Bitcoin Was The Safe Haven Asset We All Needed

This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 140,000 other investors today. To investors, There was blood in the streets a year ago. March 12, 2020 will be a day that financial investors will never forget. Bitcoin fell over 50% in a single day. Every other asset was in a free fall as well. Circuit breakers were tripped every few hours it seemed. Investors were full of fear. They couldn’t sell every liquid asset in their portfolio fast enough. The pandemic had hit full stride. The NBA was shutting down. Countries around the world were going into lockdown. The S&P 500 dropped 7% the second it opened. The Dow Jones was down over 8%. Oil and gold were both suffering a similar fate. It was ugly. But not everyone was scared. The liquidity crisis was actually quite obvious to those who understood how investor psychology and markets interact. The morning of March 12th I wrote a letter to each of you titled “The Liquidity Crisis Will Drive Monetary Stimulus, Which Will Force The Adoption Of Sound Money Properties.” I started the letter off with the following:

Next, I highlighted a simple framework for investors to think through what was happening:

The key piece to preparing investors for what was about to happen in the coming days was the identification of the liquidity crisis. Some people saw fear. But fear is a psychological concept and a liquidity crisis is a market structure manifestation of the fear. I went on to write:

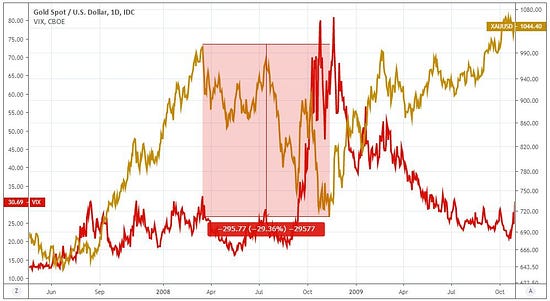

As if that wasn’t enough to grab people’s attention, I went on to show what had happened to gold during the 2008 financial crisis.

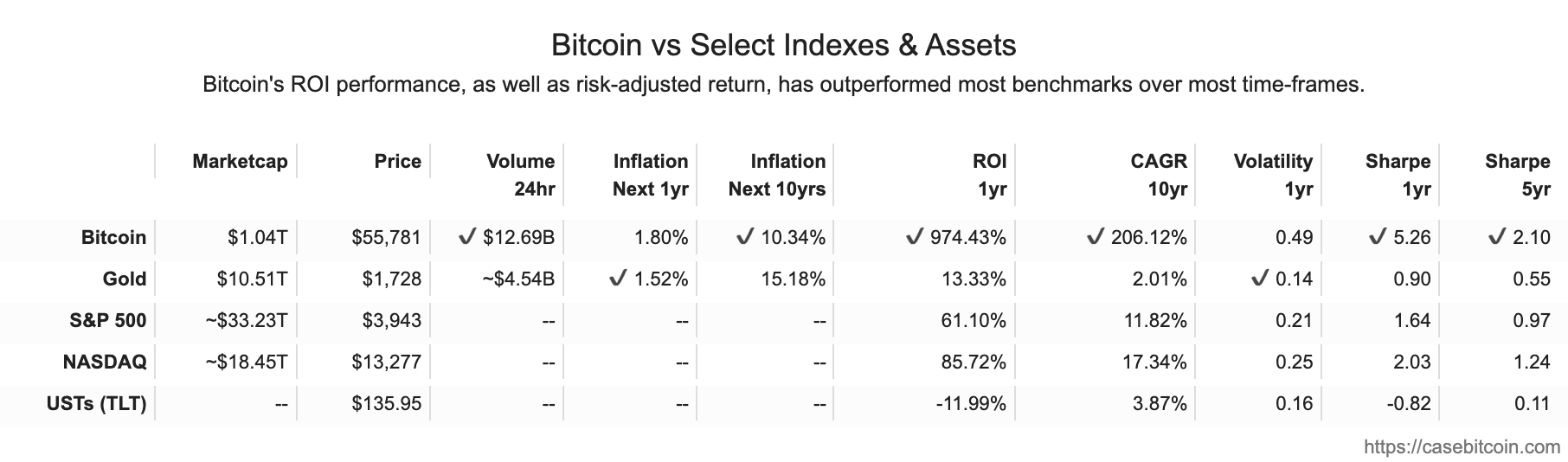

So let’s take a look at what actually happened to Bitcoin during the liquidity crisis. Simply, it was in free fall just like every other asset. The difference is that bitcoin is a more volatile asset, so while other assets went down 15-30% in price, bitcoin was down 50%. As I always say, volatility is not inherently bad. It is a positive thing when it works in your favor and a negative thing when it goes against you. You need volatility for prices to move upwards if you’re long. But the week of March 12, 2020 was a bad volatility period for the holders of the digital currency. Here is the funny thing though — if you Zoom out and look at bitcoin’s price chart from about a year before the liquidity crisis till today, you can barely even see that 50% drop in price. As we continue to discuss in this letter, long term holders have a significant advantage over the weak handed short term traders. Humans are emotional. We succumb to fear and greed. But if you have deep conviction in a thesis and refuse to allow the short term price movements to affect your decision making, you will do fairly well over the long term. My favorite analysis is the holistic comparison of various assets across financial return, volatility, compound growth, and sharpe ratio. The folks at casebitcoin.com highlight just how attractive of an asset the digital currency has become. Lastly, don’t forget about the safe haven status that everyone was contemplating over the last few years. The big question was what would happen to bitcoin in a market downturn? Would it survive? Would it thrive? We now have the answer to that question — Bitcoin was the single best asset that you could have held during the market uncertainty and chaos. The return, sharpe ratio, and overall reduction of risk in a portfolio are unrivaled. Pretty crazy to think about in hindsight. Bitcoiners have done the work. They understand the asset and the market. The conclusion of bitcoin’s dominance is not that of a religious zealot, but rather the product of a deep analysis of all options. They are being proven accurate in that analysis, which can be frustrating to those who reached a different conclusion years ago. That doesn’t mean that it is over though. Bitcoin is actually just getting started in all likelihood. Time will tell how far into this journey we really are. Have a great start to your week. I’ll talk to everyone tomorrow. -Pomp SPONSORED: Last week, you might have heard that the art market went—as they say in business school—absolutely bonkers. Christie’s cashed in on the mania, setting a new record of $69.3 million for a jpeg, er, digital artwork. The takeaway? Art investing has hit the mainstream. But if you’re anything like us, putting your money in real, tangible art by blue-chip artists makes a lot more sense. For one thing, contemporary art prices have outperformed the S&P by 152% from 1995–2020 according to data from Masterworks. They were the first platform to let you invest in paintings by the likes of Basquiat, Kaws, and Haring. But what about returns? They’ve got that too: they recently sold their first painting, a Banksy work, for a cool 32% annualized return to investors. With results like that, it’s no wonder there’s over 25,000 people on the waitlist. Just use my special link, tell them we sent you, and you’ll be good to go. THE RUNDOWN:Australia’s Government Allocates $5.3M for Blockchain Pilot Projects: The government of Australia has allocated AU$6.9 million (US$5.3 million) to the Department of Industry, Science, Energy and Resources (DISER) to investigate the role blockchain technology could play in regulation. The money will be spent on two pilot projects intended to show how cost reductions in regulatory compliance are possible with the use of blockchain, ZDNet has reported. Read more. Ripple Execs Ask Court to Block SEC Requests for Personal Financial Records: Two senior executives of Ripple have asked the court to quash requests for access to their personal financial records by the U.S. Securities and Exchange Commission. In a letter to the Southern District Court in New York on Thursday, Ripple CEO Brad Garlinghouse and Executive Chairman Chris Larsen asked Judge Sarah Netburn to block subpoenas sent to multiple banks seeking eight years’-worth of their financial information. Read more. Argo Blockchain Takes 25% Stake in $40M Crypto VC Fund: Crypto venture capital firm Pluto Digital Assets has raised a $40 million fund with U.K.-listed Argo Blockchain as its lead investor. In an announcement Wednesday, Pluto said it now has $50 million in assets under management after launching earlier this year. Argo Blockchain will be maintaining a 25% stake in the new fund with an investment of $10 million. Read more. Start9 Labs to Build on Its Self-Sovereign, Private Internet Solutions With $1.2M in Funding: Start9 Labs recently closed a $1.2 million funding round spearheaded by Collider Ventures, Ten31 and Erik Voorhees, CEO of the decentralized exchange ShapeShift. The money will drive additional Embassy developments including additional apps for its decentralized app store, further open-source development by contributors and the “killer of all messaging apps.” Read more. Binance Faces CFTC Probe Over US Customers Trading Derivatives: Cryptocurrency exchange Binance is being investigated by the Commodity Futures Trading Commission to determine if U.S. residents traded derivatives on it in violation of U.S. rules, Bloomberg reported. Binance hasn’t been accused of any wrongdoing and the CFTC may not bring an enforcement action, according to the report, which cited people familiar with the matter. Bloomberg also did not outline a time period for this alleged trading.Read more. LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE Zach Herbert is founder and CEO of Foundation Devices, which is building open devices for a sovereign internet powered by Bitcoin. In this conversation, Zach and I discuss:

I really enjoyed this conversation with Zach. Hopefully you enjoy it too. LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber. |

Older messages

The Stimulus Package Won't Cut Poverty, It Will Accelerate It

Monday, March 8, 2021

Listen now (10 min) | This installment of The Pomp Letter is free for everyone. I send this email to our investors daily. If you would also like to receive it every morning, join the 135000 other

Meet Five of the Greatest Investors You've Never Heard Of

Monday, March 1, 2021

Meet dealmakers and investors that you can learn from.

Special Message From Pomp 🙏🏽

Thursday, February 25, 2021

Hey! What a wild ride bitcoin bull markets are. Thanks for being a free subscriber to The Pomp Letter. Hopefully this has helped you understand what is currently transpiring across assets and markets.

Gold Bugs Are Capitulating

Thursday, February 18, 2021

Listen now (4 min) | To investors, Bitcoin has unique properties that continue to prove valuable in the market. This value leads to increases in demand, which drive the US dollar price higher. As the

Special Message From Pomp 🙏🏽

Tuesday, January 26, 2021

Hey! What a wild ride 2020 was. Thanks for being a free subscriber to The Pomp Letter. Hopefully this has helped you understand what is currently transpiring across assets and markets. I really enjoy

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these