I first heard about NounsDAO from this tweet:

My first thought: this is word salad and I have no idea what it means.

My second thought: I am amused by the idea of a pseudonymous founder who identifies as a CryptoPunk NFT that he owns. Kids these days!

Then I found out this project, NounsDAO, has in less than two months amassed a community-controlled treasury worth $20M, growing by roughly $500K a day. (My third thought: What!?? I am ngmi 😭)

Here’s how it works.

On August 8th, 2021, Punk4156 and his team deployed a smart contract to the Ethereum blockchain that randomly generates a new NFT digital avatar (called a Noun) every 24 hours and auctions it off to the highest bidder. 100% of the auction proceeds get sent to a community treasury that is controlled by Noun owners. One Noun = one vote.

The Nouns look like this:

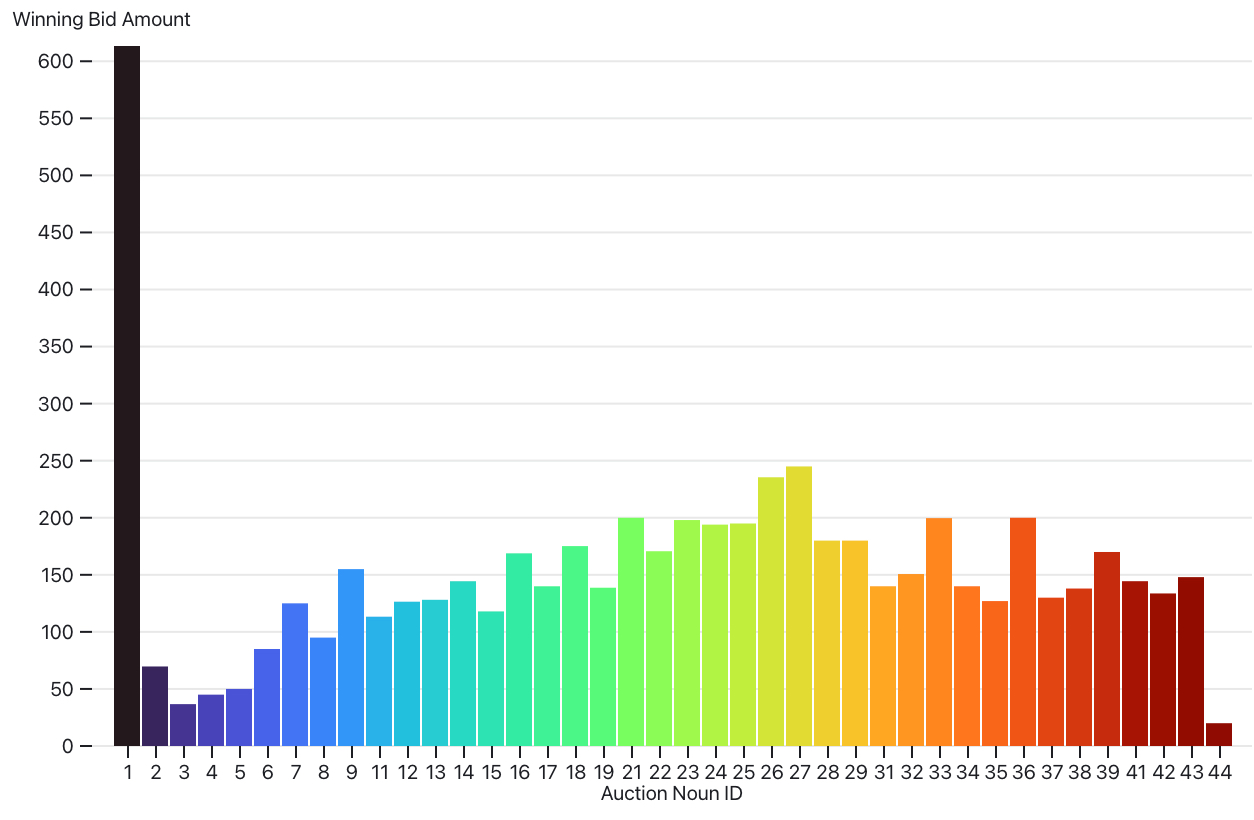

So far, the most expensive Noun was the first one, which sold for 613 ETH ($2.1M USD) to an anonymous NFT collector named xaix.eth. The cheapest Noun was sold a few days later for 36.69 ETH ($130K USD) to richerd.eth. After that, the price of Nouns began to rise and then stabilized at ~150 ETH ($532K USD).

Here’s a graph of the winning bid amount in ETH for each Noun so far:

(Source: Nounalytics)

The obvious first question is why are people spending so much money on these Nouns?? I had to find out.

So I started lurking in various self-proclaimed “degenerate” corners of Twitter and Discord, where spending millions on NFT memes is cool and using a real name or photo is not. These communities have all the exuberance of revolutionary France, and fully see themselves as destroying the Ancien Régime of law, culture, art, and power defined by modern democratic capitalism. The new ideology is crypto, and it is in the earliest stages of reshaping society.

The first phases of the internet, web1 and web2, were respectively defined by static one-to-many broadcast websites (e.g. Yahoo) and centrally controlled social networks (e.g. Facebook); in the long arc of history they will come to be seen as a fundamentally flawed and transitory technology, like the digital camera and MP3 player were to the smartphone, or how the Articles of Confederation were to the Constitution. To these crypto degens, web3 is the true and final form of the internet.

Once you start to internalize this paradigm, whether you agree with it or not, then you can begin to understand why someone might spend $2M on an NFT of a pixelated figurine that entitles them to a vote in a community-controlled bank account. If everything I said above is true, and we’re in a critical historical moment where the future is just beginning to be created, then maybe there’s a chance these projects will be looked back on by future generations the way we look back on Socrates’ Athens: the origins of a radical new way of life. If this is true, the value of these tokens could be immeasurable.

Of course there are some cynical people that are on the web3 bandwagon despite privately believing it’s all driven by a bullshit narrative designed to trick greater fools into paying hyperinflated prices for worthless jpegs. But I don’t think short-term flipping is the main cause of what’s happening right now. Genuine long-term belief in the paradigm is what’s driving the value of CryptoPunks, Beeples, Bored Ape Yacht Club, XCOPY, Loot, and a million other NFT projects.

Belief, though, may be hard to sustain in the long run. Without a sustainable business model, people will eventually get demoralized and distracted, and move on.

This is where NounsDAO stands out. Unlike most NFT projects, Nouns comes with a unique mechanism they hope will ensure Nouns remain valuable long into the future: a decentralized autonomous organization, or DAO.

With most NFT projects like CryptoPunks and Bored Ape Yacht Club, the initial run of NFTs are claimed by early adopters, who can then sell them and keep the profits, with a small percentage of each transaction going to the project creator. NounsDAO is different. In their case, 100% of the proceeds from the daily Noun auction get put into a community account on the Ethereum blockchain. Anyone who holds a Noun can propose a way of spending the money, and everyone else who holds a Noun can vote on the proposal.

But what will they spend money on? I’m glad you asked.

The purpose of the NounsDAO is to make Nouns more valuable. So far, they’re off to a good start. They’ve got $20M and counting as their budget to create demand for Nouns.

So far, NounsDAO has passed four proposals:

- donated some of their money to charity

- created 3D versions of the Nouns

- created a way for multiple people to bid on a Noun as a group

- created an API exposing data about when the next Noun auction will be

The point of these projects is to create a positive feedback loop that goes something like this:

- Convince people to spend money buying Nouns

- Use that money on projects that will convince more people to spend more money on Nouns

- GOTO 1

As the treasury grows, more and more ambitious projects that increase the value of Nouns can be undertaken. If those projects succeed, the treasury gets even bigger. For now the ideas are simple, but you could imagine wild projects like designer merch, a private IRL clubhouse, TV shows, theme parks, giant bronze sculptures in every major metropolitan area, etc. It seems silly, but maybe the next Marvel Universe will come from a DAO like this? A surprising amount of our daily experience is shaped by the desire to make vast pools of capital slightly more vast.

It might be tempting to interpret NounsDAO as a proof of concept for some other “more serious” DAO that has a more obviously important purpose. For example, MolochDAO is kind of like NounsDAO, except the purpose is to pool capital to fund projects that benefit the greater Ethereum ecosystem. It was a lot easier for me to wrap my head around that than NounsDAO, which solely exists to increase the value of Nouns. But yes, that really does seem to be the end game: to create a positive economic feedback loop for its own sake.

If this makes you queasy, The Nounders (the founders of NounsDAO) would probably ask you to consider whether it’s ultimately that different from any other business that exists to generate profit. Invest, profit, re-invest.

The big question, the thing I haven’t seen any clear thinking on, is what NounsDAOs strategy is for converting cash into demand for Nouns. Honestly I’m skeptical. But it’s worth taking a moment to remember they currently have $20M in their bank account after being in business less than two months. I gotta admit: so far so good!

But if you want to predict what will happen in the future, it’s helpful to understand why they’ve succeeded so far. That way you can look at the forces involved and ask yourself how and when they might run out of steam.

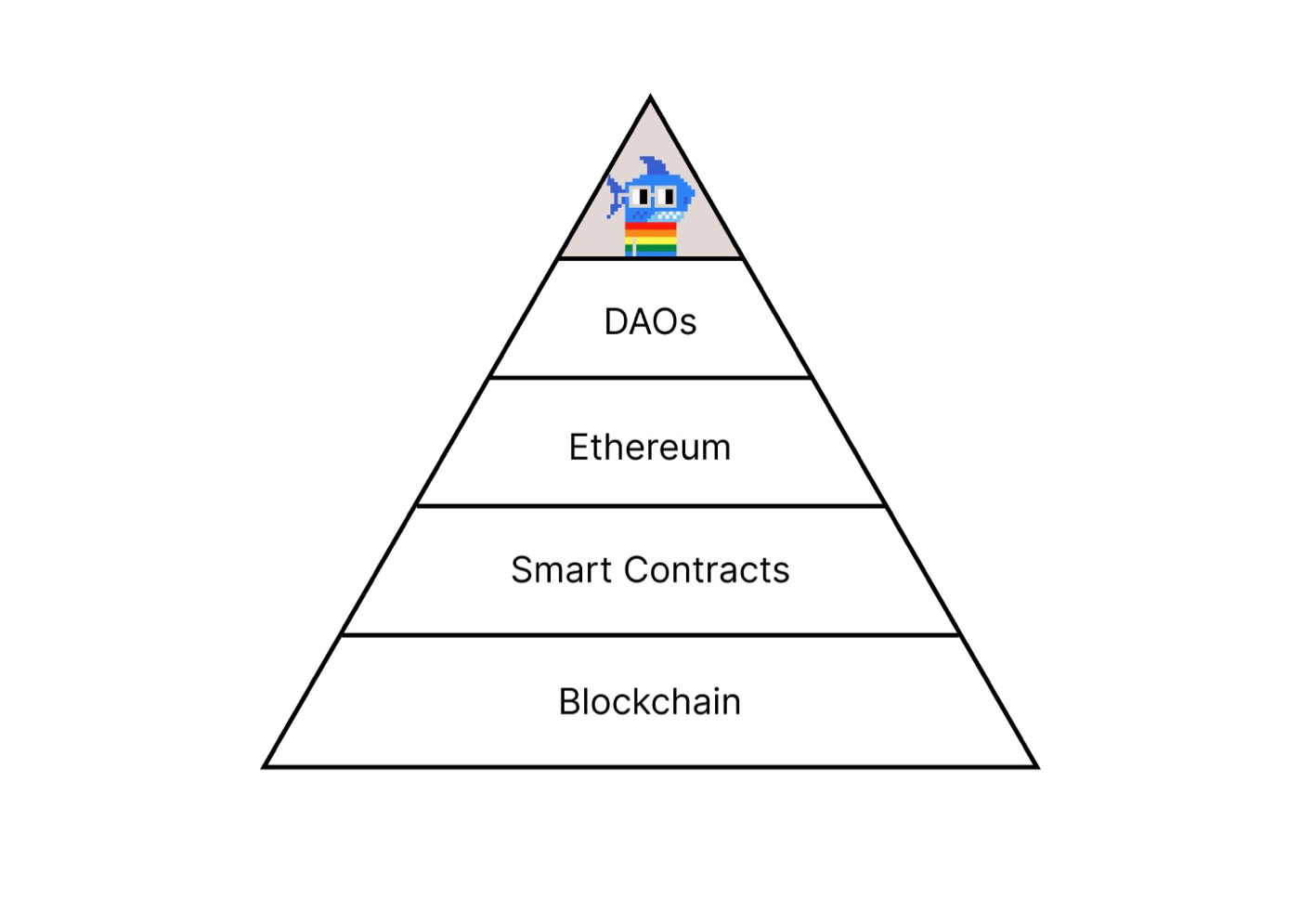

My read on NounsDAO’s current success is that it’s a function of a pyramid of belief. Take away any one layer, and the whole thing collapses.

At the top, there is belief in NounsDAO. But without belief in the lower layers of the stack NounsDAO can’t continue to attract $500K per day. It’s pretty unlikely that general belief in blockchains, smart contracts, and Ethereum will fade, but I suspect belief in DAOs is fragile. And no matter how big NounsDAO’s treasury may seem, it’s nowhere near big enough to turn the tide if that excitement begins to fade. Live by the hype, die by the hype.

If DAOs really are the future, if they end up supplanting joint-stock corporations as the best and most common way to organize economic activity, then I believe key early experiments like NounsDAO have a good shot at retaining their value. It would be like owning a piece of art connected to the East India Company. But this is only possible if the Nounders (founder) and members of NounsDAO don’t screw it up. Which is itself a test of the question of whether or not DAOs are a good way to organize a group of people towards creating sustained economic value.

I am curious, but skeptical.

DAOs are basically like if you started a business that went public on day 1, and held shareholder votes way more often.

This is exactly the opposite of what most late-stage startups over the past decade have decided to do. They’ve opted to stay private longer and give up less control when they do. One theory why this happened is that these companies are better able to unify around a strategy driven by a visionary founder. But also, founders generally just don’t like giving up control unless they have to, and as competition amongst investors has increased and eroded their bargaining position, they could no longer force founders to give up as much control.

DAOs are basically the opposite of this. They believe “ask the audience” is the winning strategy, and if you set up the right decision-making systems, collective wisdom is greater than individual vision.

One way to think about it is the next wave of democratization. First, we devolved power from monarchs and dictators to elected representatives in the management of nations. Now perhaps we’ll see a similar shift of power to the people in the management of businesses.

So, will DAOs supplant corporations? Will NounsDAO ultimately make it? Like I said, I’m skeptical, but trying to stay open.

I’m not rooting for or against yet. I’m trying to understand.

PS—We’re working on something new here at Every and I’d love to run it by you! If you have a few minutes to chat, book a time here.

PPS—One thing that didn’t fit in the piece but is worth noting: NounsDAO and most other DAOs are almost certainly violating the letter of securities law, as currently written. But maybe they’re not violating the spirit of the law? The goal of these laws is to increase transparency for investors, which makes less sense in the DAO context given that all of the code and transactions are publicly visible on the blockchain, but it’s worth noting that the legal status of these things is unclear.

Ok that’s it!

Thanks for reading, I’d love to hear what you think. If you liked this (or didn’t) click the feedback buttons below.