Be Ready for the $100K – The 11 Things That Point to a Phenomenal Q4 2021 for Bitcoin

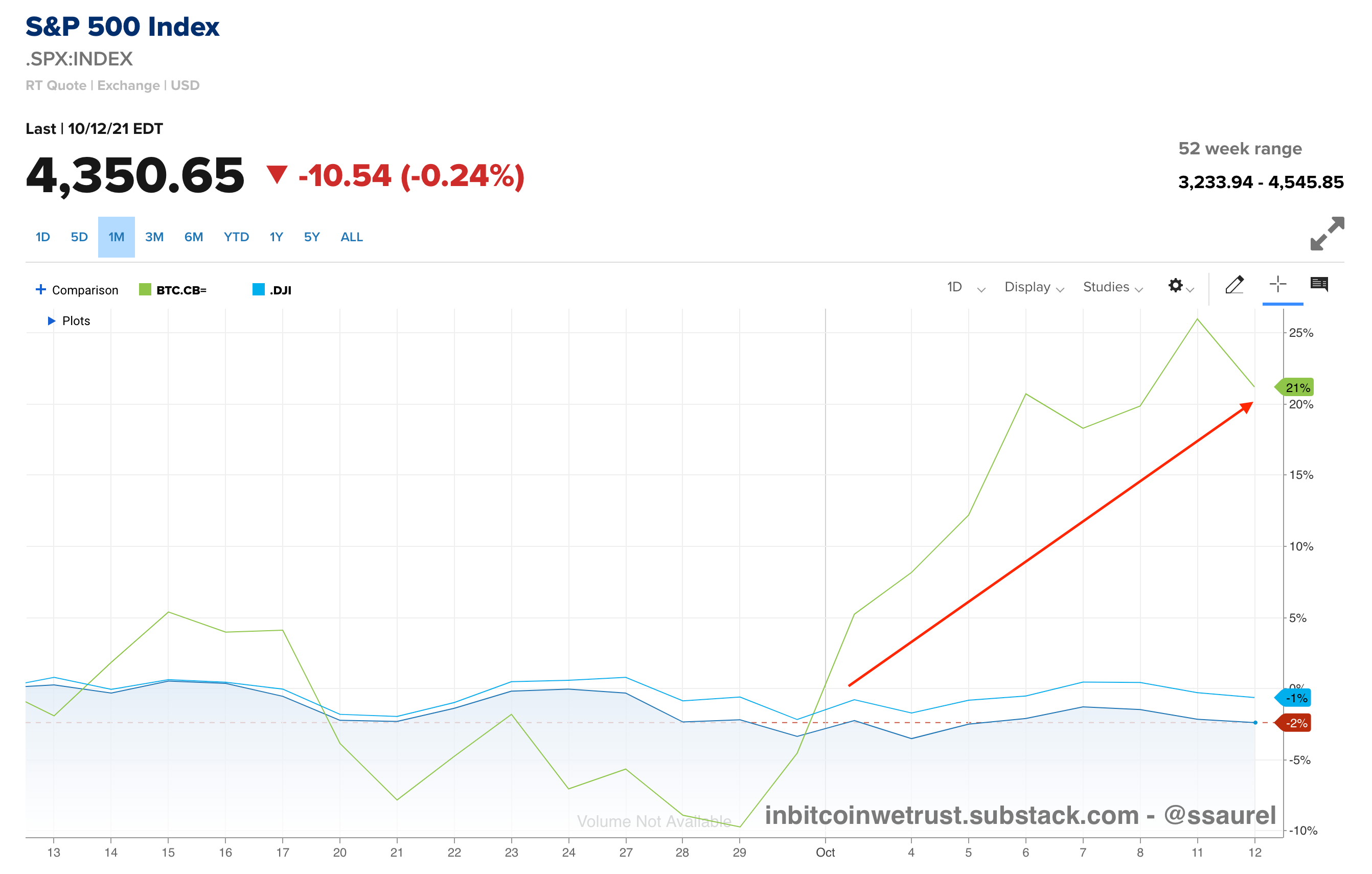

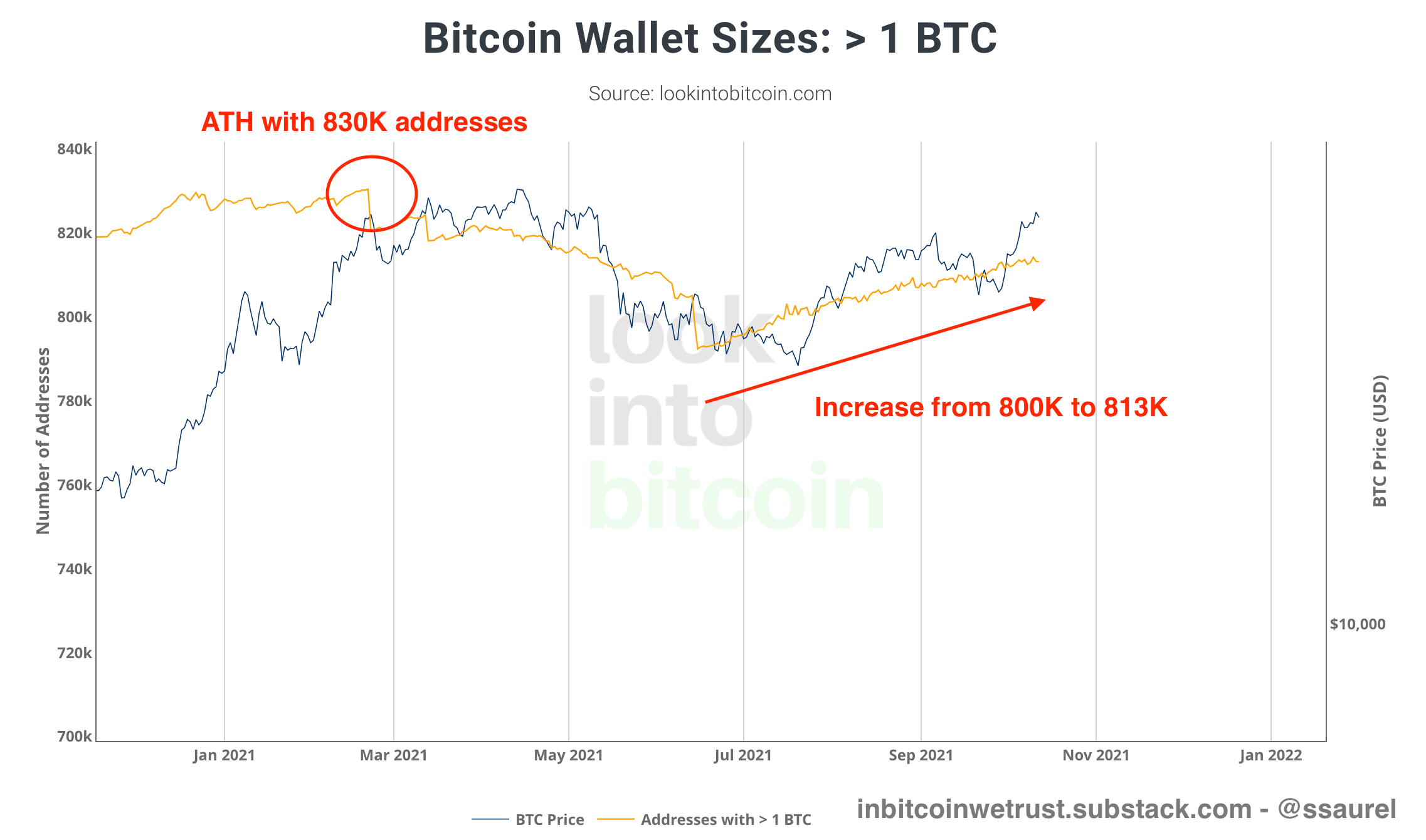

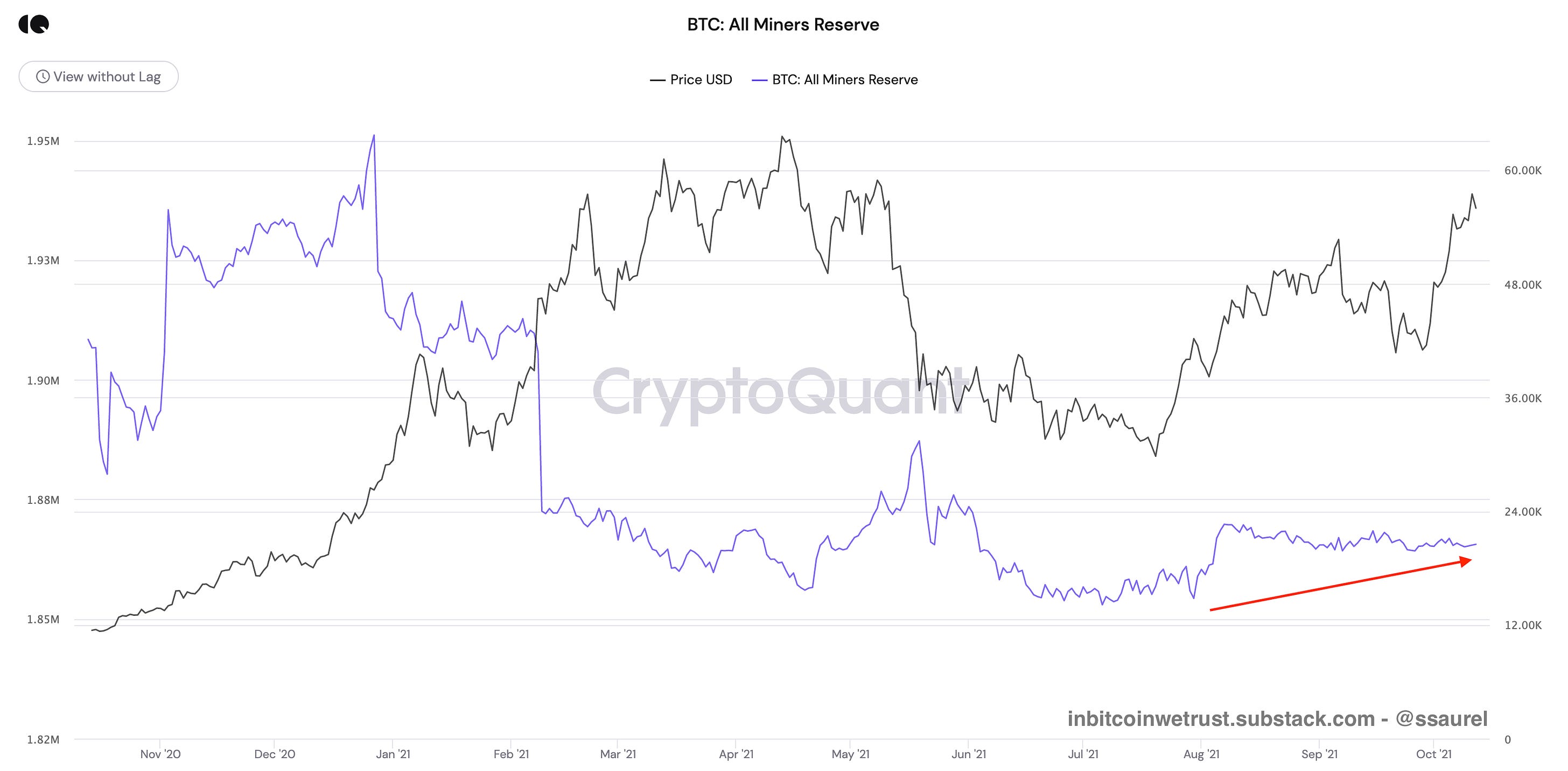

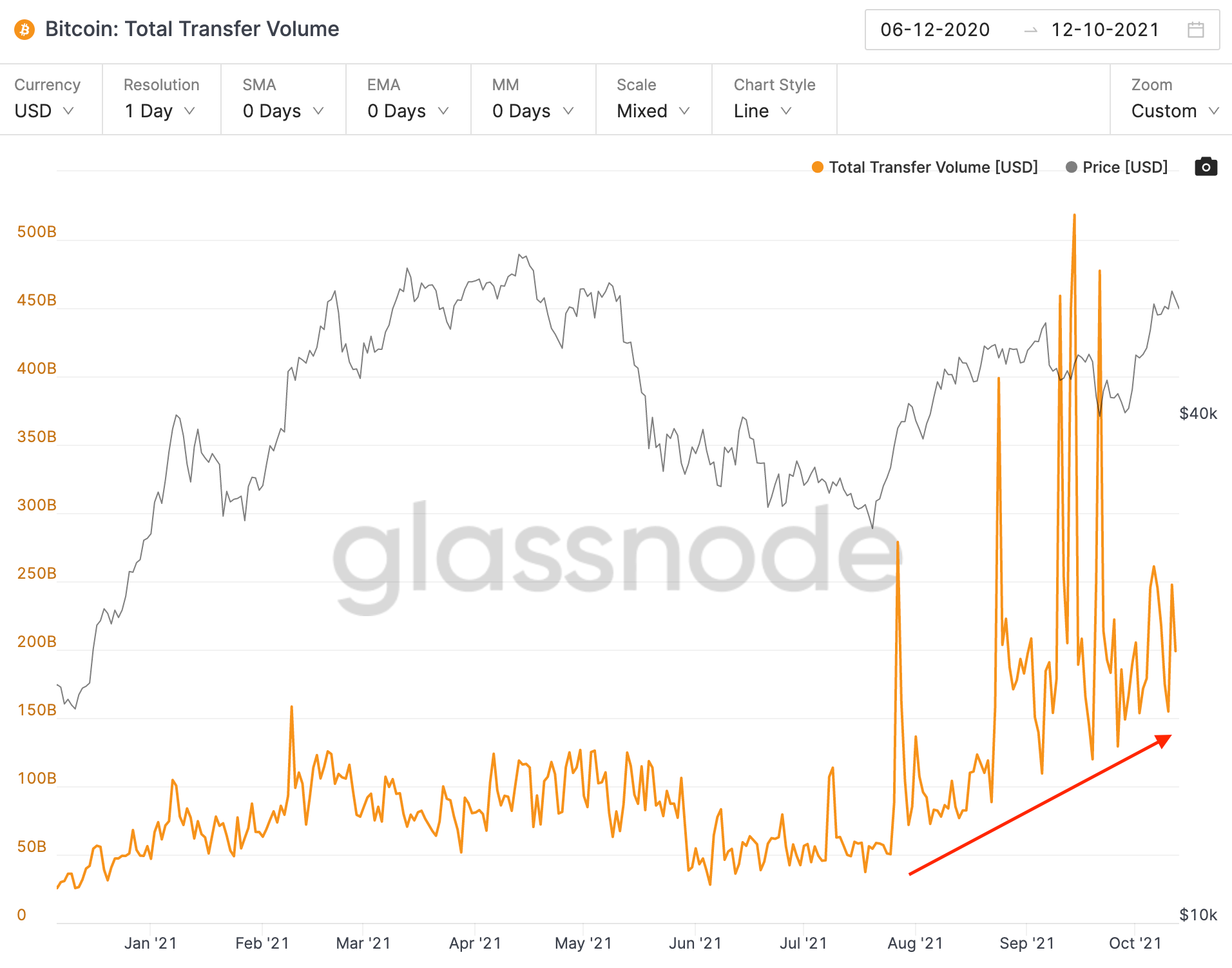

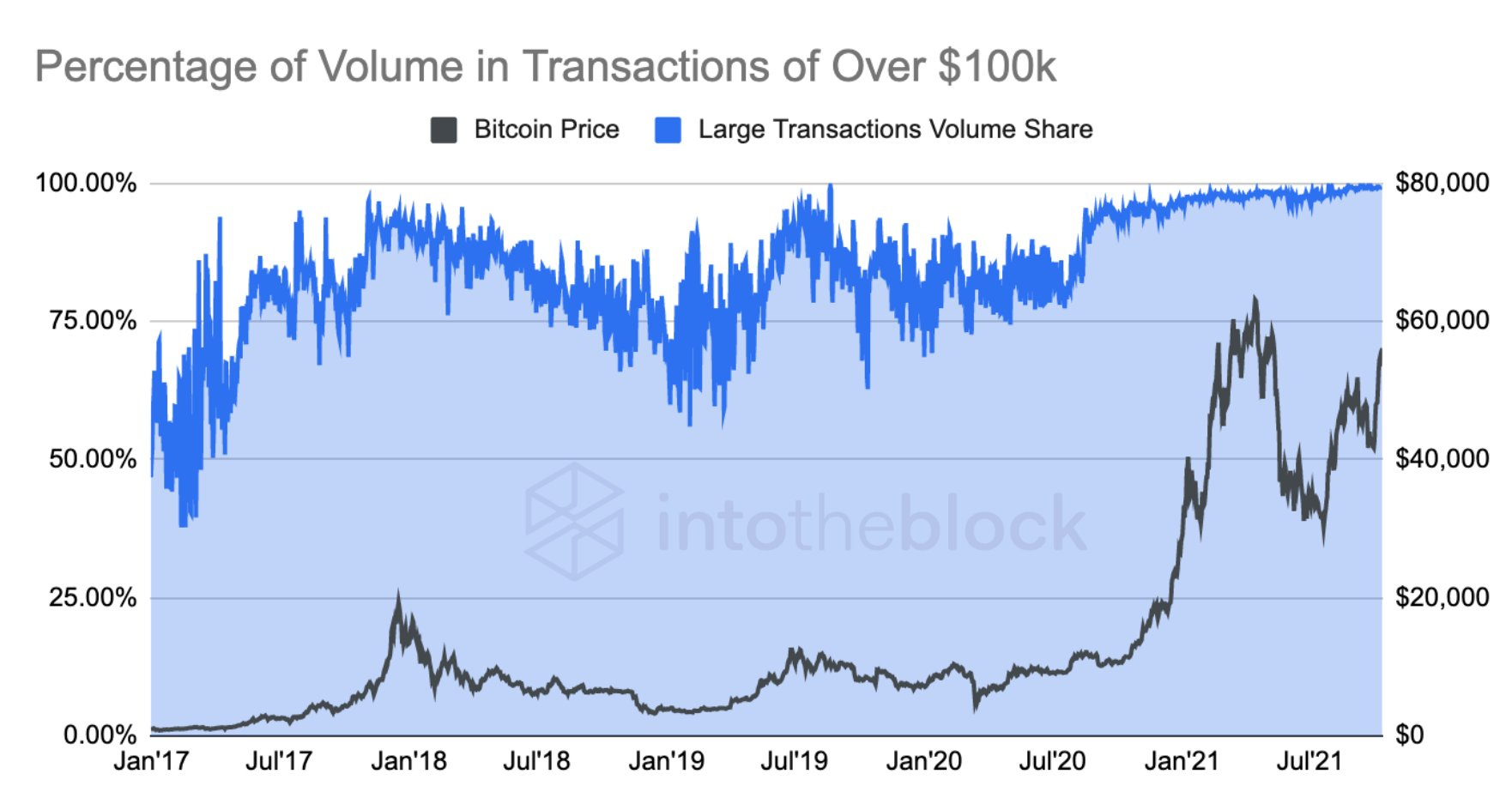

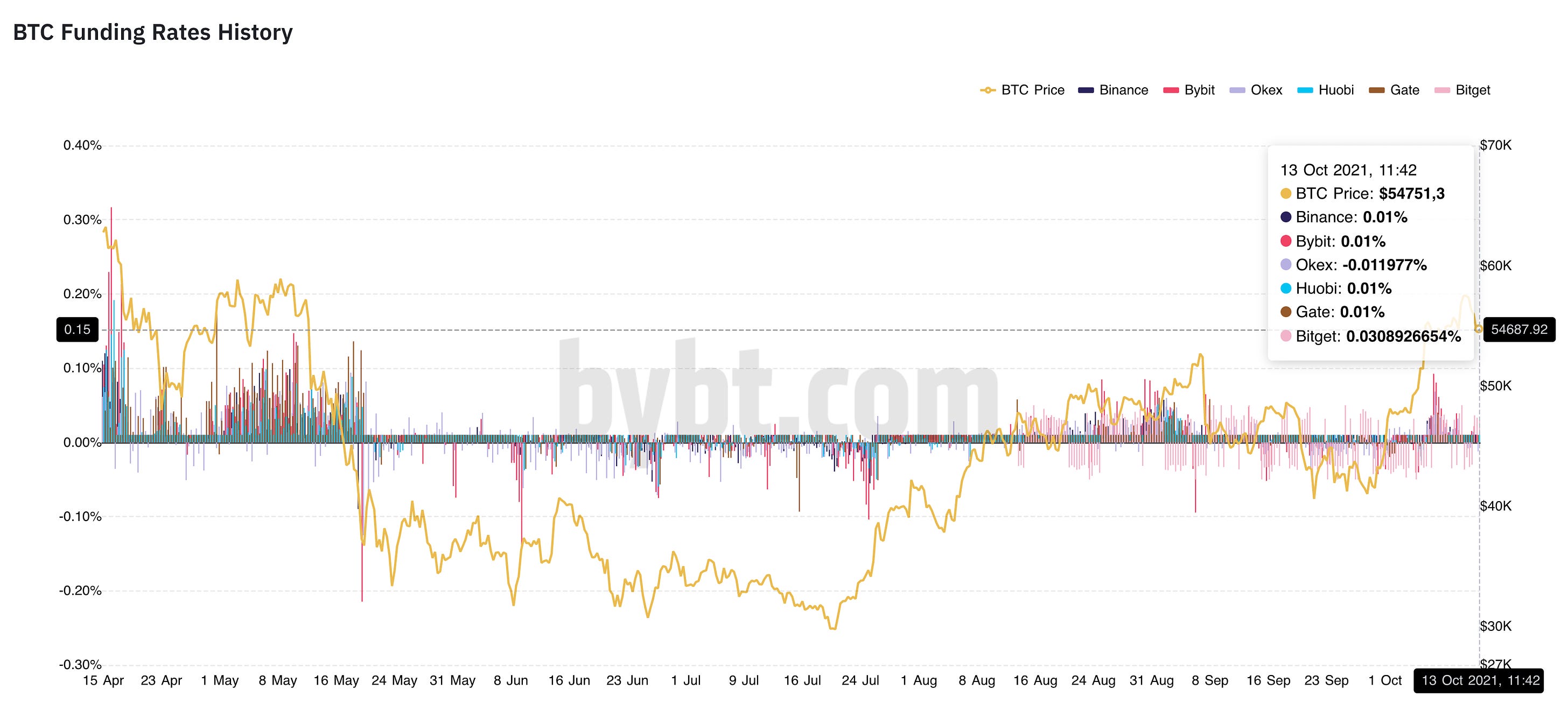

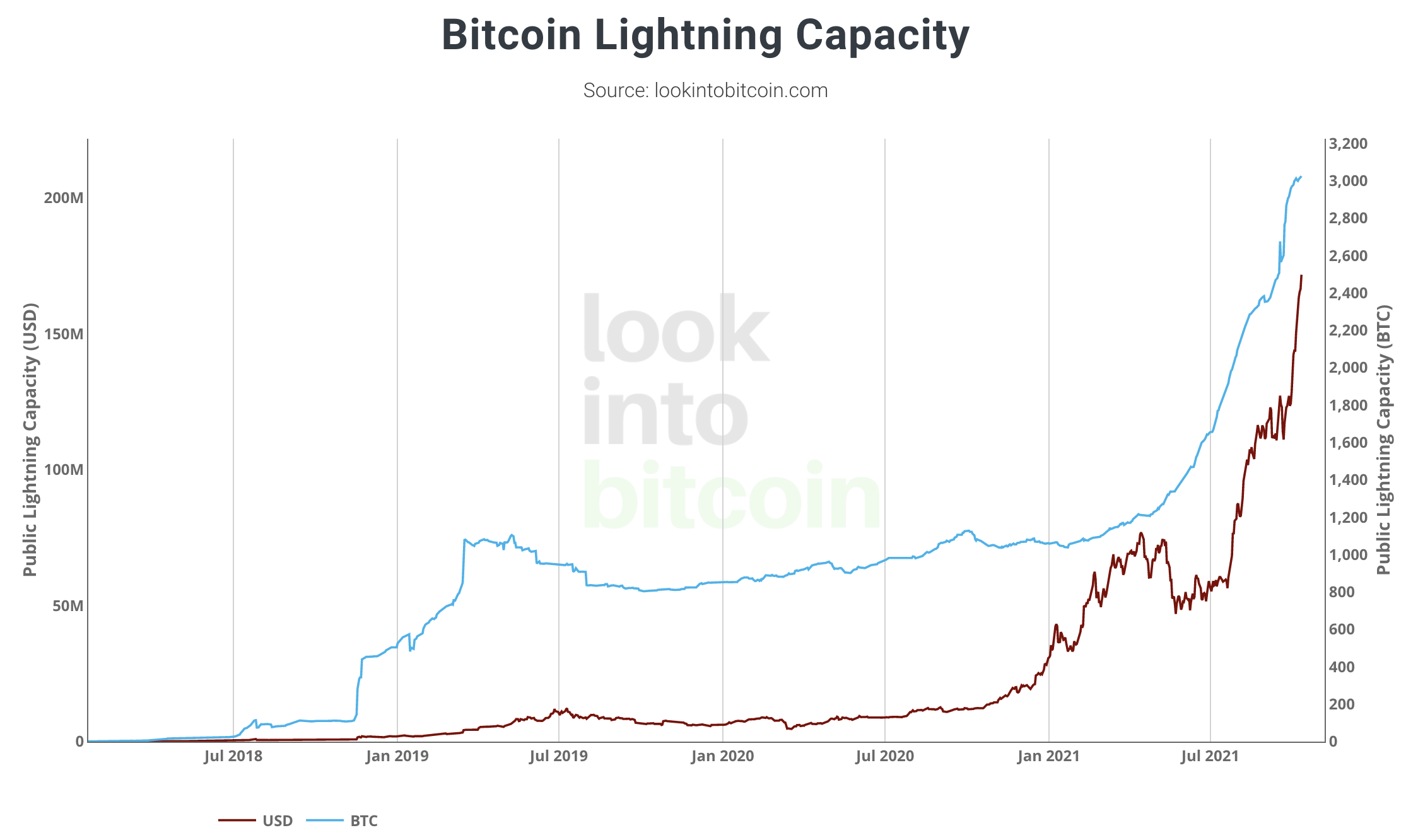

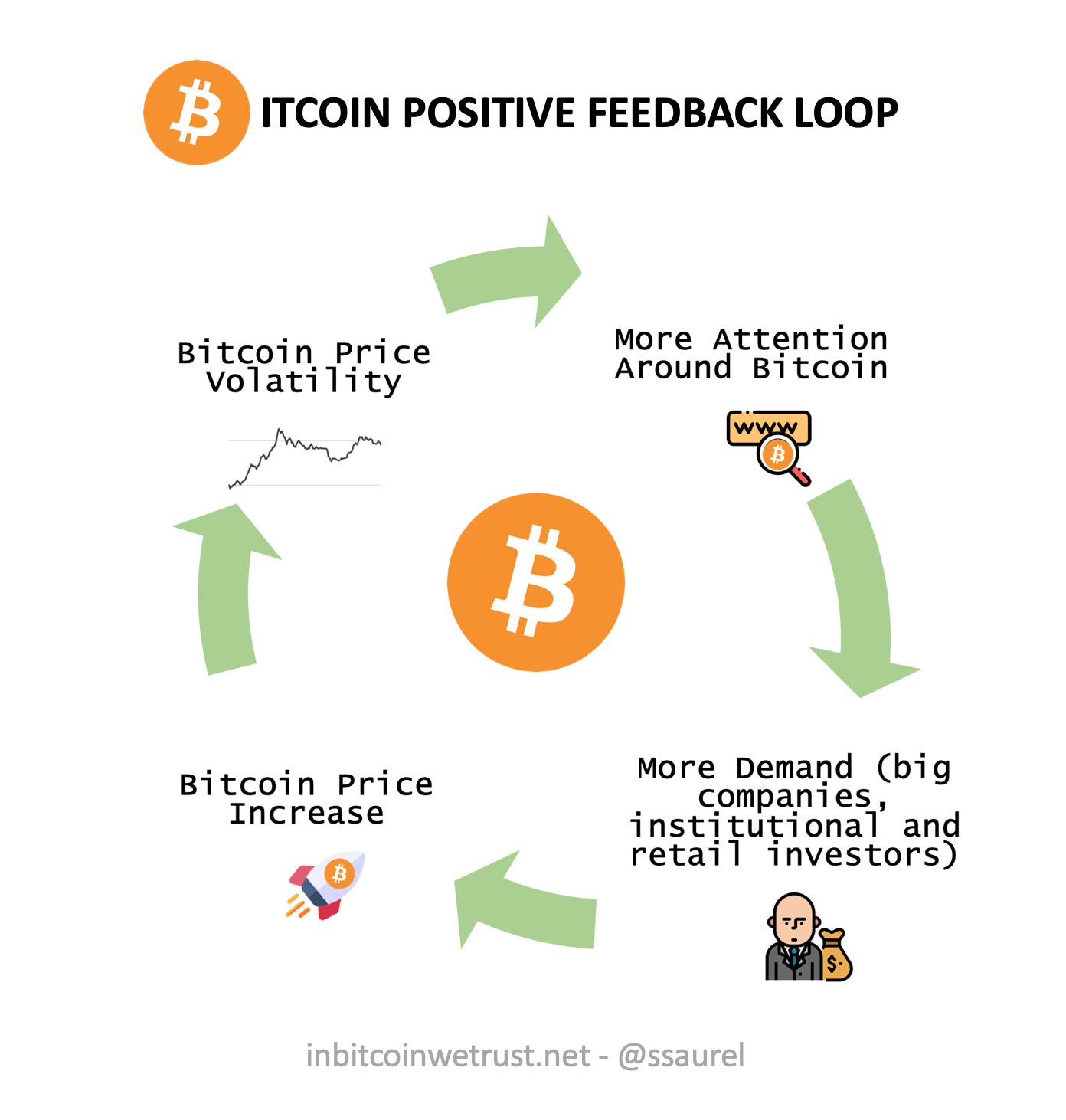

Be Ready for the $100K – The 11 Things That Point to a Phenomenal Q4 2021 for BitcoinHODL Bitcoin, and enjoy the ride.Written by Sylvain Saurel - In Bitcoin We Trust After a start to October that saw its price rise from $43K to nearly $58K, an increase of around +45%, Bitcoin has just paused with the rejection at the last major resistance level before a new All-Time High (ATH). However, make no mistake: what lies ahead for Bitcoin in the coming weeks looks phenomenal. The 10 reasons I put forward in July 2021 as to why the price of Bitcoin would move towards $100K in the coming months are still very valid for me. To these reasons, I now see much more specific elements that let me imagine that Q4 2021 will be phenomenal. I highlight these elements in the following. Bitcoin has entered UptoberSeptember is usually a red month for Bitcoin. This was confirmed again this year with a lot of uncertainty and a -7% like in September 2020. However, we could see a Falling Wedge forming at the end of September which resulted in an upward exit on October 1, 2021: In a few hours, everything changed. Sentiment shifted from extreme fear to neutrality and the beginning of greed. The Bitcoin price had entered Uptober. The most incredible period of any Bitcoin Bull Market is usually Q4. Good thing we're here! Bitcoin looks to decouple from the stock marketThe correlation of the Bitcoin price with the US stock market has always been a topic of debate in the Bitcoin world. For some, there is no correlation if you step back and look at the long term. For others, a decoupling must occur for Bitcoin to truly justify its reputation as the best hedge against uncertainty. Since the beginning of October 2021, we can see a decoupling of the Bitcoin price from the S&P 500 and the Dow Jones: While Bitcoin took +21% over the period, the Dow Jones and S&P 500 were relatively flat with a moderate drop of -1% and -2% respectively. We will have to see this over the rest of Q4 2021, and even more so in 2022. Indeed, a stock market crash seems like a growing possibility. We will have to see if Bitcoin can play the role of a hedge by totally decoupling from the US stock market in the event of such a crash. The number of addresses with at least 1 BTC is increasing since July 2021By the end of February 2021, the number of addresses on the Bitcoin network with at least 1 BTC owned reached an ATH of 830K. From this high point, there was then a drop to a low of around 800K addresses in July 2021: Since then, there has been an accumulation phase of everyone taking a long-term view with Bitcoin. The number of addresses with at least 1 BTC has reached 813K recently and it is a safe bet that the ATH of 830K addresses will be beaten during Q4 2021. Miners' BTC reserves stabilize at an interesting levelIt is always interesting to watch what Bitcoin miners do with their BTC. Whether they are hoarding or selling their Bitcoin is an indicator of sentiment for the weeks and months ahead. Currently, we see that miners' Bitcoin holdings are stabilizing at interesting levels and rising since July 2021: We are still far from the levels reached at the end of 2020, but we feel that miners are optimistic for Q4 2021. Another sign that does not deceive. Volumes are up again since the beginning of October 2021Since the beginning of October 2021, the volumes traded on the Bitcoin Blockchain are again on the rise. This is despite the price of Bitcoin approaching $60K in recent days: Volumes have exceeded $200B per day regularly since the beginning of October 2021. We are clearly in a different phase than in the first half of 2021. Institutional demand is backThe rapid rise in the price of Bitcoin from $50K to $58K in the last few days can be credited to institutional investors who are making their return to the market in force. More than 99% of the volume in transactions has come from transactions over $100K: As soon as the price of Bitcoin passes the ATH of April 2021 at $64.8K, we should see the return of retail investors eager to take advantage of a rising Bitcoin. The climb to $100K will then probably only be a matter of time. Funding rates look bullishIn the derivatives market, we notice that traders have also had a bullish bias since the beginning of October 2021. While funding rates are approaching May 2021 levels, they are still far from the overheating levels reached between February and April 2021: Long positions are not yet excessive, and the market still has plenty to look forward to in Q4 2021. The current pullback from $57.5K to the $54.5K-$55K area is even an excellent thing for Bitcoin to offer us a phenomenal Bull Run in the coming weeks. The arrival of a Bitcoin ETF by the end of October 2021Investors have been waiting for months, if not years, for the approval of a Bitcoin ETF on Wall Street. After many rejections and postponements, no less than 6 ETFs are in the running for approval to launch on the US market: If just one of these ETFs is approved, it will boost the price of Bitcoin even more and the $100K mark is practically guaranteed to be reached by the end of 2021. The verdict is expected in the coming days. Beware, however, as some analysts on Wall Street are starting to bet on a further postponement of the decision until 2022 until the regulatory environment is clearer. We will know in a short time anyway. Bitcoin Lightning Network Capabilities Increase ParabolicallyThe Lightning Network is a layer-2 solution built on top of the Bitcoin blockchain to enable the use of Bitcoin as an everyday payment method. With the Lightning Network, the scalability of Bitcoin is no longer an issue and transaction costs are reduced to a minimum. This makes it the future of Bitcoin as an everyday payment method. El Salvador is using the Lightning Network to enable its population to use Bitcoin daily at a lower cost. The good news is that the adoption of the Lightning Network has accelerated dramatically in 2021 with the capacity of the Lightning Network increasing to parabolic levels over the past few months. Over 3,000 BTC are now locked into the Lightning Network: This is something extremely Bullish for the future of Bitcoin. Something that will push investors a little more towards Bitcoin in the weeks and months to come. Taproot upgrade is set to into effect in November 2021Who said Bitcoin never evolves? Probably opponents or Altcoiners seeking to denigrate the system invented by Satoshi Nakamoto. Bitcoin is evolving at its own pace regardless of criticism from the outside world. Hundreds of billions of dollars are at stake, and the hopes of millions of people for a better world through Bitcoin are at stake. Every evolution of Bitcoin needs to be properly evaluated and tested so that there are no bugs that could undermine its revolution. After 4 years without a major evolution of the Bitcoin source code, the Taproot update will take effect in November 2021. This is a perfect signal from the Bitcoin community at the best of times. The Bitcoin system will be able to offer support for smart contracts, but also better privacy. Bitcoin price is entering in the same positive feedback loop as in Q4 2020At the very beginning of November 2020, I wrote that Bitcoin had entered a positive feedback loop that would bring its price close to $100K by the end of 2021. We're not there yet, but this positive feedback loop is now setting up again to give us a phenomenal Q4 2021: The price of Bitcoin is rising, as is its volatility. This attracts media attention which leads to more demand from various players: institutional, retail, and big companies. This mechanism is slowly taking hold and will cause the price of Bitcoin to explode in the coming weeks. Final ThoughtsAs I write this, the price of Bitcoin is in the $54.5K-$55K area after a very welcome pullback from the $58K resistance. This pullback will allow the market to catch its breath and prepare itself for the next step. First, the break of the last big resistance zone between $58K and $60K: After that, a new ATH will only be a matter of days. Once this new ATH is reached, Bitcoin will enter discovery price mode again, with all the phenomenal things that this implies for Q4 2021. In Bitcoin We TrustLearn how to earn…Become part of our community.Follow our socials.Subscribe to our podcast.Subscribe to this publication.

If you liked this post from Cryptowriter, why not share it? |

Older messages

Art of the Chart - TAking Requests!

Thursday, October 14, 2021

Hey all! We're looking really good right now on Total MC, as you can see here: We got the little corrective pullback I said we would get, re-testing the topside of the green S/R zone after breaking

3 Key Reasons to Think Long Term With Bitcoin

Thursday, October 14, 2021

At first it's about $$$. Then, it's about the future.

Ethereum Upgrade/Burn Mechanics Released!

Tuesday, October 12, 2021

The CryptoFinney burn mechanism on Ethereum will go live Friday 6pm EST. Before you burn (destroy) any Finney you should check the rarity of its attributes here. Burning has become synonymous with

Why China Is Playing a Dangerous Game With Its Future

Monday, October 11, 2021

Is going all-in on fiat currency really a good idea in the modern era?

No Plan To Ban Bitcoin – America Must Go Further in Embracing the Bitcoin Revolution Right Now

Monday, October 11, 2021

Bitcoin represents values of freedom in line with America's original values.

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏