The Signal - Nintendo’s stuck in HD

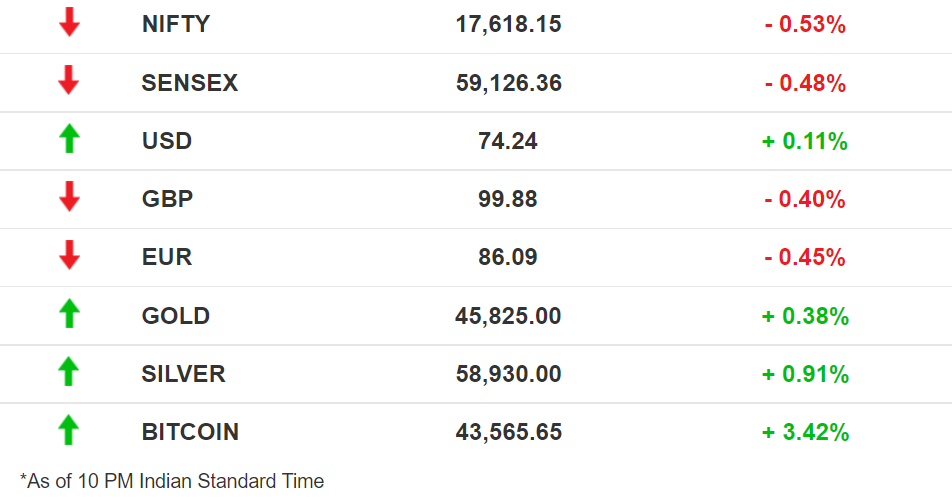

Nintendo’s stuck in HDAlso in today’s edition: A few more rich men, Google gets some context, Retailers all in on DiwaliGood morning! Macy’s isn’t hiding its dislike for Amazon. It is fighting so the everything store doesn’t put up a giant ad above its store in New York City. And so Amazon can’t put that sign up, Macy’s has sued the company that lets out the ad space. Things are getting crazy out there. Btw, we’ve got a new podcast going. It drops every weekday at 5-ish PM. Give us a try. Subscribe, turn on notifications, and give us a shoutout on social media.   The Market SignalStocks: Benchmark indices reversed their behaviour from recent sessions to collapse post midday. However, sectoral performances continued in the pattern set for the week with Metal, Realty, and PSU Bank recording gains while most others closed in the red. Perhaps in response to recent divestment announcements, stocks of government-owned stocks are performing well. One Percent Of One Percent Gets A RefreshThe IIFL Wealth Hurun India Rich List 2021 is here, featuring a record number of fresh faces thanks to the startup funding and IPO boom. As many as 229 new names adorn the list that tracks India’s richest. Over 1,000 Indians now have a wealth in excess of ₹1,000 crore, as the cumulative wealth of those listed increased by 51% over the period. *cough* K-shaped *cough* Now, we’re sure you’re tired of reading the same old names (Mukesh Ambani, Gautam Adani, and Shiv Nadar who top the list in that order). So we’ll roll out some fresh ones. Searching for bugs in software? Boring. Rising to an individual wealth of ₹12,400 crore each while doing it? Not so much. Just ask BrowserStack founder Nakul Aggarwal and Ritesh Arora. Another lucrative business? Making chemicals, apparently, propelling Ajaykumar Patel, Ashok Boob, Venkateswarlu Jasti, and Ravi Goenka of Tatva Chintan, Clean Science, Suven Pharma, and Laxmi Organic respectively onto the list. Naveen Tewari of InMobi is a surprise new entrant in that he wasn’t already there. Meanwhile, Adar Poonawalla of the Serum Institute of India can now further expand his car collection which already features a ‘Batmobile’. NintenD’oh!It is not usual for one of the top three gaming companies to take a misstep in the high-stakes industry. That too with a successful product. Nintendo, however, appears to have missed a trick with its gaming console Switch which does not support high fidelity 4K graphics, a common feature in rival products. Underpowered: What is perplexing is that it had distributed 4K software toolkits to developers working on games for the Switch, according to Bloomberg News. Nintendo denied that it was planning a new console with higher resolution capabilities but the report claims it was until disrupted by a shortage of components due to the pandemic. It’s getting hot: The misstep comes at a time when the gaming industry is really heating up. Netflix bought a game studio and Amazon (finally) delivered a hit with New World. Game publisher EA Sports has been flexing its muscles. Console rivals Microsoft and Sony have ratcheted up the power and performance of their machines while the Switch, despite being a bestseller, has made only incremental upgrades. Your Google Search Might Start Looking DifferentContext, they say, is everything. And that’s the bandwagon Google is now hopping onto, especially for its flagship search engine. It will use something it calls “Multitask Unified Model” technology to make search more intuitive. Sounds complex? Let us break it down. What the MUM? In simple terms, MUM will understand what you are searching for, and pull out relevant information around the same. This will happen via “things to know” boxes Google will add to its search results. So, if you are searching (or asking) something travel-related, Google could cull out queries such as “Things to do” in the place you are searching for. Sounds simple? This, it says, is also to combat the misinformation menace. Former Google CEO, Eric Schmidt has a different take. The lens on shopping: When was the last time you searched for a product on Google? Not sure? We neither. But now, Google wants you to do that. How? Through Google Lens, again with MUM — Google will let users search for and seek more information such as similar products, check inventory, and shop.

The Hubs Are HitPower shortages and rising commodity prices shrunk Chinese factory activity in September, a first since the pandemic began. The manufacturing purchasing manager’s index (PMI) fell to 49.6 from 50.1. A figure below 50 indicates contraction. Double tap: Covid-19 has also forced the other Asian manufacturing centre, Vietnam, to shut down, snapping global supply chains just ahead of the holiday and shopping season. China, the world’s second-largest economy that makes everything from toys to semiconductors, slowing down will have a twin impact. As supplies from there dry up, shortages will increase elsewhere and prices will rise. Chinese factories and construction slowing down will also reduce consumption of metals and other commodities, hitting exports of other countries such as India and Brazil. That is not good news. Is That An Oasis We See?The sale of daily groceries, a good gauge of buying enthusiasm, went up marginally in September. By about 1%. It doesn't sound like much but context is everything. This comes after the bottom fell out in August when there was a 14.5% drop in sales. This has to be green shoots: People are spending again. Finally. Compared to last year, FMCG sales grew 29.7%. Sure, the base is low. But with big sales of Amazon and Flipkart incoming, the numbers could perk up. Unusual cheer: Unusually, demand and spending are coming from rural areas and from people who make anywhere between ₹2 lakh-₹5 lakh a year. What does it mean: Most states are lifting restrictions. Net jobs created is still in the negative, but after months of being locked indoors, there is some movement in the economy. But this could also be a one-time spike because of the festive season and it could all slip into the red soon. What Else Made The Signal?Tatas for AI: The minimum sale price for Air India may be set at ₹15,000-₹20,000 crores based on its projected future cash flows, brand value, and intangible rights. The Tata Group is most likely to get control of the carrier. Vaccine update: AstraZeneca’s vaccine has an efficacy rate of 74% at preventing Covid-19. It was lower than the 79% reported in March but in individuals over 65 years, it increases to 83.5%. Quick charge: Swiss company ABB has debuted the world's fastest electric car charger. The Terra 360 can completely power up EVs within 15 minutes and charge upto four vehicles at one time. Growing strategy: Facebook deepens Instagram integration with new cross-app chat features, including polls in Instagram DMs. Growing short: While the rest of the world is growing taller, Indians are now shorter than they used to be. Researchers believe it's a result of low nutrition and standard of living. Towards goals: Ola Electric has raised over $200 million in a new financing round at a valuation of $3 billion, to expand its product portfolio with electric motorcycles and scooters for the mass market. Going big: Bharti Airtel is investing ₹5,000 crore to expand its data centre business. It also unveiled a brand ‘Nxtra’. FWIWBidding adieu: Gary Wipfler, Apple’s treasurer who was tending to the company’s ~$200 billion cash mountain, has retired after a 35-year stint with the iPhone maker. Treasured wall: Stonemasons digging out a remote French mansion had a field day – they discovered over 1 million euros ($1.2m) worth of gold coins in the walls. The 239 gold pieces date back to before the French Revolution. Bon Appétit: Japan has a vending machine culture that pops out more than just blasé soda and snacks. There’s one in Kyoto that dispenses authentic French cuisine! How exotic! Want to advertise with us? We’d love to hear from you. Write to us here for feedback on The Signal. If you liked this post from The Signal, why not share it? |

Older messages

Oh America

Thursday, September 30, 2021

Also in today's edition: Amazon's kooky gadgets, The many shapes of Metaverse, Oyo IPO may get stuck.

Who has Swiggy gotten in bed with?

Wednesday, September 29, 2021

Also in today's edition: Adani enters e-commerce, Brexit from Britain, TikTok is a user unicorn.

India needs chips. Bad.

Tuesday, September 28, 2021

Also in today's edition: Festival face-off, Gig work pays but scares, Pet boost to the economy.

Who is Facebook's Marlboro Man?

Monday, September 27, 2021

Also in today's edition: Power cut in China, Google spies on staff, Quad is about vaccine now

Why an RSS affiliate is building Kerala’s largest supermarket chain

Saturday, September 25, 2021

Hint: It is not about business

You Might Also Like

The Gratitude Shift: From 'Grateful For' to 'Grateful In'

Wednesday, November 27, 2024

For many of us, 2024 has been a year of extremes. The highs have felt exhilarating, and the lows have been profoundly difficult.

Short Video 101

Wednesday, November 27, 2024

It's as easy as 1, 2, 3.

⏰ Black Friday Countdown: 2 Days to Go!

Wednesday, November 27, 2024

Alert: Incoming Savings!

Google uses search remedies trial to subpoena OpenAI, Perplexity and Microsoft over their generative AI efforts

Wednesday, November 27, 2024

In an attempt to show AI has created a more competitive search industry, Google is trying to get OpenAI, Perplexity AI, and Microsoft's strategies to defend its own. November 27, 2024 PRESENTED BY

🔔Opening Bell Daily: US exceptionalism

Wednesday, November 27, 2024

The classic advice to diversify with international stocks has become a losing strategy for portfolio managers.

How this founder scaled to $4.6M ARR and a 13x revenue exit!

Wednesday, November 27, 2024

Let's break it down!

MAILBAG! FCS Bowl Games, FBS regular season expansion, and more:

Wednesday, November 27, 2024

Plus, EVEN MORE EXTRA POINTS BOWL PICTURES

Into the black

Wednesday, November 27, 2024

Offshore crypto-gambling is having a moment ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

1 minute to increase your email open rate

Wednesday, November 27, 2024

Every year we bring the highest quality software to RocketHub for an insane BFCM event. This year is no different! BFCM starts now so check the page below for one new lifetime deeaaal drop each day.

Memo: The Distressed Brand

Wednesday, November 27, 2024

The opposite of brand equity isn't no equity; it's brand apathy. View this email in your browser 2PM (No. 1014). The most recent letter was read by 46.1% of subscribers and this was the top