Micro Angel - MicroAngel State of the Fund: July 2021

Hey! Eyal from MicroAngel here. Every now and again, I release free deep dives like these to newsletter subscribers. If you get value from them, consider supporting the newsletter so I can continue sharing the journey and my results along the way. Enjoy! MicroAngel State of the Fund: July 2021T6M report, newest acquisition, reaching + surpassing Fund I goals & player 2 has joined the game 💸Woohoo! What an amazing month July has been! 🔥 I’ve been super heads down chasing the rabbit down its hole across a variety of initiatives, from rounding out buying to hiring to customer development and customer acquisition. The roller coaster definitely is swinging back upwards and I’ve been feeling the momentum accumulating this month, despite child quarantine and the insanity that it implies. 😅 We’re finally past the most complicated section of the journey in which sharing what I do is a complicated, touchy thing. Woot! First and foremost, I’m happy to say I’ve closed a transaction this month which will meet the fund’s initial MRR goals as well as exceed them, creating an interesting reinvestment opportunity.   Back in February, when I set out to invest for freedom & profits, I set my goal to produce a 2.7x total return on $500k of invested capital.

To pull off the first goal, the idea was to field $500k and collect $15k worth of monthly profits from acquired products to amount up to $360k by February 2023, the scheduled fund maturity date. To secure the roll-up, my goal is to leverage the portfolio producing $15k as of the moment I stop buying and to grow its ARR up to a figure that would represent at least $1m in value (3.5x+). However, considering the fact I invested $75k more than I was supposed to as well as what my MRR 30 days from now likely will be, it makes sense to revisit at least one of these goals. Since I’ll be posting far above $15k MRR next month, I will most likely cap myself to a salary for a little while and redirect the rest of the free cashflows towards a hire who can buy into the partnership and meaningfully accelerate product output so I can focus on growth while being their code Padawan. Because equity into the fund also means monthly dividend distribution, I’m going to effectively cap my dividend, sell some off, and reinvest the rest towards growth. I foresee being able to do this for at least a year without impacting my 2-year cash-on-cash goal. Beyond the fact I can afford it, handing off Tier 1 support is another meaningful way to buy-back some time I’d rather invest into product or growth marketing activities. In parallel, I’ve just closed the books and recorded a 6th consecutive month of healthy returns from MicroAngel Fund 1, which so far has been producing like clockwork provided the health and predictability offered by Reconcile.ly. It’s a month of many milestones at MicroAngel! Really excited to be onboarding someone unique to the team with the kind of grit and scrappiness I’m looking for — someone used to getting their hands dirty while having the intellectual output needed to manage, crunch and solve some of the most interesting challenges ahead of us. Thank you to everyone who’s been sending me leads and referrals, as I’m moving forward with a referral. I literally couldn’t have done this without you all, so thanks so much once again! Current fund lifecycle stage

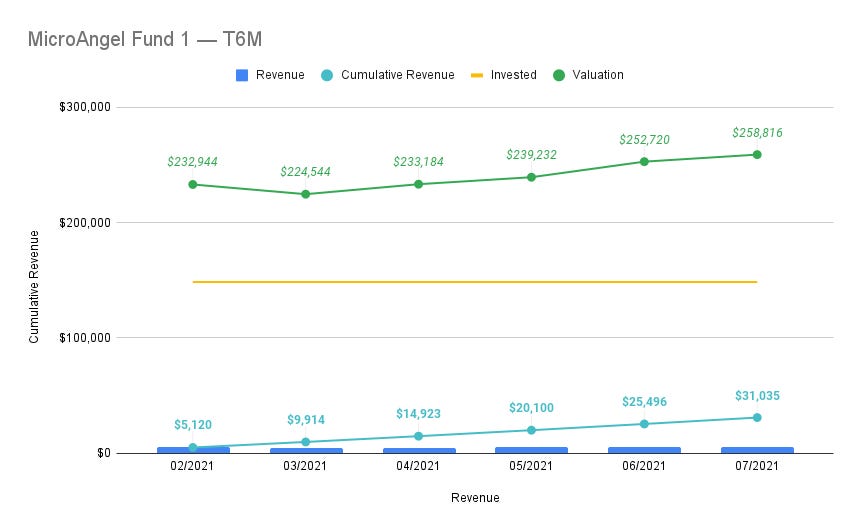

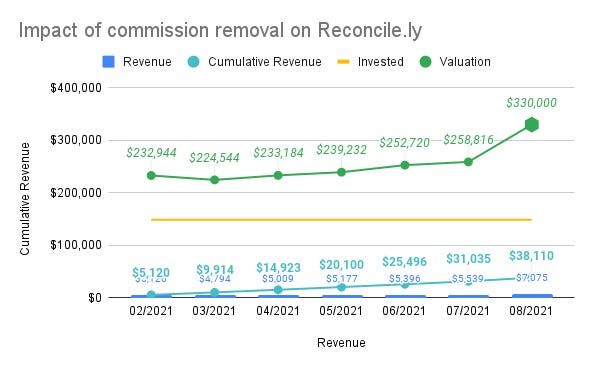

Bouncing back from losing a deal is no easy feat, especially so close to the real starting line, which I’ve put off for nearly 2 months now. Thankfully, the Buying drought is over, and the fund can take advantage of the arriving currents provided by the Shopify App store commission break to sail more quickly towards its MRR goal. It’s fucking workingCash-on-cash returns so far on my invested capital are at 21% in just six months, which is absolute hilarity compared to what real estate investors are jostling to secure. Importantly, unlike most real estate, the value of the product I’ve acquired has steadily grown over the past 6 months. Its modest but steady growth has resulted in revenue run rates now in excess of $65k ARR, up from approximately $58k ARR. In that time, I’ve also optimized some costs, driving up profitability. So… the model definitely works at least at a small scale! Over the course of the month, the product will enjoy an even bigger bonus as commissions for Shopify partners under $1m annually disappear, a benefit I am excited to now enjoy. The impact this will have on the valuation of Reconcilely will be considerable, representing a capital gain of over $70k over the valuation being posted today of $258k and granted a selling multiple of 4x or better. Naturally, there’s still so much fixing and improving to be done for the rate of growth to start accelerating, mostly from increasing customer retention. I certainly feel thankful and blessed by this happy tailwind, considering I’ve also been closing the fund’s second transaction over the last week or two, just in time for the commission change, which will have a large impact on the valuation of that product just the same as it will for Reconcile.ly. At this stage, I can officially move on to Fixing, which is very much in an accelerated timeline so that improvements can kickoff as of next month. I need to be patient though. The training period for the second product will last between 1 to 6 months, which is an important window considering improvements should leverage any and all training and insight offered by the sellers. At this point, we can point to December as the last month for improvement-related activities before really pressing on the accelerator and driving new MRR through value-added features as well as a focus on sales & marketing. I’m going to regroup with MicroAngel’s newest partner to determine what the roadmap should look like, but by and large, we should be done fixing or improving old stuff up by end of December so we can start doing only new stuff moving forward. In the spirit of team output, I’m probably going to migrate any and all product/engineering stuff out of Notion towards Linear, which I’ve been longing to use for the past few months. From there, we’ll set our sights on the current backlog, re-groom it together, and then begin executing. Fund Activity

Headlines

Current Deal FlowDone buying for now and closing up most investing activities for the foreseeable future. Won’t be reporting on this moving forward. I will likely send any and all referrals and inbound requests to other microangels, so if you’re looking for deal flow, don’t hesitate to get in touch so I can keep you on my shortlist. When LP fund?Thanks so much for your interest, which is both humbling but also awesome because it gives credibility to the journey and the act of writing about it. The idea of running an LP fund feels like the natural next step, but I don’t know under what terms and thesis that would be upon and I don’t want the enterprise of figuring that out to consume most of my days. The natural thing to do would be to try and scale the current model, but I don’t see eye-to-eye with many folks when it comes to considering exiting investments at specific time horizons. The reason I want to do that is because the game has changed and we have that level of liquidity now. We can get out anytime, and before we couldn’t. That change in fundamentals means new models are possible, and mine is a demonstration of that being true. I think it’s important to exit out of investments — or at least have the intention to — at specific intervals because the nature of a product and the ecosystem it inhabits both evolve hugely over a 2-3 year period. If you can instrument a sure-win over a 2 year period, then do it. When the 2 year mark strikes, if you find yourself with more eggs than you expected and still feel hungry for more (and willing to lose eggs in that pursuit), then you know, by all means. The bigger challenge I have been thinking about is whether to base an LP fund thesis on any cash-on-cash returns at all. Part of my idea to scale the MicroAngel model is not to invest and do more alone (or as a team) but to decentralize the model much in the way Spotify decentralized their engineering culture. Portfolio ActivityThe model, by and large, has been proven despite the Buying phase taking much longer than anticipated. In hindsight I’m glad I was patient and stuck to my process. Thanks to it, I’ve both reached and surpassed my 2 year goal in just 6 months! Some might pack up, roll-up and ride into the sunset. Not me! This show’s just getting started. Taking into account additional invested funds ($75k more than planned) and since I’ve both reached and surpassed the MRR goals, moving the goalposts and establishing a new fund goal makes sense. I think the cash-on-cash goal will stay the same, but we’ll aim for an additional $1m in return. Thus, we’ll aim to return $2m+ from selling the portfolio at minimum 18 months from now. When I chart out the expected MRR in February 2023, I find numbers in the $35k to $45k MRR range, which defines an expected valuation range between the two products of $1.68M to $2.16m. I think $2m is just ambitious enough to make it realistic while not easy to reach, which is a hallmark of a good goal. A $2m liquidaton event would represent a return on invested capital of 347% on the $575k I’ll have invested so far. If I tack on $360k in cash-on-cash returns along the way, I should be posting closer to 410% in total returns, which is nooooot toooo shabbyyyy. Whether we actually end up selling 18 months from now is irrelevant — thanks to the likes of MicroAcquire, FE International, SwiftExits and others, we have the liquidity to exit our investment when the time is deemed most appropriate. In that spirit, we’ll certainly have a roll call in February 2023 to count our eggs at that time and make a decision to either exit or maintain course. I’m positioning for debt service to acquire a third product within 6 months rather than fielding much more additional cash on my own, and I plan to maintain a 2.7x return horizon at minimum. Because of that, I’m considering increasing the distance to liquidation because an acquisition 6 months from now would be too close to our expected exit event (1 year only) when it could be leveraged more creatively now. I’d like to raise up to $1m in non-dilutive capital to finance the acquisition of MicroAngel’s next product, and to roll all of that up into the first fund shared between myself and any partners present at that time. Player 2 has joined the gameSpeaking of partners, I’ve been scouting and am now bringing on-board a fund CTO/partner by selling equity into the fund for the first time. The mechanics to make this work weren’t simple, as I’m still operating within the confines of a bootstrapped startup post-acquisition. Since I don’t inject any other capital and play with what I have, charting profitability from day 1 is essential to create an opportunity worth buying for present and future partners. What I ended up doing was designing a realistic onboarding ramp for a partner-level hire by aligning on a few important things:

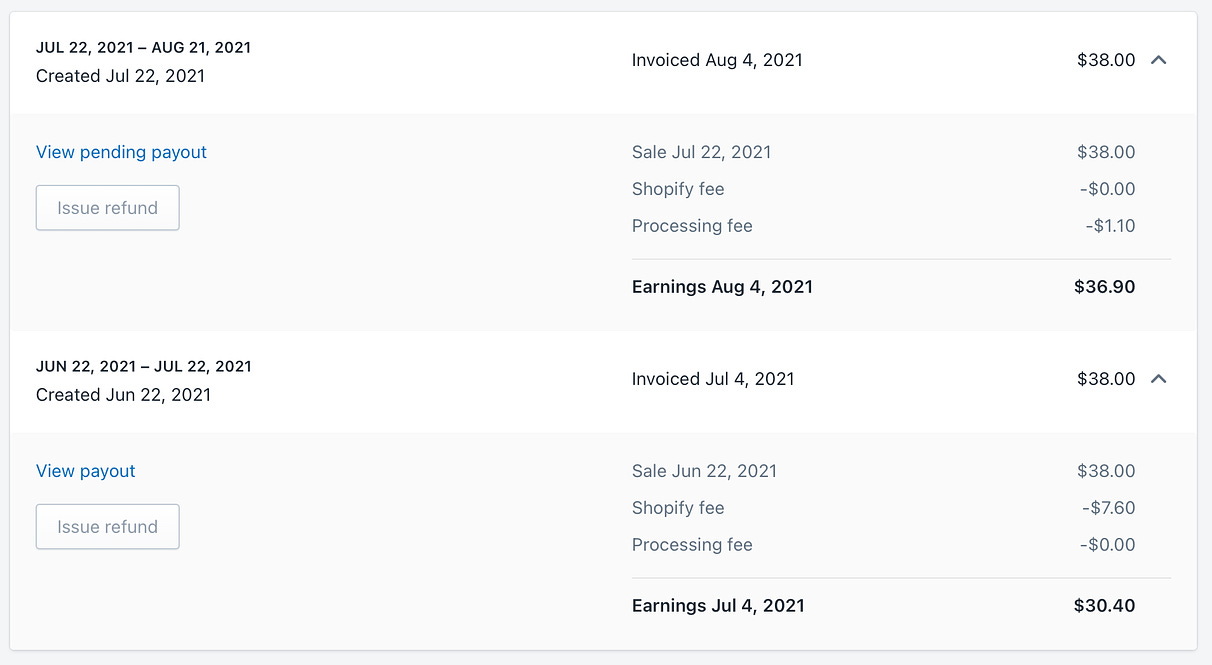

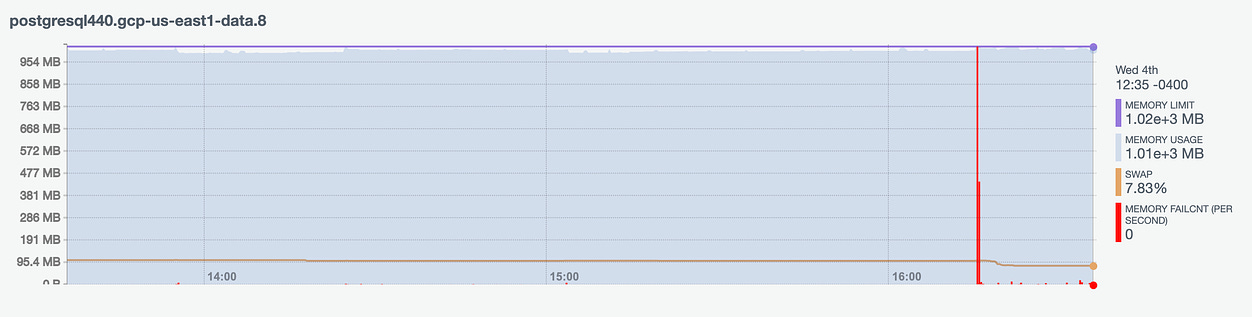

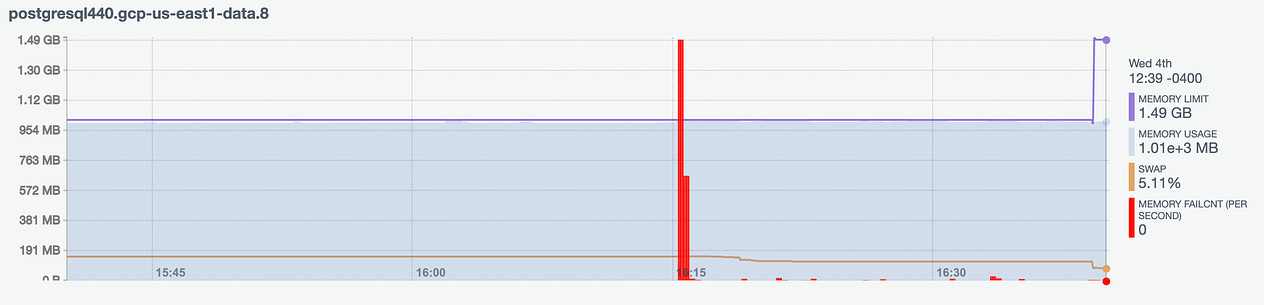

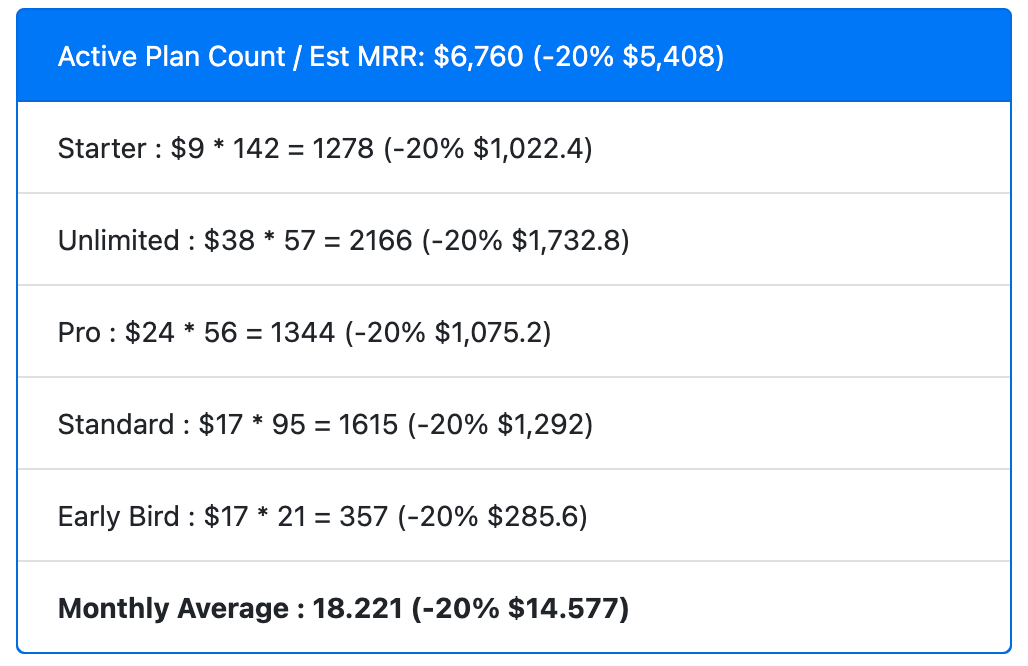

If I can manage to close a third acquisition using mostly debt-service that doesn’t destroy the cashflows, I’d really love to bring on another partner or two within the next 6 months to round out the crew, perpetuate the cycle and grow the journey. Win a Business via MicroAngel I’m working on rerouting the revenue created through this Substack newsletter towards the creation of a yearly Win A Business contest, sponsored by MicroAngel and exclusive to subscribers. If the goal is to inspire, then there is no better way than to put a business into the hands of someone teetering on the edge of micro entrepreneurship. I’ve love to contribute any support to expedite that journey, which will be shared in public over Twitter and on the Substack itself. I’m still testing the waters, so do let me know if you’d be interested in following or participating in something like that! Reconcilely Revenue is predictably trending upwards, but the state of the product needs to start rapidly improving if the app is to continue acquiring 5 star reviews from its customers, which it has mostly been able to do on the back of triple-A support and problem solving. With the growth in the number of customers and the resulting database burden implied, things have been breaking more often as the product starts to reach the limits of its current set up. As an example, customers often get in touch via Live Chat to ask me to backdate some payouts or orders completed months ago. That’s trivial, unless the number of orders in a payout is insane. In which case a small database query can have catastrophic effects, like unknowingly suffocating the production database 😬 I went ahead and scaled the stack so there’s more space and memory to go around, at least for now. This will certainly be an area to improve by migrating Reconcile.ly out of Compose to something else that can scale more elegantly and without costing nearly as much. Not something I’m an expert in, which is again why bringing on a deeply technical partner is a magical thing for the fund which I’m simply so excited by! On the revenue side, things have continued to progress, albeit a little slower than last month, with end of month MRR closing at the $5.4k mark. I’m pretty excited to get rid of the -20% column 30 days from now, and if we add in our expected MRR growth in there, we should be closing in on $7k MRR pretty soon. This is an exciting figure considering the product was at $4.8k six months ago and with no significant changes since then. As mentioned, most of the information about Reconcilely including product tasks have been stored over Notion so far, which has been fine since I’ve been managing them for myself in a sort of contained chaos which quickly breaks down in a team format. I don’t think we’ll need to run a tight sprint system or anything, but something that can represent healthy momentum will certainly be required while reducing any red tape implied in product management. My expectation is to review the Reconcilely roadmaps after onboarding is finalized and dev environments are up. We’ll groom the backlog and build a roadmap based on business objectives, product improvements and customer requests which I’ve been noting so far. There’s a lot of exciting momentum already brewing in the internal MicroAngel slack, where the word on the street is that the immediate focus will be on getting a handle of Reconcilely to kickoff the development of any improvements. These will have a tangible impact on MRR growth, such as support for additional payment gateways locked behind higher pricing tiers. There’s still a slew of fixes and improvements left to complete which I’ve been putting off so I could close a deal on-time, so we’ll finish those up and then take on the task of executing our roadmap towards the end of the year and beyond. Batch As of now, the product is working fine and serving the number of merchants who have integrated the product into their marketing stack, but all development has ground to a halt. I’m pretty salty about it but think it’s probably a good idea for everyone in the team to take a break from the project (or side-projects altogether) and to come back rejuvenated and opinionated about something specific in the future. That’s not something that can be rushed or scheduled, which is why I’m putting the tarp over Batch for the foreseeable future or until something can change there. Not holding my breath. 😬 Learning and adjustments I haven’t learned as much this month as in previous months because I was intently focused on trying to build a portfolio within the investment criteria I’d defined when I started this journey. I did however make several adjustments that I believe will produce massive momentum for the fund moving forward, both from the perspective of reducing my time involvement in anything that doesn’t currently produce and increasing my investments towards things likely to increase our MRR or profitability. The current focus is on the last details of the new acquisition, and I’m very excited to share with you the details surrounding that opportunity in the coming days. Bonus: If you don’t have a MicroAngel subscription yet, use this link to get a one-day pass to enjoy subscriber-only content. Any support of your choice is deeply appreciated! Until then, thanks for reading!¹ 1 Thanks to the following Newsletter Sponsors for their support: MicroAcquire, Arni Westh, John Speed, Henry Armistread & the many other silent sponsors. Include your name in every newsletter as a sponsor (name your price) You’re on the free list for Micro Angel. If you get value from what you read, consider supporting the newsletter. |

Older messages

MicroAngel State of the Fund: June 2021

Saturday, July 10, 2021

Dissolved + new deals, revenue milestones, challenges bootstrapping Batch. Closing MRR: $5.28k / $15k (35% to goal)

Micro-SaaS Acquisitions as Startup Call Options

Thursday, July 1, 2021

Salty you missed out on GameStop?

The plan to fix Reconcile.ly

Friday, June 11, 2021

First red alert, getting a lay of the land and picking low hanging fruits ahead of improvements + growth

Balancing Revenue Generation & Profit Management to Grow Micro-SaaS Valuations

Friday, June 4, 2021

Every acquisition comes with a built-in opportunity

MicroAngel State of the Fund: May 2021

Thursday, June 3, 2021

Closing Deal #2, sunsetting deal flow and preparing transition from Buying to Fixing. Closing MRR: $5k / $15k (33% to goal)

You Might Also Like

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📂 EXACTLY how Teachable got the first $1M ARR

Monday, March 3, 2025

Here's what the founder of Teachable, Ankur Nagpal, said about growing Teachable to their first $1M in ARR. Later, they'd sell for $250M! Fall 2013 I was 24 years old and had just moved