Welcome to issue #3 of Base10: Automation for the Real Economy. Similar to our Forbes articles, each issue will explore our insights into a trend that is automating a Real Economy industry, as well as highlight companies that are building solutions to real world problems affecting the 99%. Today, Rexhi Dollaku discusses our research and insights into environmental impact monitoring for the back office.

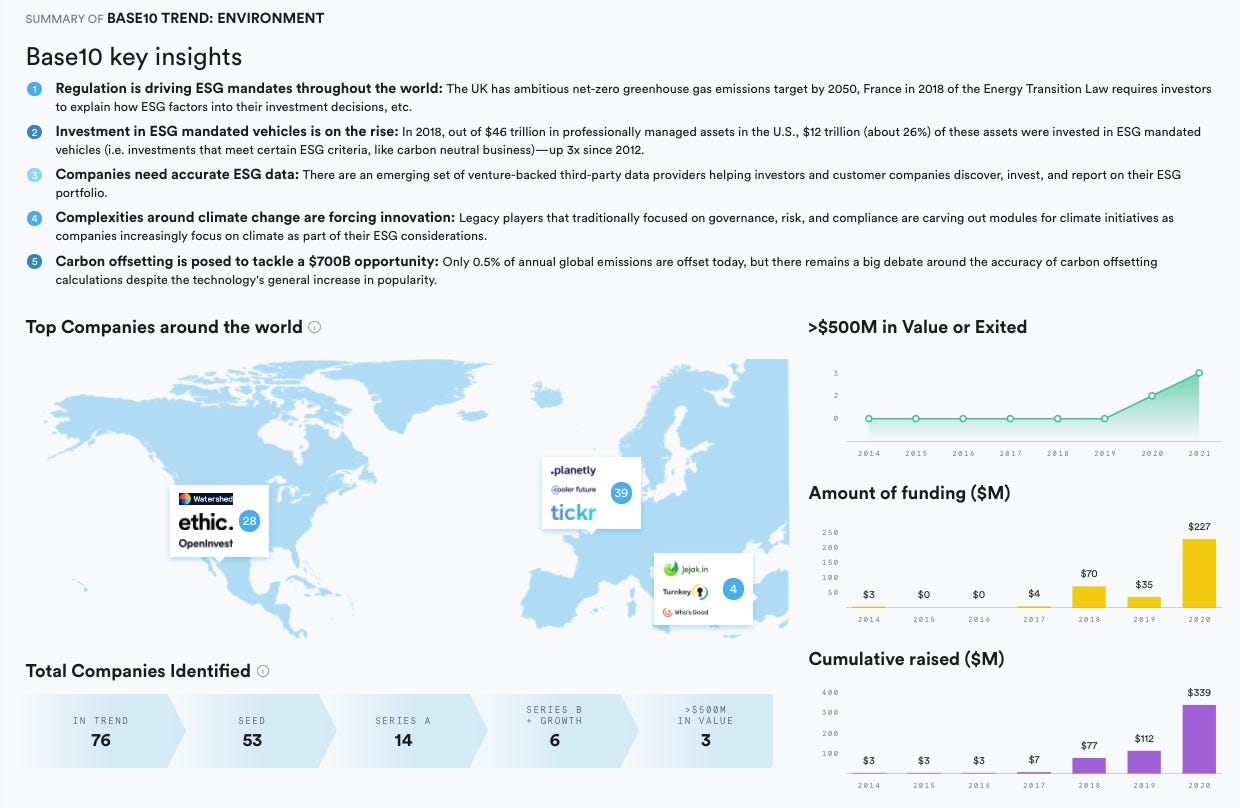

A comprehensive, visual summary of the research Base10 has done on environmental impact monitoring offerings is available on this research page.

Jennifer is the CEO of a fast-growing e-commerce store. She’s built a large and loyal customer base over the years, but recently she’s noticed a number of negative reviews from customers citing her store’s excessive packaging. Jennifer is surprised, but notices that it’s her favorite, largest customers—her regulars—complaining to her about her business’ climate policies.

“What am I supposed to do?” she asks a few of her friends that also run e-commerce stores. They tell Jennifer about a new software solution that helps stores reduce their excessive packaging and also offers carbon offsets so customers can reduce their footprint at the time of purchase. Raving about the software, Jennifer’s friend insists the tool has actually increased cart conversion rates by 25% and customers are elated to have the option to feel good about their purchases. Jennifer is stunned that this is good business!

A few weeks after implementing this e-commerce app, Jennifer sees her positive reviews return to normal and customers are raving about her store again.

Jennifer’s story is not unique—there are hundreds of sustainability-related conversations happening every day in board meetings, Slack channels, and email threads across a variety of businesses. And these conversations are about a lot more than just the environment—they touch the contract between society and technology, which is being redefined in the wake of Prop 22, new corporate D&I programs, important humanitarian challenges like immigration, climate change, and others. Critics will say this time isn’t different, and that some companies have always been more conscious of these issues than others.

But it’s clear that this time is different. Consumers and businesses have higher expectations for accountability and transparency (and much more access to the information to make these judgements). And others stakeholders are listening too:

Investors are aggressively re-allocating capital towards good corporate stewards: $12T of assets, up 4X in the last decade, are managed with an ESG investing strategy.

Corporations are setting new guidelines and benchmarks around these topics: Google for example announced a goal of increasing its number diverse board members 30% by 2025, while Facebook plans for half its workforce to be underrepresented groups by 2024.

Regulators are pushing more stringent ESG guidelines: The EU regulation on Sustainability-Related Disclosures took effect on March 10, 2021, requiring investment managers to disclose sustainability risks surrounding their investments, which include environmental, social and employee matters, respect for human rights, anti-corruption and anti-bribery matters. U.S. companies are preparing for similar regulations, whether they touch diversity, carbon emissions, and other sustainability metrics.

Addressing a company’s environmental impact is increasingly becoming a part of a greater group of decisions that executives have to make as their business interacts with different stakeholders.

Investors have dubbed this category ESG, which stands for “Environmental, Social, and Governance” programs. These programs are “a set of standards for a company’s operations that socially conscious investors use to screen potential investments,” according to Investopedia. Although this criteria is rapidly evolving, a consensus has emerged about what falls into each of these categories:

Environmental criteria consider how a company performs as a steward of nature

Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates

And Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights

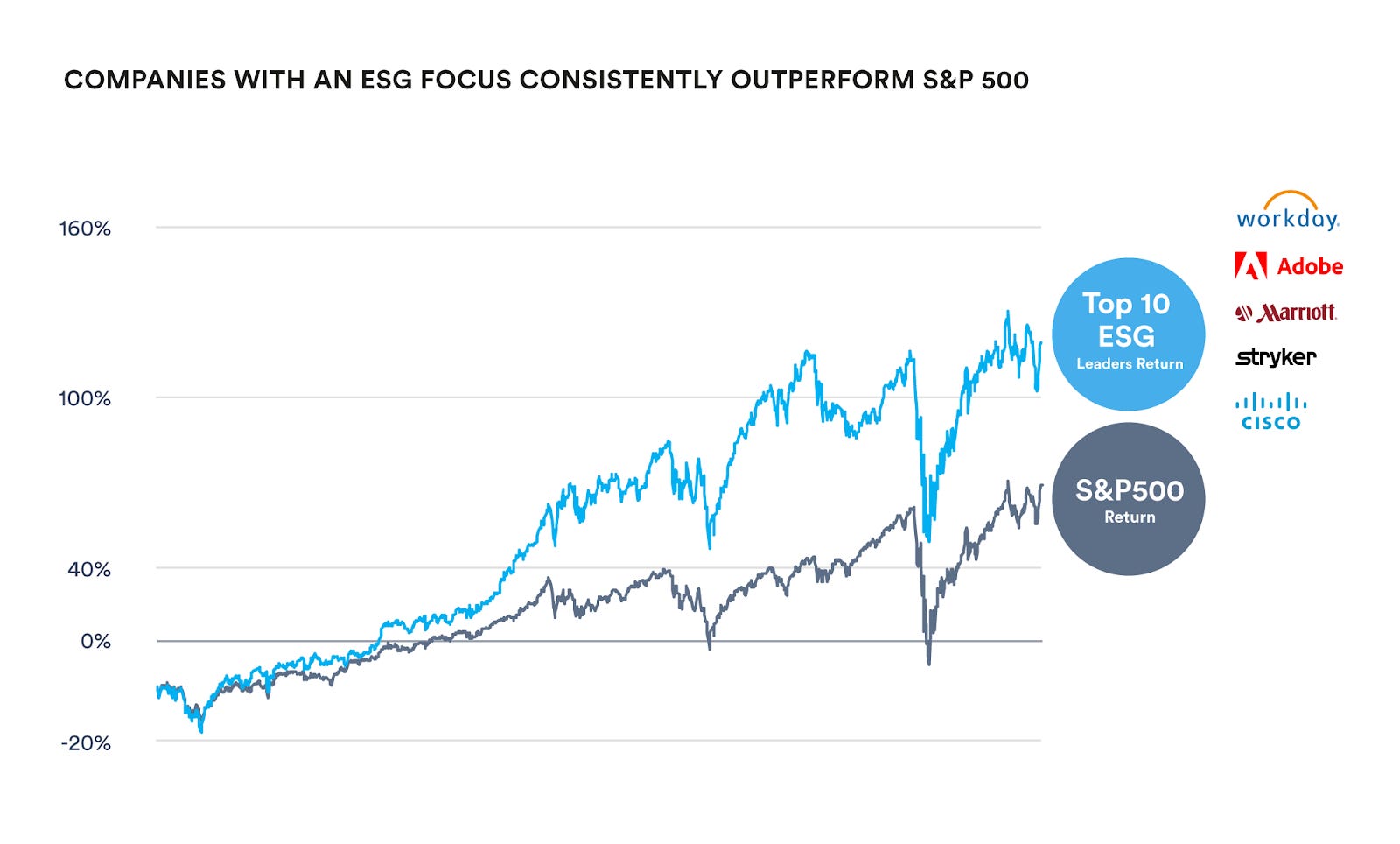

Corporations have taken real leadership positions on these three topics as they’ve realized that being an ESG leader is good business, and it’s important to communicate your ESG posture to customers, investors, and other key stakeholders. In fact, they are being rewarded for it—ESG leaders have outperformed the S&P 500 by 100% over the last 5 years:

Managing and reporting on these programs is quickly becoming a full time job. At Base10, we are seeing renewed interest from entrepreneurs and investors who are actively building tools to help companies better manage their ESG programs, making consumers aware of their environmental footprint, and organizing voters on important new policies related to ESG topics. We believe this time is different, and that this new wave of innovation will birth many significant and enduring companies. And of course, we’re excited about these new technologies because we aspire to leave the world a better place than we found it, and the entrepreneurs building in this trend will help us do just that!

Just to get a sense of how much this trend is growing, in 2018, out of $46 trillion in professionally managed assets in the U.S., $12 trillion (about 26%) of these assets were invested in ESG mandated vehicles (i.e. investments that meet certain ESG criteria, like carbon neutral business, or not investing in oil and gas businesses).

This is up 3x since 2012! Let’s take a look at the state of climate technology and what’s to come for both startups and interested investors.

This is first of a series of posts that explore the broader ESG opportunity. We’re going to start with the innovation happening in the Environmental (also known as the Climate) category, with software and internet opportunities in particular. Climate change is one of the most important issues our planet faces, and it’s not surprising that it is increasingly grabbing more and more attention. Innovation is happening here in many dimensions—new research is identifying ways to put carbon in the ground rather than the air while others work to create or modify plants to more effectively consume CO2—and while we are excited about these opportunities, we are focusing our research in this piece specifically on the broader opportunities for software to improve our climate position. As a result we won’t be featuring any memes about Elon and his successes tackling climate change—but we will highlight some opportunities for Elon to make Tesla even more successful. 😊

Trend movement in climate tech

As part of our work in the climate tech trend, we asked some of the top minds in climate startups and investing to share their perspectives on the opportunities in environmental tech and answer the question: What is the most impactful transformation to happen in climate change in the next 10 years?

"Real estate is the single most contributive industry to Climate Change - responsible for 30% of all greenhouse gas emissions. Fifth Wall is optimistic that tenants, policy makers, and capital markets will begin holding the real estate industry accountable and encourage the industry to begin investing in the Climate Tech R&D to decarbonize."

— Brendan Wallace, Managing Partner, FifthWall Ventures

The most impactful change will be harnessing the power of the people and democratizing the ability to live sustainably.

— Dane Baker, Co-founder and CEO of EcoCart

The most meaningful shift to happen in the next 10 years is not going to be in one particular industry, but rather the rate in which these shifts need to take place. As a species, we need to retrofit 200 years worth of infrastructure in 20.

— Brennan Spellacy, Co-founder and CEO of Patch

Businesses decarbonizing, leading to the potential for society to decarbonize (and perhaps even go into negative emissions territory through carbon capture and removal) in the following decade.

— Nikhil Basu Trivedi, investor

We will have it solved and wonder what all the fuss was about (see my full argument here, but basically solar + batteries + capture are all much further along than most people realize)

— Tyson Woeste, Partner, climate tech, FifthWall Ventures

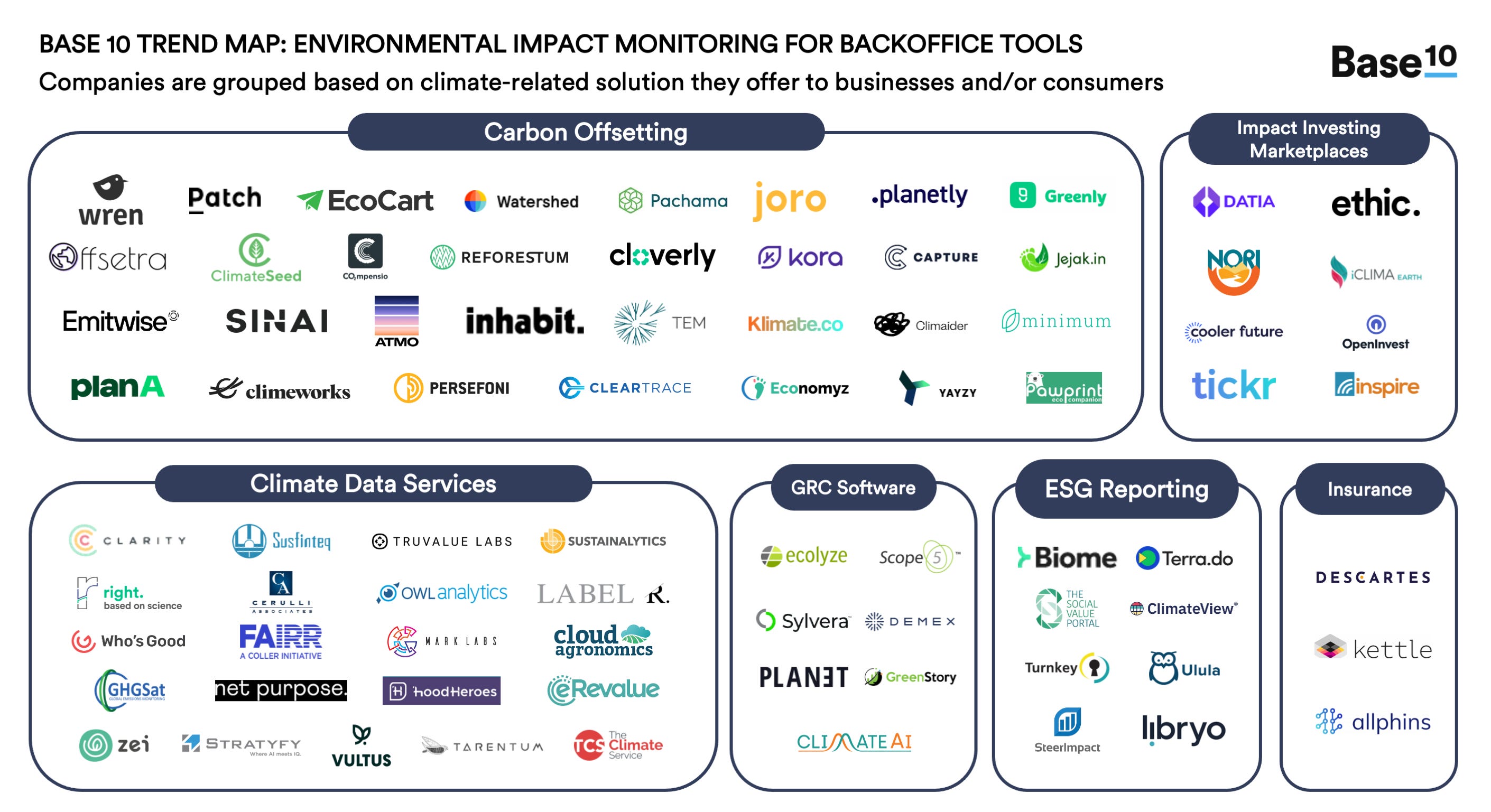

For all of the responses we collected, check out this Substack page. Our research and work has been aligned with this expert feedback, and we’ve bucketed the broad patterns of innovation we’re seeing into six trends:

Data services that help investors and companies better understand different ESG standards, which companies meet those standards, etc.

Impact investing tools that help consumers put their money in support of companies with sustainability practices they care about

Tools for businesses to measure, manage, and report on their ESG practices

Tools for businesses to offer carbon offsets

Climate-related risk insurance and brokerages

GRC software tailored to manage compliance with environmental standards

One area of innovation we are excited about is an emerging set of data providers that are helping investors and other companies discover, invest, and report on their ESG portfolio. Historically, it has been difficult for asset managers to “score” climate change policies across companies and it ends up being a subjective exercise. Companies like Clarity AI are emerging to aggregate all ESG data across an asset manager’s portfolio so they can independently create their own scoring systems. These tools are particularly interesting from the asset manager’s perspective since they can typically justify charging more for social impact-focused funds. Truvalue Labs also operates in this data segment, selling an API to large investment managers to build their own analysis and reporting. Truevalue differs from Clarity AI and others in that the company defines their own framework to rate and rank companies based on their performance in the E and S of ESG, whereas Clarity AI simply gives companies a birds-eye view of all ESG data so that they can then set their own ESG metric definitions.

For the ‘E’ in ESG specifically, platforms like Metrio and Watershed Climate offer comprehensive sustainability reporting tools that enable big companies to centralize data across E as well as S and G subcategories. Planetly and other similar environment-focused GRC platforms take this one step further, leveraging data to help customer companies reduce the carbon emissions they can and offset the remainder they can’t eliminate. Other platforms like Terra.do focus on education and provide companies with resources to understand how their operations impact the environment and what solutions to that negative impact could look like.

Climate change is such a uniquely challenging opportunity that this new class of corporate reporting tools have focused specifically on it. But there is an existing large software market—called GRC or governance, risk and compliance software—that historically has focused on some (if not all) of these ESG topics. Many of these businesses are quite large—MetricStream and NAVEX Global, two leaders in the GRC market, are 1,600 and 1,200 employee companies, respectively—and have a legacy of helping large corporations manage risk associated with these programs (like negative press from a supplier that employs child labor, or accidentally doing business with a criminal group). Some of these platforms have launched climate modules too, creating more corporate awareness for climate as an important ESG consideration. But the scope and impact of some of these programs is so large, and the topics that fall into ESG are still evolving, that we are confident more big players will emerge focused on a subset of these categories, taking share from the GRC players.

For a more comprehensive view of the environmental impact monitoring tools and players we compiled for this research dive, we put together this visual trend summary that includes a spread of the current players, fundraising history, and active investors.

Carbon offsetting as an immediate climate opportunity

Only 0.5% of annual global emissions are offset today, but the sheer volume of emissions presents a potential $700B opportunity for companies solving. That kind of TAM doesn’t come without challenges, however. There is a big debate around the accuracy of carbon offset calculations on both the offset provider side and the supply chain side. Supply chains tend to be opaque, so even if a company like Jennifer’s finds a carbon offset vendor or broker that has successfully reduced carbon emissions in a verifiable, repeatable way, it can be difficult to accurately calculate the company’s own carbon footprint. And finding carbon offsets that you can trust is easier said than done—there’s been an increase in less reputable offset projects following the increase in general popularity of carbon offsetting.

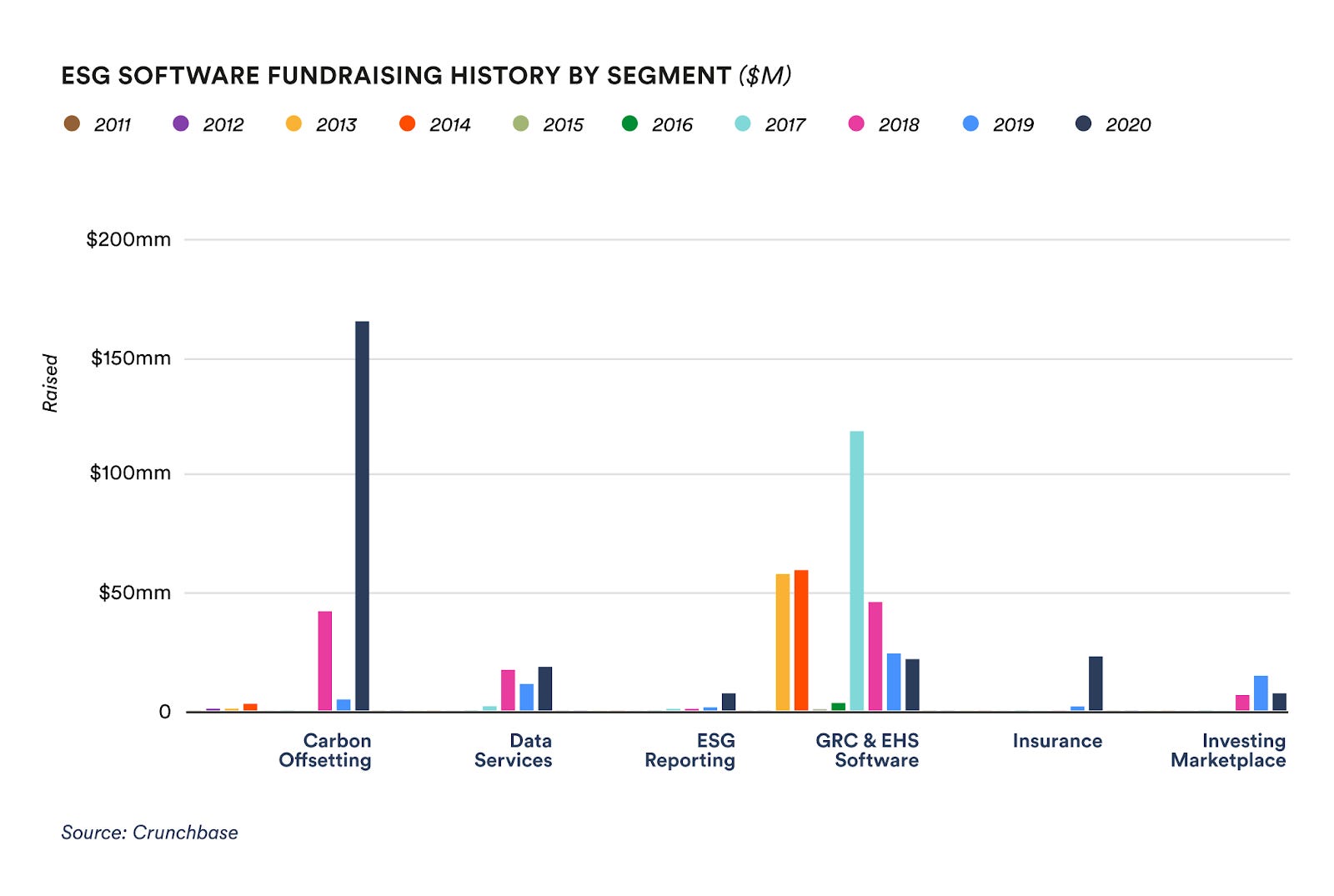

Regardless of the ambivalence around carbon offsetting itself, we have seen a huge spike in investment in the carbon offsetting segment of the broader ESG universe in the past year.

Carbon offsetting in climate tech takes on a few unique forms. Firstly, carbon offsetting infrastructure connects the broad supply chain of carbon offsetting projects and brings financing partners and sources of financing together to make the overall supply of carbon offsets more accessible. Carbon offsetting projects are quite diverse and range from activities that you would expect (planting trees and ground sequestration, for example) to more unconventional activities like providing communities with clean water filters to prevent wood burning in the name of water purification.

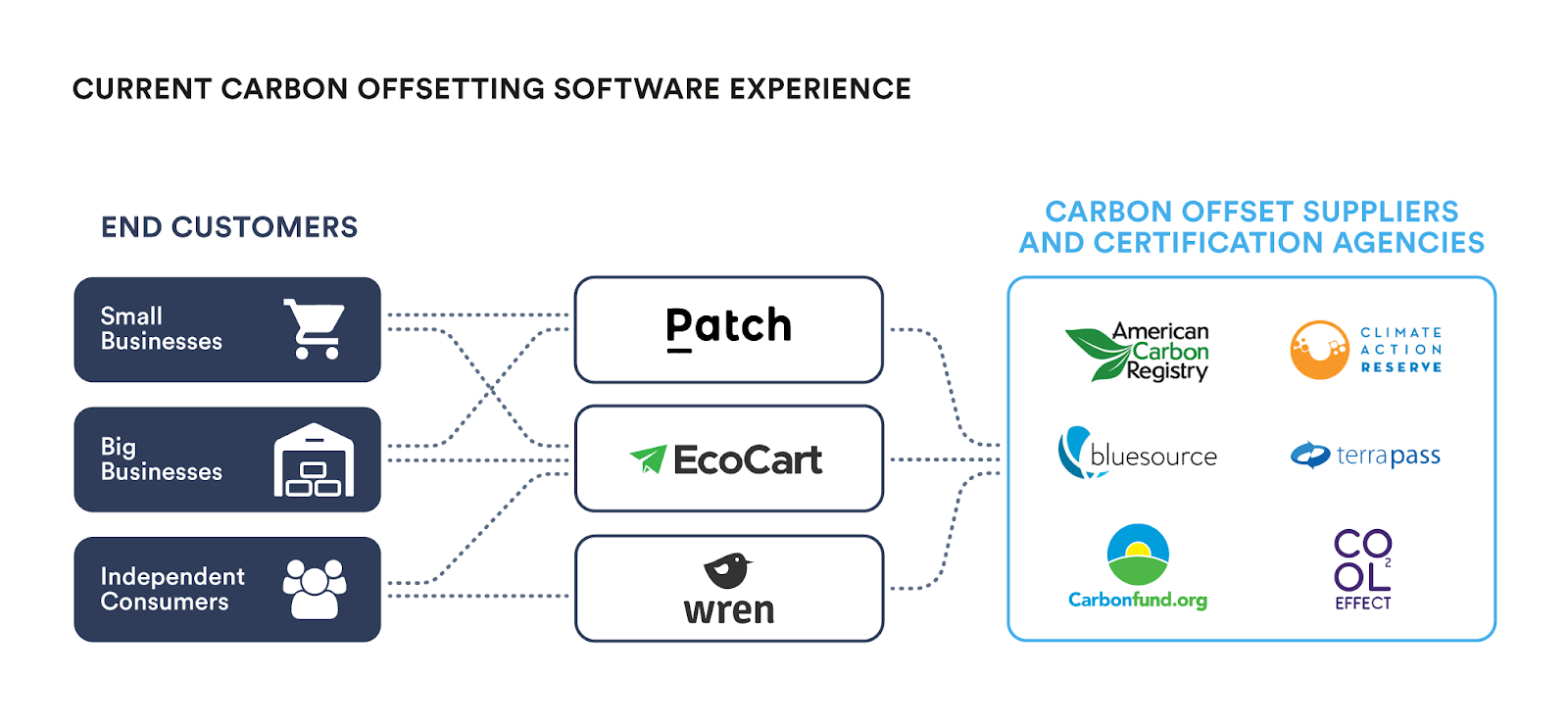

This infrastructure is where we’re seeing batches of smart entrepreneurs and smart investments. There’s demand from both B2B and B2C angles, which presents a few different distribution channels for startups in the space.

Companies that are taking a direct-to-consumer approach to carbon offsets include Wren and Joro, backed by Union Square Ventures and Sequoia respectively. These tools primarily provide guidance to consumers to build goodwill and help users feel that they are taking personal responsibility for their carbon footprints. Joro specifically connects to users’ bank accounts and provides suggestions based on the user’s behavior to make lifestyle modifications that will lower their carbon footprint. Wren helps users calculate their unique carbon footprint and offers users to pay for offsets directly based on this footprint. For around $25 per month, Wren makes offsets incredibly accessible to individuals, something that was usually only possible for businesses. The consumer demand for these solutions is high, but they do nudge users to change their behavior (sometimes meaningfully)—and that can be quite a challenge.

On the B2B side, we’re seeing carbon offsets get embedded more seamlessly into everyday activities like swiping a credit card or making an order online. Stripe recently announced Stripe Climate, which gives Stripe customers the ability to divert 1% of their revenue that flows through Stripe’s payment gateway to carbon offsetting. We’re also seeing startups building carbon offsetting directly into checkout for e-commerce stores so customers can opt to negate the carbon emissions of their online orders.

This approach is particularly powerful because it exposes consumers to their carbon footprint and drives awareness of solutions. Taking Jennifer’s online store as an example, her team could leverage EcoCart and add a checkbox on their e-commerce website to (1) calculate the carbon emissions of their users’ unique orders and then (2) offset that impact for a small fee. With a tool like EcoCart, Jennifer’s brand can educate its customers on the environmental impact of their order but also give them an immediate solution to this problem, thereby aligning the company with sustainability and communicating that dedication to the environment to its customers.

Solutions like EcoCart are compelling because they don’t require a ton of upfront investment from the company. While bigger companies like Stripe and Shopify have the internal resources to hire teams to accomplish their sustainability goals, getting from 0 to 1 when it comes to environmental initiatives is a huge investment for most brands. For brands that do want to build their climate solutions in-house, companies like Patch are developing APIs to build an infrastructure layer into the carbon offsetting market. Developers can leverage these APIs to build carbon offsetting into their e-commerce, travel, and transportation businesses. This technology would make sense for Jennifer if she wanted to hire a dedicated team to build her company’s carbon offsetting mechanism from the ground up, but if she’s overwhelmed by the decision making alone, a plug-and-play solution like EcoCart could potentially be more appealing.

We see significant opportunities for third-party companies to help brands bundle sustainability offerings that would look like a combination of what the market currently offers. Given the fact that there are multiple approaches to tackling climate change, climate-conscious consumers are developing their own opinions about what approach makes the most sense to them. If brands can show that their sustainability efforts are multi-faceted, they will be able to build loyalty with a broader customer base.

Climate’s increasing importance and connection to ESG at large

We believe there’s huge potential for startups to go out and build multiple big businesses that are solving climate-related problems for both consumers and companies. Climate is still just a singular piece of a broader effort around companies becoming increasingly aware of their secondary and tertiary operational impact. In addition to environmental impact, social impact and corporate governance are becoming top priorities for businesses of all sizes, and we’ll be exploring the universe of startups building solutions for these in-demand areas in our next article!

Base10 is a San Francisco-based early-stage venture firm investing in Automation for the Real Economy. Founded by Adeyemi Ajao and TJ Nahigian, the firm invests in technology companies that are bringing automation to sectors of the Real Economy, including industrial logistics, consumer logistics, restaurants, financial services, and sales & customer service. Portfolio companies include The Pill Club, Virtual Kitchen Company, Acquire, Popmenu, and others.

Subscribe to Base10: Automation for the Real Economy and get full access to our research into various trends that are automating Real Economy industries, as well as companies that are building solutions to real world problems affecting the 99%.