MicroAngel State of the Fund: April 2021

Hey! Eyal from MicroAngel here. Every now and again, I release free deep dives like these to newsletter subscribers. If you get value from them, consider supporting the newsletter so I can continue sharing the journey and my results along the way. Enjoy! Murphy’s Law and Sturgeon’s Law are two concepts that perfectly describe the month of April 2021. If you’re not familiar with Murphy’s Law, it simply states that anything that can go wrong, will. While things certainly were much less chaotic than in March, the shuffle of life has gotten in the way more often than not, leading to one of the most difficult months I’ve had to deal with in a really long time. Thankfully, I still found time to meet interesting people and keep building the MicroAngel movement. For example, I spoke with Mike Williams about the fund, revenue growth & the future of work.   Current fund lifecycle stage

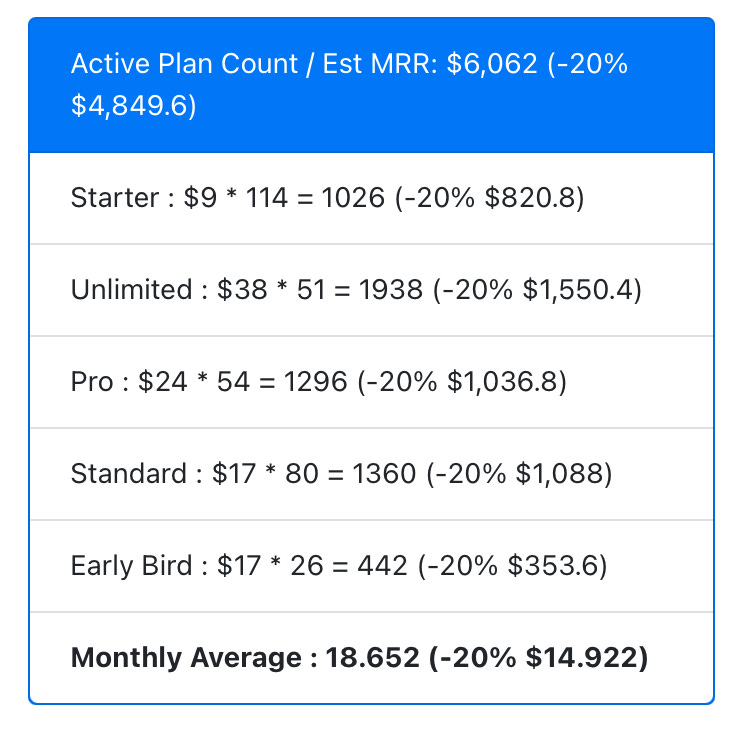

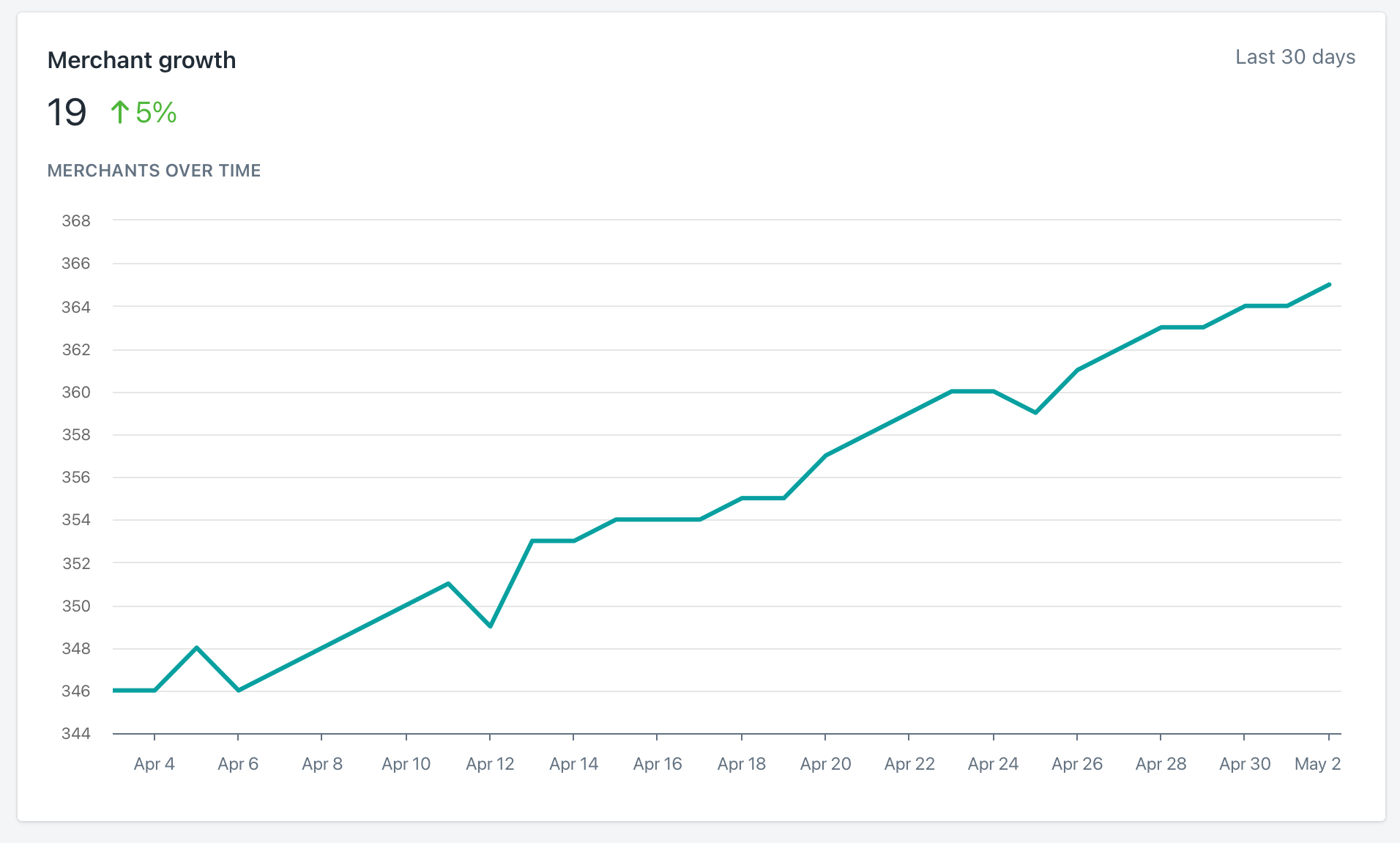

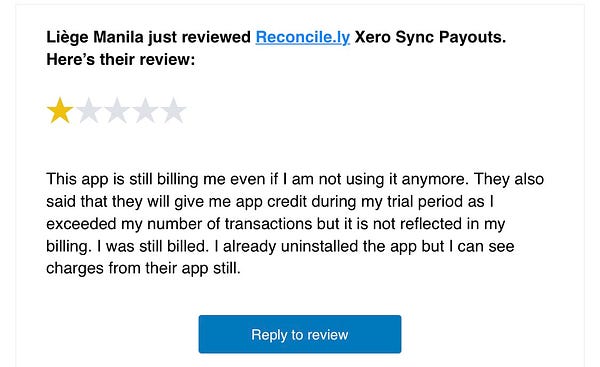

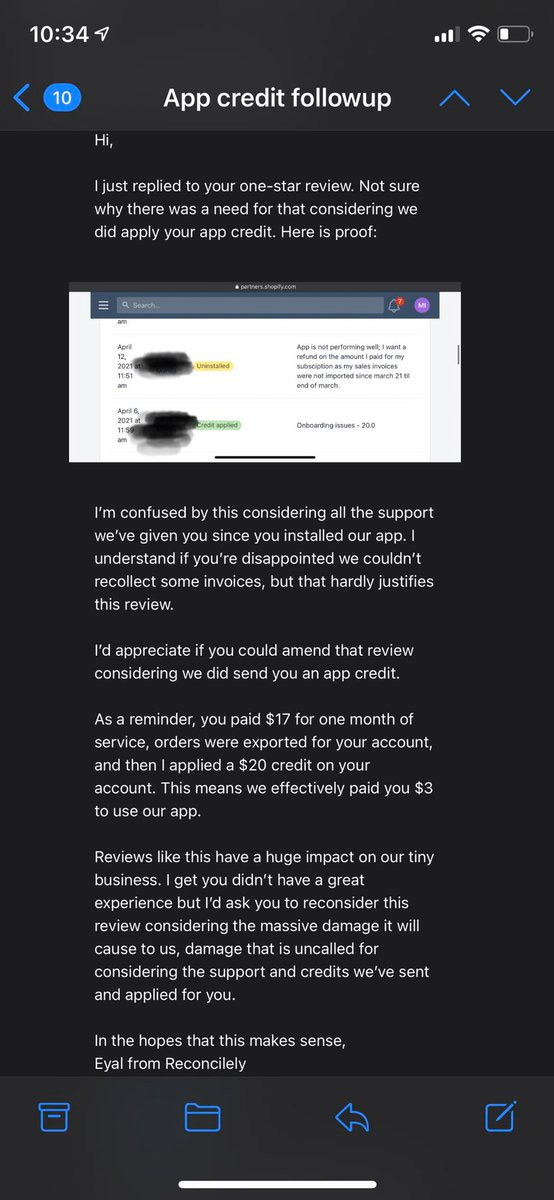

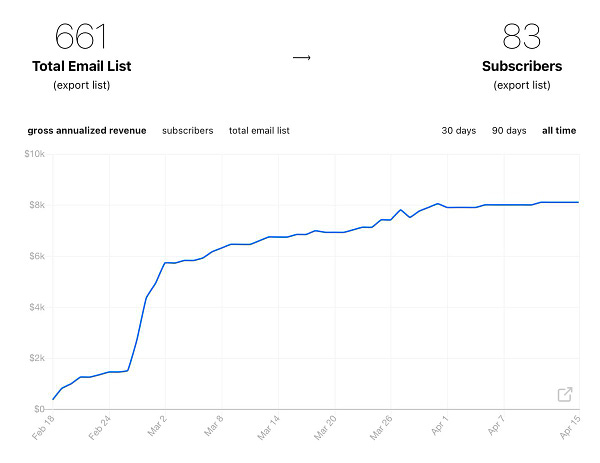

Things got difficult right as the month kicked off as my daughter’s daycare class closed down due to a COVID scare. The poor kid’s been tested 4 times in the past 6 weeks, and spent the majority of the month at home, in quarantine. This has made it challenging to focus given the need to both educate and stimulate my child in their most important waking hours of the day. From playing and physical exercise to drawing, painting and calligraphy. In that time, tax season coming to a close means my (superhuman) wife had to pull several late nights to manage the pace created by the incredible growth her firm has maintained in the past 5 years. Being a couple of self-employed business owners means we regularly tag in and out of the ring as our careers call for it. Despite this, we maintain a constant presence and are actively engaged with our children to help them develop into the amazing beings they are. In this context, keeping up with my schedule has been next to impossible for the majority of the month. It’s been incredibly hard to maintain the pace and respect my process, especially because I closed last month with the ambition to increase my fund activity. I amped up the lead generation on the fund side and had my busiest month yet. I’m not sure why volume swung up that much, to be honest. I did reach out to more people, but the response rate was also much, much higher. One of the benefits of building in public is that people both recognize you and legitimize your words because your actions have followed for some time. People know what to expect and it breaks down several barriers for both parties. Unfortunately, Micro-SaaS products are fatal in their own way and that’s where Sturgeon’s Law came in (90% of everything is shit). Nine-tenths of my leads this month were nonsense, but the good leads I managed to activate are the refutation of that nonsense. As with anything, being out of balance due to being late on my investing means I had to dedicate more time than is healthy to MicroAngel, and the suffering was transferred to Batch this month. Things turned around for Reconcilely this month, though not without its fair share of challenges. Finally, we just signed and are moving to a new home in 7 weeks. I’ll have to juggle that, which mostly means sacrificing my nightly block of focused work to pack my house and get ready for the move. I know what you’re thinking. Holy shit, Eyal, that’s… a lot. It is a lot. But that’s life. Shit happens. Daycare classes close. Tax season happens. You sometimes move. As I look back, I notice that several of my “milestone” life events were cascaded with several other small events that, when put together, created a vast improvement in my quality of life. No pun intended, I like to batch things and front-load as much as possible to materialize my goals. Not many things deserve MVP thinking when you’re thinking about quality of life. It definitely makes things harder because you’re not working with a conveyor belt. The only reason I can manage to do that is because I’m a great multitasker with serious discipline. You want to move fast, but you want things to last and to be significant. I like to plan how things will come together and strike once in a manner that causes all dominos to follow. In the case of the fund, 90 days ago I decided to kickoff so I could spend most of my time doing anything other than freelance. I’m 100% certain that I wouldn’t have survived the past month with a 9-5 job or while sharing my brain with one or many clients. To me, that’s a huge victory in life design and a chip on the shoulder of the fund’s model, the purpose of which is first and foremost to liberate its microangel to optimize for anything other than selling time for money. Portfolio ActivityReconcile.lyAt the beginning of the month, Reconcile.ly lost a sizeable chunk of its MRR to a churning agency. While I reported that loss in last month’s report, it really had its effect this month. Fortunately, things have turned around on that front, with $300 MRR of growth for the product and making up the majority of that loss, and a little more, ending April with +$150 in net MRR to $4,850. I’m very happy to see demand generation accelerating slightly as a result of adding several five star reviews, a direct consequence of focusing on customer support and success. I usually expect 20-25 new customers per month to produce the +$300 of MRR growth required of Reconcilely. Though it is at least one month late on its growth curve due to last month’s churn event, I’m very satisfied to see that growth maintained despite not making any significant changes to the app or its listing. Speaking of reviews, I ended April with my first ever one-star review on the app store. The customer alleged that the application continued to bill them despite having uninstalled it. As they signed on to a trial, the user encountered a bug that prevented them from collecting the invoice for a single transaction. Despite this, more than 400 transactions had been exported on their behalf to Xero. The customer reached out over Live Chat 5 times in the month, consuming support resources to justify an eventual success onboarding and using the product. Due to the issues they encountered, I provided a one-time $20 application credit as a token of good faith to a customer who had just spent $17 for one month of service. I effectively paid them! Despite the support, app credits and value they received from the app, they submitted a one-star review to the app store, which would have a sudden and dramatic impact on the app’s rankings, and thus, its ability to produce installs every month. This is an example of how customer support can be a competitive advantage. I had built up so much good faith with the customer than leaving a review like this made next to no sense. I immediately got in touch with the customer to provide proof of app credit and a guarantee that we would not be charging them any further, as the Shopify API simply doesn’t allow apps to charge customers after they’ve uninstalled. It related news, it may be time to start experimenting with Reconcilely’s pricing a little bit. Over the past 30 days, the app processed over 1,200 one-time usage charges to customers processing orders beyond their account limits. But, laughably, it only produced about $32 of revenue in doing so. You’re not going to get far billing surcharges at a rate of $0.03 per. That’s not even nickel and diming, which would produce 2x-3x more value. Something that’s interesting is that I can attempt to cancel out some of the natural churn through the surcharges. If I can produce $300 per month of one-time revenue, that would cancel out the churn and pretty much double Reconcilely’s run-rate BatchAs it relates to Batch, my cofounder and I made the decision not to invest or raise any funds whatsoever for the next while. While Februargproved the massive promise behind Batch, it is clear we are still pre-market/product fit as of April 2021. At the current rate, the quality of most of the installs coming into Batch is simply too low to produce positive revenue growth and our ranking isn’t growing due to that lack of customer success. That, in turn, means we don’t get accelerating install velocity, which means the faucet is still only trickling water, and that water is not drinkable or usable in any way. Sturgeon’s Law rearing its head here too, where 90% of installs are not qualified leads whatsoever. More than 70% of Batch uninstalls are involuntary, that is, a result of stores closing, stores being suspended and/or Shopify trials ending prematurely. That’s fundamentally good for Batch retention, but ultimately bad in absolute terms — we don’t get good users signing up from the App Store and nothing is going to change unless our rankings magically do. I don’t think we can effect a change there without pivoting the messaging to a totally new use case that does have search demand, and mangling the value proposition in the process, on top of having to change the product to appropriately respond to that new customer. On the recruiting side, I conducted a few interviews with potential hires intended to execute against market/product fit experiments.. I’m taking things quite slow here as a result of optimizing for few but good hires who fit into the culture my cofounder and myself want out of our bootstrapping. I’m scouting a sales leader for Batch who can has ground-floor pedigree in SaaS and can build, execute and manage a full-stack sales process and team. So far, I’ve mostly done very manual outreach via LinkedIn and such to get a feel for the sales pitch, demo and messaging. I’m producing a 100% closing rate on every demo I’ve given this month for Batch, and have finally identified 3 customer segments to focus on to rapidly build ARR/valuation and create a stronger basis for investing into the product and team. It will make more sense to bring on friends to invest once we have a repeatable process to acquire installs and customers that have a very high affinity to the product and value proposition. In the meantime, I’ve started making micro-investments into specific market/product fit experiments, and the results of those will either excite me to raise or push me to sell/fold. Frustratingly, I’m acutely aware that I’m not putting enough energy into Batch and it’s making me feel like I’m failing what is otherwise a winning concept. We’ve failed to find the time to invest in our product at the same pace as the previous month, creating gaps in our momentum and decreasing our learning velocity. I’m jittery at the idea of spending the majority of my days building the systems that Batch needs to build demand for itself. But I’ve also become more sensitive to the Shopify ecosystem as a whole. Reviews are a truly double-edged sword, and the stack involved in operating a sales channel creates complexities that severely affect operations for a lean, two-man team. Somewhere down the line, I realized we’re playing the game on Ultra Hard difficulty, and often find myself wondering if we’d be better building a portfolio of small, simple products, much in the same style of my MicroAngel investments. In doing so, our speed to market would increase, as would our total exposure to the many micro-niches and use cases on the app store. The Pareto principle would produce 80% of our output from one of the portfolio’s apps, which we would discover over the course of sequentially releasing apps over time. PartnerCRMWe didn’t work on PartnerCRM at all this past month. It’s proof we need to open source it, but even doing that would be a cost we don’t want to incur right now with Batch barely getting enough attention already as it is. I’ll have to find the time to package that up sooner than later and send out a message to users letting them know we’d love for them to clone the app and submit PRs so everyone can start working on the platform at their own pace. Naturally, we’ll keep hosting it for anyone who wants to run off of the official servers and/or doesn’t want to manage their own installation themselves. It will run the most recent version of the app as enabled by open sourcing it. I’d prefer to see the project thrive on open grounds for a time rather than petrify. The only time we’ll contribute to this CRM is when we have a need for new functionality out of our CRM. That’s far too ad hoc for a population of developers with a searing pain to better manage their customers. If you’re a Shopify app developer and would like to contribute to PartnerCRM, please get in touch. I’ll try to onboard one by one for now so things can at least kickoff. Fund Activity

Headlines

Current Deal Flow

Reconcilely’s starting MRR was $4,679 and it is currently sitting at $4,858, an MRR delta of $179. Assuming a 4x selling multiple, I can annualize the MRR to $2,148 and assume a net valuation increase of $8,592 on that basis. With Reconcilely sitting at $58,296 ARR, and on the basis of the paper return I can perceive from selling Reconcilely to the right buyer via the right brokerage, its current valuation assuming a 4x selling multiple is $233k, an awesome 57% paper increase over my cash investment so far invested into Reconcilely. Over the past 90 days, I’ve also collected $14,845 in net income from the portfolio, representing a 10% cumulative cash-on-cash return, which, added to the valuation increase leads to a total app return of 67% so far, if I choose to exit right away. I have plans to list Reconcilely for sale this month to test the waters privately and see what kind of buyers are currently interested. Much in the same way I’ve seen this month, my expectation is to verify what the multiples are currently like, and whether I should seriously consider short-term projects as a legitimate source of returns for the fund moving forward. This logic is impaired by the reality that this month provided fewer qualified opportunities than expected, by a factor of at least 4. The number of people I spoke to quadrupled, but good opportunities did not follow that pace. A short-term approach doesn’t work if lead flow is not consistent. It isn’t clear yet whether this is the ebb and flow of SaaS microacquisitions. I wouldn’t even call it seasonality because there is no repeatability to the inventory being listed on any given month. It is fully reliant on what kind of outreach you perform added to the new inventory provided by marketplaces such as MicroAcquire. Over the course of the month’s activities, folks I met 3 months ago got back in touch about a project they want to sell. It gave credibility to the process I’ve created by which I can continue to track various opportunities in time and maintain a sense of momentum with regards to the product’s progress. Fortunately, the total output of my investor efforts were positive, as I’m now in talks with 5 products, each with unique attributes and possibilities. So… for obvious reasons, I’m spending most of my time doing analysis right now. I know many of the folks I’m in talks with right now read my newsletter. If you’re one of those, thanks so much for the opportunity to study your business and figure out if it’s the right fit for me as both an operator and investor! In the end, what matters is that I did not complete an acquisition in April. Despite all of the great opportunities that I was able to analyze, I could not get excited enough about any one of them to pull the trigger so far. The good news is that the current deals I’m studying show a lot of promise, to the point where I’m considering moving forward on more than one. Two of the deals I’m considering are quite large, with a possibility of requiring additional capital I may find myself adding into the fund for the sole purpose to make the deals happen. I’m supposed to stick to $500k, but if the deals are that good, I may allow myself up to 50% more margin provided the fundamentals are sound, and everything else makes sense. While I don’t want to limit myself arbitrarily, I am cognizant of the fact I have to stay within the specs of my fund experiment, otherwise it becomes invalidated if I change variables on the fly. The majority of the fund’s activity happened towards the tail-end, as I’ve fielded a few NDAs and LOIs so far, and am deep in pre-due diligence analysis. Mostly quantitative stuff making sense of the numbers I’ll be using should I choose to move forward. I’ve sent a butt-load of NDAs this month, this time leading with that action as my opening statement to outreach and marketplace deals. I found that approach to be surprisingly effective at breaking down trust or credibility issues borne from reaching out to someone with a direct offer to buy their business all-cash. When your opening statement includes a PandaDoc link to sign an NDA, it seems to communicate that you are a serious, direct, time-constrained buyer who wants to cut to the chase and have a real conversation. Ended up signing and submitting 4 letters of intent, but quickly disqualified 3 of those deals on the basis of the revenues or churn numbers being completely different than what had been reported. I’m nearing a decision on an existing LOI so I can focus on the other 5 deals that require analysis, scoring and a binary decision. Mostly finished doing meets and greets with the sellers and am focused on deciding what to focus on. Without getting too much into detail, of the 5 active deals I’m noticing a love triangle forming between 3 of them, and I need to figure out what the relationship is and how I might be impacted by either decision. Basically, I could field a large portion of my cash into 1 of the deals in return for larger total potential, and reasonable MRR. Unfortunately, that deal is trading at a really, really high multiple, and it might create an issue downstream when I try to sell it. I won’t benefit from any immediate returns for sure. A core feature of the fund thesis is buying at low multiples to guarantee paper returns and reduce ARR reliance for strong returns. The reason I’d want to buy that deal is because it is effectively a runaway success in the making, with a few quirks and inefficiencies that may or may not be impeding future growth (i.e. 20% monthly revenue churn is simply too much pressure, any way you slice it). The other 2 deals form an interesting relationship. They’re not Shopify apps, so they may be disqualified solely on that basis, but they’re available at very reasonable multiples, and both throw off nearly $20k in MRR between them, which, additional to Reconcilely’s MRR, may produce cash-on-cash returns that make up for any ARR gaps I fail to solve over time. Basically, the cash-on-cash return mixed with the low buying multiple might make it worth it to buy those products despite them being outside of my fund’s focus and/or not having as strong of a revenue growth rate as other opportunities at higher multiples. But, well, that’s the trade-off. The reason you’d buy at lower multiples is because the growth rate is lower. But the total MRR might still be significant enough to justify that decision regardless. This is similar to a real estate investor picking a cash-cow C property or a high-potential B property. Apples & oranges, really. There’s more to analyzing this situation than numbers. I’m qualitatively trying to decide if and how these are products I can operate, improve and grow within the same confines of a Shopify app. I don’t like the idea of having a split-stack, but I do like the idea of having more of my MRR coming directly from Stripe without giving up 20% to Shopify, especially if the MRR growth is in direct result of inbound lead generation via organic (i.e. SEO benefits). If a pure SaaS (outside of Shopify) is growing organically from their SERP rankings much in the same way a Shopify app might as a result of their app store ranking, then those properties cancel each other out and I have to base my decision on some other characteristics. The situation on the Shopify App Store is that new incumbents have an extreme difficulty reaching the threshold required to compete, and the trough of sorrow in between is difficult to justify considering 20% of the income you work hard to build evaporates monthly as Shopify Partner fees. In the end, the basic rule is that maybe = no. If I can’t consolidate my decision to operate these products, then I shouldn’t bother investing in them in the first place regardless of the numbers. There is such a thing as idea/buyer fit, after all. The future of building in publicI’ve found myself exploring this idea quite a bit over the past few weeks, wondering where we go from here and beyond. Where does the indie hacking go from here? There is only so much decentralization to go around, and survivorship bias will increase with the number of new indie hackers entering the fray. If you don’t have a nest egg to pull from while you kickoff your project, how else can you finance it without raising money? Worse, how many years will you waste slugging it out in a 9-5 before finally finding the courage and resources to make the leap? As I see it, bootstrappers are happy to “raise” funds if they can maintain 100% of their control and equity. Generally, that means debt but I wonder if there’s space for a new asset class that can be more flexible. Something that looks and smells a lot like P2P Pipe.com. I’m starting to sketch some concepts for an MVP that could fundamentally change the way indie hackers fund their projects. Not quite sure yet what it’s going to do, but I’m pretty clear on the mission I have for it: let indie hackers sell any amount of their ARR at whatever multiple they want, and enable real-time MRR trading between title holders and prospective investors. Basically, I’m thinking about an asset class that would remove the need to operate a fund like MicroAngel altogether. What if I could just buy a piece of MRR from several companies I strongly believe in without the complexities of equity or loans? Yeah, that’d be pretty cool. Learnings and adjustmentsThere’s not much to do other than keep on keeping on. Showing up every day is how momentum is created and maintained. One thing I’ll say is I’m really looking forward to the pandemic ending so things can be little less chaotic at home. As my environment at home becomes more cluttered by the moving preparations, my ability to focus suffers from it. It’s important I solve this if I expect to keep working from home, otherwise I’ll make use of the WeWork membership I’ve yet to activate. I’d rather not waste hours of the day commuting though. Revenue at Batch cratered as a consequence of our best customers being completely out of stock. The product worked too well too fast and there’s nothing left to sell. That’s hilarious in its own right, but really drives home how critical it is to move on from Buying so I can dedicate all of my focus hours and brainpower to my portfolio. I really can’t wait to be heads down on my stuff, but I can’t skip steps and must continue to stay consistent with my process with the confidence I’ll produce a strong deal that rivals or outperforms Reconcilely. I’m staring down the barrel of the fact I’m unlikely to finalize my buying on-schedule. Not too bothered by that, but there are some potential consequences:

We’ll see how May develops as I consider listing Reconcilely for sale and testing the market, while focusing on the open deal flow I have an opportunity to take action against. By the way, I’d like to thank you for joining me so far on this journey. The support you deploy motivates me to this day.   Until next time!¹ 1 Thanks to the following Newsletter Sponsors for their support: MicroAcquire, Arni Westh, John Speed & the many other silent sponsors You’re on the free list for Micro Angel. If you get value from what you read, consider supporting the newsletter. |

Older messages

The math behind Micro-SaaS exits & guaranteed micro-angel returns

Tuesday, April 27, 2021

How to arbitrage micro-acquisition valuations for instant ROI

(Part 2) Lean micro-acquisitions from first-touch to close & asset transfer

Monday, April 19, 2021

Computing cash-on-cash, compiling research into an offer, financing options, LOI submissions & closing the deal

MicroAngel State of the Fund: March 2021

Sunday, April 11, 2021

Bootstrapping Batch, Reconcile.ly + tax season, jittery sellers, and more. Closing MRR: $4.7k / $15k (31% to goal)

Buy, Renovate, Rent, Refinance, Repeat: Micro-SaaS Edition

Wednesday, March 31, 2021

A spin on today's proven real estate investor playbook

Structuring micro-acquisition deals creatively for maximum cash flow & IRR

Wednesday, March 31, 2021

"We're starting a SPAC." —Thomas Edison

You Might Also Like

Making Wayves

Tuesday, March 4, 2025

+ Girls just wanna have funding; e-bike turf war View in browser Powered by ViennaUP Author-Martin by Martin Coulter Good morning there, Since 2021, VC firm Future Planet Capital (FPC) has secured more

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏