Warner Media/Discovery Deal Is the Barbell in Action |

In what seems like a deal that came out of nowhere, AT&T announced that it would be merging its subsidiary, Warner Media, with Discovery, to create a more focused, albeit larger media company. |

The new company will be led by Discovery President and CEO David Zaslav, with a management team and top operational and creative leadership from both companies.

The venture will have a projected 2023 revenue of approximately $52 billion, adjusted EBITDA of approximately $14 billion, and a free cash flow conversion rate of approximately 60%, per a statement. It plans to spend around $20 billion in content, which is more than Netflix currently does.

"We are here today because John and I and our boards are confident that Warner Media and Discovery are better together. We think together, combination makes us one of the best media companies in the world," Zaslav said.

|

I don't know if Zaslav is right that a combination of the two companies makes them better. But I do know one thing: being in the middle of the media barbell is a horrible place to spend your time. |

While there are plenty of narratives tied to this deal (including why, oh why, did AT&T decide to burn tens of billions of dollars), the barbell is an important story. Being a generalist, average-sized media property is a pretty bad outcome. You don't have a true scale that gives you competitive advantages and you also aren't niche enough where you own a particular content focus. |

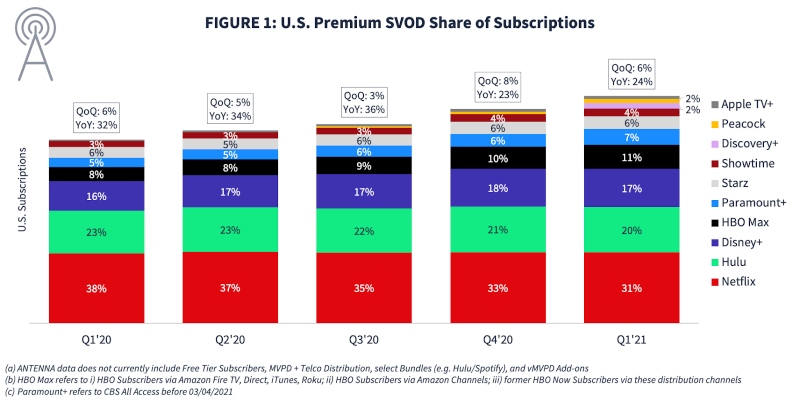

If we look at the below image provided by Antenna, a subscription business analytics company, we can see how this deal leaves the streaming landscape. |

Prior to the deal, HBO Max had 11% of the U.S. SVOD market share with Discovery coming in with a small 2%. Admittedly, Discovery just launched in January, but it was still small. Netflix remains the largest single streamer out there with Disney-owned Hulu and Disney+ taking second and third place respectively. If we assume a merger between the two brands, they'll still be in fourth place at 13%. |

The new transaction will combine HBO, Warner Bros. studios, CNN and several other cable networks with a host of reality-based cable channels from Discovery, including Oprah Winfrey’s OWN, HGTV, the Food Network and Animal Planet.

With such a large menu of cable networks — most of which are highly profitable — the company can build a cash hoard to fuel the newer streaming business, which still loses money and needs time to gain enough customers to become profitable.

|

AT&T had a critical problem. With as much debt as it was carrying, it had enough cash flow to either invest more in its 5G business or more content. Now that it'll be a pure focus media company, the only investment is content. And as Axios reported, the combined entity intends to invest $20 billion per year in content. |

The reality is very simple... if you're going to try and become one of the largest streaming platforms out there, you need to invest a ton of cash. There is no middle ground. You're either small, large, or dying. Warner and Discovery didn't want to die and neither could be classified as small, so a merger ensures they get larger. |

Now let's look at Crunchyroll, for example. Sony is currently trying to buy this from AT&T for just shy of $1.2 billion. Crunchyroll is an example of a small streaming company that is doing rather well. Since 2016, it has grown from 1 million streaming subscribers to over 3 million today with its content focused almost exclusively on anime. Those numbers are not impressive relative to Netflix or Disney+, but they're incredibly impressive at the niche level. Users know what they're getting when they go to Crunchyroll and my suspicion is they stick around because it's the type of content they love. |

If we look at these two examples, it's clear that there's a very specific decision being made. Either the company is going to stay very focused on a certain type of content (this is Crunchyroll) or it's going to try and scale as large as possible. This deal between Warner Media and Discovery is them trying to get as large as possible; take the cash earned from cable and funnel that into the streaming business. |

It's the right strategy. Warner could never go niche because it owned IP in too wide a category. I've watched DC movies, The Sopranos, and a romance limited series all on HBO Max. Where's the niche there? It needed scale and it needed investment to reach it. |

This does present an interesting question. What comes next? Paramount+ is only 7% of the market; Peacock is 2%. Are they future acquisition targets? |

I've staked my career on working in niche media. I like going deep with a specific audience and building a business with them over time. But for media companies operating in generalist topics, either niche-down or scale-up. There are plenty of digital media companies that have tried to scale up that have failed. It's hard. |

Local newsletters are an augment, not a replacement to newspapers |

There's been a lot of talk over the past 6-12 months about how great local newsletters are and that they are a bastion of hope for the local media deserts that exist across the country. I used to believe that too until I had a conversation with the CPO at The Dallas Morning News, Mike Orren. He basically said to me, "this publication, with all its brand, has a far bigger impact than any of these new digital upstarts." |

Maybe that's just him being a newspaperman, but looking at the climate, I can't help but agree. There's no denying that the local media market is struggling, but I haven't found much in the world of replacement yet. |

Ryan Barwick at Marketing Brew published a good piece the other day on 6AM, a local newsletter business that is seeing incredible growth: |

Started in Greenville, SC, 6AM City has quickly expanded to 11 cities like Nashville and Kansas City, and has more than 425,000 subscribers. At least three more cities as far away as Texas are planned for this year.

In 2020, 6AM City posted revenue of $2.4 million and spent $3.5 million. It expects to clear $5 million in revenue in 2021.

Pricing hovers around $11–$12 CPM for national advertisers.

|

But as Barwick explains in the piece by referring to them as the "Thrillist of the Southeast", this doesn't actually replace local news: |

But 6AM City isn’t a replacement for local media. For instance, the newsletter has a policy against covering local politics or crime. That’s not the ambition, said Johnston. “We have no crime and punishment, no politics. We are the marketing engine and the PR platform for the city.”

|

None of this is to say, of course, that this is bad. I think what 6AM is trying to do is smart for its type of business. People want to know what's going on in their local areas and this is a great way to get that information. And clearly, it's working because it is growing at a nice clip. |

Axios is another example of a company with local newsletter ambitions that has people very excited. And looking at the types of stories they publish in their respective communities, it's closer to what you'd expect from a local news publication. However, Axios hardly scratches the surface. Looking at Tampa Bay, for example, there are two reporters covering a geographic area with over 3 million people. |

Again, I think it's an interesting model and I look forward to seeing how it grows over the coming years, but it is an augment, not a replacement, to local newspapers. |

None of this is to say, of course, that local newspapers are any better. They've either been gutted from their hedge fund owners or don't yet realize that someone who is reading a local newspaper wants local stories rather than wire serviced national stories. |

But it does act as a reminder... more and more people in the United States don't have a local news source that is actually providing legitimate reporting. It's unfortunate. While I am very excited to watch these local newsletter media companies grow over the coming years, let's not delude ourselves into believing it replaces what has been lost. We have a long way to go before that happens. |

And now, a piece from Colin Morrison over at Flashes & Flames. |

Will Informa Buy Journal of Commerce? |

As S&P Global and IHSMarkit continue to navigate the regulatory hurdles to their planned $44bn merger, Informa Plc is believed to have resumed negotiations to acquire (or establish a JV with) the $300m-revenue IHS Maritime & Trade portfolio including the Journal of Commerce. It is believed that earlier talks had been interrupted by the S&P merger announcement in December 2020. |

The 194-year-old Journal of Commerce, which was formerly a daily newspaper, is now a twice-monthly magazine and digital service. The IHS Maritime & Trade portfolio also includes Lloyd’s Register of Shipping and the International Maritime Organisation’s ID register of ships. It would be good fit for the Lloyd’s List and Seatrade information and events of Informa Plc. The possibility of merging the Informa and IHSMarkit maritime interests may have first been discussed two years ago when the two companies, respectively, exchanged their Agribusiness and TMT groups in a no-cash deal. |

|

|

|