Hey, it’s Eyal 👋 You’re reading a free preview of my latest post on the MicroAngel newsletter. If you’d like to access the full post and the rest of the archive, consider subscribing and supporting the newsletter. It’d be great to have you!

It’s relatively straightforward to identify whether a deal is qualitatively good because you have already have clarity on what kind of products you are looking for.

Quantifying whether a deal is worth investing into is a totally different exercise that is much more science than it is art.

Because I have a clear fund goal to return 2.7x over 2 years, one of the easiest ways to ensure its success is by computing what my returns must be from each deal so that my aggregate return works.

Consider a given opportunity expected to produce a 2.2x multiple on invested capital (MOIC) over 2 years on the basis of its EOY2 ARR, additionally delivering “only” 56% cash-on-cash (vs the required 70%) over the 2 years.

I may be willing to forego the MRR gap knowing the product is going to be worth much more, and that I’ll make it up at exit, later on.

This is a computation, so you need to build a calculator for yourself that helps quantify whether a given investment scenario is going to produce the expected goals you’ve set to accomplish.

Once you have a general idea of what your offer range is, the next thing you want to figure out is how to execute the transaction.

This means the other side of that coin is the method by which you intend to complete your transaction, and the second-order consequences you’ll incur from using such financing mechanisms.

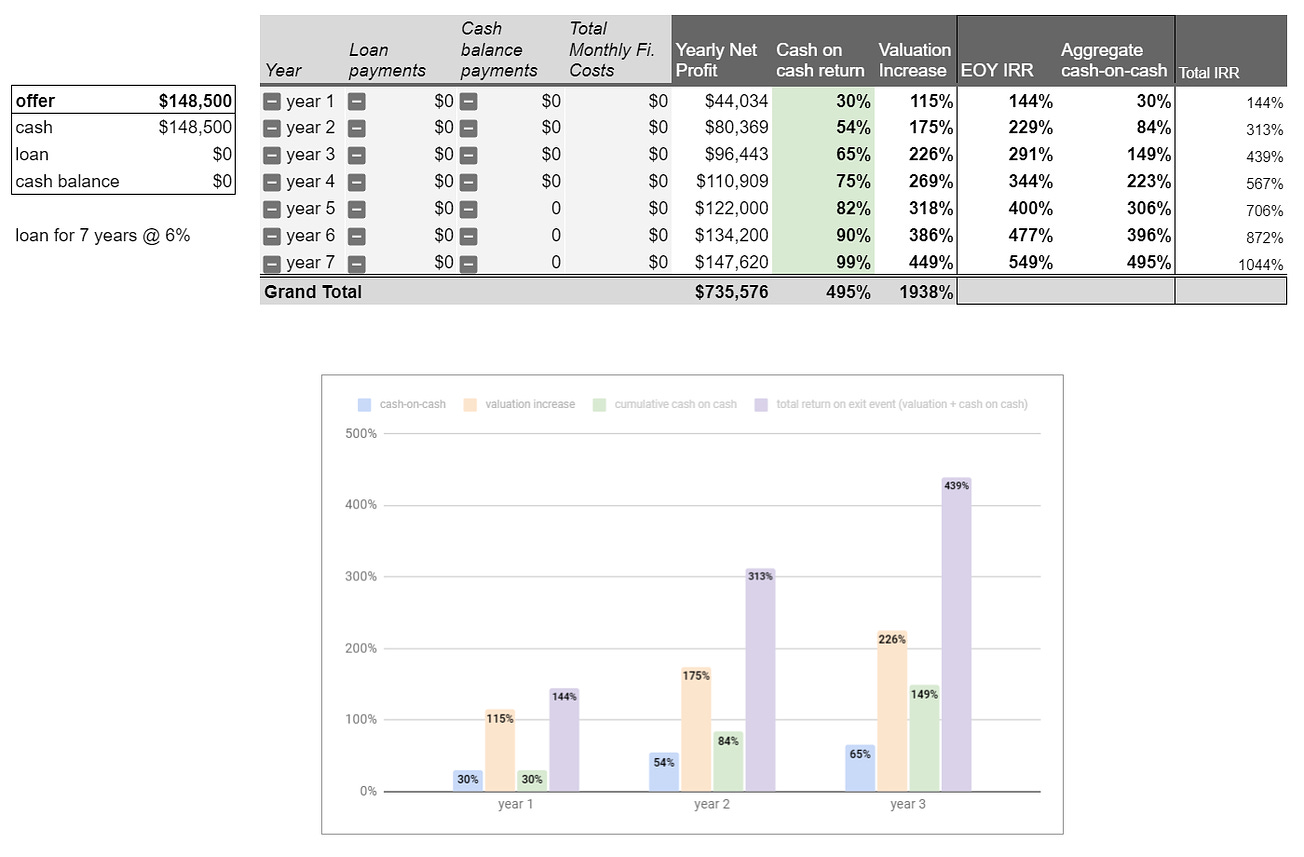

It’s building scenarios to know how each one works out, so you need some inputs relative to your offer, unit economics and financing mechanisms so you can quantify your year-on-year returns.

Where part 1 of the process is concerned with finding opportunities, part 2 aims to close deals with a high confidence of success both from a transactional perspective but also to increase the rate of return on invested cash.

Build a pro forma of the acquisition terms and determine possible financing scenarios based on my available capital

Now that you know the expected earnings of the product you’re analyzing and your general offer range, you can begin to orchestrate various combinations to finance the acquisition in a way that creates the highest return for your effort.

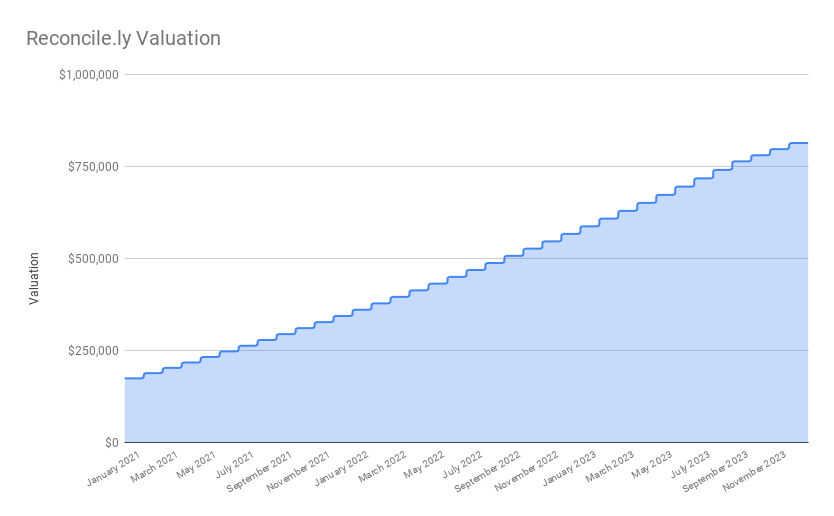

The valuation of the product will be driven by its ARR.

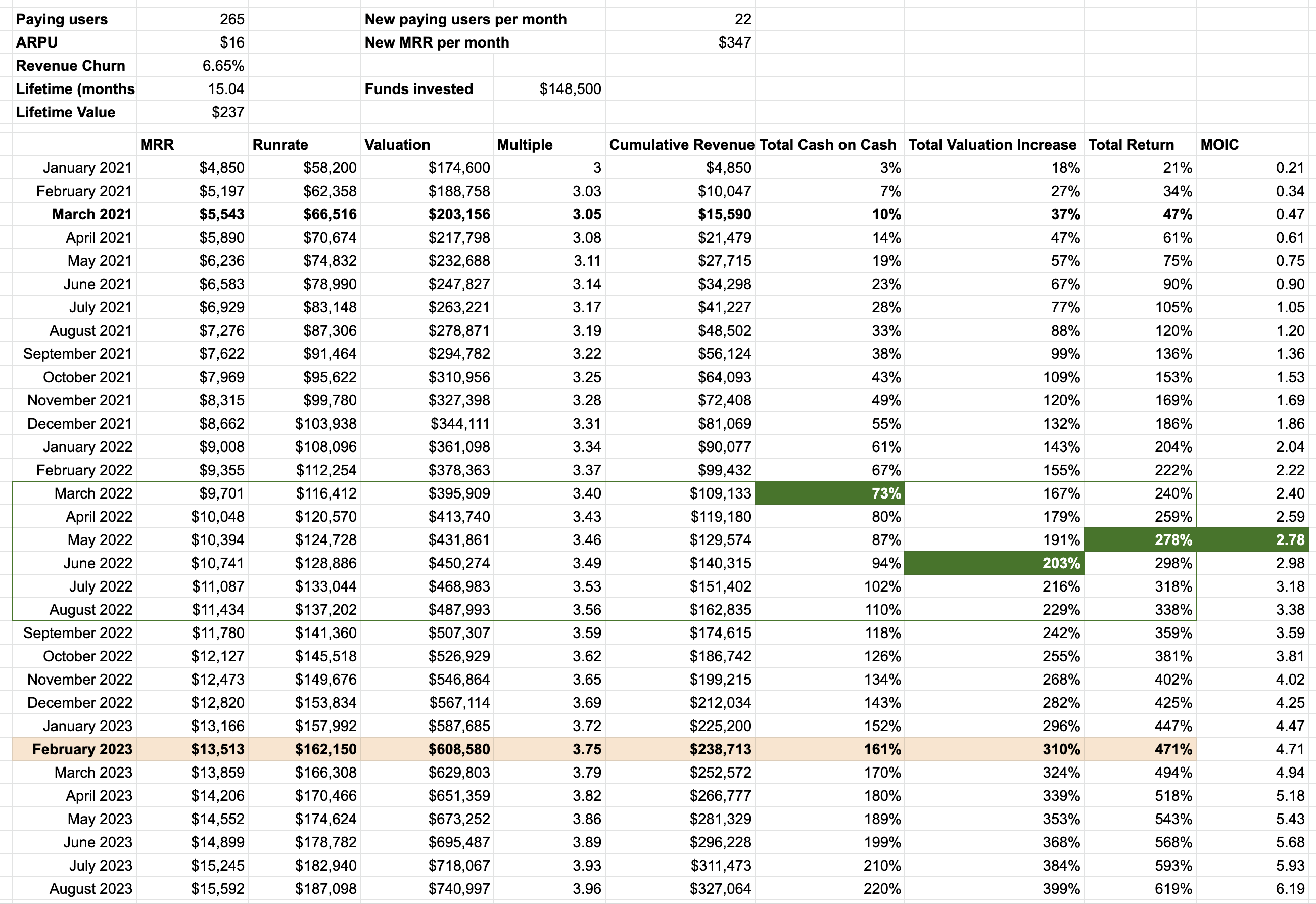

You can create a pretty standard spreadsheet whereby the main inputs are unit economics, the current EBIT and your expected offer range which would have already been established by now.

Because I’m aiming for all-cash transactions, that’s where I start. My sheet supports cash balances and loans, but I can set those to 0 and assume I’ll pay the whole thing all-cash.

This sheet outputs the expected 3-7 year performance assuming the current revenue growth rate, which I will also have quantified by now.

I can then discount costs and taxes and get a general idea of what my cash-on-cash returns will be on any given year.

Because I can realistically chart the ARR growth, I can also derive a valuation for the assets on that basis, typically applying multiples that follow my own benchmarks as a buyer.

Enjoying the post? I created a 1-day pass to let you read the rest and get full access to the newsletter archive.

Thanks for supporting the newsletter!