The Signal - You ready for Fortnite the film?

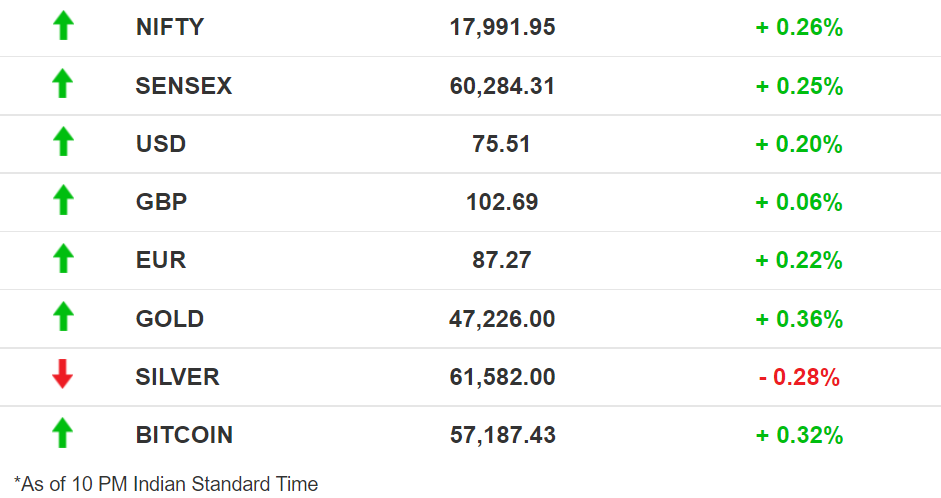

You ready for Fortnite the film?Also in today’s edition: Facebook bends the knee, TakaTak x Moj, China down but India upGood morning! We’re always amused with crypto pump and dump schemes. Here’s what happened. CoinDesk published a story about the setting up of a UAE-based blockchain and crypto fund. Everyone was excited. Cryptocurrencies, all of them, soared. Then CoinDesk sheepishly apologised and pulled the story. It seems the fund was imaginary. Prices promptly fell. Someone, somewhere made a lot of money. Btw, we’ve got a new podcast going. It drops every weekday at 5-ish PM. Give us a try. Subscribe, turn on notifications, and give us a shoutout on social media.   The Market SignalStocks: Benchmark indices inched higher to register fresh record closes. Among the sectoral indices, Auto continued its rally and was joined by all others except for IT. Interestingly, Foreign Institutional Investors were net sellers for the sixth consecutive trading session, pulling out ₹278 crore. Domestic Institutional Investors were also net sellers, pulling out ₹741 crore. The Brief Facebook RetreatWith the regulatory gaze firmly on Facebook globally, the company says it will stop linking users’ Instagram and Facebook accounts without their consent. This, Facebook claims, will improve user privacy and “is consistent with evolving advertising, privacy, and regulatory environments”. What does this mean? Simple. If your Facebook and Instagram accounts aren’t linked via the Accounts Center, the company will consider you as distinct users on the platforms. Until yesterday, if you logged on to the platforms from the same device or with the same login (email), you were counted as a single user. Upping the ante: Meanwhile, Europe is turning the heat on social media platforms such as Facebook and Google with measures to prevent misuse of microtargeting. A draft proposal now requires the companies to disclose detailed information on political advertising, especially around “how much is spent on particular campaigns, who is the buyer and whether the ad was amplified by an algorithm”. In A First, Sebi Bans A Rating AgencyMiffed with a series of debt defaults over the past four years, the Securities and Exchange Board of India (SEBI) is tightening the screws on credit rating agencies (CRAs). The markets regulator is set to cancel the license of Brickwork Ratings. It will also ban two former senior employees at Care Ratings. Why? SEBI’s investigations have found that rating committees at CRAs such as Brickwork lack independence and sometimes eschew standard procedures. Managements collude with these agencies to present a wrong picture of companies’ liquidity position. Coming on strong: The ratings business is built on a fundamental contradiction: companies that CRAs rate are also their source of revenues. CRAs’ role has attracted scrutiny every time a company defaults on highly rated debt, often triggering financial crises. SEBI is looking to reduce events such as the IL&FS debacle in 2018 and the more recent Essel group default. In both cases rating agencies had failed to warn investors before the event. The Post-TikTok Era Is HereThere it is. Consolidation has begun in the Indian short video market. Sharechat, which owns short-video platform Moj, is said to be in talks to buy Times Internet’s MX TakaTak for an undisclosed amount, Mint newspaper reported citing unnamed sources. Both the companies have a common backer in Chinese behemoth Tencent. Times Internet, meanwhile, continues to own another short video app, Gaana HotShots. In TikTok’s wake: Last year, TikTok, the undisputed short video app leader globally, was banned in India. More than 17 apps sprung up overnight to fill the void and capture its orphaned user base of 300 million users. More than a year later, the top four — Moj, Josh, MX TakaTak, and Glance Roposo — were still vying for the top spot. Some of the others bowed out. Global players such as YouTube and Instagram suffer from class issues. And Snap seems to be on the surge in India, especially among younger users.

Epic’s Mortal KombatIts ongoing legal battles with Apple and Google have restricted Fortnite-maker Epic’s growth on mobile devices. So it’s looking for loot elsewhere. Rumours are swirling ($) around that it may airdrop into the scripted-programming scene i.e. TV shows and movies. Be-witched: Nowadays it’s a route well paved by many franchises that have successfully made the transition from games to script. Some pioneers from the ‘90s such as Streetfighter, Mortal Kombat, and Lara Croft: Tomb Raider were hit or miss. But of late, they’ve been making the leap with greater success. Sonic the Hedgehog raked in nearly $320 million, while The Witcher (at least then) was Netflix Originals’ most-viewed season debut. Squad game: A Fortnite movie may well be in the offing as countless collaborations have helped spread its roots deep into the entertainment industry. From Marvel and DC to Disney, Epic has teamed up with everyone. It also has three former Lucas Films executives on board who have worked on franchises such as Star Wars. It also regularly hosts short film festivals, and has a foot in the door with certain audiences. PS: Reed Hastings wasn’t entirely wrong. Thumbs Down For China, Up For IndiaPresident Xi Jinping’s crackdown on Chinese tech companies has shifted the course of private capital flows from that country to neighbouring India, the dean of a top diplomacy school has argued in Foreign Policy magazine. Shifting flows: Venture capital investments in Chinese startups fell from $17.3 billion in June to $4.8 billion the next month while those in Indian counterparts went up from $1.6 billion to about $8 billion. This when capital flows into startups in China were 10 times that of those into India in January-March, 2021. Private equity firm Tiger Global has ramped up investments into Indian start-ups, 25 at last count. Japanese Softbank has halted China investments but said it would put $4 billion in Indian companies this year. Risky bet: Yet, Bhaskar Chakravorty, dean of global business at Tufts University’s Fletcher School of Law and Diplomacy, contends that India is an alternative but not the ideal destination for investors. He points to scaling up in the price-conscious country, lack of appetite from big firms to buy small ones, difficulty in exiting through IPOs, and regulatory uncertainties among key risk factors. What Else Made The Signal?VI lifeline: A few months ago, when he stepped down as chairman, Kumar Mangalam Birla was even willing to give up his stake in Vodafone Idea. Now Birla may pump in his own capital into distressed Vodafone Idea, although likely less than the rumoured ₹10,000 crore. Small leeway: Multinational banks operating in India will be allowed to store some data such as customer names, addresses, and limited KYC details on overseas servers. In-cred-ible: A TechCrunch report claims that fintech startup CRED is seeking funding at a $5.5 billion valuation. iReady: Apple has announced a hardware event for October 18, where it’s expected to launch a pair of new MacBooks, a redesigned higher-end Mac Mini, and possibly a pair of third-generation AirPods. Truce: After a year-long legal battle and a botched sale of assets to Reliance, the Future Group may negotiate with Amazon once the Singapore International Arbitration Centre (SIAC) delivers its initial rulings this month. That was kwik: Following a round of ESOP sales, Mobikwik’s valuation has jumped from $720 million in May to $1 billion now, ahead of its IPO. Dear neighbour: Swiggy is set to test the waters of social commerce with the launch of group buying for groceries. FWIWGifts of secrecy: As with a lot of bungled presidential pursuits, it turns out that former president and failed casino owner Donald Trump’s administration also messed up receiving gifts. From Jared Kushner holding on to two swords and a dagger from the Saudis, which were unaccounted and unpaid for until after he left office, to former second lady Karen Pence taking two gold-toned place cards, a bunch of exchanges overrode the country’s code of conduct on the same. The Matrix wins: Who isn’t pumped about The Matrix Resurrections? The cast and crew of Venom: Let There Be Carnage. Hardy's comic book sequel film had to readjust a number of its filming sequences because the Keanu Reeves-starrer was shooting at the same location in San Francisco and took up much of the space. Embracing the rainbow: Henceforth D may as well stand for diversity in DC Comics. The publisher has announced that Superman’s son, Jon Kent, is bisexual. While other comic book characters have come out of the closet in the past, including DC’s Robin and Marvel’s Captain America, this will perhaps be one of the most popular additions to the fictional LGBTQ+ community. Want to advertise with us? We’d love to hear from you. Write to us here for feedback on The Signal. If you liked this post from The Signal, why not share it? |

Older messages

Missing the democratic republic of TikTok

Friday, October 8, 2021

Also in today's edition: A zee-gzag affair, Biyani's festive gift to Ambani, Saudi Arabia joins the EPL.

IL&FS dominoes are still falling

Thursday, October 7, 2021

Also in today's edition: Will fuel inflation derail recovery? No stopping shoppers, Steve Jobs' legacy endures at Apple

There is gravy in meat

Wednesday, October 6, 2021

Also in today's edition: PVR and chill, Facebook shrugged, Will Swiss Re be third time lucky?

Brace for blackouts

Tuesday, October 5, 2021

Also in today's edition: Thrasio enters India, Whistleblower lights a fire under Facebook, Oyo checks in for IPO.

Covid may be licked soon

Monday, October 4, 2021

Also in today's edition: Tesla has a model quarter, Jobs are where you are, Apple is big game

You Might Also Like

The Gratitude Shift: From 'Grateful For' to 'Grateful In'

Wednesday, November 27, 2024

For many of us, 2024 has been a year of extremes. The highs have felt exhilarating, and the lows have been profoundly difficult.

Short Video 101

Wednesday, November 27, 2024

It's as easy as 1, 2, 3.

⏰ Black Friday Countdown: 2 Days to Go!

Wednesday, November 27, 2024

Alert: Incoming Savings!

Google uses search remedies trial to subpoena OpenAI, Perplexity and Microsoft over their generative AI efforts

Wednesday, November 27, 2024

In an attempt to show AI has created a more competitive search industry, Google is trying to get OpenAI, Perplexity AI, and Microsoft's strategies to defend its own. November 27, 2024 PRESENTED BY

🔔Opening Bell Daily: US exceptionalism

Wednesday, November 27, 2024

The classic advice to diversify with international stocks has become a losing strategy for portfolio managers.

How this founder scaled to $4.6M ARR and a 13x revenue exit!

Wednesday, November 27, 2024

Let's break it down!

MAILBAG! FCS Bowl Games, FBS regular season expansion, and more:

Wednesday, November 27, 2024

Plus, EVEN MORE EXTRA POINTS BOWL PICTURES

Into the black

Wednesday, November 27, 2024

Offshore crypto-gambling is having a moment ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

1 minute to increase your email open rate

Wednesday, November 27, 2024

Every year we bring the highest quality software to RocketHub for an insane BFCM event. This year is no different! BFCM starts now so check the page below for one new lifetime deeaaal drop each day.

Memo: The Distressed Brand

Wednesday, November 27, 2024

The opposite of brand equity isn't no equity; it's brand apathy. View this email in your browser 2PM (No. 1014). The most recent letter was read by 46.1% of subscribers and this was the top