VCs operate their day to day using filters. A filter is a way to determine who to meet with and who not to. Startups filter in and out of a VCs attention zone depending on a variety of factors. Because a VC has a limited amount of time, and there is practically an unlimited flow of deals coming their way, filters are a set of rules that help them prioritize their deal flow.

I wrote a post on filters a few months ago to share what some of the filters are and how they are used. In the post, I also make a point that I wish the filters for venture capital were different than what they currently are. But they aren’t, and it’s because venture capital is not built for outsiders. It’s not built for outsiders because I know that there are no good filters to evaluate an outsider, even if they are the next Katrina Lake. This is losing VCs billions of dollars in value every year.

How do the Hidden Geniuses Get Discovered?

We have an issue. There could be the next Kristen Anderson living in Omaha Nebraska, but they may have no connection to a VC, or may not even know what a VC is. She may just be happy building her software company growing at a rapid rate through organic growth. Little does she know that if she was based in the Bay Area (pre-covid), she would be able to raise money simply by walking to her local Philz and muttering the word “seed round”.

The issue isn’t her skillset. The issue isn’t her company. The issue is that the best VCs in the game are so busy dealing with their current deal flow, that they don’t actually know how to identify this founder as a good founder. There isn't some algorithm where she can enter her data and measure how good of a founder she is. Instead, the algorithms are the filters I mentioned earlier. If she isn’t able to filter into the attention span of a VC, does she even have a startup? (half joking). So, it seems like the plan for outsiders is to identify a filter, and then leverage it to build trust with investors.

There are a few filters that VCs suggest founders go through to “prove they are worthy” of venture capital if they are currently an outsider.

Accelerators

I was arguing with an investor about this filtering problem on Twitter and he mentioned he thinks the system is efficient because of accelerators. Any outsider can break in by joining an accelerator. They work in a more meritocratic way than a typical VC, and since there’s so many of them, anyone who has some skill will be able to get funded to join an accelerator and get that first filter. This is a weak take in my view.

There are dozens of viable accelerators right now, and most founders don’t even know how to determine which ones are good vs. which ones aren’t. But VCs know, and actually 90% of accelerators are a filtering OUT mechanism. If someone is in a tier 4 accelerator, that is much weaker than just simply getting a warm intro to the VC in the first place. So unless you get into YC, LAUNCH, etc. the accelerator is actually working against you.

IF a startup gets into a top accelerator, sure the filter is good, but the cost for the accelerator is incredibly high. The accelerator I joined took 7% + pro rata rights. My company was making $24,000 MRR, but we needed the accelerator to get the trust of SF investors so they would feel comfortable investing in us. 7% for a shot at building trust seems like a bad deal.

So what are some other ways a founder can earn the trust of insiders and get an investment?

Network Into The Inner Circle

Many VCs say the best founders know how to find the investors to give them money. I would argue that this is a filter disguised as laziness. Their incentives force them to create this narrative. What they are really saying is “I can’t evaluate a founder efficiently myself, so I’m going to make sure they go through other filters so I can learn more about them without trading my valuable time to get that information”. But the best founders are not trying to play games; they have companies to grow.

What do the best founders do? They run teams. They build. They manage. The best founders don’t spend an ounce of time thinking about VCs. They don’t break into the inner circle; not because they don’t know how to, but because they don’t even know what the inner circle is in the first place. Asking them to break in is telling them to take 1-2 years to divert focus from their company, and spend time networking into a new class of people, who actually need founders to make money, not vice versa. In reality, the investors should be spending time looking and scouting for founders, not the other way around.

Sure but Traction Trumps All, Right?

Wrong. Some argue that traction is the best filter. They’d say that if you’re growing really quickly, it doesn’t matter who you know; you are investable. And it pains me to say that this is a fallacy too. I have two examples of this. The first is my own.

My last company, PubLoft, grew to $24,000 MRR in 7 months. Throughout the whole time, I was cold emailing investors updating them on the traction. 5k, 12k, 16k, etc. No one ever budged. They all said the market wasn’t there or the business model doesn’t support a venture scale company. And the difficult point is that they aren’t wrong. And eventually that company got funded, and it still failed. So this easily could be a “told you so” moment. Yet it doesn’t excuse the fact that we had five figures in revenue, growing quickly, and very few investors batted an eye.

Yet even today, when i’m as connected as I am with a growing company, investors still think it’s not a venture scale market or are worried I don’t have a technical cofounder. Traction trumps all…until it doesn’t. I’d argue traction as a filter is somewhat strong, but only truly effective when tied with another filter that a VC likes. Alone, traction is nothing.

Here is another proof point:

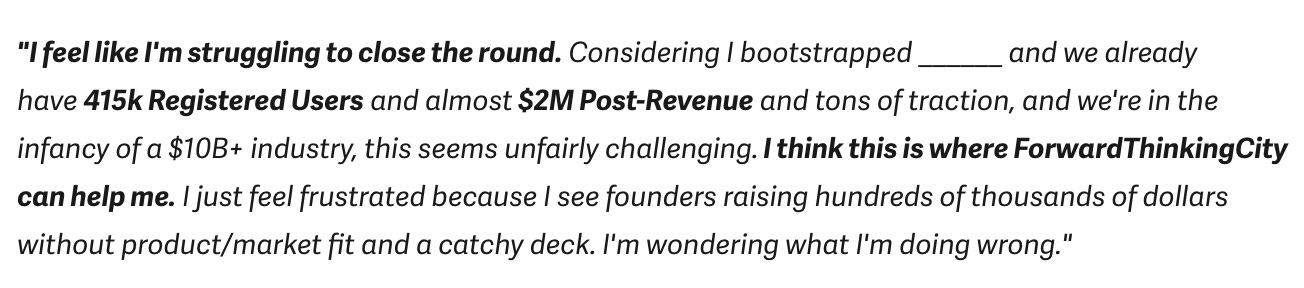

A few days ago, I got this email from a founder. Yes, I got his permission to share it.

This founder should be able to raise capital, but no one taught him the rules of fundraising. In reality, there shouldn’t be rules. There should just be what you have done, and can do in the future.

For what it’s worth, the reason that VCs don’t think traction is a good filter is because they are aiming to fund someone who can go from $0 to $100M ARR in 5-7 years, so the few thousand dollars of MRR doesn't matter. I see why they don’t use traction as a filter, but the general consensus is that traction trumps all. This is is a fallacy.

There is Always Data to Debunk These Critiques

Although this sounds all fairly logical, if you ever bring these critiques to a VC, they will always be able to debunk you. At the end of the day, most startups fail, even the funded ones; most markets aren’t big enough, most founders aren’t the right ones for the job, and most venture scale “problems” don’t actually exist. Yet, I believe these are the rejections that VCs will tell founders as an excuse when a founder just doesn’t meet their filters.

Since it takes a decade to find out if a fund will do well, there are a lot of VCs who actually aren’t very good, telling great founders to change course, because the founder doesn’t fit a filter used by VCs.

In general, VCs prefer filtering by network. And if you can’t get through that way, i’d argue that the filters mentioned in this post are simply busy work. Even if you network your way in, go through an accelerator, AND have traction, a VC will 9/10 times rather invest in someone already in their network than you. I hate to report it, but these are vanity filters. You have been warned.

I write this post to help give founders outside of the tech circles an idea of what VCs are really thinking when they don’t respond to your cold email or take a meeting with you, even if you have a great company. In my next post, I will be exploring what it looks like to create a new filter for the next generation of entrepreneurs.