Balancing Revenue Generation & Profit Management to Grow Micro-SaaS Valuations

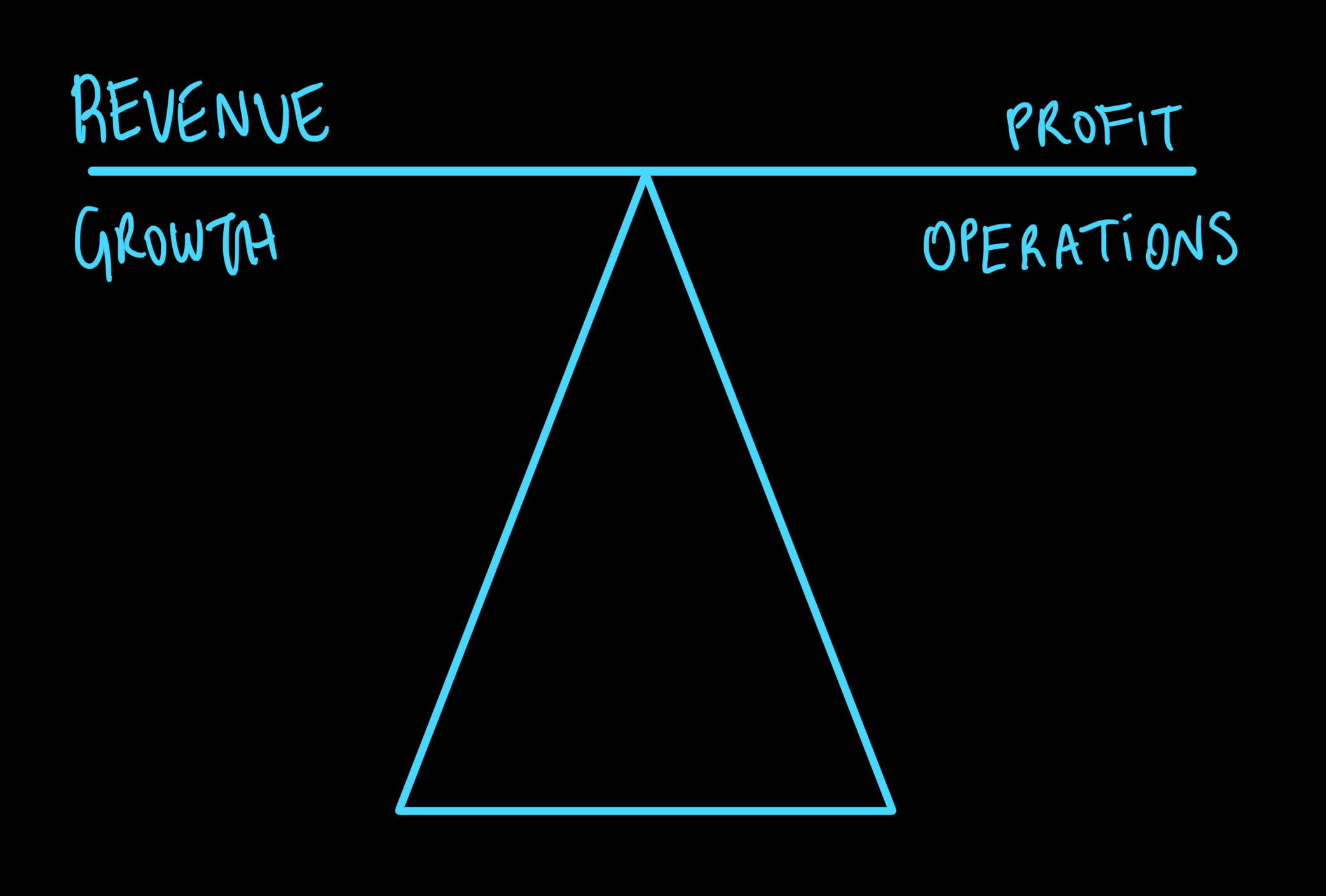

Hey! Eyal from MicroAngel here. Every now and again, I release free deep dives like these to newsletter subscribers. If you get value from them, consider supporting the newsletter so I can continue sharing the journey and my results along the way. Enjoy! Every entrepreneur has a style, whether consciously or otherwise. Do you know yours? We find ourselves on a spectrum balancing the natural inclination to increase customer acquisition, drive new revenue and grow the top line versus making the most out of your product through operational excellence. I started my career as the Idea Guy, which hardly has any value at all, both internally as your personal ability to execute and externally as a value proposition to any potential team or project. Soon, I recognized the value of technical chops as a way of creating continuous product value but it felt too out of reach for someone with a more natural inclination for sales & marketing. As I focused on that side, I became great at it, and my own skills and value proposition became scoped to that natural talent. Soon, I found myself creating value for projects through revenue generation by way of profitable user acquisition, and being capable of creating durable and layered systems to drive continuous growth. This side of the spectrum is incredibly valuable considering the critical nature of successful user acquisition to a business. But the best marketing in the world isn’t going to save a non-existent or bad product. For the longest time as an entrepreneur, I felt regret at the thought of being unable to materialize the many ideas I had as a founder, and worse, to be constantly reliant on teammates that often turned out to be unsuccessful founding arrangements. I eventually bit the bullet and spent an entire year learning to code and it had a transformative effect on me as a digital entrepreneur. Quickly, I noticed that the time I wasn’t spending on marketing marked the cost of acquiring a new skill such as programming. The deeper I dove into code, eventually going as far as co-authoring Batch and other projects from the ground up, the further I traveled down the spectrum towards profit management. Being so close to the product creates an inevitable interest to improve on its ability to create and capture value. For a person like myself having spent a decade as a growth marketer, this represents the holy grail of growth marketing. Instead of standing at the intersection of marketing and product, I could be that intersection. In doing so, I inevitably traded away some of the pure marketing acumen that drove the majority of my value generation in the previous years. Trading away sounds a lot more permanent than it really is. When really, it’s actually a lot closer to riding a bike again. Marketing is so easy when your product sells itself, and a great marketer who can create a product that sells itself has the ultimate luxury of pulling on both sides of the spectrum. It’s an interesting balance, because it transforms the entrepreneurship style for a person like me who’s travelling down the spectrum from focusing on selling to focusing on making. I don’t fear that path because I regularly travel up and down, and all around it. I have a natural inclination for revenue generation and stay in operational excellence just long enough to create the right tools and context for successful growth execution. Too many indie hackers are stuck at the opposite end of the spectrum, focused entirely on making with no experience selling. I think that’s a tough spot to be in, and why advice like ‘launch early, ship often,’ and so on, is valuable for that type of person. Because when you launch, you make a conscious choice to travel away from operational excellence towards growth. This is a journey filled with a completely different set of specs that someone without experience might try avoiding altogether, which of course leads nowhere. Growth vs. Operational ExcellenceIf every potential acquisition has a built-in opportunity, then it is good tactics to assume that the built-in opportunity has an affinity to either growth or operational excellence. If your natural inclination is to go out and sell, but the acquisition opportunity you’re assessing hinges on technical acumen to drive product changes that will increase retention, there will be a mismatch. It’s a good idea to understand whether you are growth or operationally oriented as an operator, and to scope your investment thesis to take that important nature into account. Growth orientedSomeone who is growth oriented has an innate ability to communicate the distance between the past and future state of the customer, and drive profitable customer acquisition resulting in new revenue. It’s typically an A type personality that has high emotional intelligence and excellent communication and creativity to pull from for the purposes of creating top and middle of funnel activity. We often think of things like:

If you often lose yourself in these type of tasks and they feel like play, then you are probably growth oriented. You ought to focus on acquisition opportunities that would benefit from a growth oriented leader that will import a culture of revenue generation filling the top of the funnel and selling what you have. And you should beware any opportunity that already has strong growth but glaring operational needs you are unprepared to solve. Operationally orientedA Product Manager is probably the perfect example of an operationally oriented individual, who seeks to make the most out of what they have by producing the most product (value) at the lowest cost (friction). This is where the majority of product makers are: there exists an infinite energy surrounding the activity of creating and production. They are tinkerers and perfectionists. The value here is obvious: Materializing the solutions that customers will use to solve their pains and derive value out of the promise that acquired them in the first place, and create a long-lasting relationship and thus successful business out of it. When I think about the operationally oriented individuals, I simply picture a focus on making the most out of what exists, through internal activities like:

Acquisition opportunities that would benefit from the operationally inclined are ones that have strong marketing momentum but with gaps in the product or value generation in general (i.e. retention). A marketer doesn’t help if product isn’t where it should be, but a product manager-type won’t be successful building/fixing a product that doesn’t have a strong value proposition to grow from to begin with. Reconcilely is a bit of a hybrid in that it is an operational opportunity at 75% and a growth opportunity at 25% I say 75% because the vast majority of the growth hinges on additional product integrations, which will cause an acceleration to the existing mechanisms driving revenue growth. It’s true product-led growth in this case, but not without gaps. The other 25% surely represents the marketing systems that don’t yet exist for the product, from SEO/content to ad management to growth marketing and experimentation (i.e. pricing). Balancing the actThe things you spend most of your day doing are the defining blocks of your nature as an entrepreneur, and the projects you aim to buy should not only benefit from your skillset but also the things you’ll find yourself wanting to do naturally during the day. It’s more nuanced than just what the project needs. Your success rate goes up if the things the project needs can be done without feeling like work: and that reality will manifest provided the things that need doing are things you naturally like to do. I often say that if tomorrow, I lost all of my income from producing and selling products online, I’d still do what I’m doing now. It doesn’t sound crazy at all to me because that’s how I started doing this stuff to begin with! I was doing exactly this stuff but not getting paid for it, until things suddenly took off forever. As a teenager, the only thing I earned out of my efforts was experience, yet I often found myself trying different things throughout the night. What’s interesting is that the things I naturally like to do now are very different than those I gravitated towards as a teenager. I was excited about making $100k of side-income at 18 years old through Upwork (then called oDesk) or doing mid six digits reselling organic clicks & leads to local businesses. This could be the reason why I eventually took it upon myself to learn to code. As I became older, I grew into a different person and my intrinsic motivations evolved and created a void that only learning to code could fill. This feels like a really important fundamental truth: who you are has an impact on your natural affinities, and those affinities change over time relative to your life experiences and personality. In the past, I probably would have never touched a product that wasn’t built on Rails, as that was the only language I was really comfortable with. I’m not a professional developer, just self-taught to the extent that I could create awesome MVPs. In picking up Node over the past year working on Batch, I became more open at the idea of acquiring something built on a stack I’m not super strong on. I had the goal to both improve myself as a developer (proof of my new natural affinities) and access better acquisition opportunities through my new technical abilities. I couldn’t have purchased Reconcile.ly if I didn’t understand Node, and I wouldn’t have learned Node if I wasn’t naturally inclined to spend time on it without it feeling like work. Lost count of the nights and weekends we spent figuring out how to make Batch work within the insane constraints we built upon. And that wouldn’t have happened if my natural inclinations hadn’t evolved over time, considering I was a pure marketing-type just 5 years ago. Stepping into the voidInterestingly, I can finally explain a completely unrelated phenomenon. If an acquisition that requires a playbook that comprises activities you are interested in but not necessarily talented at, look to successful individuals having joined organizations into roles they have zero experience in. Or better yet: look to 18 year old CEOs who manage to create huge companies despite having zero experience in their field. This is made possible by the same energy that drives natural affinity. It takes a certain kind of person to create Uber. You can make the app, but you still need to have the natural affinity to hop into cabs and pitch drivers the potential of going completely independent and make more money with Uber. That means that building Uber required a special kind of symbiosis between operational excellence and revenue generation. The founders of that product exhibited natural affinities to those activities, which drove up their success/survival rate, whichever way you look at it. Imagine the Uber founders didn’t have that growth orientation, and decided to sell off their asset. If the acquirer didn’t have the gusto to hop into cabs and pitch drivers, the result would be the same failure. If you have a strong ability to self-reflect, and can identify what your affinities really are — which you can do by simply reflecting on the things you like to do outside of work — then you’ll have a marked advantage as a microangel in your qualitative analysis. It will make the non-tangible tangible by taking stock of what the project really needs to become a self-sustaining and growing business, and matching that against your talents and natural affinities. There is an ultimate equilibrium between what the project needs and what you are good at, and this is it. Something in me hopes there is a just middle in between revenue generation and operational excellence, in that being in the middle might be equivalent to being good at neither. It’s another version of lack of focus, though my expectation is that provided you can do both well, and you only do one at a time, you should be able to zoom in/out of those functions as the need arises. For me, Reconcilely is very much a hybrid of revenue generation and profit maximization. There’s much more to do on the profit maximization side that excites me before I can become truly excited to drive customer acquisition. This is a natural thing to feel, but it gave me clarity with respect to: (a) why I purchased Reconcile.ly; (b) what kind of activities I’d eventually execute; and (c) the sequence of that execution bearing in mind what the product needs and what really interests me. Things that interest you can be produced with a high degree of speed and quality with nearly no spend in energy. Just remember the last time you did an all-nighter on something you were truly passionate about and the process that held your attention for so long. That’s the stuff you are attuned to. You ought to buy something that needs that very energy. Then, growth will feel completely natural as an extension of what you do. That kind of stuff is really powerful because you can accomplish more without having to pull on a limited supply of motivation and discipline. Next time you’re looking at an acquisition opportunity, spare a few moments to reflect on the backlog of things that the product needs, and whether you’re the kind of person who does those things for fun. Good luck out there!¹ 🤘 1 Thanks to the following Newsletter Sponsors for their support: MicroAcquire, Arni Westh, John Speed, Henry Armistread & the many other silent sponsors. Include your name in every newsletter as a sponsor (name your price) You’re on the free list for Micro Angel. If you get value from what you read, consider supporting the newsletter. |

Older messages

MicroAngel State of the Fund: May 2021

Thursday, June 3, 2021

Closing Deal #2, sunsetting deal flow and preparing transition from Buying to Fixing. Closing MRR: $5k / $15k (33% to goal)

The subtle limits of quant analysis in micro-acquisitions

Monday, May 10, 2021

Balancing post-acquisition consequences vs. potential gains

MicroAngel State of the Fund: April 2021

Wednesday, May 5, 2021

Murphy's Law, Reconcilely turnaround, lead flow explosion & more. Closing MRR: $4.8k / $15k (32% to goal)

The math behind Micro-SaaS exits & guaranteed micro-angel returns

Tuesday, April 27, 2021

How to arbitrage micro-acquisition valuations for instant ROI

(Part 2) Lean micro-acquisitions from first-touch to close & asset transfer

Monday, April 19, 2021

Computing cash-on-cash, compiling research into an offer, financing options, LOI submissions & closing the deal

You Might Also Like

Making Wayves

Tuesday, March 4, 2025

+ Girls just wanna have funding; e-bike turf war View in browser Powered by ViennaUP Author-Martin by Martin Coulter Good morning there, Since 2021, VC firm Future Planet Capital (FPC) has secured more

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏