Micro-SaaS Acquisitions as Startup Call Options

Hey! Eyal from MicroAngel here. Every now and again, I release free deep dives like these to newsletter subscribers. If you get value from them, consider supporting the newsletter so I can continue sharing the journey and my results along the way. Enjoy! If there’s one thing the GameStop saga taught me, it’s that the world is finally waking up to the fact that anyone can trade. That, obviously, is making hedge funds shit their pants. Most investors rely on stock ownership and the ensuing capital gains produced by holding stock of a growing company. But, like microangels, a class of savvy investors regularly get their hands dirty buying and selling puts and call options on the open markets. The only difference is that we deal in acquiring privately held products in their entirety, rather than a fraction of publicly traded stocks. They’ve been around for decades, but only recently has the impact of options been given the attention they deserve. In terms of the GameStop saga, the big unlock was Reddit coming together to realize that a shitload of GameStop options were going to expire, and that removing as many shares from the open markets as possible would create a short squeeze, and eventually a rapid increase in the price of the leftover available stock. The basic idea of an option is a contract that gives you the right, but not the obligation, to buy or sell a predetermined amount of stock at a fixed price on or before an expiration date. That’s it. The reason you’d want to buy an option is because you’re making some kind of prediction about a given stock’s direction, and positioning to take advantage once that direction cements. If you bet a stock will go down, then you’d want the ability to sell your stock at today’s price (that’s shorting). Microacquisitions are the opposite: they’re calls that the products will grow in value. We go long on that fact in the most ultimate way (buying control over the entire product asset). Options can be used for different trading strategies, some of its pros including hedging risk and the ability to produce positive returns no matter the health or direction of the market. It’s a speculative tool too, giving people like you and I a low-cost way to go long or short on something without much downside risk or upfront capital. In other words, you hold the option to sell or buy the stock based on the new environment of the market. If that environment dictates that you can purchase stock under its current market price, then the option gains in value. Here’s where things get interesting. Investors can exercise the options they buy to be able execute transactions that would produce a guaranteed ROI on the basis of their cost of the contract and the arbitrage created by the fixed cost of the stock through the option and the actual market price. In a really simple form, it works out something like this: If you have $5,000 and can buy a stock that is worth $10 for $8, then you should, because you could immediately resell the stock and pocket a $2 profit per acquired share:¹

But what about someone who has $10,000 to invest? Or $100,000? $1M? This option is far more valuable to them than it is to you! Obviously, that would depend on the amount of option contracts purchased, since option contracts are usually for 100 shares. But the idea is the same:

For that reason, it’s actually far more profitable to sell the option contract itself to a buyer who has the kind of capital to really make that arbitrage work to larger absolute numbers. And you can safely pocket pure profit selling the contract for way more than, say, $1,250. Indeed, one might sell a contract representing $250k of profit for $25k or more, which is leaps and bounds ahead of what could be produced by investing $5k directly. MicroSaaS as Call OptionsThe first advantage of an option is that it lets you hedge risks while creating non-standard ROI opportunities. As I observe the micro-acquisition ecosystem take shape and evolve, it has occurred to me that there are several types of buyers and that this creates arbitrage opportunities on that basis. In fact, one might even guarantee positive returns due to the existence of that arbitrage. With an approach similar to options trading, a savvy microangel could acquire a small, growing MicroSaaS product as a call option that they could then resell to a larger investor with more capital to swing. If you can prove something is going to continue growing, then buying that asset is effectively the same as buying a call option!

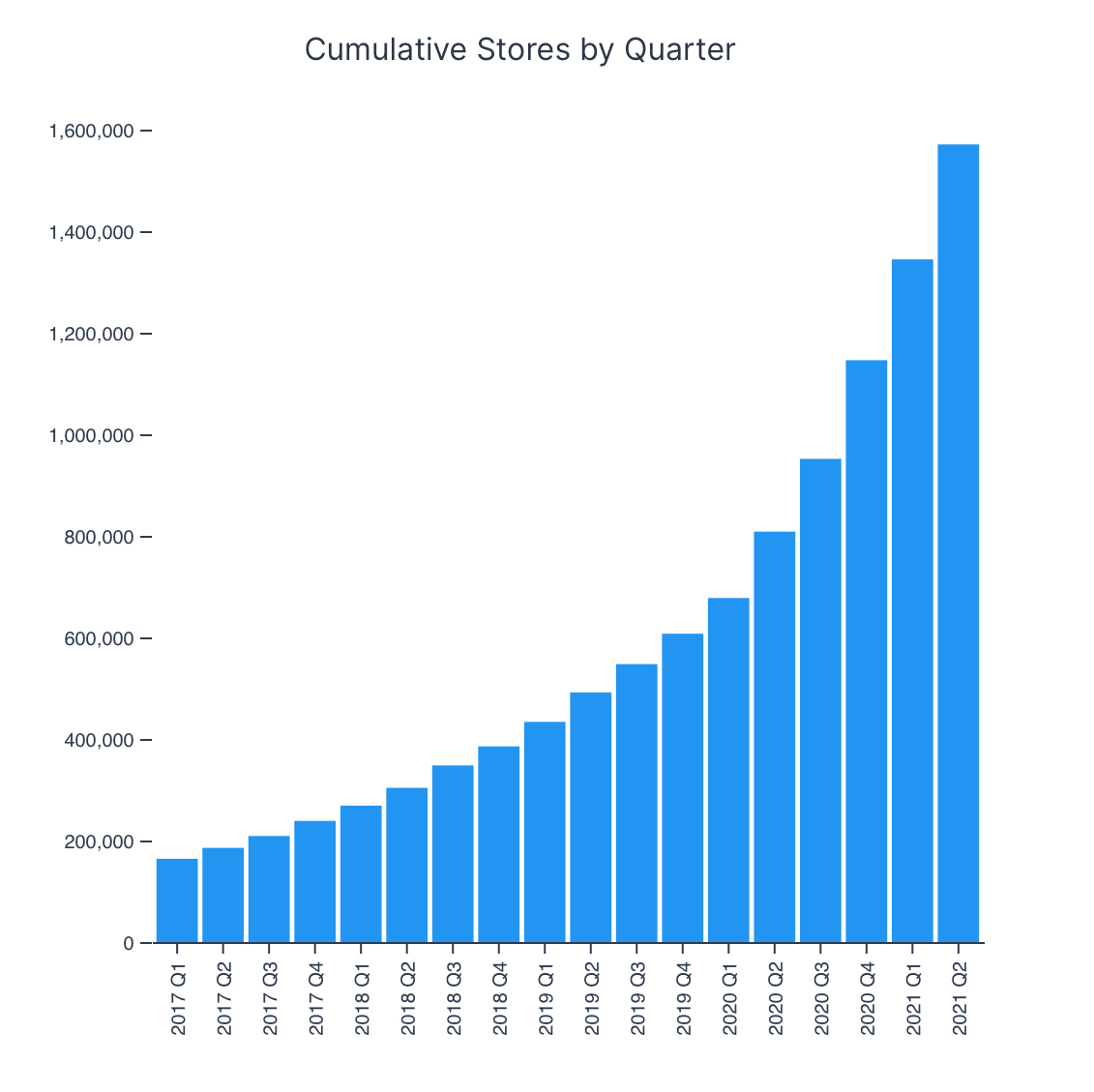

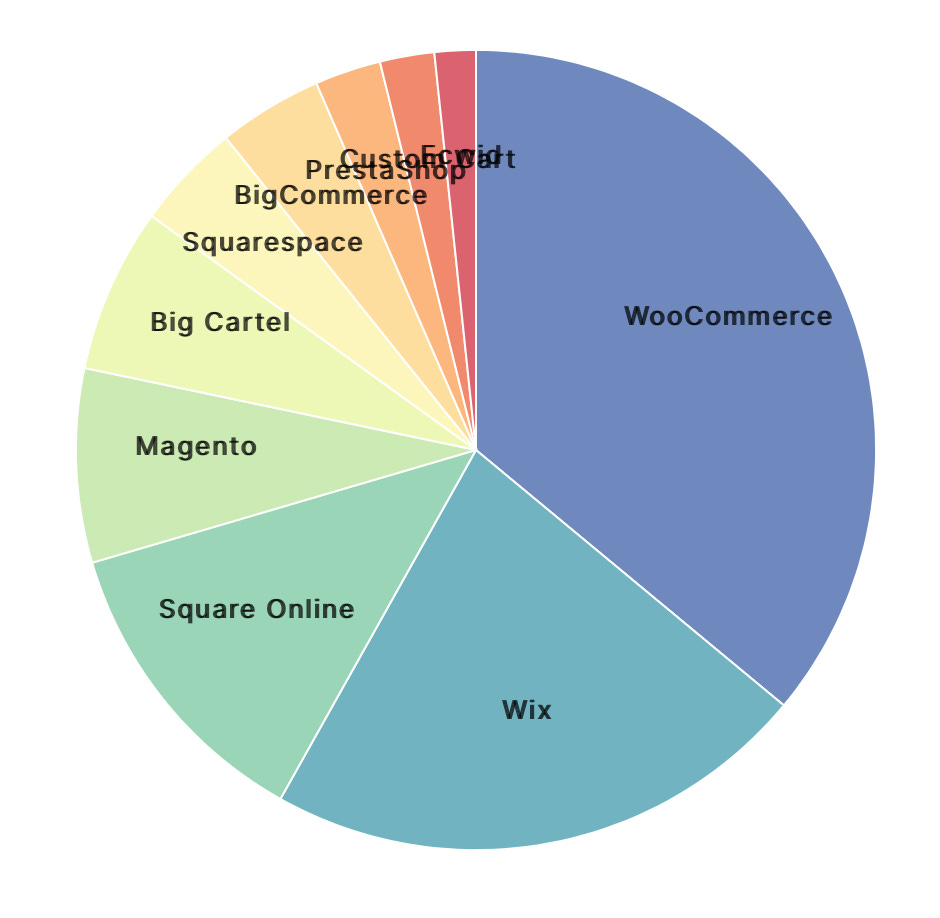

What I really like about micro-acquisitions is that creative financial instrumentation can lead to literally the exact same behaviour as call option contracts: You don’t have to pay for the entire thing all-cash if you don’t want to, and in doing so, you can make an effectual bet on the future of the product, and benefit from huge leverage in the event that the future in question is bright. Profiting from market tailwindOn top of hedging risk and creating awesome ROI possibilities, options are a quintessential speculative tool. The recent announcements during Shopify Unite created a perfect illustration of Shopify apps as call options. We Shopify devs bought the option years ago, and today its value went up 25%: Already, the entirety of the Shopify ecosystem is in full bloom. Even before the pandemic’s effect on ecommerce, the number of active merchants on the platform has been exploding over the past several years, indicating a massive opportunity for Shopify apps with defensible positions. Indeed, apps that have decently stable ranking on the App Store profit from the tailwind created by Shopify as a platform, where the growth of merchants to the platform creates a rising tide for apps serving those merchants. In the last 90 days alone, Shopify lured 7,000 merchants away from other ecommerce platforms, with WooCommerce shedding the lion’s share This is an important factor behind my own fund’s focus on Shopify, and investing in that ecosystem is basically an extended call option on Shopify itself, where the value of most apps today is likely to grow on the basis of the growth of the greater ecosystem. It’s the type of option you buy when you’re intimately convinced with the direction the world is headed and how you might position to take advantage of that. Rolling up = selling the optionIn this view, rolling up several products together is a means of consolidating the advantage of a given product and to assign it to the others in a portfolio, such that the total valuation can increase rapidly in unison, rather than slowly independently. Much in the same example, Shopify apps are not all built equal, as they each have different growth rates, churn rates and monthly recurring revenues. While you can’t blanket assign the same multiple to all apps in a portfolio, it’s possible to invest in homogenous products that complement each other well or have access to synonymous customers. If a portfolio’s value grows with the creating of synergies between assets, then the creation of a portfolio’s returns might be deliberate vis-a-vis the work implied in creating those synergies. In acquiring Reconcilely, I accessed a majorly Australian market. That’s just a circumstance, but it becomes an element of importance relative the potential value in acquiring another Australian app, and the ensuing advantage created by two disconnected Australian customer segments that would cross-sell well. This synergy might be valuable to me on the basis that I can cross-sell, but it could be worth strategically more to a larger investor who’s intent on taking a larger share of the Australian Shopify market, which is an option I’d get from serving that market. What future are you betting on?Is the success of your acquisition entirely dependent on your ability to execute? Are there any fundamental truths that you can leverage to peek into the future and make an educated predilection about what is most likely to happen? Prediction is an important and developable skill that is less Jedi mind trick and more pattern finding. Here’s what I know: I bought Reconcilely at a price that creates instant arbitrage based on the appetite of other investors who would want to buy it at a multiple above 4x. I chose to focus on Shopify because the market is continuing to grow, which enables Holding assets by the fact apps will grow with the market without much effort, and that any large advantage created by Shopify would likely be passed on to its partner network. This week’s news was another boon which will increase Reconcilely’s MRR by 25% (not 20%, as was correctly pointed out), which is my version of the stock reaching $10 while holding an option to buy it at $8. The recent news will unlock about $1,200 in MRR for Reconcilely, representing an increase of $14.4k in ARR and a valuation increase in excess of $57k, on the basis of a 4x selling multiple. While the proverbial stock might be worth $10, I expect it to continue rapidly growing. While the market direction drives up portfolio valuation naturally, upcoming product improvements will create new forcing functions that will increase retention and rapidly accelerate new MRR, for an exciting future! Talk soon!² 1 In reality, when you buy an option contract, the cost of that contract is to buy/sell 100 shares of the underlying stock. So if you want to scale the buying, you’d need more options. If you only have 1 option, then the most you can do is 100 shares — and its value is thus capped. 2 Thanks to the following Newsletter Sponsors for their support: MicroAcquire, Arni Westh, John Speed, Henry Armistread & the many other silent sponsors. Include your name in every newsletter as a sponsor (name your price) You’re on the free list for Micro Angel. If you get value from what you read, consider supporting the newsletter. |

Older messages

The plan to fix Reconcile.ly

Friday, June 11, 2021

First red alert, getting a lay of the land and picking low hanging fruits ahead of improvements + growth

Balancing Revenue Generation & Profit Management to Grow Micro-SaaS Valuations

Friday, June 4, 2021

Every acquisition comes with a built-in opportunity

MicroAngel State of the Fund: May 2021

Thursday, June 3, 2021

Closing Deal #2, sunsetting deal flow and preparing transition from Buying to Fixing. Closing MRR: $5k / $15k (33% to goal)

The subtle limits of quant analysis in micro-acquisitions

Monday, May 10, 2021

Balancing post-acquisition consequences vs. potential gains

MicroAngel State of the Fund: April 2021

Wednesday, May 5, 2021

Murphy's Law, Reconcilely turnaround, lead flow explosion & more. Closing MRR: $4.8k / $15k (32% to goal)

You Might Also Like

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📂 EXACTLY how Teachable got the first $1M ARR

Monday, March 3, 2025

Here's what the founder of Teachable, Ankur Nagpal, said about growing Teachable to their first $1M in ARR. Later, they'd sell for $250M! Fall 2013 I was 24 years old and had just moved