When celebrating the success of media, it’s impossible not to mention The New York Times. It has passed 6 million subscribers; it’s making incredibly smart deals acquiring podcast companies; it continues to expand its newsroom in an impressive way.

The New York Times is doing wonderfully and it’s easy to look at that and feel excited. But we also have to be realistic. The success of The New York Times—and more specifically, it’s success with subscriptions—directly competes with every other news product out there.

The New York Times is your competitor.

In a piece published last week on Columbia Journalism Review, Scroll’s Tony Haile broke down what that looks like and how to compete:

Here’s the Times in 2020: it added 587,000 new subscribers in the first quarter. That’s almost three times the number of total subscribers to the Los Angeles Times. It’s more than 70 percent of the total cumulative subscribers to Gannett’s 260 media properties. The New York Times has more digital subscribers in Dallas–Fort Worth than the Dallas Morning News, more digital subscribers in Seattle than the Seattle Times, more digital subscribers in California than the LA Times or the San Francisco Chronicle.

When I read that paragraph, I was absolutely floored. Much of this can be blamed on local papers gutting their newsrooms, thus not providing a product that is worth paying for. But much can also be blamed on the fact that The New York Times provides a much more robust product and has spent the time and resources really understanding how it gains subscriptions. The reality is clear: The New York Times is dominating subscriptions across the country.

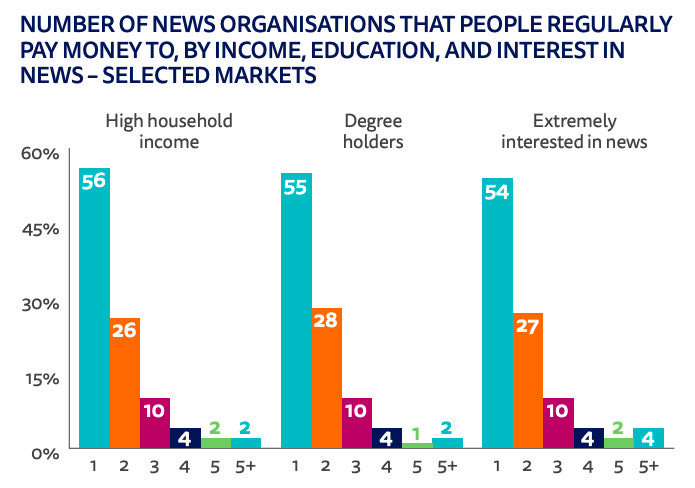

But why is that? Haile references the Reuters Institute Digital News Report 2019, which shows that the majority of people that pay for news only have a single subscription.

|

If the majority of people that will pay for news are only going to get a single subscription, that means The New York Times is a direct competitor to every city’s local paper.

And just to be clear, that’s not likely going to change. I’ve seen some suggest that The Times should do more to support local news, but that’s just not realistic. If people are only going to have a single subscription, why would The Times want to share any of that money?

I don’t really believe that altruism works in business. Perhaps it’s because I’m jaded, but when it comes to money, people tend to operate in their own best interest. Therefore, any sort of arrangement to have a lasting impact must have strong incentives for both participants.

When you’re the one acquiring all the subscribers like The Times, you have no incentive to share. The local papers want to share, but why wouldn’t they? They’re the ones losing the fight.

Haile presents a proposal that I find to be quite compelling: create bundles with The Washington Post. The Post is a direct competitor to The New York Times and, while it is doing alright, it is falling farther behind The Times despite offering very similar national coverage.

So, if The Post and local papers are already losing to The Times in this “1 news subscription only” world, both parties have an incentive to try and find a solution. In this case, Haile suggests a hub-and-spoke “skinny bundle” as an option:

While the Times is famously insular and slow to collaborate, however, the Post has leveraged a large and innovative base of tech talent to embed collaboration with other publishers into its DNA, first by enabling its Arc CMS on hundreds of sites, and now with the rapid growth of Zeus, a revenue management platform.

In a hub-and-spoke network, a digital subscription to the Post is combined with a local publisher in a series of bilateral skinny bundles. For example, the Seattle Times may struggle to compete with the Times on its own, but a subscription that provides the combined local and national coverage of the Seattle Times with the Post for the same price as the Times is far more attractive.

Now this starts to make a little sense. With a single subscription, I can now get regional news from my local paper and then national news from The Washington Post. It’s still only one subscription, but I am getting a better bundle of information.

Haile’s proposal is to divvy up the revenue based on time spent on each publisher’s website:

Distributing subscription revenue based on attention share would be more effective. A Seattle Times subscription is $16 a month. We can set aside $6 for the Seattle Times as a revenue buffer, and put the remaining $10 into a pool based on attention share. If the Seattle Times subscriber spends 50 percent of their time on the Post’s site, then the Seattle Times makes $11 that month and the Post makes $5.

Let’s break down how both parties win here…

The Seattle Times is trading some Average Revenue Per User (ARPU) dilution for the capacity to attract a dramatically larger subscriber base and to increase overall revenues. (They already do this through strategies like discounted subscriptions.) However, they are only doing so among the subscribers who actually get significant value from the combination. If the subscriber realizes no additional value, there is no dilution.

The Washington Post is not realizing its normal ARPU, but these are unlikely to have been subscribers it could have acquired on its own. These subscribers represent new cash flow at near zero marginal cost. The hub-and-spoke nature of the bundle protects their existing subscription base from ARPU dilution. The small number of Post subscribers with an interest in Seattle who switch to the bundled offer would still spend much of their time with the Post, making dilution minimal. In addition, this would likely be more than offset by subscriber growth.

This is a model not built on altruism, but on smart business practices. Both parties make less money per user, but they are able to fight for a larger piece of the pie. For The New York Times to compete with this, it would need to staff up considerably. Even then, the “per city” newsroom would be smaller at The Times than with this hub-and-spoke model.

However, even if this is the perfect idea, there remains a single core fundamental that must happen with this skinny bundle. Both the local paper and The Washington Post must both have their relationship with the reader. That means a user needs to have two logins rather than one.

This is imperative for two reasons. First, the reader needs to know that they’re reading both The Post and their local paper. Second, both The Post and the local paper needs to have 1st party data for their advertising businesses.

But let’s say this works. And let’s say that last week’s news about The Matchup works. Suddenly, with a single local news subscription, a reader would get:

Local news from their local paper

Local sports from their local paper

National sports from every other local paper

National news from The Washington Post

That’s an incredibly powerful product. It also puts the local paper at the center of the equation. Rather than being an afterthought, the local paper is now what people are building a direct relationship with.

Ultimately, though, these are still business deals. The Washington Post would need to work on dozens of contracts with local papers. This takes work and media companies are not historically very collaborative. Perhaps in a world where The Times is the biggest competitor to everyone else might be the impetus to make change.

Something else happens in this situation. When all the local papers can rely on The Washington Post to do their national reporting, each local paper doesn’t need to have national news desks. Those journalists can be reallocated to local beats, which provides better coverage. Or, and no one likes to write this, it means that those national desks aren’t needed and teams can be leaner.

To sum this portion up, let’s leave with this… The New York Times is a competitor. Research shows the majority of people that pay for news will only get a single subscription. Because The Times has the biggest bundle, people will opt for that product. The rest of media needs to figure out how to compete. This is one very interesting solution.

BuzzFeed Shopping is DTC? Not exactly…

According to The Wall Street Journal, BuzzFeed is introducing a standalone website called BuzzFeed Shopping.

The digital publisher has now introduced a standalone website called BuzzFeed Shopping that lets visitors complete purchases without going anywhere else.

BuzzFeed’s move was enabled partly by the relatively recent spread of checkout functionality beyond traditional e-commerce platforms to a range of websites and apps, said Nilla Ali, senior vice president of commerce at BuzzFeed, citing shopping on Instagram in particular.

The way it works is pretty straight forward. Using a platform called Bonsai, BuzzFeed is able to offer checkout of products without the user having to leave BuzzFeed’s website. In the past, BuzzFeed would have simply linked to an e-commerce site and hope the user converts. Now, BuzzFeed has more control around the actual conversion.

Here’s the thing… This isn’t really DTC commerce. It’s better classified as a form of drop shipping. Web Smith of 2PM had this to say:

BuzzFeed’s latest retail strategy isn’t direct commerce at all, it is a low-risk, slightly higher margined version of affiliate. And that's fine! But the story can be confusing when publishers like Food52, Hodinkee, MeatEaterTV, Uncrate, and Goop have had success with true DTC strategies.

Here is "direct commerce" in short: a brand or publisher manages a warehouse, they're concerned with product packaging, and they're obsessed with inventory forecasting. By working with Bonsai, BuzzFeed is approaching DTC as a media company selling through affiliate links.

What’s interesting is that BuzzFeed has an owned-commerce play through Tasty. It sells kitchen gear through Walmart, which gets it into 4,700+ stores in the United States alone. But the Shopping site, alone, is not really direct to consumer. It’s just fancier affiliate marketing.

And the thing is, that’s okay!

I’ve advocated publishers move away from relying entirely on Amazon for their affiliate revenue. It’s lazy. While moving from one company to another—Amazon to Bonsai—is still platform dependent, it moves closer to the brand. Ideally, though, I’d like to see affiliate deals be 1:1 with the brand.

Thanks for reading. If you’re new here, I hope you found this helpful. Consider sharing this with your colleagues in media. And please become a paid subscriber so you can gain additional insights into building media businesses.