The First Bitcoin ETF in the U.S. Is Here – Don’t Be So Optimistic, It Is Not Based on the Spot Market

The First Bitcoin ETF in the U.S. Is Here – Don’t Be So Optimistic, It Is Not Based on the Spot MarketThe November 14 verdict for Van Eck's spot market-based Bitcoin ETF will be more important.Written by Sylvain Saurel - In Bitcoin We Trust After years of waiting and negative responses from the SEC, the first Bitcoin ETF is expected to begin trading on October 19, 2021. This news has been expected by the entire Bitcoin market for months. The narrative around the arrival of this Bitcoin ETF in America has completely overshadowed all of the bad economics that have been building up for weeks. The potential real estate crisis in China with the Evergrande case already seems behind us, while the problem is far from being solved. For Bitcoin, this already seems far away as its price has risen from $43K on October 1st to over $62K in the last few hours. Bitcoin has also just achieved the highest weekly close in its history. The first Bitcoin ETF accepted in America is futures-basedEverything seems to be going well for the king of digital currencies. Uptober is indeed predicting an exceptional Q4 2021, especially since the current macro-economic conditions favor such a scenario for Bitcoin. The first ETF to be accepted by the SEC in America is that of ProShares. It is named “ProShare Bitcoin Strategy ETF”. It will give investors exposure to future Bitcoin contracts under the ticker BITO. You read the subtlety right here. This Bitcoin ETF will not be directly linked to the spot market, but rather to future Bitcoin contracts. That's a notable difference, which is why you shouldn't be so sanguine about this first Bitcoin ETF in America. The first thing to understand is that the Bitcoin ETF landscape in America currently falls into two categories:

A Bitcoin ETF based on the spot market would be much more interesting for investors and the market in generalIf you look closely at the differences between these two alternatives, it is clear that futures-based ETFs will be more expensive and less efficient than those based on the spot market with direct exposure to Bitcoin. This is due to their complex structure requiring more maintenance. However, the SEC, through Gary Gensler, had once again reiterated in the summer of 2021 that it favored futures-based ETFs over spot-based ETFs because of the greater protections that this would supposedly provide to investors:

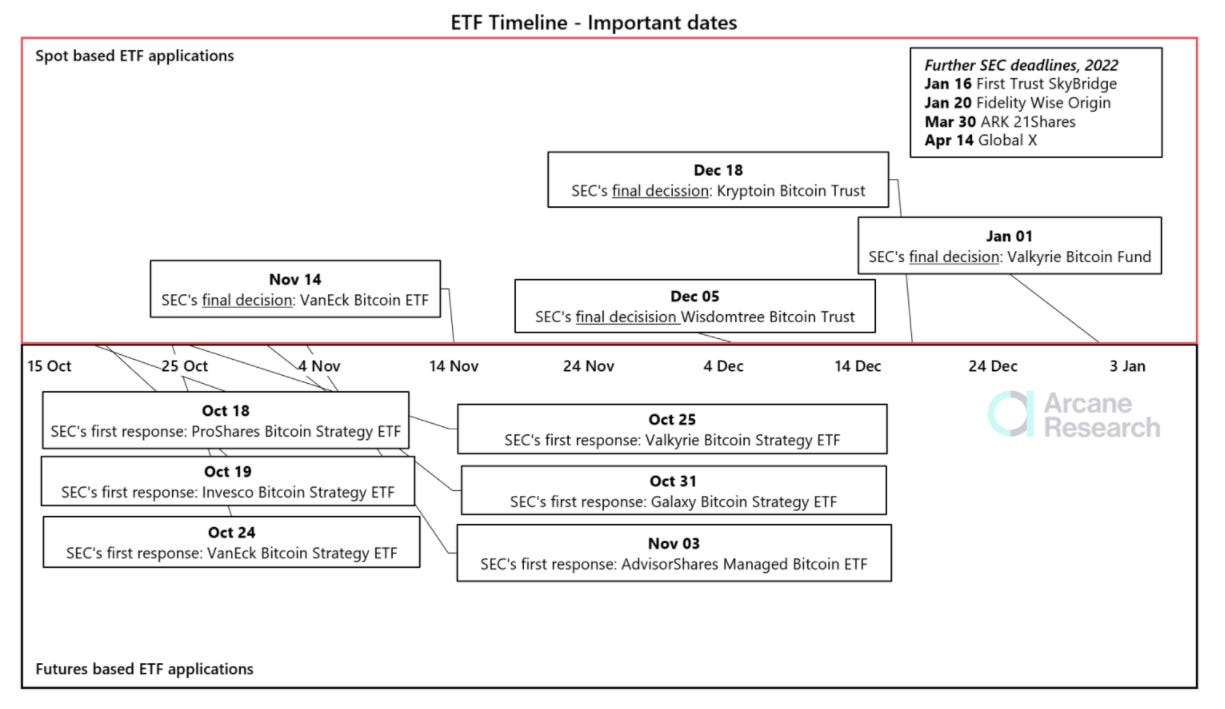

Gary Gensler's message was clear: a future-based ETF application had a much better chance of being approved by the SEC in Q4 2021 than an ETF based directly on the spot market. In the coming days and weeks, the SEC will give a response to the Bitcoin ETF applications made over the past few months: As you can see, 6 futures-based ETFs are awaiting approval from the SEC, while four spot-based ETFs are awaiting feedback from the SEC by the end of 2021. ProShares is getting the first positive response, but returns on ETF applications from other players like Invesco, VanEck, and Valkyrie are expected by the end of October 2021. While these futures-based ETFs will allow more American investors to gain exposure to Bitcoin, they will also allow traders and other financial professionals to better manipulate the market to their advantage by leveraging the Bitcoin futures market to the spot market. So from that point of view, it's not such good news. The short-term impact of these ETFs will be extremely bullish for the price of Bitcoin in the spot marketThe first real deadline we have to wait for before we can get excited is November 14, 2021. That's when VanEck will receive the final verdict on its spot-based Bitcoin ETF. An approval from the SEC would propel Bitcoin towards $100K by the end of the year. A rejection of VanEck's Bitcoin ETF would not necessarily mean that others awaiting approval in December 2021 or January 2022 would be rejected. It would, however, chill investors who are euphoric about the current narrative around a U.S. Bitcoin ETF based on the spot market. The SEC could justify its rejection of a spot-based Bitcoin ETF by arguing that the legal framework around Bitcoin and crypto-currencies is still too unclear and does not protect investors enough, as this seems to be Gary Gensler's leitmotif in recent weeks. We'll see in the coming days and weeks what impact the entry of this (or these) first Bitcoin ETF(s) will have on the Bitcoin spot price. We can already imagine that in the short term the buying pressure on the CME will be more constant. This should lead to an increase in open interest with more cash coming into the market and thus ultimately buying pressure on the spot market. The approval of a Bitcoin ETF based on the spot market would have a more direct effect on the demand for Bitcoin, which would absorb the available supply and thus rapidly increase the price of Bitcoin initially. The lower fees could attract many more investors than a future-based ETF. In the longer term, these ETFs would simply be an additional investment vehicle for traders seeking exposure to Bitcoin without buying it directly. Once the market has absorbed the entry of these new players, they would have less impact on its price. However, the price of Bitcoin would then be well above $100K or even $200K at that point. Final ThoughtsFrom a more personal point of view, if these ETFs giving exposure to Bitcoin tempt you, know that nothing will ever be worth buying a Bitcoin directly if you can do it. The whole point of Bitcoin is to give you power over your money. To do this, you must have the private keys associated with your Bitcoin. You must not let traditional financial players come in and steal this incredible revolution from you by trying to centralize a system that is all about decentralization. Keep this in mind before making any investment decisions. In Bitcoin We TrustLearn how to earn…Become part of our community.Follow our socials.Subscribe to our podcast.Subscribe to this publication.

If you liked this post from Cryptowriter, why not share it? |

Older messages

BluDAC Rockets are Launching Soon on WAX

Monday, October 18, 2021

DeFi or decentralized finance is a big blockchain trend today. Peer-to-peer trading and lending-borrowing activity without the intervention of a middleman or third party has become possible due to DeFi

EOSweekly: Chief Delegates Plans, DeFi Grants, DAPP/BOX, EOS Support, EOS Costa Rica, Burning Finney

Sunday, October 17, 2021

Charging Chief wants the future now! DeFi wishes granted. DAPP Network with BOX rewards. EOS Support to the rescue. EOS Costa Rica uplifts members. Chief Delegates hold their first meeting while Dan

Earn DAPP & BOX LP Rewards

Saturday, October 16, 2021

DAPP Network dual liquidity mining starts October 19th at 17:00 Hong Kong Time (or 9AM UTC). DAPP and EOS token holders can provide DAPP-EOS liquidity on Defibox to earn LP rewards. DAPP rewards will

Be Ready for the $100K – The 11 Things That Point to a Phenomenal Q4 2021 for Bitcoin

Thursday, October 14, 2021

HODL Bitcoin, and enjoy the ride.

Art of the Chart - TAking Requests!

Thursday, October 14, 2021

Hey all! We're looking really good right now on Total MC, as you can see here: We got the little corrective pullback I said we would get, re-testing the topside of the green S/R zone after breaking

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏