The last COVID relief package was passed by Congress in April. Since then, the pandemic has gotten much worse. With large segments of the economy still shuttered, 10 million Americans are still unemployed due to the pandemic. Millions more have given up looking for work because job growth has stalled. At the current rate of growth, "it would take 29 more months to return to February employment levels." Why hasn't Congress acted?

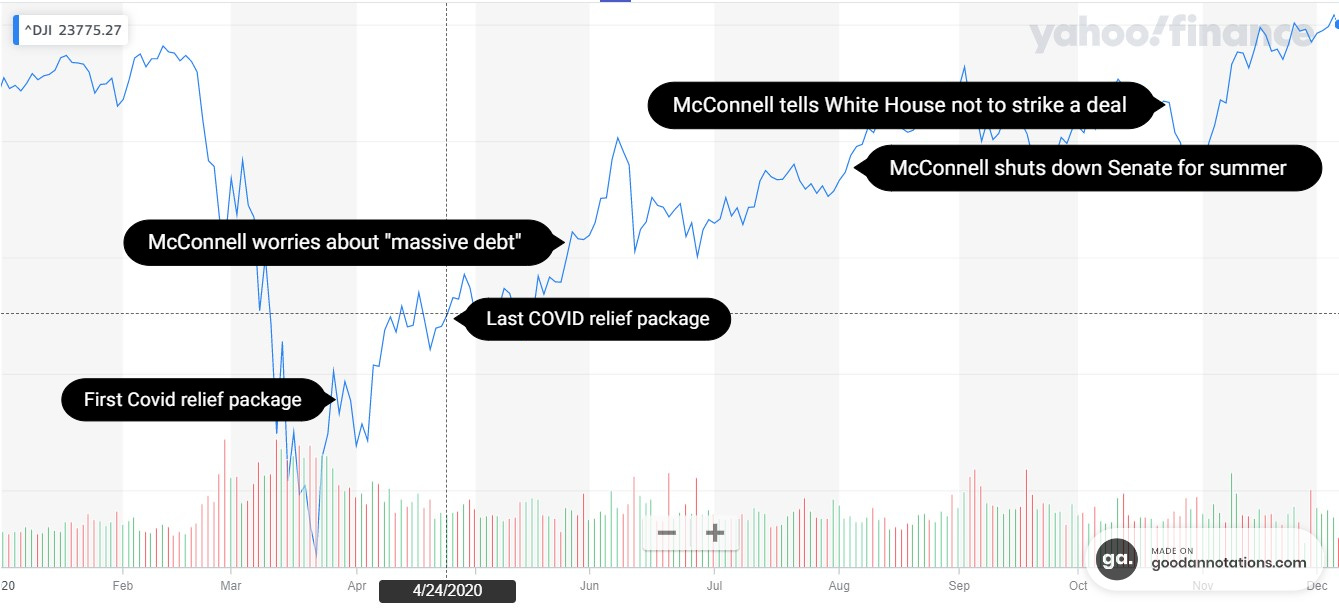

Republicans in Congress were eager to pass an economic stimulus package in March and April when the stock market was tanking. But once the stock market began to recover, Majority Leader Mitch McConnell (R-KY) and the rest of the Republican party became less interested in economic relief and more concerned about the budget deficit.

As the Senate deflected and delayed, more than one million small businesses closed their doors and state and local governments have been forced to make crippling cuts.

This month, McConnell has finally gotten serious about another round of pandemic relief. Why? It could be that a dramatic spike in case counts, hospitalizations, and deaths have given another round of relief new urgency. Or it could be that Senators Kelly Loeffler (R-GA) and David Perdue (R-GA), who face a run-off election on January 5, are campaigning on their support for additional pandemic relief. If Perdue and Loeffler both lose, McConnell will no longer control the Senate.

The new relief bill, however, is likely to fall well short of what's needed for millions of Americans. That's because of a dysfunctional process that caters to the needs of Republicans who oppose a significant new deal. First, a bipartisan group of centrist lawmakers negotiated a compromise proposal. The total spending in the compromise bill is $908 billion. That is less than one-third of the $3 trillion HEROES Act which was passed by the Democratic House in May, when the impact of the pandemic was less severe. Now, Democrats have agreed to make the compromise a jumping off point for further negotiations with Republicans, who are pushing an even more austere relief package.

Without action, 20 million people could become homeless

The federal eviction moratorium expires at the end of the year. Without federal rental assistance, January could usher in an avalanche of evictions and even excess deaths, Popular Information reported last week. As the deadline for lawmakers to act quickly approaches, millions of renters across the country are facing an increasingly bleak situation.

"Nearly 12 million renters will owe an average of $5,850 in back rent and utilities by January,” finds Moody’s Analytics. Moody’s Analytics’ chief economist warns that “renters will owe close to $70 billion in unpaid rent.” Another report by the Federal Reserve Bank of Philadelphia notes that mounting rental debt will impact “greater shares of households of color and female-headed households.” This is consistent with the most recent data from the Census Bureau’s “Household Pulse Survey” – at least 47% of Black renters and 39% of Hispanic renters behind on rent said that it is likely they will have to leave their homes in the next two months due to eviction.

The lack of rental assistance, coupled with lapsing unemployment benefits and scarce job opportunities, could mean that millions of renters will face housing insecurity in less than a month. How severe could this be? One analysis estimates that “8.4 million renter households, which include 20.1 million individual renters” could be rendered homeless.

In an effort to address the problem, the latest bipartisan proposal includes $25 billion in rental aid. This is less than half the amount previously proposed by House Democrats. But even the Democratic proposal was likely insufficient. Diane Yentel, president and CEO of the National Low Income Housing Coalition, argues that it will take “at least $100 billion in rental assistance.”

The new package will reportedly “extend a freeze on evictions,” though it is unclear for how long. Despite the compromise, not all lawmakers are on board with providing rental relief. McConnell’s $500 billion “targeted relief bill” does not include any rental aid or “continuing eviction protections.”

The corporate shield

Since April, McConnell has conditioned any further economic relief on legislation to shield companies from liability if their workers get sick or die as a result of corporate negligence. "[T]rial lawyers are sharpening their pencils to come after health care providers and businesses, arguing that somehow the decision they made with regard to reopening adversely affected the health of someone else," McConnell told Fox News.

But many months later, there have been very few lawsuits against businesses filed by consumers or employees who contracted COVID-19. A national tracker maintained by Hunton Andrews Kurth has recorded just 29 personal injury or wrongful death lawsuits related to consumers contracting COVID-19 in a public place. And employees have filed 116 COVID-related complaints related to working conditions, including lack of PPE and exposure to COVID at work.

Why have so few lawsuits been filed? Part of the reason is that it is difficult to successfully sue anyone for causing an injury. This kind of suit is known as "tort action." In the United States, an "injury victim generally bears the burden of proof on every element of a tort action, so that to recover in a negligence suit, for example, the plaintiff must convince a factfinder that it is more likely than not that a defendant was careless, this carelessness empirically caused injury and played a significant causal role, and that injury inflicted specific losses."

Avoiding liability does not take "superhuman" efforts. Rather, defendants win if they show they have taken "reasonable, ordinarily prudent, duly considerate measures to limit the risks of injury they impose on others."

The liability shield proposed by McConnell would make no difference to the businesses that do what they can to protect their employees and customers from the virus. But it would protect the very worst actors. That's why, previously, Democratic leaders rejected any proposal with McConnell's corporate liability provisions.

But the bipartisan group reportedly included a corporate liability shield in their proposal.

No checks

The stimulus packages in March and April contained trillions in assistance for businesses of all sizes. But individuals below an income threshold of around $75,000 received a single stimulus check of $1200.

The new stimulus package proposal will not include another $1200 check. The Associated Press reports that “lawmakers involved in the negotiations said the direct payments would have to wait until after Biden is inaugurated on Jan. 20.”

Senator Bill Cassidy (R-LA), who is part of the bipartisan group, said that “this is not a stimulus bill, it’s a relief bill” and indicated that stimulus checks would have to be introduced in Congress separately.

The bill will, however, provide “roughly $300 in extra federal weekly unemployment benefits” for three months. That's "half the $600-a-week boost workers received from the $2.2 trillion CARES Act, passed in the spring." That benefit expired over the summer.