Investing in Digital Collectibles with NBA Top Shot

From CryptoKitties to digital trading cards, the world of blockchain-backed collectibles is quickly evolving. Welcome to issue #27 of Alternative Assets by Stefan von Imhof. Each week I explore unique investment ideas & opportunities. I hope you enjoyed the last on the world of voice acting. I took a bit of a risk with that one — sure, your voice is technically an "asset", but as far as alternative assets goes, it's admittedly a bit out in left field. However the reaction I got to that issue was way better than expected. For some it was a swing and a miss, but for many others it was right on point. This bit of feedback was especially uplifting:

This week we take a look at a brand new asset class: The burgeoning world of digital collectibles. Let’s dive in! Investing in collectiblesOf all the alternative investment opportunities out there, few capture people’s emotions quite like collectibles. Investing in collectibles has been popular for quite a long time. Starting with more traditional assets like stamps & coins in the 70s, collectibles saw a huge jump in the 90s with the beanie baby craze. (Side note: As a former Santa Barbara resident, beanie babies hold a particularly strong importance for me. The founder, Ty Warner, is from there, and he has funnelled his $2.6 billion dollar wealth into some fantastic philanthropic efforts for the city, including the Ty Warner Sea Center, which is a delight to visit) Anyways, over the years, the definition of "collectibles" has expanded to include toys, action figures, (think Funko Pop dolls), antiques and comic books, to bizarre things like toasters and even dinosaur skeletons. While value is harder to pin down for some classes, many collectors don’t care. Items like this aren’t always purchased with growth in mind. People just like collecting stuff they’re passionate about, or enjoy trading with other collectors. The asset class has the intangible but very real bonus of being kind of cool. But as we continue to move into the digital age, a whole new class of collectibles has emerged: digital collectibles. These assets are completely intangible, only available online, and as we’ll see below, often simply licensed from another company. The idea of owning assets like these is both a bit odd, and yet somehow completely logical. Before we look at the current landscape, let’s take a moment to understand how we got here. History of digital collectibles and NFTsAs you probably can guess, blockchain is the premise upon which digitally licensed collectibles are built. The decentralized technology is able to record digital transactions and, especially in the case of collectibles, digital assets. This means that ‘your slice of the internet’ can now be securely stored, retrieved and traded without any IP or patent issues. Specifically, digital collectibles utilize NFTs, or non-fungible tokens. NFTs represent fractions of real-world assets that can be stored and traded as tokens on a blockchain. Unlike regular cryptocurrency, NFTs represent something unique; they are not mutually interchangeable, and that is their key feature – the uniqueness creates scarcity. The first company to implement a fully digital licensed marketplace was CryptoKitties. Launched in late 2017 by Dapper Labs, CryptoKitties lets you buy, sell and breed various “collectible kittens” that are uniquely owned by the owner. Kinda like a real cat, minus the allergies and kitty litter. Originally intended as an engaging game and community, CryptoKitties also presented itself as a secure investment opportunity, with cats ranging from $5 to well over $300,000! CryptoKitties got off to a great start, positioning themselves as the "eBay for Digital Collectibles" and hitting #1 on ProductHunt. They gained pundit praise, and global recognition for their innovative business model. And as we'll get into below, their success paved the way for the founders next venture, NBA Top Shot. Another early mover was Ecomi. Its digital platform VeVe has sold over $200 billion worth of licensed digital material via the blockchain. Available as an app, users (as well as patent brands) can buy or supply assets to be licensed, sold, and traded. Companies such as Marvel, Disney and Cartoon Network have begun utilizing this platform to market digital collectibles. Similar to CryptoKitties, VEVE intends to create an interactive environment where instead of feeling like you own an intangible string of a code sitting somewhere on the Internet, you can immerse yourself in a world of owned collectibles — truly bringing the asset class to life. How NBA Top Shot was formedOver the last 20 years, the NBA has exploded into the global marketplace. Since The Dream Team delighted the world at the 1992 Olympics, its audience has grown and permeated seemingly every nation. As of 2018, even became China’s most popular sports league. One of the main reasons for the NBA’s global success has been its adaptive and progressive marketing under David Stern (who boosted the NBA’s revenue from $118 million to 5.5 billion throughout his tenure) along with his successor Adam Silver. Such innovation in the industry has allowed the NBA to seize potential revenue streams as they become available. Reacting to the rise of cryptocurrency and understanding the potential of the blockchain, in 2019 the National Basketball Association teamed up with CryptoKitties founders Dapper Labs (as well as the NBA Players Association) to create NBA Top Shot. NBA Top Shot lets you own the original, exclusive highlight clips of NBA players. These are short, exciting video moments available to purchase as digital packs. Think of them like video versions of digital trading cards. Described by Dapper Labs CEO Roham Gharegozlou as a “revolutionary new experience where jaw-dropping plays and unforgettable moments become collectibles that you can own forever”, NBA Top Shot has metamorphasized basketball’s cinematic plays into an appealing new market asset that can be owned by both LeBron James fans and traded by investors. Sponsored

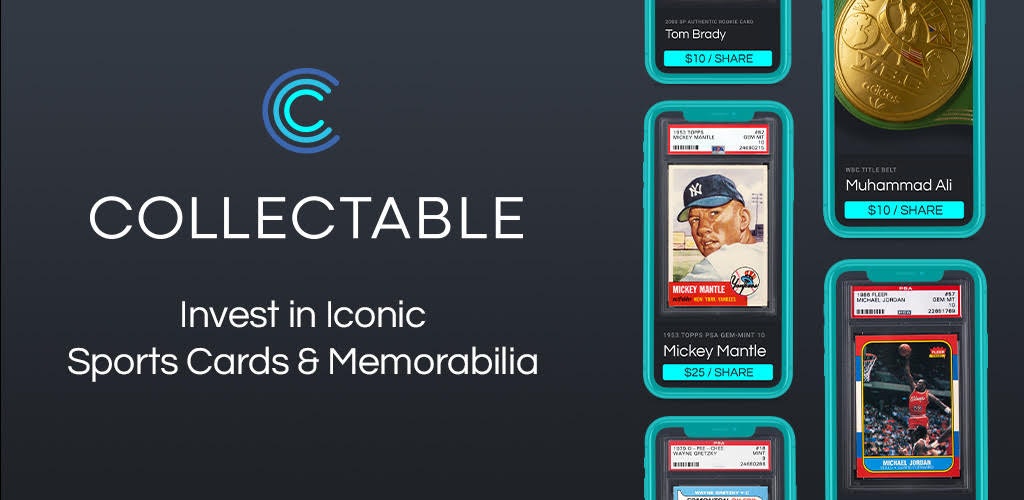

Collectable is a new fractional platform that lets any fan invest in the most rare and exciting sports cards and memorabilia, with share prices starting at just $1. Since January 2008, high value sports collectibles have outperformed the S&P 500 by 81%. (source: PWCC) But until now, top sports collectibles were expensive to acquire, and the industry was burdened by high fees and a lack of transparency. Not anymore… Collectable is making the investments of wealthy sports collectors available to all, and investors are already seeing returns (e.g. 196 investors just realized a 35% return in just 1 month on the sale of a Patrick Mahomes rookie card) Explore one of the hottest asset classes around…

How does NBA Top Shot work?For all intents and purposes, highlight clips operate the same way as a Yu-Gi-Oh trading card. Value is determined by a player’s popularity, how incredible the highlight clip is, and of course, the asset’s overall rarity. The NBA provides a clip to Dapper Labs, who then bundles up these highlights into digital packs.. The NBA gets a cut of each sale and, per their agreements with the Players Association, so do the players. To boost asset prices, the NBA has created artificial scarcity with these goods. Each moment is only available for a limited time, and once it’s sold out you can only acquire that Kevin Durant dunk you via the NBA Top Shot P2P marketplace — often at an inflated price. Highlights can rise or fall in value after purchase. A particularly noteworthy example of this is a Ja Morant clip purchased for $2,000 and sold a few months later for $35,000. NBA Top Shot tracks and keeps the entire sales history for each highlight, bringing data and transparency to the market. After a moment is sold on the marketplace, the transaction is entirely peer-to-peer. This means that the sale could be conducted by a young NBA fan in need of quick cash for a holiday, or a high-end investor who believes that the value of the video has peaked. More common sets of plays often have 50-100 people selling it at once, with asking prices typically ranging from under $10 to over $400. While each moment has a unique serial number, there are no fundamental differences between them other than this number. The #1 moment in a set may be worth a few grand, while the 4000th edition of the same highlight not even crack double-figures. Note: The footage for each moment isn’t technically purchased, it’s licensed. The actual ownership of all footage is ultimately retained by the NBA. Buyers may not realize this, or may not care. But still, this is an important distinction Who is buying these NBA highlights?As with any collectible investment, there are a diverse set of buyers with differing financial situations and natural affinity towards the player, team, and sport. For many in the younger demographic, smaller $5 purchases are typically made solely for the cool factor of owning a piece of memorabilia, without much understanding or care of the highlight's potential appreciation. From the chart below, we can see that the majority of purchases are probably made by people who have lower disposable income and are most likely just buying the moment for the same reason they might buy a baseball card — because it’s a pretty neat piece of memorabilia and collectibles are just damn appealing. However, NBA Top Shot isn’t just a younger person’s gimmick. There are definitely professional investment opportunities here for savvy investors armed with data. Top Shot investors are typically into cryptocurrencies, which makes sense considering its very existence is contingent on the efficacy of blockchain. Those aiming to capitalize on more expensive assets are also typically fans of the NBA. If you’re going to take an outsized risk on an asset class like this, it helps to have deep exposure to the sport, and an innate understanding of a moment’s relative value. With that said, as NBA Top Shot grows in popularity, investors that couldn’t tell a tennis racket from a basketball hoop are becoming involved. SponsoredWant to supercharge a website before you start building? ODYS is a fantastic new way to kickstart the site of your dreams with an aged, brandable domain that’s relevant and full of link juice. These aren’t just premium domains, they come with a backlink profile that can boost your site for years. Think of it like building a house: Instead of starting from scratch, you can build on top of an existing strong foundation. In fact, this is such a well-kept secret that ODYS doesn’t just let anyone in. Your referral code is Alternative Assets.

What is the most expensive NBA highlight ever sold?Some purchases have been made for tens of thousands, with original owners buying and flipping moments for profits in excess of $20k per clip. The most expensive comes from LeBron James, who is almost certainly the most popular player in the NBA. His top plays are loved, shared, and scrutinized by fans around the globe. As impressive as it is to watch LeBron James jamming the ball down on some poor soul, what’s even more impressive is how much investors are willing to pay for them. While this $43k moment got lots of buzz, one investor was willing to pay a whopping $71,455 for another LeBron clip, which holds the current record. How easy is it to resell a digital moment?A clip owner can resell the asset on the official NBA Top Shot marketplace immediately after purchase. The marketplace treats the buying & selling of moments like trading candy, and it seems to be a pretty active marketplace. However, as a buyer, fencing these assets via the NBA Top Shot marketplace isn’t actually your only option. Finding a place to sell digital collectibles is becoming nearly as simple as selling physical ones. Because each purchase is backed by the blockchain, these are relatively simple to sell. Digital asset transactions aren’t a new concept, and numerous platforms could theoretically facilitate such a transaction, including eBay and Flippa. (In fact, as of this writing there are currently 32 moments for sale on eBay.) The more pertinent question is, how often do people actually buy them? Despite the backing & marketing power of the NBA, these moments are still a relative novelty that is only just starting to enter the mainstream consciousness. If you take a look at the NBA Top Shot marketplace, you’ll see hundreds of sellers moving the exact same asset at very similar prices. Generally speaking, there are more ‘for sale’ highlights than there are historic sales on any given moment. Surely it will take some time for the market to become less saturated, and in the meantime investors may find it difficult to get a quick return on their purchases. With that said, rare and valuable sales topping $10k are becoming more common across all digital trading card platforms, and given the way things are moving, it certainly wouldn’t be unreasonable to expect this trend to continue. New SponsorFind your next investment with MoneyMade MoneyMade is an innovative and free investment discovery platform. Coming fresh out of LA and armed with new VC funding, the team is bringing everyday investors a simple way to find and compare the latest investment opportunities. 150+ investments online, from Rental properties, Bitcoin, Stocks, Video Game Startups, Banksy artwork, Pre IPO's, and more. Invest from $1 - $100,000. Search by investment type, target returns, minimum investment, ease of liquidity, investment timeframe, fees, and more. Want help finding the best investment? Complete our quick Investor Quiz to get a tailored list of opportunities. Check out MoneyMade to find your next investment.

What are the risks of trading NBA Top Shot moments?Rising interest in NBA Top Shot moments means a subsequent rise in both prices and, for now, value. Top Shot moments have ridden the coattails of surging cryptocurrency and physical trading card markets, suggesting these classes may be somewhat linked despite the relative infancy of Dapper Labs. It is worth remembering that in 2011, 2 years after Bitcoin’s inception, it was valued at anywhere between $0.30 USD and $5.00, with extreme volatility. As of this writing, it's up to USD 34k. This comparison is not intended to reflect on the potential growth of digital asset markets but rather the instability of youthful ones. With NBA Top Shot being such a novel business, there are likely to be troughs and peaks in its development, and there isn’t yet a large enough body of statistics to gain a solid understanding of how this particular market operates. Digital collectibles will also take a little longer to gain credibility as reliable stores of value. Whereas with physical collectibles you know that you own it (because you can see it), ownership of digital collectibles still feels a bit iffy (despite the fact that it’s backed by the blockchain.) People are still a bit weary and uncertain about this asset class. Nobody really knows whether websites like NBA Top Shot are real, powerful investment opportunities, or just gimmicks attempting to create scarcity out of thin air. Digital trading card marketplacesThere are a few other marketplaces gaining ground in the digital collectibles space. While these marketplaces are more focused on digital trading cards than video clips, that could change at any moment. And in the meantime you'd be wise to pay attention to what these sites are doing. DigitalTradingCards.comDigitalTradingCards.com is a collectible marketplace & resource for crypto games that harness the power of the blockchain. You can buy & sell everything from Garbage Pail Kids to Hearthstone strategy cards. The site is a bit rough around the edges, but in addition to news and card ratings, they have an active community and member forum. They have also partnered with the quickly growing Worldwide Asset Exchange (WAX) to deliver surprisingly robust data analytics on hundreds of virtual goods. We'll be covering WAX in more detail in an upcoming issue on NFTs. Stay tuned. Neon MobNeonMob is a marketplace where digital artists meet digital art collectors. They enable artists & creators to have tens of thousands of people collecting their work, and claim creators can earn the highest royalty rates of any similar art marketplace. Similar to NBA Top Shot, people can buy packs and collections of digital trading cards from artists around the world. This is a much cleaner site than DigitalTradingCards, and with a much different value proposition. This is more than just a site for artists to share their work — it’s a place for people to discover and collect rare pieces from up & coming digital artists looking to make a name for themselves. The future of digital collectiblesIt’s difficult to predict the future, particular with such a new, untested asset class. What I can say is that the concept — particularly for fans of the NBA — is both extremely unique and highly appealing. Who wouldn’t want to be one of the few rare owners of a highlight clip of their favorite NBA player? It’s the kind of stuff that sounds a bit ridiculous at first, but that diehard sports fans live for. Given the rise of cryptocurrency and younger investors, it stands to reason that the purchase and sale of digital moments, trading cards, and other digital collectibles could have a very bright future. The world is becoming more connected every day, and the digital age is starting to redefine what the concept of "collecting" means in the first place. There’s no doubt it’s an unproven market. But there’s something really exciting about that. Digital collectibles could be a great opportunity to get your foot in the door on something new, unique, and fun — especially before that door gets blasted wide open. Other News

That’s it for this week’s issue. If you enjoyed reading, please smash that share button. Thank you for your shares and support. It means a lot! See you next time, How'd you like this issue? ✅ Helpful, thanks! SponsorshipInterested in sponsoring Alternative Assets? Let’s chat. Each issue of Alternative Assets receives over 1,600 impressions. Due to high demand I've added a third ad slot. Three ad units are now available per issue.

|

Older messages

Big News: Introducing Alternative Assets Insider

Wednesday, March 31, 2021

~Announcing a new joint venture and a new paid service~ Welcome to a very special issue of Alternative Assets. I hope you enjoyed last week's issue on Trading NFTs with NBA Top Shot. Today I'

Investing in Sneakers

Wednesday, March 31, 2021

The sneakerhead revolution (and a new asset for Insiders!) Welcome to Alternative Assets. We hope you enjoyed last week's special issue on our big merger and our launch of Alternative Assets

Your Insider Subscription Just Got Better

Wednesday, March 31, 2021

Hi Your subscription to Alternative Assets Insider just got better. You can now sign up to receive all our best analysis on four amazing new asset classes. Just click the link for each asset you'd

A look at MoneyMade: A new investment platform

Wednesday, March 31, 2021

New alt investment platforms to explore Welcome to Alternative Assets. You are receiving this because you are subscribed to our General newsletter. To change your settings, scroll down to

Exploring SDIRAs with AltoIRA

Wednesday, March 31, 2021

Understanding the Self-Directed IRA and how it works Welcome to Alternative Assets. You are receiving this because you are subscribed to our General newsletter. To change your settings, scroll down

You Might Also Like

AI's Impact on the Written Word is Vastly Overstated

Monday, March 3, 2025

Plus! VC IPOs; Sovereign Wealth Funds; The Return of Structured Products; LLM Moderation; Risk Management; Diff Jobs AI's Impact on the Written Word is Vastly Overstated By Byrne Hobart • 3 Mar

Know you’re earning the most interest

Sunday, March 2, 2025

Switch to a high-yield savings account ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Longreads + Open Thread

Saturday, March 1, 2025

Hackers, Safety, EBITDA, More Hackers, Feudalism, Randomness, CEOs Longreads + Open Thread By Byrne Hobart • 1 Mar 2025 View in browser View in browser Longreads A classic: Clifford Stoll on how he and

🚨 This could be a super bubble

Friday, February 28, 2025

An expert said we're in the third-biggest bubble ever, the US poked China one more time, and OpenAI's biggest model | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Boring, but important

Friday, February 28, 2025

For those life moments you might need . . . ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Last Trader Standing

Friday, February 28, 2025

The Evolution of FX Markets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

My secret 15-minute video sharing my triple digit options strategy

Friday, February 28, 2025

Free training + book ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👋 Bye bye, bitcoin

Thursday, February 27, 2025

Bitcoin's biggest one-day blow, Trump's latest tariff threat, and robots playing soccer | Finimize TOGETHER WITH Hi Reader, here's what you need to know for February 28th in 3:12 minutes.

Don't Overlook this Sector Billionaires are Quietly Investing In

Thursday, February 27, 2025

The Billionaires' Energy Secret (You Can Get In) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Giveaway: Set Sail on Your Next Adventure 🚢

Thursday, February 27, 2025

Enter to win a chance to win a free trip from Virgin Voyages. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏