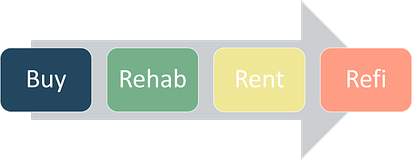

Buy, Renovate, Rent, Refinance, Repeat: Micro-SaaS Edition

Unless you’ve been living under a rock for the past few years, you’ve likely run into the idea of BRRRR — Buy, Renovate, Rent, Refinance, Repeat. It’s a popular playbook used by real estate investors across the world. The idea is simple, but very deliberate and calculated. The reason I like it is because it’s a totally unorthodox way of creatively financing acquisitions in a way that accelerates your ability to purchase your next asset. The usual RE game is typically played by buying properties one at a time, earning some equity over the initial term, and then refinancing when the term ends by pulling out the earned equity. The basis of the average real estate investment is two-fold:

If that sounds similar to something you’ve recently read about, it’s because I’ve inspired much of Fund I’s approach on real estate thinking, taking and leaving some stuff to build a hybrid strategy. I’m not a real estate guy at all. But I’ve been learning and researching it for years in anticipation of my first purchase. Since I read a bunch of business books, and I’m ambitious, I started seeking out best sellers in real estate to educate myself on how others are playing the game. I followed a bunch of folks on Twitter like Nick Huber, who is basically building his real-estate portfolio in public. I’ve found much of his techniques to be applicable to the world of micro-acquisitions when distilled to their mental models. While I learned a lot, and came really close to buying my first few properties, I decided not to pursue a potentially decade-long project without the experiences, tools, network or interest to really become efficient and profitable. Guess what I did instead?¹ As it turns out, there’s quite a bit more to the real estate discipline than I originally thought. And there’s so much that can be taken from it as you build your Micro-SaaS strategy. For the past few years I’ve had the chance to follow the movement from the sidelines and try to draw parallels to the world of Micro-SaaS. ResidentialFirst, I paid attention to trends in residential real estate across North America, looking from my own backyard and stretching to Vancouver and all the way down to the Mexican border, trying to get an idea of where the real opportunity is. What I mean by real opportunity is that it’s much more important to get a great deal in the macro-economic sense than it is to get it at the micro-level. I could inevitably wiggle my way into a great local deal. It would be a great deal relative to my location. But in the macro-sense, in the grand scheme of things, it’d be a pretty shitty deal compared to what my dollar might fetch say, 1,000 km away. Eventually, I came to grips with the sad reality that the economics in Montreal and its surroundings simply don’t work for me, and I didn’t see myself ruining my foray into real estate by investing in properties I’m not close to or unlikely to be successful with. That makes no sense as a first-timer. You want to be starting something new with a really high level of optimism and confidence in the success of the project. That obviously entails a bunch of things, but by and large, you can get away with a few mistakes down-stream provided you land a really good, really solid deal at the onset. The Internet has fundamentally changed the game. It used to be inconceivable to operate properties remotely. Today, it’s just the way things are done. You can’t ever hope to build generational wealth by focusing only on your backyard. If you carry this logic a little further, then it goes to reason that you ought to start outside of your backyard on the basis that your exposure to good deals is limited by your local focus. By starting out with a continental or international focus, you expose yourself to a far greater variety of deals, and inevitably increase your odds of scoring a legitimately great one. You can access a huge selection of internet-based businesses and it would be inconceivable to focus only on a single marketplace if you are really trying to find a great deal. Naturally, that’s super hard to do in real-estate, but it’s our way of life when it comes to software. We are Internet citizens and have no boundaries keeping us thinking inside a box. Quickly, it dawned on me that the numbers for residential didn’t work for a microangel like myself. Nevermind cash flow and having to be present for tenants. I couldn’t justify the time or financials relative other far more profitable activities that make up my day-to-day. In such a hot seller’s market, you’d be lucky to score a property without paying a premium that eats into your net operating income. So, I started to look into commercial real estate, instead. CommercialHere, my optimism grew. I quickly learned that 95% of investors shy away from commercial because it’s big and scary. It’s more moving pieces. And the prices are so huge! How could one possibly enter CRE without deep pockets? Actually, commercial real estate works very differently. The math is different. The banks look at things differently too. The financing instruments are varied and flexible. The first big difference is the way properties are acquired. Most deals, naturally, are not all-cash. In the US Midwest, you could find a destitute house in need of renovations for $70k. Forget that if you want to buy yourself a 10-unit building or more. For that reason, most of the transactions involve quite a bit of debt. And that debt often simply changes hands from one owner to the next, radically reducing the financing burden on the part of the purchaser who would only need to fill the gap between the asking price and the current open mortgage. You’re looking at high six digits and much higher, depending on location, net operating income, and subsequently, cap rate. For example, if an investment property costs $1m and it generates $75k of NOI (net operating income) a year, that's a 7.5% cap rate. Usually different cap rates represent different levels of risk. Low cap rates imply lower risk, higher cap rates imply higher risk. The cap rate is basically an idea of how much net return you can expect to be producing every year relative to your purchasing price. In effect, much of the purchase price is thus determined by the cap rate. A high cap rate means a better return, but generally in exchange for some risk. The reason you’d be able to buy a property for a higher cap rate is because it might be in a crappier neighbourhood. Or because it’s in need of fixes. Maybe it has vacancy that needs filling. This relationship between cap rates and risk determines classes of properties that investors tend to focus on. A 4-cap (4% cap rate) building doesn’t return much relative its selling price, but it’s likely really stable, and in a really good location. A property with those kinds of metrics might be classified as Class A building. Retailers tend to only rent in Class A properties. Provided you can secure a Class A property with mostly debt, you’d be able to take advantage of awesome tenants who pay premium rents across multi-year contracts. Everyone wants Starbucks as a tenant. But you’d be paying a huge premium on the purchasing price. Class B properties are a step down from that. Class C properties might have a few broken windows. Think corner store building or storage units in the middle of nowhere. Class D properties contain vermin and crackheads. You get the idea. The more fixing and risk involved, the lower the asking price, and thus the higher the cap rate (as the NOI is fixed at that point in time). I’m exploring this real-estate approach to investing in greater detail to draw parallels to what I’m doing with MicroAngel, what’s different, and what is relevant within the scope of micro-acquisitions. Most real estate investors understand their work is the fruit of many years of careful financial allocation, intelligent deal-making, cash flow management, and above all else, patience. Real estate is a game of patience for the vast majority of investors. But there exists a class of buyers whom, much like micro-angels, are in a rush as it relates to their financial goals and are looking to short circuit the process and leapfrog. Where survival is the mother of innovation, ambition is the mother of determination. Go try and ask a highly ambitious individual to “stop & be patient as things don’t work that way” and you’ll likely observe the person doubling-down on their effort to find a way. I bet this was the case with real estate, which is one of the oldest ways of creating and keeping wealth. In the past, it was a game only playable by highly wealthy, highly patient individuals who have a knack for selecting good deals they can earn equity with over time. That was the game: if you made a good purchase and then sat on it for a long time, you’d find yourself owning the a growing amount of equity in the building and its ensuing net cash flows. Repeat that process across dozens or hundreds of properties and you’d find your wealth growing as your equity in your portfolio increases. Of course, it takes money to make money applies here. Savvy finance professionals leveraged their connections to secure cheap financing to purchase properties that would later appreciate, both in collectible rent as well as the internal rate of returns on their original investments. Meanwhile, the Average Joe continues to believe that this game is reserved for the big boys, and that building a portfolio as a sole individual would be quasi-impossible, otherwise it would take decades to materialize. That’s where BRRRR comes in. Buy, Reno, Rent, Refi, Repeat (BRRRR)The playbook’s purpose is to accelerate the process of building a real estate portfolio by being creative about the financial instrumentation used to purchase, manage and eventually sell real estate assets. It goes far beyond the idea of collecting cash flows and perceiving capital gains from selling off the assets. It goes beyond selecting good deals as an investment strategy and competitive edge. It’s a templated, repeatable approach that anyone with enough discipline and determination could accomplish to great effect. As you explore how BRRRR works, consider how this method of creating value “from thin air” might be applicable to the world of micro-SaaS. Especially for ambitious individuals who may not have a lot to spend, and are in a rush to reach their initial milestones as micro-angels. I should caveat that this doesn’t only apply the the investor who’s trying to build a portfolio. An operator-investor could pull equity out of the business that they have bought to reinvest that into growth. It works either way and you can and should build your own model. FOUNDATIONI could talk about it all day long. BRRRR is everything I love about business all wrapped up into one strategy. It’s efficient, it allows you to scale faster, to leverage what you have, and it forces you to become excellent at what you do. The order in which you are buying properties is close to the classics. You’re just switching a few things around. And those small changes can then add up to a huge difference in the amount of money you are able to pull out of a deal. Take an example where I buy a house for $100k, and put $30k down. Someone could pay $70k for the same house that is worth $100k. That’s what you’d qualify as a good deal. It’s being able to buy something for value x despite that thing being worth more than x. But there’s more you can do than just find good deals. You could pay the $70k. Get the house. Then, because the house is actually worth $100k, you can refinance it. Your bank lets you grab 70% of the value. You get your $70k back. You can then go and buy another house. You learn from the first deal and apply what you learned on the second deal to a greater effect. With your new $70k, you have additional funds for key activities that define two main scenarios:

From the little example:

Were you to buy the thing all cash at $70k, the maximum you’d be able to pull out is $70k (all of the equity). Instead, by investing in the asset you acquire to increase its revenues, you instantly create equity that can be leveraged to access funds that allow you to perpetuate your process. By and large, this is a challenge to the typical approach because you’re merely focusing on rapidly increasing your assets under management (AUM). You’d be comfortable giving up cash flows for a little while in exchange for more properties. It’s a question of style and context. I could aim to acquire 10 properties in 2 years by buying an asset every 2½ months and following the process:

What’s cool about this is that you could also bide your time, earn equity across your portfolio, and then pull out a much larger chunk and increase the scale at which you invest. I’m currently focusing my energy on cash flow, but my next fund is going to be the opposite and BRRRR will probably be the template from which I’ll build the Fund II thesis. I could focus on rapidly expanding the size of the portfolio, and then operate a permanent in-house team that can work to create cross-selling and economies of scale out of the products under management. So, if down payment is almost irrelevant, and what matters is your equity, then at the end of the day, you’re trying to secure a deal by buying equity. Down payment ≠ equity. If you overpay for a deal, that paper equity is not real because the market value is below what you paid. To make a gain you’ll have to increase the value way more than an individual who managed to buy with less cash in the deal. How does this all relate to Micro-SaaS? The dynamics present in commercial real estate are present in Micro-SaaS. Micro-angels can create huge value by focusing on acquiring C and D class products and succeeding in going upclass to command a higher selling price based on newfound value & stability. We might be willing to take on more risk by buying less stable or proven products knowing there is hidden potential underneath. This creates the opportunity itself because the potential that the micro-angel will unlock by increasing ARR is in direct correlation with their returns and future leverage. Here’s how I figure it would come together for people like us. BUYActually finding a great deal that you have buyer/product-fit with can be a huge challenge. You want to stick to what you know, not get in R&D territory unless you can’t help it or are deliberate about doing that. Fortunately, platforms and networks like MicroAcquire, SwiftExits, Transferslot, IndieMaker, Flippa and fabulous brokerages like FE International, have removed the barriers of entry for buyers. You can acquire a Micro-SaaS business for as little as $500. As you build your thesis about what kind of product(s) you are looking for, it will also become straightforward where and how to build lead flow on your own through outbound outreach to unlisted products. There’s a lot to be written about on the subject of finding deals and creating a pipeline, but as a micro-angel I’m not super concerned about doing that. The simple reason is that I’m going to only be spending about 15% of my fund’s lifetime actually focused on buying and acquiring. The rest will be improving, fixing, rolling-up and selling. In the future, I might consider a rolling fund, but since I’m just a single person with plenty already on their plate, I’m limiting myself and scoping based on my available time + resources. Because of this, I’m working quickly and I’m pretty scrappy about how I manage things. I just have a Notion space and chuck stuff into my watchlist and try to keep it tidy as I update data. Once you have an idea of what type of product you’re after, and how/where you’re likely to build deal flow, it’s time to scope yourself based on your available resources. Count your eggs and confirm what your available budget for an acquisition is. It can be anything, really, but you want to be giving yourself a chance so the numbers actually work out in your favor. Once you know what you can play with, that defines the size of the acquisition, and the kind of tools you might end up using to secure your transaction. The smaller the deal, the more likely an all-cash purchase. It’s just a question of volume. It’s much easier to buy something for $10k all-cash than it is to buy something $100k or $1m all-cash. The bigger the deal, the more likely you are to be using debt, especially considering your personal limits for injecting cash into the deal. Something you should know is that your typical lender will require that you have at least 30% of equity in a transaction for them to be willing to finance the remaining 70%. Much like commercial real estate transactions, you can use a mix of lender financing and seller financing to reduce your required out-of-pocket down payment. In that regard, it is entirely possible to buy a business without spending much, but the math might not work out:

It’s up to you to build an area of operations that is determined by what you can put in. If you can’t put in much cash, consider Rob Walling’s stair-step approach and start smaller. RENOVATEExecuting a BRRRR strategy means you’re starting out with the ability to pull out equity. But you want to maximize the amount of equity you pull out so the refi is worth it. So that might define a larger cash position at the onset, but it’s a cash position you’d be recycling for a greater effect. I don’t know how feasible something like this is, but it’s worth exploring and testing (with a bank who would refi SaaS). There are several services that have recently popped up to offer SaaS financing based on MRR. I’ve received emails from Stripe giving me instant access to capital on the basis of my account’s daily transactions. Other platforms like Clearbanc makes this play an interesting, perhaps viable option for creating value quickly. Here’s an example:

You could either “buy the SaaS for free” by pulling out your original investment, or you could increase cash flow (and thus value) by paying off the seller cash balance, or you could use the money to invest in the business or another, based on your strategy. RENTThis is the big advantage of SaaS — there is no physical limit to how many tenants your software can have. There is no need for physical interaction whatsoever, but then churn is a real thing to consider. Your average real estate tenant has a lifetime of 2 years. They literally sign a contract. SaaS retention has huge variance. While you have much more potential relative to the amount of people who can pay you every month, there is far more risk involved in software as a service and the ease with which customers can churn out. Like the BRRRR strategy, the idea is to increase rent so the value of the business is higher, and thus so is the refinanceable amount. For a SaaS, that really means buy & grow, not buy & hold. It’s an active playbook that knows exactly what needs to be done post-acquisition. You’re looking to increase ARPU, decrease churn, increase net dollar retention and solving for a profitable LTV:CAC ratio. That’s the playbook. The BRRRR investor has a proven, repeatable process for creating value in a home, from the bathrooms to the kitchen to the lighting and electric and so on. A SaaS microangel should build their strategy with a similar playbook in mind. Considering the potential to acquire several assets under management, one should have a repeatable plan that creates value after buying the product(s). That leads to the eventual refinancing of micro-acquisitions fairly quickly after the initial transaction has taken place. The more you can grow MRR, the more capital you can extract without giving up your equity. REFINANCEThis is the point I’m most trying to develop. In a repeatable playbook, the refinancing element is the most straightforward because the value in the asset has already grown since the acquisition. The basis of the conversation with the lender is already really strong:

Whether or not it is worth pulling out equity is a totally separate topic. The point is to show that your equity can be an immediate untapped resource that you can leverage to secure funds without giving up any control very quickly. Which is the bootstrapper’s way. REPEATThe last part of the process is to decide how and when to repeat. How quickly are you able to increase MRR? How much are you trying to pull out of the equity after the acquisition, and does the math work out? It’s an interesting world, and and even more interesting model. I’m going to keep learning about it and look forward to sharing more as I discover. If you have an opinion on how this might or might not work, please call it out so everyone can benefit! Was this an interesting or thought-provoking read? Take a moment to share it with a friend.² 1 I started a $500k fund to buy Micro-SaaS businesses :) 2 Thanks to the following Newsletter Sponsors for their support: MicroAcquire, Arni Westh, John Speed & the many other silent sponsors You’re on the free list for Micro Angel. For the full experience, become a paying subscriber. |

Older messages

Structuring micro-acquisition deals creatively for maximum cash flow & IRR

Wednesday, March 31, 2021

"We're starting a SPAC." —Thomas Edison

Bouncing back from losing a big deal to an even bigger competitor

Wednesday, March 31, 2021

I'm still reeling from losing a deal I was deeply passionate about to a huge public company, but all hope is not lost

My micro-acquisition process from first-touch to close & asset transfer — Part 1

Wednesday, March 31, 2021

How to execute a lean micro-angel acquisition process that is fast, efficient and scalable

You Might Also Like

Making Wayves

Tuesday, March 4, 2025

+ Girls just wanna have funding; e-bike turf war View in browser Powered by ViennaUP Author-Martin by Martin Coulter Good morning there, Since 2021, VC firm Future Planet Capital (FPC) has secured more

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏