Margins - Grift is Good

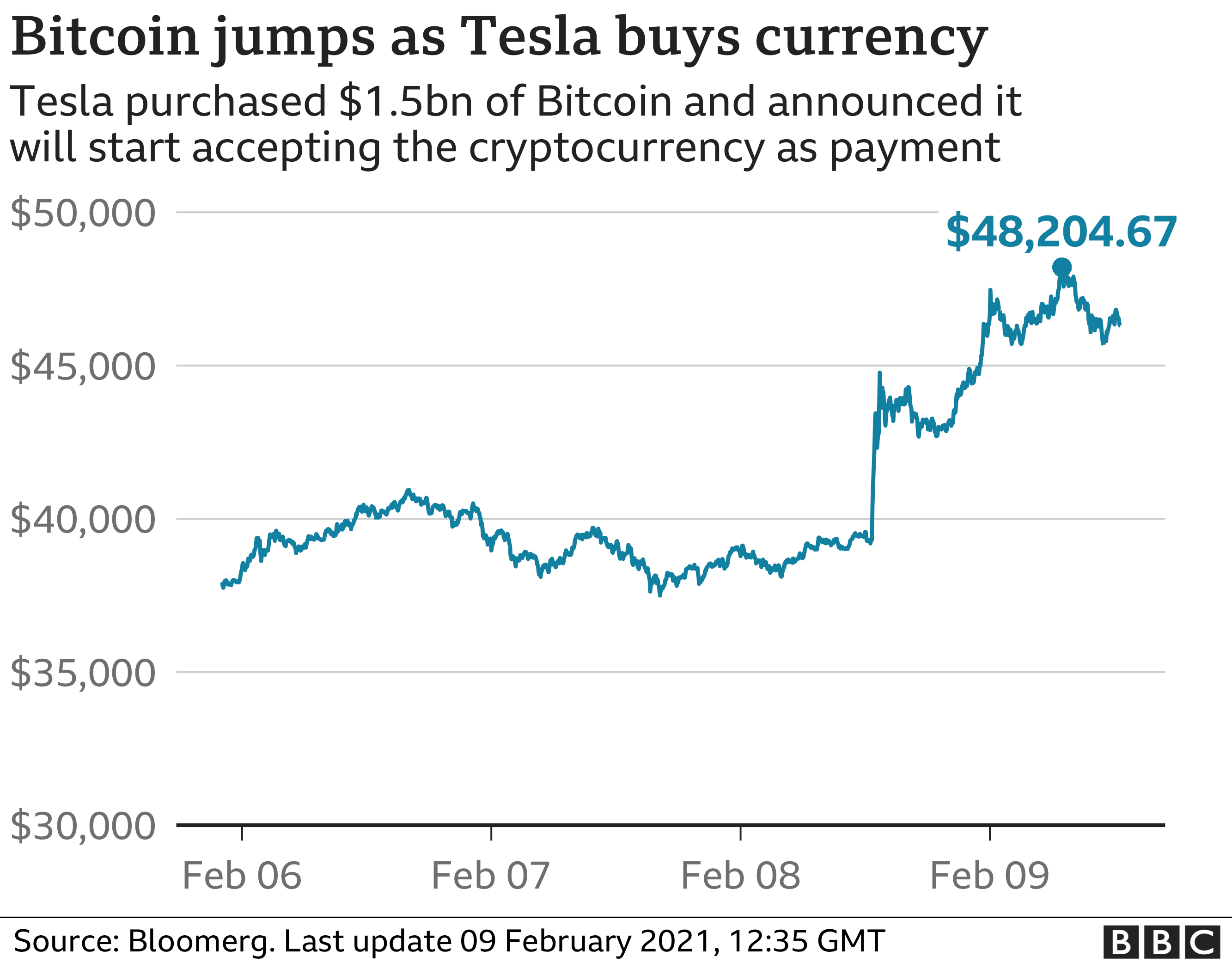

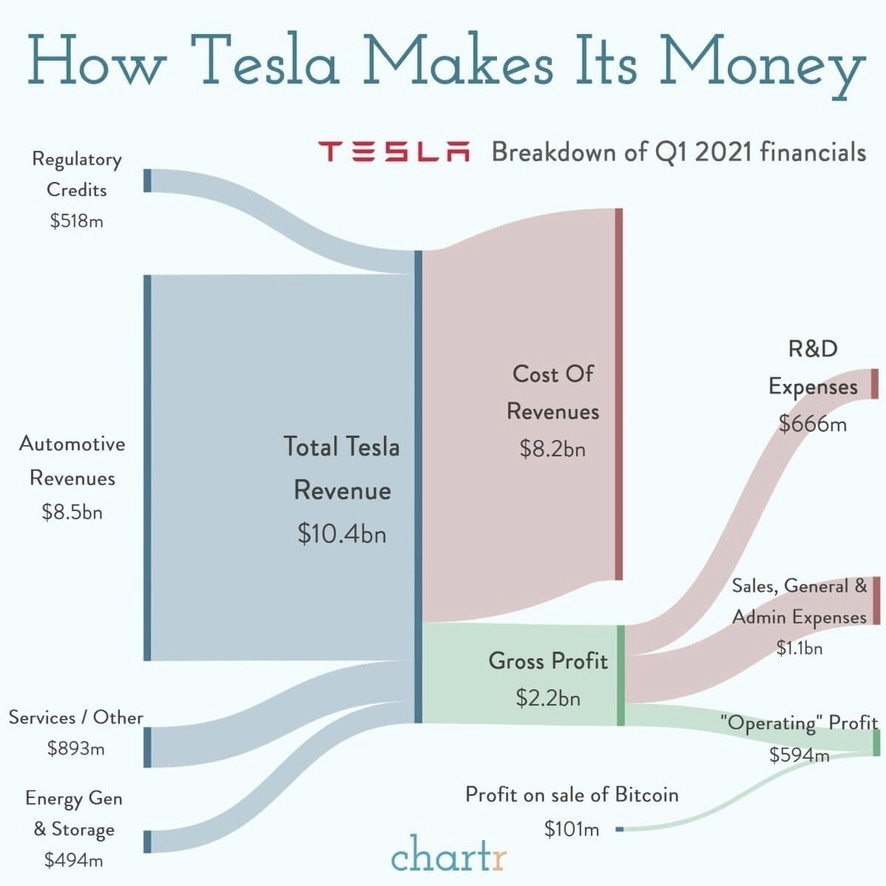

Hi! Can here, after a long hiatus. I’m going to pretend my absence from writing was more precipitated by having a mild breakdown over realizing i’m a Content Creator, but in reality, I had been busy starting a company. More on that later, but today, we talk about….grifts. If the battle chant of the 90s was “Greed is Good”, the animating phrase for the 2020s has to be “Grift is Better”. While Gordon Gekko’s defining trait was never satisfied with what he had, the grifters of our generation make their mark by being utterly shameless about what they are up to. It’s not enough to earn more, you have to do it while leaving any shred of dignity you might have at the door.  I mean, I joke, but not really. Having been immersed primarily in Starting Something New the past few months, and trying to do it with both ambition and integrity, it’s been somewhat confusing, and maybe even disheartening a bit, to see many grifters grift so well. It made me wonder (and not going to lie here) if I had been leaving something on the table by not running my own grift. I even jotted down some ideas, but then I realized I am actually not a sociopath and tweeted some risqué jokes instead. But seriously, what is a modern grift? There are a couple of qualities that are common to all modern grifts. First of all, most of these grifts are enabled by a high-profile media personality who is good at content. Second, the grifts have to straddle a fine line where they are shamelessly unethical, but always one plausible deniability away from being extremely illegal. The third and the most important quality is that the main perpetrator of the grift has to be wildly shameless about their actions. A true modern grift is not run behind closed doors. Instead, you do it fully out in the open, screaming about it from the mountaintops. While greed is about focus, grift is about shamelessness. With greed, the game is to find the path between the rules with the most profit. Grift, on the other hand, ignores the rules altogether, armed with the knowledge that with shamelessness comes zero social costs, and with absent enforcement, no real legal risk. Bannon and War Room Defense PackLet’s start with a basic, simple grift like the one-time Seinfeld investor turned racist-in-chief Steve Bannon of the Trump Reich shilling his vitamin supplements. I mean, I am trying real hard to not be mean about this, but it almost feels sad to watch someone go from being the bookish face for fascism (with a penchant for layering?) to succumb to Alex Jones level cheap tricks to monetize their fame. But going back to our rubrics, you’ll see it fits neatly into all the categories. America is a first-world country where you can have commercials on TV for drugs that most people cannot buy themselves. The “let the stupid be stupid” ethos runs deep in this country’s veins so I am not particularly shocked or even bothered that you can essentially claim anything about a food supplement and get away with it as long as you put a disclaimer somewhere in there, but still, this feels icky. You can’t, however, blame Bannon for trying to squeeze out every inch of value from his one-time fame (criteria #1), do it in a legally dubious way (criteria #2), and also being wildly shameless about (criteria #3). If it feels like I’m kind of pushing it with the shamelessness, it’s just because Bannon himself is barely anyone these days. He’s shameless, but he also is a nobody, so those cancel each other out a bit. Tesla and Bitcoin (and Doge)If you want to see someone who is both shameless and extremely high profile running an extremely profitable grift, luckily, you don’t have to look much farther than the top of the Richest People in the World list. I have long tried to never mention crypto on Margins but since that seal was broken a while ago, I do have to bring up Elon Musk and his Bitcoin / Dogecoin thing here. And seriously, I am convinced the world will never see a bigger, more shameless grift than this one ever again. Let’s just briefly go over what happened here: Elon Musk decided, probably after confusing his indica for a sativa, that Tesla, the regulatory credit company that also makes cars for the Chinese market, will be accepting Bitcoin as payments, but also, btw, Tesla now holds a couple billion dollars in Bitcoin. This single piece of news coming from a single person unsurprisingly sent the extremely-decentralized, authoritarianism-busting cryptocurrency that’s mined primarily in China using fossil fuels to the moon. And of course, just a few short weeks later, Tesla offloaded some of those said Bitcoins for a healthy profit, to the tune of 1/7 of their operating profits to be exact. But since we are, as Musk once proclaimed, all living in a stupid simulation and Elon finally realized it’s sativa that’s actually the good stuff, he decided that Bitcoin is bad actually with a tweet, and something something decentralized and Bitcoin lost 20 percent of its value. Look, I am struggling to string together words into legible sentences here. Just like there’s no real person that thinks Bannon deserves his accolades as a wellness warrior, no one who doesn’t put laser eyes in Twitter bio thinks that Elon Musk didn’t know about the environmental horrors of Bitcoin. Or that he could not get away with a pump and dump scheme as blatantly run as this one. I know we are all amused by his antics, and as a car-guy who doesn’t even drive, I have somewhat of a soft spot in my heart for the Model S. But the grift here is so, so obvious and run so transparently that it becomes borderline paralyzing. I do wonder if I am not getting something here?   NFTsIt’s kind of tough to top Elon Musk but since we are talking about cryptocurrencies already, I do want to bring up a personal favorite here: NFTs This is actually a hard one for me to call a grift because I actually like the idea quite a a lot. This NPR podcast does a better job than I could explaining how they work, but for the uninitiated: (do they exist?), the idea behind NFT is to use the decentralized and immutable nature of the Ethereum blockchain to build a record of ownership. The idea, for example, is that an artist could “mint” an NFT of her painting, basically a certificate of ownership with a link to the piece, and sell it for the highest bidder. While this all seems rudimentary, the programmable nature of the Ethereum blockchain could, for example, mean the artist would get paid royalties on all future sales and have all the records always be public, with no effort on their part. I mean, this all sounds nice! In fact, as a software engineer, I am always quite intrigued by the idea of expressing the intricacies of a financial contract in code. And the idea that artists could be paid for all their work even after their work is purchased the first time does sound like a good use of this technology. Again, it’s not the idea that is new, but that you could now do this without having to rub elbows with the right people and do it in a programmatically guaranteed way. That is a good use of the technology. Or at least I thought it was. It only took a few weeks before this idea too got sucked into the world of griftery. Almost immediately, the supposedly deflationary crypto market did what it does best and inflated the prices into the stratosphere. Behind the $69M sale of a JPEG or the $1M sale of a pixel, there were other crypto people who were paying those obscene sums in inflated cryptocurrencies just to hype up the entire crypto market. If you are holding on to millions (in USD) in crypto, what’s a couple hundred thousand to spend on some novel New York Times NFTs to juice some of that sweet sweet Gray Lady traffic? If Elon can move a trillion dollar industry (ugh?) by nothing other than a tweet, it does make sense to try to move smaller markets, such as Ethereum, by co-opting major news publications. Who cares it also legitimatizes what looks more and more like a Ponzi scheme that’s going to make the MBS crisis feel like a bubble wrap when the bubble of our economy pops? Remember, grifts are all about shamelessness. Greed can suck it. And, look, maybe that’s fine. I really want to like NFTs. Any new way to make an honest buck is going to attract some hucksters initially, but it already left a bad taste. Maybe that is why we can’t have nice things. The grift slowly takes over thing all that is good in the universe. And I barely scratched the surface here. Yet, there are still some other notable ones worth a mention and maybe their own eventual Margins pieces. From unending Substack beefs between the usual suspects to opting out of corporate life with a book, to only then complain about the said opting-out to sell more books, grift is as natural and all-encompassing as the air you breathe now. And to be honest, can you even really blame anyone? The markets, ZIRP, the virus, really, whomever seems to have the strongest grip on reality has spoken: grift is good. I’m not even joking here. Unless you are already YOLO-rich are only so many avenues left for so many people to make an honest living anymore, where they can move up the social mobility ladder. The 1980s are over. Greed might have been good, but grift is better. And here’s where I plug my own grift. As I mentioned, I recently started a new company called Felt with my good friend Sam. His previous company Remix, where he was the CEO, was recently acquired by Via. We are keeping our cards close to our chest but we are also hiring, especially talented front-end folks. We offer great benefits including top of the line health care for you and your dependents, generous equity with employee-friendly terms such as early exercise and 10-year purchase windows, and even 401(k) matching. I’m biased, but we really care about our employees. If you are interested in working on ambitious problems and are based in the Bay Area, hit us up and we’ll get the ball rolling. If you liked this post from Margins by Ranjan Roy and Can Duruk, why not share it? |

Older messages

Cathie Wood and Content Strategy

Wednesday, March 24, 2021

Downloadable spreadsheets and media hacking

Bitcoin and Buying Things

Sunday, February 28, 2021

Here's to the risk managers, not the risk takers.

Game. Stop.

Thursday, February 18, 2021

It's not what you think.

Joke Capital

Thursday, February 18, 2021

GameStop Populism and the Desire for Narrative

Who Gets a Slice of Apple’s Pie?

Thursday, February 18, 2021

A Discussion of Tech Platform Antitrust

You Might Also Like

Little Stream Software digest for the week of 2024-12-25

Wednesday, December 25, 2024

Hey there, Here's articles I published over the last week. - Eric Davis Merry Christmas Merry Christmas to you and your family. Hopefully you're able to take some well-deserved time off today

Use AI and protect your data

Wednesday, December 25, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo Next month is Artichoke and Asparagus Month, Reader! Are you a mayonnaise or

A reason to celebrate

Wednesday, December 25, 2024

Whichever way you celebrate the end of the year, my team and I would like to wish you Happy Holidays. Thank you for trusting us to be part of your marketing journey. Let's keep the momentum going

Don’t Write Another Newsletter Until You Read This

Wednesday, December 25, 2024

Why 1/5/10 Changes Everything

How they flipped a domain for $90k (in just 22 days!) 😱

Wednesday, December 25, 2024

You're invited to join in on all the fun! View in browser ClickBank Happy Holidays! TODAY, two of ClickBank's top vendors, Steven Clayton and Aidan Booth, have officially kicked off their 13th

The Gift of Leadership

Wednesday, December 25, 2024

From all of us at The Daily Coach, Happy Holidays!

Hack to define your key activation event

Wednesday, December 25, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

Polymarket, Sora, and The Hallmark Killer

Tuesday, December 24, 2024

What's on the top of my mind today?

ET: December 24th 2024

Tuesday, December 24, 2024

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Perfume Layering (trends) Chart Perfume

10 Steps to Improve The Odds You Get Funded

Tuesday, December 24, 2024

And happy holidays from SaaStr! To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Prismatic 10 Simple Steps to Improve The