A House of Brands Allows for a Concise Acquisition Strategy |

There is a semblance of schadenfreude when The New York Times publishes a pretty intense piece confirming what many in media already believed about Ozy. Before we talk about that, let's actually discuss some substantive media news. |

But before all that... A message from our sponsor, Omeda. |

If I were starting a new media company today, Omeda would be the first company I would talk with to discuss their software. |

The best time to start collecting data on your audience is as soon as you realize you need it. So, on day one of starting a media company, I’d want to have the infrastructure to do that. But then I’d also need to think about acquiring users, engaging them, and monetizing them appropriately. |

Omeda’s “owned audience strategy” in a box effectively allows you to do that. The individual is at the center and then the various pieces of the tool—CDP, ESP, paid-subscription management system, etc.—are built around that individual data. |

One of the reasons I find a house of brands strategy so compelling is because of the relative ease in adding new publications to the network. Unlike acquiring a publication and trying to force it into an existing brand, the house of brands strategy keeps things simple. |

And when I say the words ease and simple, I don't mean there isn't work. There obviously is. But the strategy is not complicated. The front end—what the user reads and consumes—likely doesn't change. This oftentimes includes the name. But the back end—the systems, the sales team, the growth, etc.—does change. It gets streamlined with costs spread across all the publications. |

This is why it should come as no shock that we're seeing a lot of M&A activity from these types of companies. First, there's IAC, which is rumored to be acquiring Meredith. According to The Wall Street Journal: |

IAC/InterActiveCorp. IAC is in advanced talks to acquire magazine publisher Meredith Corp., owner of brands including People and Better Homes & Gardens, according to people familiar with the situation, in an effort to build more scale in online publishing.

The deal, which is expected to be valued at more than $2.5 billion, would vastly expand IAC’s collection of online publications, which include Brides, Serious Eats and TripSavvy, the people said. It would also bulk up IAC’s portfolio of websites, which has shrunk recently after the company moved to spin off online-dating behemoth Match Group Inc. and video-hosting and sharing platform Vimeo Inc.

The Meredith titles that IAC would acquire—which also include Real Simple, Allrecipes and InStyle—would become part of Dotdash, IAC’s publishing division, one of the people said. Formerly known as About.com, Dotdash controls 14 websites that collectively reach over 100 million people each month, according to IAC’s website.

|

If we dig into Meredith's FY 2021 financials, it shows a pretty interesting story. National Media, which consists of many of the brands we know (People, AllRecipes, Health, InStyle, etc.), generated $965.4 million in advertising-related revenue. Consumer-related revenue was an additional $992.8 million. Finally, it generated $66.3 million in "other" revenue. In total, it generated $392.3 million in adjusted EBITDA. |

So, at a valuation of more than $2.5 billion, it's buying Meredith for roughly 6.3x 2021 EBITDA. |

When you're dealing with valuations this high, the right or wrong becomes far more subjective. But the deal is certainly very interesting from a broader perspective. At the core, what we're looking at is IAC very squarely pushing Dotdash forward as its 12th spin-off. According to a WSJ story from over the summer: |

Solid margins, coupled with strong revenue growth in the first half of the year, have analysts across six different banks valuing Dotdash at an average of just over $1.9 billion—a premium to BuzzFeed despite its smaller size.

|

If this deal were to close, it would effectively turn Dotdash into a business valued at over $4.4 billion. Not bad. But one thing is interesting. Based on my calculations over the summer, if Dotdash was valued at $1.9 billion, that meant it was being valued at 28.7x 2020 EBITDA. Now it's unfair to compare valuations based on Dotdash's 2020 numbers and Meredith's 2021 numbers, but I can tell you, there's still likely a very big delta between the two. |

In some respects, I wonder if investors were looking at Meredith through a messy lens because the business has made some big mistakes. And could it get a cleaner look as part of Dotdash, giving IAC a bit of an arbitrage opportunity? One man's trash is another man's treasure. |

I am curious to see what IAC would do with titles like People and Entertainment along with the entire magazine business. People and Entertainment don't really fit the type of content that Dotdash likes to create. Could Dotdash look to quickly sell these to another publisher and focus on the more lifestyle-related publications? I wouldn't be surprised. |

On the magazine side, my suspicion is that they'll continue to operate them. In 2020, Meredith generated $611.8 million in subscription revenue; fast forward to 2021 and that was down to $564.7 million. At what point does it make sense to shut these down? |

Even before that question has to be answered, the business will have to undergo a seismic shift in focus. Most magazine companies are still led primarily with a print subscription mentality. Dotdash is purely digital. Therefore, I anticipate that there will be a hyper-focused approach to ensuring Meredith's network is up to par with Dotdash's. I would expect to start seeing Dotdash move quickly to integrate its technology across the network of sites. This coupled with its ad stack would be critical to pushing revenue growth at the brands. |

And this is why the house of brands strategy is so straightforward for Dotdash to execute against. Meredith comes to the table with a multitude of brands and large audience numbers; Dotdash can streamline things and really push them to the next level. |

If we turn our attention to the B2B side of media, we see that Industry Dive has made another acquisition this year by purchasing PharmaVOICE. According to Axios: |

"We've built a platform that allows us to acquire publications to enter new markets or build audiences in our existing ones," Griffey told Axios.

Why it matters: The company, which is expected to finish 2021 with more than $80 million in revenue, is pursuing a similar strategy to several other media companies that are trying to remain independent: acquire small brands to get bigger incrementally.

Details: PharmaVOICE is a hyper-niche publication read by roughly 60,000 pharmaceutical executives. The company, which also produces events and podcasts, will remain a standalone brand under Industry Dive.

|

When Industry Dive sold to Falfurrias Capital Partners in 2019, it generated roughly $30 million in revenue. In November 2020, Digiday reported that Industry Dive had "30% profit margins on $60 million in revenue, $40 million of which came [sic] its core ad business." Suffice it to say, it should come as no shock that it has grown to over $80 million in revenue. |

Industry Dive, as well, is a house of brands model. Originally, it was purely organic. It launched new publications and grew them methodically. But starting in July 2020, it began to acquire other businesses. First was the marketing side of Newscred, which allowed Industry Dive to spread services across its entire network of sites. After that, it added other publications to go deeper into specific audiences. |

At this point, the strategy is likely a playbook. First, it finds publications that it wants to go deeper on or expand into. It picks them up. Second, it starts integrating its 1st-party data stack into what they do. For Industry Dive, the ability to target a specific type of person who is interested in certain stories is critical; therefore, it needs to start collecting that data from the acquired properties as soon as possible. And finally, it can start to generate more revenue by taking its current partners and bringing them onto those new sites. |

Like I said above, it is a very straightforward strategy, but that doesn't mean it doesn't take a lot of work. Many of these old publications are dilapidated and likely have horrible technology. It takes work to get them to the point where Industry Dive can really start to generate a return on them. |

Ultimately, scale matters. On their own, all of these publications are very small and likely don't carry much of a premium. But in aggregate, they're an enticing asset. That is likely what Falfurrias and the entire Industry Dive team saw when they first made their deal in 2019. |

Taking a look at Ozy's numbers |

The whole Ozy story is fascinating and has blown up over the past 36 hours thanks to the good reporting by The New York Times' Ben Smith. The entire story is worth reading (including what sounds like securities fraud), but I wanted to focus on two small parts. In the story, he wrote: |

Ozy doesn’t rely on standard measurements of traffic, but the best known service, Comscore, shows nothing close to the company’s public claims. According to Comscore, Ozy reached nearly 2.5 million people during some months in 2018, but only 230,000 people in June 2021 and 479,000 in July. Mr. Watson called the Comscore numbers “incomplete,” noting they don’t include impressions on platforms ranging from social media to television and podcasts.

...

Jason Urgo, the head of the analytics firm Social Blade, said Ozy’s YouTube effort “doesn’t really stand out as a breakout channel.” On the channel, many videos have more than a million views but fewer than a hundred comments, an unusual ratio for YouTube that suggests the views aren’t coming from regular YouTube watchers, Mr. Urgo said. Other videos on the channel have fewer than a thousand views.

|

Ozy says it gets 50 million monthly unique visitors. Comscore says it gets ~500,000. SimilarWeb, which I tend to trust, reports that Ozy.com got 620,800 visits in August (and a visit is not a visitor). Ozy says it has 25 million newsletter subscribers; however, if it does, it must have abysmal open rates since SimilarWeb records almost no traffic coming from email. |

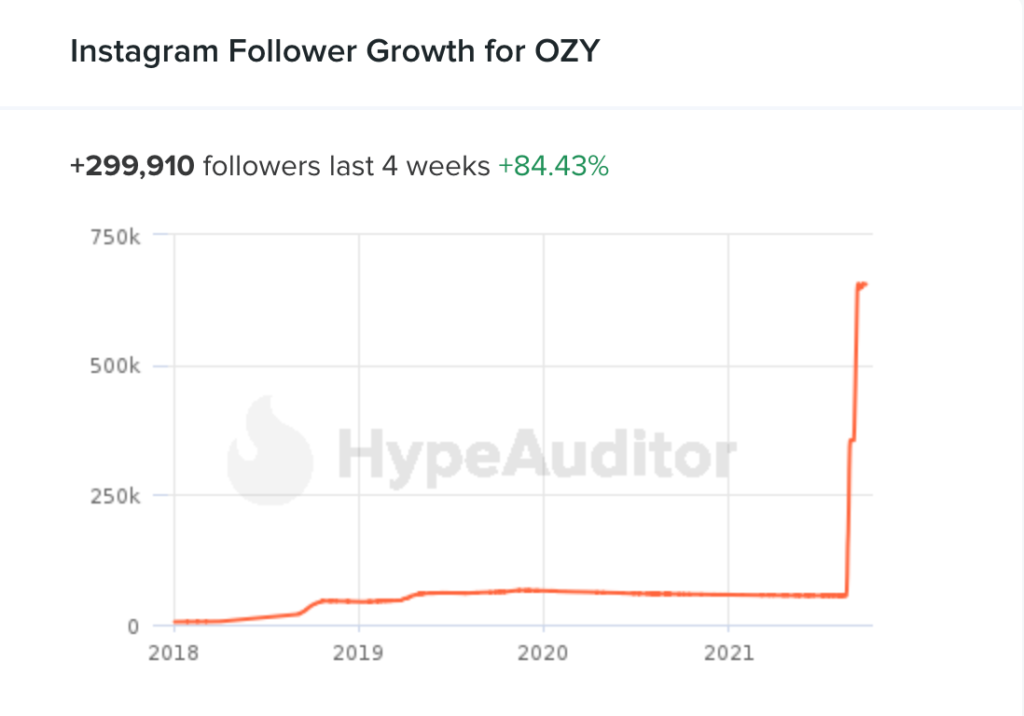

It's hard to look at this and think that this is anything other than a very carefully architected fraud. A reader in the AMO Slack channel shared these two images showing sudden growth in Ozy's social accounts these past couple of weeks. |

Second, co-founder Carlos Watson's Instagram. |

I don't know about you, but this just doesn't look natural. I've heard of hockey stick growth, but this is something entirely different. It makes me wonder. Did Ozy find out that Smith was digging around on this story and decide to start making the numbers look inflated? |

Suffice it to say, it will be very interesting to see how this plays out. For years, many in media wondered what Ozy was actually doing. Now it seems we're getting some clarity. |

Thanks for reading today's newsletter. If you have thoughts, please hit reply. And to read even more AMO and join the AMO Slack channel, upgrade to a premium membership today. Thanks and see you next week! |

|

|

|