The Diff - Modern Financial History Begins in 1998

You're on the free list for The Diff. This week was Central Bank Week. A bit of a digression from our usual material, but central banks get a lot of attention and generate a number of wild conspiracy theories. They're also increasingly important, because a more financialized world with better communications and more interlinked supply chains is also a world that's more prone to bubbles and crashes—which means the institutions tasked with popping bubbles and averting crashes are more important than ever. Subscribers-only posts this week included:

Coming attractions: next week we'll be looking at a successful SPAC spoiler, a China tech IPO that's very much in the government's good graces, a company that successfully outcompeted Google, and more. To read these, subscribe now. (And if you're deciding which email address to use, keep in mind: many readers of The Diff in the tech and finance sectors expense their subscriptions. Food for thought!) Modern Financial History Begins in 1998Plus! Two Turnarounds; Smart Glasses; Credit cards, Spending and Splurging; The Cyclical CEO Condition; Permanent Pricing

Welcome to the Friday free edition of The Diff. This newsletter goes out to 24,114 subscribers, up 47 since last week. In this issue:

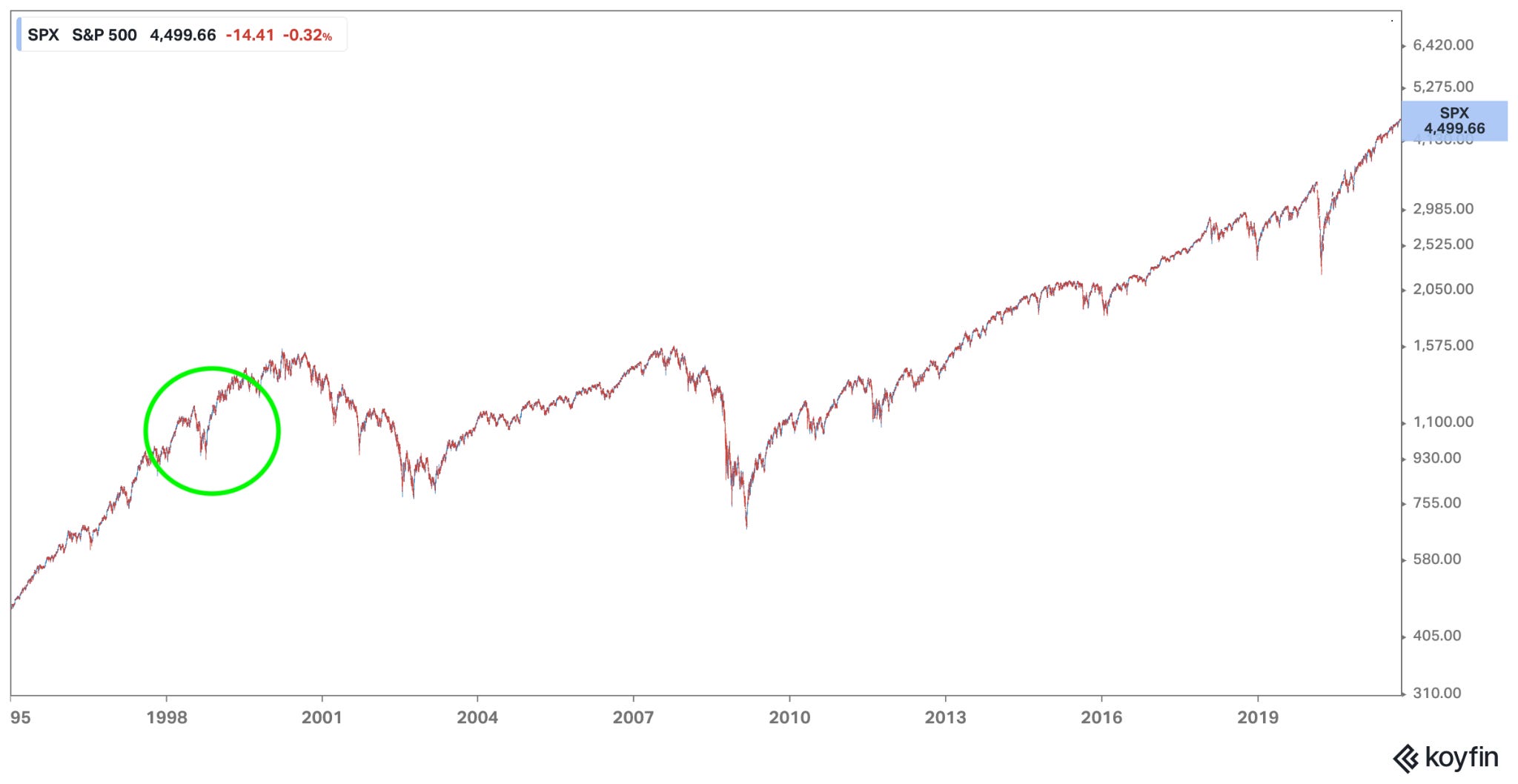

Modern Financial History Begins in 1998The easiest way to retrospectively understand market regimes is to look at a long-term chart of stock prices. It's pretty easy to see that something was happening in the 90s, that it stopped in 2000, that something else happened up through 2007 and then something pretty disastrous happened in 2008. And this is useful. Stocks are a large, widely-followed asset class, and they reflect expectations about economic growth, corporate profits as a share of it, interest rates, inflation, and risk tolerance. But sometimes the big inflections show up as smaller stock price deviations, because those inflections change why a trend is happening, without changing the trend itself.

This is a two-and-a-half-decade chart of the S&P 500. The three huge bear markets of 2000-2, 2007-9, and a few weeks of 2020 are clearly visible. But the point I've circled in 1998, which was a time when the rules definitively changed. When I started paying attention to the market in the early 2000s, there were several rules that were pretty widely assumed to be accurate:

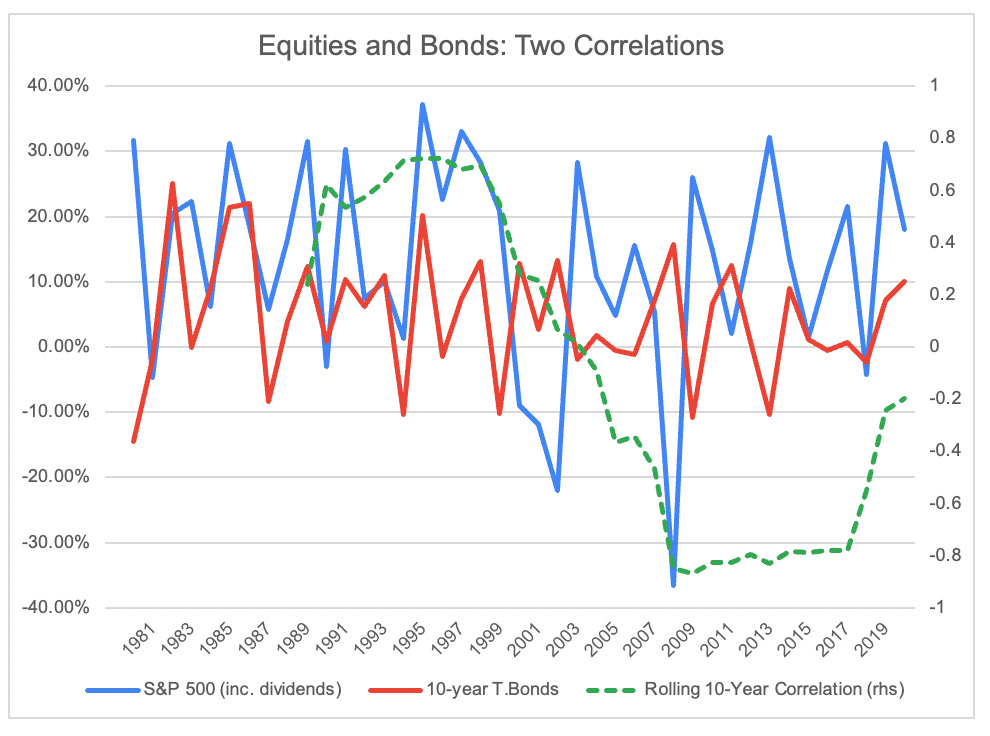

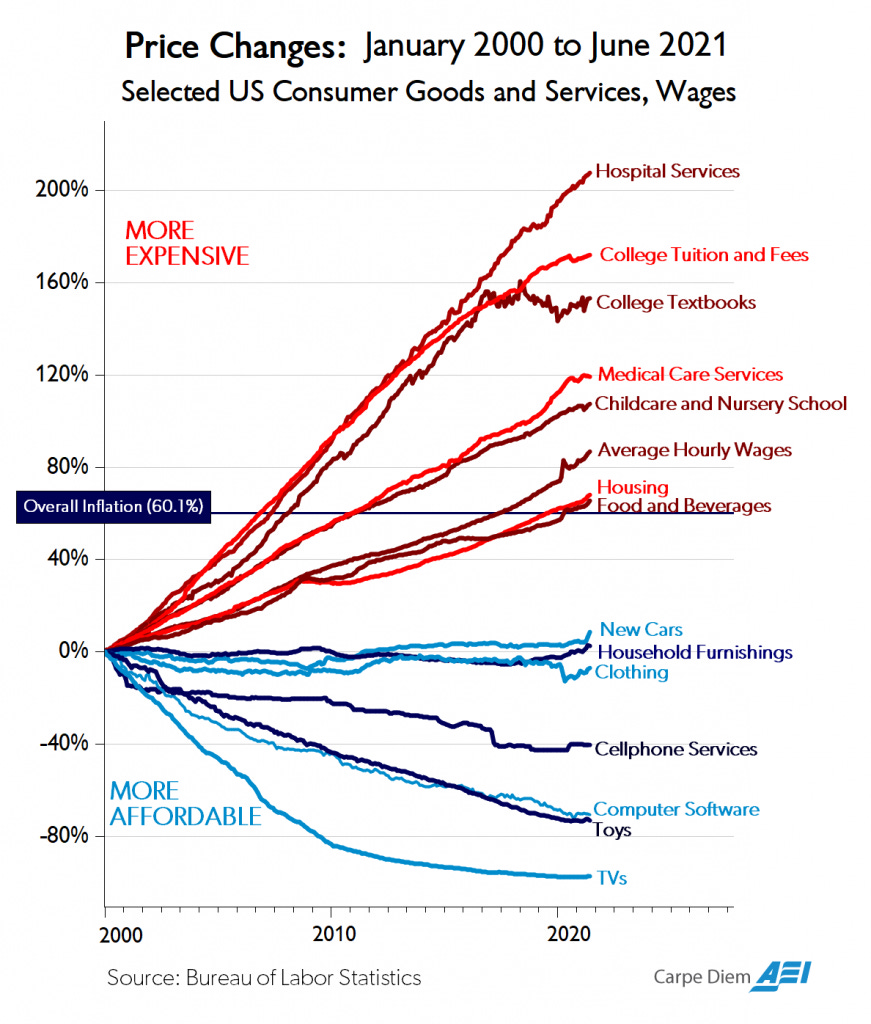

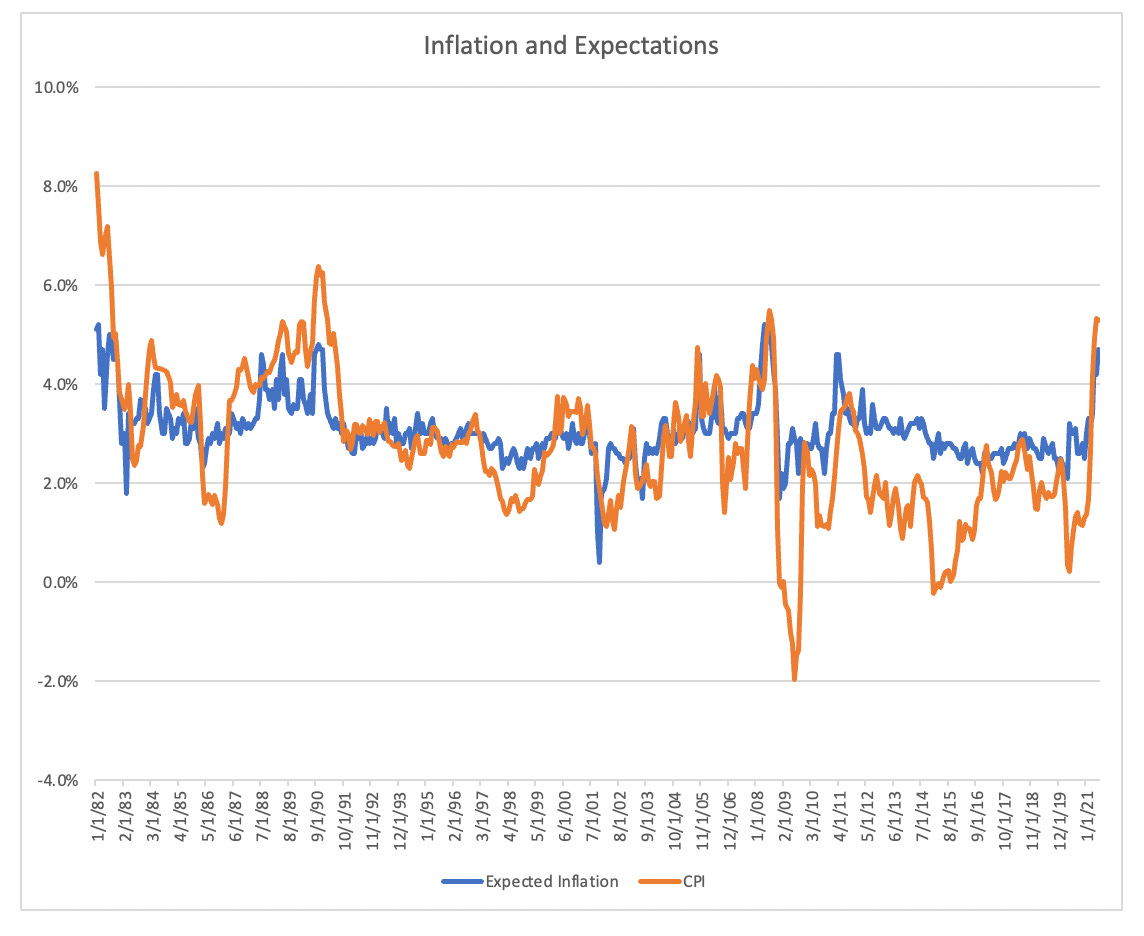

All of these have been broadly true for the last twenty years, which is a very good record for conventional wisdom. But they've also gotten true fairly recently. For example, Europe outgrew the US in the postwar period through the 70s, albeit from a lower base. And the treasury/stocks correlation actually reversed they used to move in the same direction before 1998: On inflation, there's a famous chart that splits the US economy into two buckets, the one with low to negative inflation and the one with high inflation: One way to read the chart is that heavily regulated industries like housing, healthcare, and education get relentlessly more expensive, while mostly-deregulated ones get cheaper. But the other way to read the chart is that anything you can assemble in Shenzhen and put on a shipping container has gotten cheap, and everything else has gotten expensive. In that reading, the transition from manufacturing to services is not just about a maturing economy, but about large-scale outsourcing to cheaper labor markets. And this, as it turns out, has an important connection to the equity/bond correlation. One way to look at equities versus bonds is a pure risk-on versus risk-off trade: if you expect to make money, you buy stocks, and if you expect to lose money, you stash it in bonds. That's approximately true, unless the big risk to your capital appreciation comes from inflation, in which case rates stay high and both bonds and stocks underperform. If central banks can change interest rates in response to a slowing economy, it naturally makes bonds correlate inversely with stocks—bonds are more rates-sensitive, all else being equal, but all else is only equal if inflation is not a material risk. Which, by the 1990s, it didn't seem to be. You can see this in both the inflation stats and inflation expectations. They both declined, and got significantly less volatile (from 1982 to 1998, expected inflation declined from 5.1% to 2.3%, while the standard deviation of inflation expectations dropped by almost 80%). This lower inflation rate meant that the Fed could respond more aggressively with rate cuts, without worrying too much about inflation. The collapse of Long-Term Capital Management, for example, led to a quick market swoon, but the Fed acted quickly to organize a bailout, and was also able to cut rates. From the inside, this looked like a rapid response to the collapse of a systemically important financial institution, but from the outside, where LTCM did not have especially high name recognition, it looked more like central banks were willing and able to intervene as soon as the stock market went down. There was a vigorous debate in the 90s about why inflation had dropped so much, and whether or not it would continue. One school of thought credited Alan Greenspan, and Greenspan himself argued that inflation was likely overstated because of hidden productivity improvements in tech-sensitive sectors. But a lot of it was Deng Xiaoping and Malcolm McLean. East Asian industrialization had been affecting the cost of consumer products in the US for decades; toys, steel, and cars were all getting cheaper in the 70s due to imports. But China was different, for three reasons:

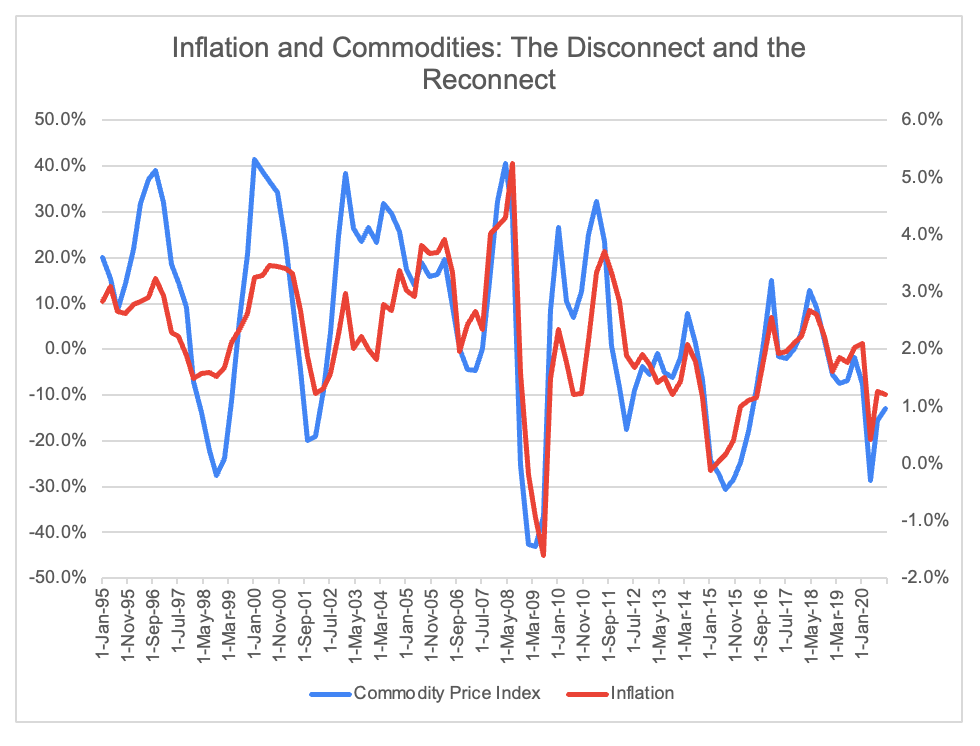

1997 and 1998 were difficult years for the East Asian growth model. Many countries in the area kept their currencies pegged and engaged in financial repression, the combination of which led to extraordinarily high reinvestment.¹ Pegged currencies make it easier for a country to do business abroad, both in terms of transferring goods and transferring money. The difficulty that arose in 1997 was not keeping currencies low, though; it was keeping them high. When capital flowed into these economies, it was invested in projects that didn't necessarily pan out, and that led capital to leave. Post-crisis, many countries devalued their currencies, which made their exports more competitive—China did not. The country could have let its currency float. Certainly, the crisis demonstrated that the amount of reserves a country would have to have on hand to maintain a stable currency was much higher than had been estimated before. China's policymakers also noted the same thing: that running an export-driven, investment-heavy economic policy required more aggressive currency management than expected, but took the opposite lesson: that it was worth doing, especially if they were the only country that could really manage it.² As a result, China's FX reserves went from under 10% of GDP in the early 90s to over 40% by the mid-00s. (Reserves have since leveled out, while GDP kept growing.) This kept the currency cheap, which meant goods remained cheap. It also had a paradoxical effect on one major mechanism for inflation. In theory, an increase in the price of raw commodities should eventually make its way to consumer products; over time, companies will find a way to pass on those costs, rather than absorb them. And in immediate terms, that's true: commodity price spikes lead to higher CPI readings, especially as energy costs either flow through directly (at the gas pump) or indirectly (through the cost of making or delivering just about anything). But something interesting happened in the 90s and early 2000s: commodities price spikes didn't get passed through to consumers. An old macro hedge fund letter I came across hypothesized that China was the reason for this disconnect: in a steady-state economy, raw materials are used to build a bit more capital that's a complement to existing labor, or to increase output (which uses more of that labor's hours). But in the 90s and especially the 2000s, the purpose of the marginal ton of iron or copper was to build things in China, where they were a complement to a large and cheap labor force. So higher commodities prices actually meant lower consumer prices, since the higher cost of components was offset by the lower cost of the people who turned those components into finished goods. But that's getting less true, for two reasons. First, from 2005 through 2018, Chinese manufacturing wages more than quadrupled in local currency terms. The cheap labor arbitrage went away. But it was partially offset by an increase in capital per worker—especially since a substantial fraction of those higher wages turned into savings, giving China's banks more resources to fund investment. In real terms, capital per member of the labor force was rising at about 5% annualized in the 90s, but this accelerated to 10% by the early 2010s, before slowing to 8% or so more recently. Or, put in starker terms, capital per member of the Chinese labor force has more than doubled since 2010. So the advantage shifted from low wages to faster accumulation of capital. And that's just the kind with accounting value. If you want to compete with Shenzhen's physical capital, that's hypothetically possible given a large enough budget. But if you want to compete with Shenzhen's human and institutional capital—the people, the experience, the dense network of suppliers—step one is to start about thirty years ago. The other reason the per capita numbers are so striking is that the size of the labor force peaked and is in decline now, so capital accumulation is racing against workforce depletion. Lots of systems tend towards disorder unless there's some external force that keeps things organized, and economies are no different. A complex economic system is highly resistant to trendlines that only move in one direction, and markets are allergic to strategies that improve risk-adjusted returns without much effort. Over the recent lifetime of the low-inflation, bonds-inverse-to-stocks, paradigm, that big input has been a shift of manufacturing to China. But that shift is reaching its limits, even absent policy changes in China (and those changes are, to put it mildly, not going to prioritize consumer price stability in the developed world over other interests). This doesn't mean inflation is inevitable, but what it does mean is that the long deflation, and its effects on asset price correlation, will peter out over time. So in the future, while real rates will probably be low and stay low for a long time, the inflation component of them will likely be more volatile over the next few decades than before. And that means some of the easy diversification strategies will stop making sense. In a way, it's a transfer of agency: China's policymakers made the decision to build an export- and investment-driven economy, and took it much further than anyone could have imagined. In the aftermath of the 1997-98 crisis, they doubled down on this strategy, which had the side effect of making inflation low for the rich world. That made it easy for the rest of the world to make fewer choices. But now China's own options are more limited, and the rest of the world has more latitude, and more of an obligation, to decide specifically what the future will look like instead of backtesting and diversifying based on a one-time trend in the past. Further reading: The China chapter in Trade Wars are Class Wars has much more on China’s model. I previously wrote about China's economic development here, with more sources listed at the end. The classic on LTCM is When Genius Failed, and The Chastening is great on the 1997 financial crisis. ElsewhereTwo TurnaroundsThe Economist draws a parallel between Intel's turnaround efforts under Pat Gelsinger and Microsoft's successful turnaround under Satya Nadella ($), noting that an Intel turnaround will be harder because software changes faster than hardware. It raises an interesting question, though: chip fabs depreciate fast, both in accounting terms and in strategic terms. With the exception of unusual periods like right now, where there are shortages in some older chips, last decade's capital expenditures mean very little today, except insofar as they help build up employees' skills and customer relationships. Meanwhile, old software—especially the kind that came on CDs rather than over the cloud—needs indefinite support. I'm sure Microsoft employees in 2005 or so wished that old software eventually rusted through and got sold for scrap, instead of needing security updates and backwards compatibility checks. There's a sense in which a hardware company with a fast product cycle is always accumulating intangible assets through its old investments—while a software company is accumulating invisible liabilities as maintenance costs accumulate and interacting dependencies compound. Smart GlassesAny company that dominates one industry has to focus obsessively on what's adjacent to that industry. For information-based companies, this is a very broad problem, since human beings have so many ways to consume and share information. Facebook was surprisingly early to mobile, and still struggled with it early on. And now they're making an effort to be early to wearables with $299 smart Ray-Ban sunglasses. Because of FB's reliance on mobile, it needs to obsess over what's after, and one way to extrapolate is to look at how mobile improved on desktop: the cameras were built in, it was easy enough to access that it could be habit-forming, and mobile activity throws off more data.³ Wearables accomplish all of this; they're default in-use, so it's a bit like a smartphone that's surgically attached to your hand. They have cameras, although Facebook goes to excruciating lengths to tell users of its glasses to be polite about recording people. And since the two modes of interaction are audio and visual, they can input and output plenty of data. The long term trend for computing is that displays get higher and higher resolution, and closer and closer to the optic nerve; this is a natural step for Facebook, and one that they'd rather be early to than late to. For earlier thoughts on Facebook's near-death experiences, see here, and I wrote a bit about Ray-Ban parent EssilorLuxottica here. Credit Cards, Spending, and SplurgingJ.P. Morgan has acquired Zagat from the company that bought it from Google ($, WSJ). This is less weird than it looks: the equilibrium for US credit cards is that they're expensive for merchants but replace some marketing spending with transaction fees ($), and it's reasonable for a company that makes money from those fees to find ways to drive more transactions. It's also an interesting reversal of the tendency for other companies—big tech companies, airlines, hotels—to slowly evolve into fintechs in order to maximally monetize their customers. JPM is moving in the opposite direction, by starting with a monetization model and then acquiring some real-world products that complement it. The Cyclical CEO ConditionI've written a few times about how cyclical industries are driven by both supply/demand cycles and a management experience epicycle: when there's a serious downturn, the surviving CEOs are the ones who didn't splurge during good times and cut costs fast in the bad times. Another dynamic among cyclical companies is that there's M&A activity at the top (when everyone is flush with cash) and at the bottom (when the cheapest assets are very cheap indeed). And mergers do tend to improve the cycle, since a more consolidated industry is one where there's more restraint on investment and production. The CEO of Pioneer Natural Resources, a fracker that has acquired a few companies recently, talked about the game theoretic dilemma he faces at a conference yesterday:

It will be interesting to see if, in line with Matt Levine's many musings on index funds as a coordination mechanism for cartel-like behavior, there will be more take-one-for-the-team mergers in cyclical industries. Permanent PricingA few weeks ago, I noted that hiring bonuses for low-wage workers indicated that employers expected wage increases to be temporary, but there are signs that this is changing. Amazon is paying more employees' college tuition, although the price for this ($1.2bn by 2025, or $300m/year, which works out to $400 per eligible employee per year) indicates that they don't expect most of their employees to take the offer. And Walmart is replacing a quarterly bonus program with higher base compensation ($, WSJ). These kinds of offerings are hard to reverse, so it looks like at least some large employers expect recent wage increases to be permanent. 1 This point in particular is an important takeaway from Trade Wars are Class Wars. A cheap currency alone makes exports more competitive, but makes imports less competitive. So a country with a cheap currency can sell more cars, but has to spend more on factory equipment and components it can't manufacture domestically. But since households import more than the business sector, this policy amounts to a wealth transfer to business. Combine it with high savings (which substitute for consumption, which, especially as a country gets richer, has an imported component) and it means that the country continuously creates new savings that can be reinvested in more manufacturing and related infrastructure. 2 There's a symmetry here with the CCP's response to the fall of the USSR, which was not "communism is doomed" so much as "Glasnost starts the countdown to the collapse of communist governments, so avoid anything like it." 3 Location data by itself is not necessarily the best way to target ads: if you're walking past a store, you're probably not interested in going in (or you would have gone in), and if you've already gone in, you didn't need an ad to persuade you. But location data can be fantastic for making the social graph denser, since people who spend time together, or people who spend time with one another's mutual friends, can be connected on Facebook. You’re on the free list for The Diff. For the full experience, become a paying subscriber. |

Older messages

Longreads + Open Thread

Saturday, September 4, 2021

Construction, EDM, Talent, Aerospace, Applied Divinity Studies, Black Wednesday

Globalized Talent and the Brand Grab

Friday, September 3, 2021

Plus! Developing Vietnam; Liquidity, Discount Rates, and Theft; Shortages; Pigs and OPEC; Statistical Privacy

Longreads + Open Thread

Saturday, August 28, 2021

Games, MBO, Espionage, Manchukuo, France, Fracking, Banks

Warby Parker and EssilorLuxottica: Irresistible Force, Immovable Object

Friday, August 27, 2021

Plus! Cutting the Apple Tax; Messaging; China and Security; Cyber Risk and Coordination; CEO Training

Longreads + Open Thread

Saturday, August 21, 2021

News, Tutoring, Inequality, Chips, Bank Risk, Bank Founding, Energy

You Might Also Like

Are these the two best trading hours?

Saturday, January 11, 2025

Brand New Genesis Algo ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🌭 America gets the works

Friday, January 10, 2025

The US added a lot more jobs, TSMC posted strong results, and plumbing the depths | Finimize Hi Reader, here's what you need to know for January 11th in 2:57 minutes. The US economy ended the year

A Page From Uber's Playbook: Disrupting Social Media Marketing

Friday, January 10, 2025

Read the whole story here ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Design Your Dream European Getaway

Friday, January 10, 2025

Enter to win a chance to win a $20000 trip to Europe for free. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📉 Bonds saw a selloff

Thursday, January 9, 2025

Global investors dumped government bonds, UK shoppers got a break for Christmas, and Encylopedia Britannica became an AI company | Finimize Hi Reader, here's what you need to know for January 10th

Could private student loans help you?

Thursday, January 9, 2025

Find out if you qualify and compare rates today. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🏆 The Demi Moore of it all

Thursday, January 9, 2025

Plus, workshops on estate planning and taking control of your money. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦾 Anthropic looks jacked

Wednesday, January 8, 2025

Claude's AI startup flexed a new valuation, China sought to nudge shoppers, and a wild plot to smuggle drugs | Finimize Hi Reader, here's what you need to know for January 9th in 2:57 minutes.

3 reasons to buy life insurance

Wednesday, January 8, 2025

Make 2025 the year you protect your loved ones Why you should get life insurance now A decreasing bar chart Affordable rates Life insurance premiums typically increase with age or changes in health.

Eight days in and things are already changing

Wednesday, January 8, 2025

plus Tomdaya + birdwatching ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏