3 Key Reasons to Think Long Term With Bitcoin

[Reminder: None of the opinions expressed in this piece should be construed as financial advice. Please do your own research] This is one of those articles that a certain DIY company would insist “does exactly what it says on the tin.” Bitcoin is a powerful asset, and one that has probably not yet revealed just how powerful. Understanding why you should always ensure you have some safely put away is a key element to planning for your future and is, without a doubt, the basis of one of the most common questions I am asked.

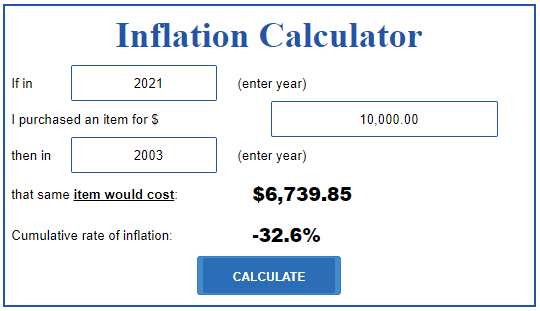

Of course, there are variations of this, usually to do with short term vs long term positions or trading now for fiat vs holding for the future and so on, but essentially they all require understanding of the long term underlying attributes of what Bitcoin is about. That’s not to say it should necessarily change your short term strategy per se, this is more about being aware of where we’re likely to be going and how Bitcoin could be a tool to be used to secure your position in the long term. Perhaps even beyond your own lifetime. Which brings us nicely to the first consideration. 1. Storing value through timeIt is surprisingly difficult to transfer value over long periods of time. Consider, for example, leaving $10,000 to your grandchildren in your will, something that many people aspire to do. Perhaps, like many people, you’ll also have a caveat that says it is held in trust until they are 18 years old. Assuming the worst happens the very next day, it would release those funds 18 years later. But what would its value be then? Historically, we can calculate an example over the previous 18 years by using a simple inflation calculator like this one. Using this tool, we can see that the equivalent purchasing power of that $10,000 is now $6,739.85, a loss of 32.6% as a result of inflationary pressures. However, we can also be reasonably certain that inflationary pressures will be higher in the coming years as the ever increasing money supply fuels greater inflationary pressures. In short, it’s likely that the real purchasing power of cash bequeathed now would be considerably lower than we have historically achieved. Cash is therefore not an option to transfer value over time, probably even if it was invested for that 18 years via the trust fund it is held in. We need something else, something harder. Traditionally, we’d look at property (which has a good track record and some advantageous inheritance tax allowances in some jurisdictions) or a financial instrument of some sort, perhaps stocks, bonds, funds etc. All of these, however, get riskier over time. For example, individual company stocks would be highly risky over a span of nearly two decades — history is littered with famous companies that have collapsed as new technologies or new network effects have replaced them. Tracker funds that follow indexes may be a better possibility, although this still relies on, perhaps, a markets sector and overall stability in the money supply. Bonds are currently not worth the paper they’re written on in terms of real time return and there’s little reason to think this will change anytime soon. All of these, of course, are reasonably complex for the average Joe and all usually need a third party to manage, hold in trust or execute. None of it insurmountable in this day and age of course, but it adds to the complexity. Finally, there is one more obvious choice, with several thousand years of “safe haven” reputation — gold. However, as I’ve talked about before gold really isn't that easy to buy, store and hold yourself and if you try and do it via a 3rd party, it gets very expensive very quickly, reducing any gains you’re likely to make. That said, the numbers in our example DO work with gold on paper. If you put that $10,000 into gold at the time, you would now have $47,803.53 to spend (using official figures obtained here) which, when inflation is taken into account, yields a profit of $32,996.41 on the same date 18 years later. Of course, this assumes you had zero cost associated with storing it. But even gold may not have the same certainty associated with it that it once had. Reducing the timescale to a decade, the numbers look less impressive. Using the same data in 2011, your $10,000 would actually now be $9,434.56, which, adjusted for inflation, yields a net loss of $2,707.20. Yes, gold actually dropped in value over the last decade and still isn't making any significant headway in terms of retaining real value even today. Of course, there are other assets driven by scarcity, such as art, collectible items and classic cars, all of which require knowledge, storage or even maintenance. However, these solutions that should, in theory, retain or at least increase in value over time. Bitcoin, on the other hand, costs zero to store, is immediately accessible by anyone on the planet, easily transferred and can be converted to local currency instantly with minimal effort. And, for reasons we shall soon see, has a high likelihood of retaining value over time. Bitcoin is not just suitable for transferring value over long distances, quickly, cheaply and easily, it’s also a great system for transferring value over time. My kids, grand kids, great grand kids (or even further into the future) could, in theory, benefit from the actions I take today in a way that was previously only accessible for the very wealthy. It’s a logical choice, so selling your Bitcoin at any point for fiat, something that is steadily declining in value, is not always an optimal solution. 2. Its rareness has yet to become apparentThe hardest thing to understand about Bitcoin when you first encounter it is this concept of digital scarcity. How is it possible that I can copy any file on your computer without issue, but I can’t copy your hard drive to get your Bitcoin? Surely it’s all still 1’s and 0's? Well, it is, but for reasons I won't go into here, Bitcoin has value largely to do with the fact this is simply not possible. Each Bitcoin (or part thereof, most transactions are fractions of Bitcoin known as “Satoshi”) is digitally separate from any other. There are no situations where you can send a Bitcoin to someone and retain the possibility of spending it again. Since we know, for a fact, that there’s only ever going to be 21,000,000 of them (again, for technical reasons we don't need to cover here) we know that’s it likely there will eventually be a shortage of them. There’s not enough for every person to own one. There’s not even enough for every millionaire to own one. The easiest way to think of this is like physical collectibles, say Baseball cards. If there are only a few hundred and more people than cards want to collect them, we have a supply problem which, in turn, drives up their value. The fact that cards sell for thousands of dollars above their original issue price tells us this has already happened and has, in fact, been sustained for years. It will change only if people collectively decide they no longer want them. This, as we know, is not likely. Importantly, the supply of, for example, 1934 Babe Ruth World Wide Gum cards, is absolutely fixed and can only decrease over time as cards are lost or destroyed. In terms of scarcity, Bitcoin works in a similar way. As the network effect continues to increase and more and more people join the network at an increasing rate, they are all competing for the same Bitcoin. This makes selling for fiat cash in the short term easy and tempting, but the long view is that, over time, the inevitable shortages in freely available Bitcoin will make it increasingly difficult to reacquire it. In other words, each time you exit the Bitcoin system and re-join the traditional fiat cash system, it’s likely (based on historical data and extrapolating current trends) that you’ll need to pay more to rejoin the Bitcoin network again and certainly to acquire the same amount as you had before. Based on this premise, if you already hold Bitcoin, it is clearly sensible to hold some (or all) of it for now and always. If you don’t own any at the moment, it might be worth researching further and considering acquiring a small amount as soon as you can. 3. The global measure of valueI have written about this extensively in the past and you can view that article here, but the TL;DR version is simply that the world has — for the very first time — an economic constant. Right now, for example, it is extremely difficult to compare values of goods and services across countries without doing some math to work out the relative value of the currencies concerned. So, if someone was comparing the price of a widget in the UK to one in Spain and sending the results to someone who lives in Brazil for their own comparison, they would probably use USD as the common denominator since it is the world’s reserve currency. However, this requires math and could never be more than an approximation for more than a short period of time as there are four fluctuating currencies to take into account in this example alone. However, by valuing everything in Bitcoin (or Satoshi), it is easy for any consumer to compare the value of goods and services instantly in any location to any other. In this scenario, Bitcoin becomes the constant by which everything else is measured — not just local currencies in whatever form they may be in at that point, but goods and services as well. This enables global trade and free movement of capital which all makes sense in an increasingly digital world. It is practical, beneficial and is already happening between people who use Bitcoin regularly and it is logical to conclude that this process will continue to grow in tandem with Bitcoin's adoption in general. Owning Bitcoin as this process becomes more accepted over time yields clear advantages. The bottom lineExtrapolating the trends of bitcoin adoption, development and use combined with fiat’s inevitable demise and basing it only on logic rather than emotional attachments, it’s easy to come to the conclusion that a Bitcoin standard of sorts is inevitable. But this is only one possible outcome, there are many others. The only thing we can say for certain is that our financial system will look very different in ten (or even possibly five) years’ time. The key point to remember is that Bitcoin is a long term phenomenon that is yet to gain its terminal velocity, so planning for that long term, and checking progress against the key milestones, is as essential as living in the present. So, do some trading if that’s your thing — volatility creates incredible opportunities to generate (or lose!) fiat which, for the moment at least, still has value. It’s worth noting that under the scenario above it’s likely there will come a time when Bitcoin is “boring” with little fluctuation globally. And by all means, spend a few Satoshis (or more) here and there to help support the network and traders who use it. Spend a few more learning how to use, for example, the Lightning Network. Like everything in life, it’s all about balance, personal choice and time preference. At the same time, the future is where we’ll be spending the rest of our lives. It’s essential to plan ahead and have that sense of security in what is an undeniably imperfect financial system. Your children may well be very grateful to you one day. Perhaps even your great-great-great-great grandchildren. Want articles and to minute analysis and opinion in your inbox? Why not subscribe to the ‘Bitcoin and Global Finance’ newsletter? Receive special offers and insider info. Unsubscribe at any time. Disclosure: The author of this opinion piece has been heavily involved with bitcoin for several years and holds a substantial cryptocurrency portfolio, including bitcoin. He also has a mining operation running the SHA-256 algorithm based in Siberia and is a published author on the subject of promoting the understanding of cryptocurrency. Jason is an analyst at Quantum Economics and consultant to Luno. Disclaimer: This content is for educational purposes only. It does not constitute trading advice. Past performance does not indicate future results. Do not invest more than you can afford to lose. The author of this article may hold assets mentioned in the piece. If you found this content engaging, and have an interest in commissioning content of your own, check out Quantum Economics’ Analysis on Demand service. If you liked this post from Cryptowriter, why not share it? |

Older messages

Ethereum Upgrade/Burn Mechanics Released!

Tuesday, October 12, 2021

The CryptoFinney burn mechanism on Ethereum will go live Friday 6pm EST. Before you burn (destroy) any Finney you should check the rarity of its attributes here. Burning has become synonymous with

Why China Is Playing a Dangerous Game With Its Future

Monday, October 11, 2021

Is going all-in on fiat currency really a good idea in the modern era?

No Plan To Ban Bitcoin – America Must Go Further in Embracing the Bitcoin Revolution Right Now

Monday, October 11, 2021

Bitcoin represents values of freedom in line with America's original values.

Finney Vol. 1 NFT Raffle Results!

Monday, October 11, 2021

Thanks to everyone who participated in our first NFT raffle! Below are the results and a link to the spreadsheet used for the raffle. NFT prizes have been sent! Pleb Raffle Winners rhvqy.wam -

Round 19 Cryptowriter NFT Engagement Winners!

Monday, October 11, 2021

Each week we reward our readers for high-quality comments and general engagement with our Cryptowriter publication. Learn more about the NFT engagement rewards HERE. Top 10 Most Engaged Users The top

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏