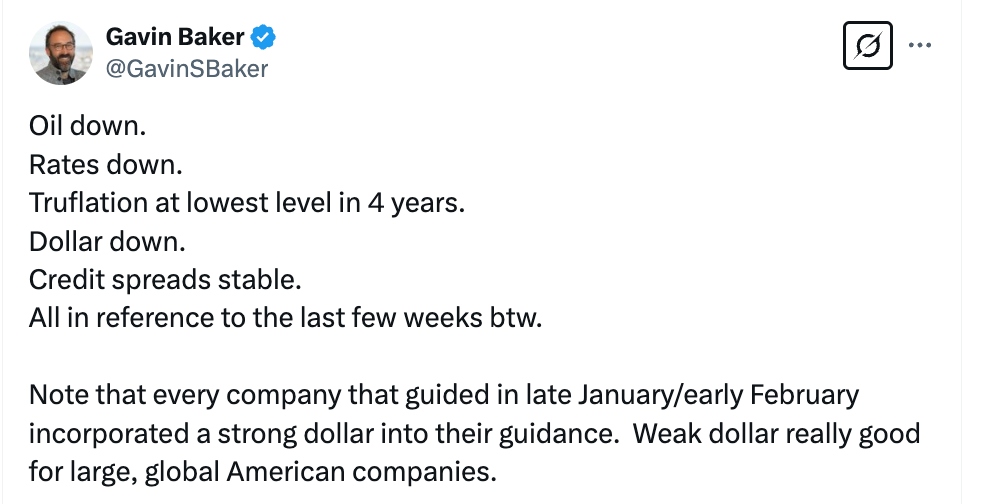

So, here’s what this means. If this plan comes true and there’s a big rotation of foreign money out of US stocks and into international ones (into foreign spending on their own domestic priorities), the US economy is not going to move like a market that was at equilibrium with the rest of the world - it is going to snap like a whip. This is the problem with reflexivity: if the flow of money stops coming in, and stock prices go down, CEOs suddenly get pessimistic (about their stock and also about all of the tariff uncertainty, etc), you see hiring projections go down, Capex go down, revenue guidance go down. And that can kick off a vicious cycle in the other direction. Reflexivity rewarded us in one direction with “the S&P basically goes up double digits every single year, and sometimes goes up by like, 25%”, but it could punish us in the opposite direction with an equally serious magnitude of outflows. And, of course, we have a president who famously does not look at the stock market as his report card. Nope, not at all. The other problem with this approach is you have to stop spending so much money domestically in order for it to work (see # 1). But that certainly doesn’t seem to be happening at a rate that will move the needle. So if you have a tanking stock market that meaningfully translates into sandbagged US growth, and you aren’t actually making any progress on the deficit, then other countries have just as much leverage over you - your ability to coordinate “controlled slow retreat from dollar-as-savings, but still have dollar-as-unit-of-global-exchange” just gets too fraught. For this strategy to work, you have to really buy into the idea of “if you’re first out the door, it’s not called panicking.” (I hope you all know where that line is from without having to click the link.) I obviously understand why the Trump team refuses to sleepwalk into a scenario where other countries are dictating the terms and the pace of de-dollarization. But this kind of high-stakes negotiation will only work if you’re coming at it from a position of strength on all cylinders. Given that #1 and #2 are going badly, then I’d categorize this thread of the story as, “successfully pursuing a bad idea” rather than “badly pursuing a successful idea”, although I’d forgive you if you mentally categorize this as #1 instead. (In fairness, they have to go after them all at the same time; you don’t get to sequence them. Still, though.) Anyway, all of this seems bad, bad bad. Is there anything we can find in our fourth quadrant? “No Crying in the Casino” / Good strategy, good executionIt is unbelievably tempting in times like these to start listening to the doomer podcasts, start regularly checking the gold price, and buy into a theory that “it’s all going to collapse”. It’s good to be open-minded, but there’s a reason why the doomer cranks are historically wrong: the American economy itself is still pretty strong, and not only is it strong, it’s pretty resilient compared to any other alternative. The stock market is not the economy. Moreover, let’s go back to Trump and Bessent’s stated goals: for rates, the dollar, oil, and inflation to all be going down. Well? (From a longer post from Gavin, a perennially thoughtful and reasonable source.) Sorry if this sounds obtuse, but… what if they’re getting it? We got our stock market correction, particularly in tech, which is down anywhere from 15 to 35% from the election highs, but no one thinks that any of these companies are actually in any sort of danger. Market stress has nudged some people into bonds; their focus on the 10-year is going fine. Meanwhile, Europe has answered the call, loud and clear, to not only fund their militaries but also to move past the “Debt Brake” era and grow into an alternate western consumer / builder superpower again. We’re getting some overseas investment into what they want to see (American manufacturing production) rather than what they don’t (the S&P). None of those things, by any means, are sufficient to get America out of the trouble that it’s in. But we are still early into this term, and we have to remind ourselves that there’s a lot we’re not seeing as of yet. That could mean things are even worse than the headlines suggest, but there is no shortage of essays and takes to that effect. I’m not smart enough to say I am following it any better than the average person who follows smart people on Twitter. You’re allowed to say it’s hazy! Okay so, what do we think?If I were to weigh all of these together, I think the one aspect of this you can safely bank on is that we’re not seeing sub 3% deficits any time soon. Every other story, like tariffs or equity rotations or the alchemy of rates, has too many unknowns for me. But congress isn’t likely, or able, to pull off a Hail Mary or hidden ball trick the way the executive branch might. And, as much as you should never underestimate the guy, the range of plausible DOGE savings is considerably smaller than it was a month ago. Still could help, but it won’t carry most of the water. Again, not investing advice. Stay safe out there, get lots of opinions from a wide range of sources, get primary source material when you can; and stay curious. Like the 70s, when we got to test every economic theory at once, we’re about to get some real data on how political and economic power actually work now, about which we could only grasp and speculate just recently. And maybe we’ll look back on this period of time and all of this will be a footnote to something even bigger. If you’ve made it this far: thanks for reading! I’m back writing here for a limited time, while on parental leave from Shopify. For email updates you can subscribe here on Substack, or find an archived copy on alexdanco.com. |

Older messages

Wine tasting with Claude Shannon

Thursday, March 6, 2025

Why we can't resist a grain of truth within a crazy argument ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10 Predictions for the 2020s: Midterm report card

Thursday, February 27, 2025

In December of 2019, which feels like quite a lifetime ago, I posted ten predictions about themes I thought would be important in the 2020s. In the immediate weeks after I wrote this post, it started

Innovation takes magic, and that magic is gift culture

Thursday, February 27, 2025

Silicon Valley's great trick: recasting well-worn business procedures as moments of gift exchange ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Tokengated Commerce

Monday, May 2, 2022

A very special issue with Packy McCormick & Not Boring

Games

Sunday, November 7, 2021

Alex Danco's Newsletter, Season 3 Episode 22

You Might Also Like

ICYMI: How Anne Ditmeyer Evolved From Blogger to Content Entrepreneur

Tuesday, March 18, 2025

Don't miss a tip that could grow your content business. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

for Authors & Publishers: Instagram Book Promotions

Tuesday, March 18, 2025

Your book on Instagram! Instagram promo image Instagram ~ a great place to advertise books

Who gets to do strategy? @ Irrational Exuberance

Tuesday, March 18, 2025

Hi folks, This is the weekly digest for my blog, Irrational Exuberance. Reach out with thoughts on Twitter at @lethain, or reply to this email. Posts from this week: - Who gets to do strategy? Who gets

Dun-nuh-nuh-nuh-nuh-nuh-nuh-nuh Lawsuit!

Tuesday, March 18, 2025

Batman vs. Batman

KU • Thrilling dystopian sci-fi • The House of Clementine by Gill James

Tuesday, March 18, 2025

Peace Child Book 4 Welcome to ContentMo's Book of the Day "Gill James has created a

Avoid Typos with Affordable Proofreading Services by ContentMo

Tuesday, March 18, 2025

👓 Two sets of eyes are better! 👓 👓 Two sets of eyes are better! 👓 Accurate & Affordable

Garbage in, Garbage out: The Alignment-to-Value Pipeline

Tuesday, March 18, 2025

Building Products That Matter ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🧙♂️ [NEW] 7 Sponsorship Opportunities

Tuesday, March 18, 2025

Plus secret research on Insta360, Scotch, and H&M ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The World Airplane Meal?

Tuesday, March 18, 2025

Seriously: DO NOT TRY THIS. (Obviously.)