Not Boring by Packy McCormick - Playing Solo Games

Welcome to the 193 newly Not Boring people who have joined us since Thursday! Join 80,476 smart, curious folks by subscribing here: 🎧 To get this essay straight in your ears: listen on Spotify or Apple Podcasts Today’s Not Boring is brought to you by… MarketerHire Work is becoming more liquid. You no longer need to limit your company to whoever happens to be available and willing to work full-time at the time you’re hiring, nor do you need to spend months and your team’s valuable time finding that “good-enough” marketer. With MarketerHire, you can bring in world-class marketers a la carte. MarketerHire matches your business with expert marketers perfectly suited for the task at hand -- the kind of marketers that you might not be able to find, hire, or afford on your own. Even better? They do the heavy lifting, and deliver you one hand-picked marketer tailored to your requirements. And it works. MarketerHire’s expert marketers have tripled their customers’ revenue in a matter of months. In fact, your feedback on MarketerHire has been so strong that I invested in the company. Just set up a call with MarketerHire, tell them what you’re looking to accomplish, and they’ll match you with the one right marketer for you. Hi friends 👋, Happy Monday! Three months ago, I announced that I was raising an $8 million venture fund, Not Boring Capital. In the announcement, I shared both the memo that I used to raise the fund and the quarterly update that I’d just sent to LPs. One more quarter down, $9.9M raised, and Fund I mostly deployed, I want to share an inside look at running a small fund during one of the wildest markets in history. Just like companies need to send updates to their investors, investors need to send updates to their investors. Part of what I want to do with Not Boring is to make all of this more accessible and less closed off, so I’m opening up the LP Update I sent this weekend, with stats on the last quarter and an outline of my strategy as a Solo GP of a small fund, with everything but company updates and any confidential company details. Everyone is becoming an investor, and if you’re reading Not Boring, chances are you’re investing in something. Hopefully there are some takeaways in here that are useful as many of you go on (or continue) that journey. If you’re not investing, and are actually doing real things like building companies, I hope it’s useful as a way to think through your own strategy given your own unique circumstances. Let’s get to it. Playing Solo GamesTwo of my favorite essays this year were Everett Randle’s Playing Different Games and Dror Poleg’s Andreessen Pulls a Bezos. The essays break down the strategies employed by two of the world’s largest venture capital investors, Tiger Global and a16z, respectively. Before this year, I’d never given much thought to venture capital firms as businesses. Most people probably hadn’t, except for the people managing the funds (and often, probably not them, either). When capital was harder to come by and funding rounds were less competitive, funds focused more on their investment strategy -- we invest in seed stage fintech deals, we’re a multi-stage fund focused on emerging markets, we’re early stage investors -- than their competitive strategy -- an action plan to gain competitive advantage over rivals as evidenced by superior performance, often measured in Return on Investment (ROI), or in venture capital’s case, Multiple on Invested Capital (MOIC) or Internal Rate of Return (IRR). They hadn’t spent time digging moats, which Flo Crivello defines as “those barriers that protect your business’ margins from the erosive forces of competition.” As Redpoint’s Logan Bartlett satirized:  Dror put the same idea in non-tweet format:

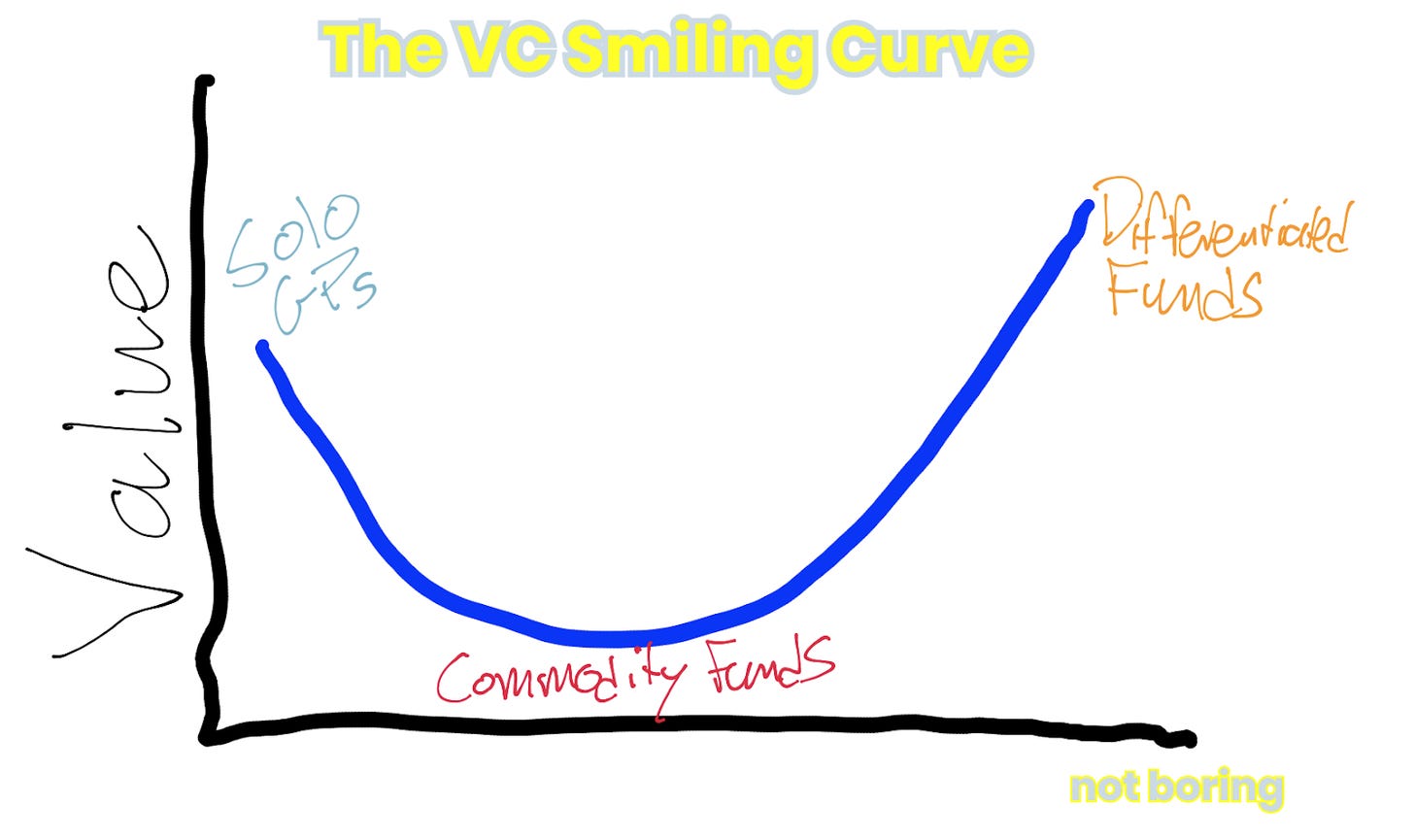

VCs can’t just try to be “better,” they need to be different. The rules of the game have changed. In The Cooperation Economy, taking inspiration from both Randle and Ben Thompson, I drew up The VC Smiling Curve: As a Solo GP (short for General Partner), I’m clearly biased in thinking that differentiated funds -- quite literally, funds who do different things, like Tiger or a16z -- and Solo GPs are going to do great while commodity funds get crushed. That makes sense for the differentiated funds, and the reasons they’ll outperform have been well-covered. It’s less intuitive why Solo GPs, like me, could outperform, given that we have far fewer resources, smaller (or no, in my case) teams, and often less track record. I’ve seen less written about that topic other than the “Everyone is an investor” and “People with audiences are now playing VC” articles, so I figured I’d share my strategy. This whole thing is a work-in-progress, and I might not be the best venture investor out there, but I’m the most willing to pull back the curtain! Not Boring Capital: Fund I, Update IIWelcome back for Not Boring Capital, Fund I, LP Update II. I hope you all enjoyed your summer and the start of your fall, and that most of you got the chance to rest and relax. Not Boring Capital did not. In Q3, we have invested $6.0 million into 59 companies (60 investments including a follow-on), for an average $100k per company. We had our first markups (all of which are yet to be publicly announced) and our first public token sale. Braintrust launched its token and is currently worth $2.3 billion — our first company to go public and a 14x return in a couple of months. Adam and the team at Braintrust are building something special, and did a fantastic job with the public sale, with $BTRST already trading on Coinbase. Short-term prices post-public token sales are always a little bumpy, but that’s noise. In the long-term, I believe that Braintrust’s community-owned model is going to wipe the floor with companies like UpWork. Braintrust will be a reference point and playbook for how to use tokens to supercharge existing business models. It feels good to get the first markups and public sales under our belt, but we’re obviously just getting started. In the first update, I mentioned that I was a little self-conscious about the pace of deployment in Q2. We did 20 investments. I thought that was fast. In Q3, we tripled that pace. That was faster than even I anticipated, but I’m thrilled with where we’ve landed and the portfolio we’ve built. The thesis is working better than I could have anticipated or even hoped. We’ve been seeing a ton of great deals, and have been able to win allocation in them. This update will have three sections:

Let’s get to it. Portfolio StatsWe invested in 79 companies in the first two quarters, with 16 more closed in Q4 or in process. When those deals close, we will have deployed Fund I. It’s very early -- the average investment is 73 days old -- but already, there are good signs of progress:

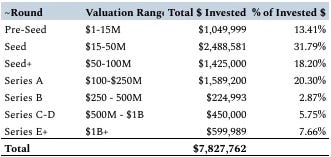

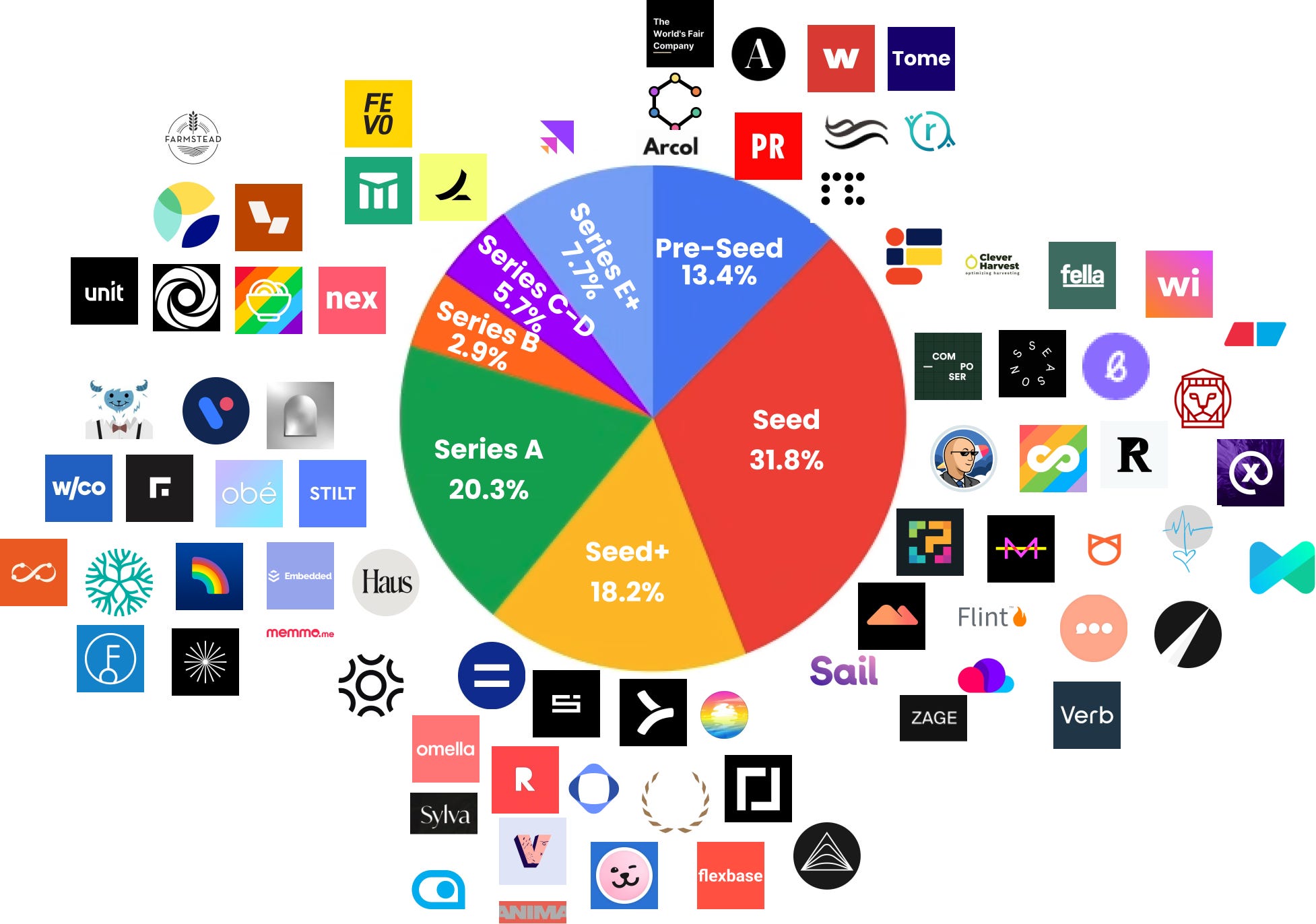

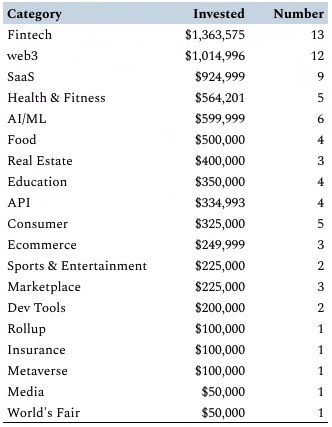

There are two obvious caveats here -- this market is wild and markups aren’t cash -- but I’m happy with how things are starting to shape up. Stage Mix In the Fund I Memo, I wrote that I was aiming to invest ⅓ in Pre-Seed and Seed, ⅓ in Series A, and ⅓ in Series B and beyond. Round names have become a little meaningless, but breaking it down by valuation at the time of investment (and yes, I know, as Lan said after the last update, “I LOLed when seeing your definition of preseed valuation :-)”), here’s what it looks like: As of the end of Q3, as with Q2, we are leaning a little earlier than anticipated, with 84% of our dollars going towards investments from Pre-Seed - Series A (as defined by the valuation ranges) and 16% going towards Series B deals and beyond. This will shift a little later as some of the pipeline closes. Here’s a look at our investments by stage (stage name, not valuation) today: Vertical Mix Fintech remains the leading vertical for Not Boring Capital, by both number of investments (13) and dollars invested ($1.36 million) with new additions like Ramp, Unit, Lithic, Modern Treasury, Flexbase, Equi, and Zage joining the fold. If you’ve been reading the Not Boring newsletter, you won’t be surprised to see that the fastest-growing category is web3. In Q2, we made only one web3 investment, Mirror, and in Q3, we invested just under $1 million in 11 web3 companies and projects, including Rainbow, Eco, XMTP, Braintrust, Massive, Optilistic, Alongside, Meow, Rare Circles, Syndicate, and Anima. Web3 will continue to be our biggest category for the remainder of Fund I, with 6 of the 16 to-be-closed deals squarely in web3 and three more web3-adjacent, and certainly into Fund II. This shift reflects both my bullishness on the space and the increased dealflow we’ve seen as a result of going deeper down the rabbit hole and writing more about web3. That said, I’m happily continuing to invest in both web3 companies and in companies that have never even heard the word crypto. I’ve gotten the question many, many times over the past couple months: “Why don’t you just become a registered investment advisor and go all-in on web3 investing?” There will be massive winners that incorporate web3 tools, and massive winners that don’t, and shouldn’t. Companies like ScienceIO, NexHealth, Kingdom Supercultures, Fount, and many more wouldn’t make any sense as web3 companies, at least for a long time, and most of the fintech companies in the portfolio, with whom web3 theoretically competes most directly, work far better without tokenizing, even if they might incorporate certain web3 features and work with web3 clients down the line. Not Boring Capital’s strategy involves investing in as many of this generation’s great companies as possible, which means leaning in hard to web3 but not being dogmatic and recognizing which business models and technology stacks give which projects the highest likelihood of success. Speaking of Not Boring Capital’s strategy… To learn about Not Boring Capital’s strategy and portfolio, and where this is all going…How did you like this week’s Not Boring? Your feedback helps me make this great. Loved | Great | Good | Meh | Bad We’ll be back to our regularly scheduled web3 programming on Monday! Thanks for reading, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

The Model of Everything

Thursday, October 14, 2021

Not Boring Investment Memo on ScienceIO

Log in to Not Boring by Packy McCormick

Tuesday, October 5, 2021

Click here to log in

Log in to Not Boring by Packy McCormick

Tuesday, October 5, 2021

Click here to log in

Log in to Not Boring by Packy McCormick

Tuesday, October 5, 2021

Click here to log in

Dad Life

Monday, October 4, 2021

Plus Not Boring Founders

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month