DeFi Rate - This Week in DeFi - October 29

This Week in DeFi - October 29This week, Osmosis DEX raises $21m, Serum announced LP rewards, 0x brings crypto prices to Pyth, and NEAR announces $800m for developers

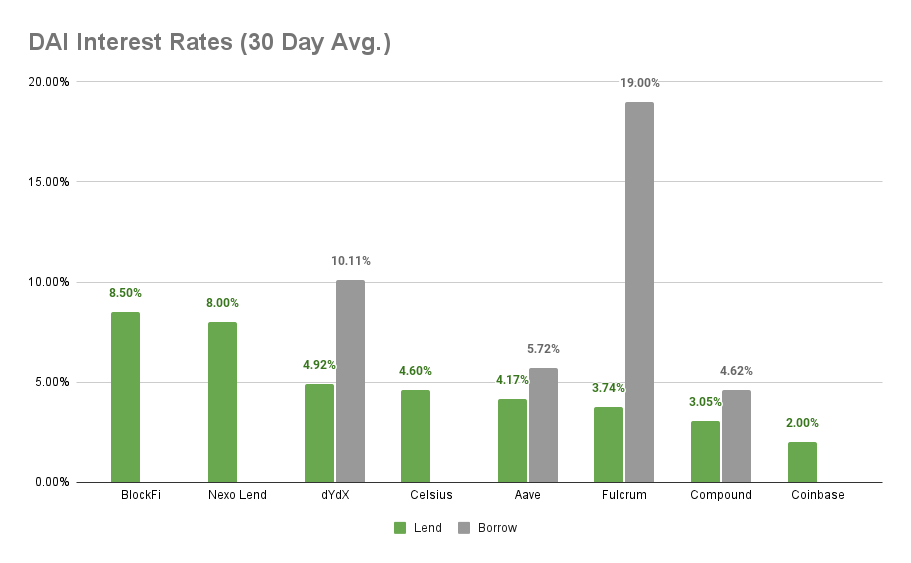

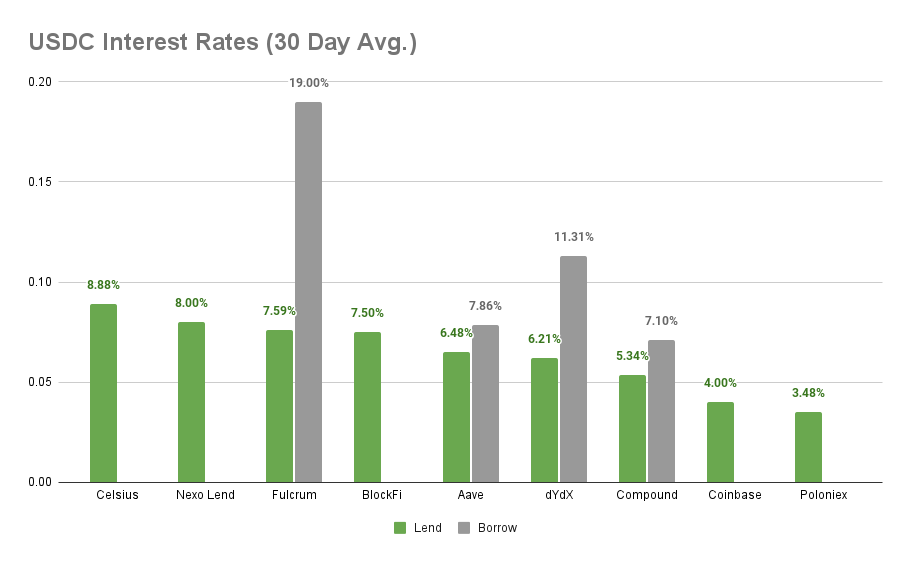

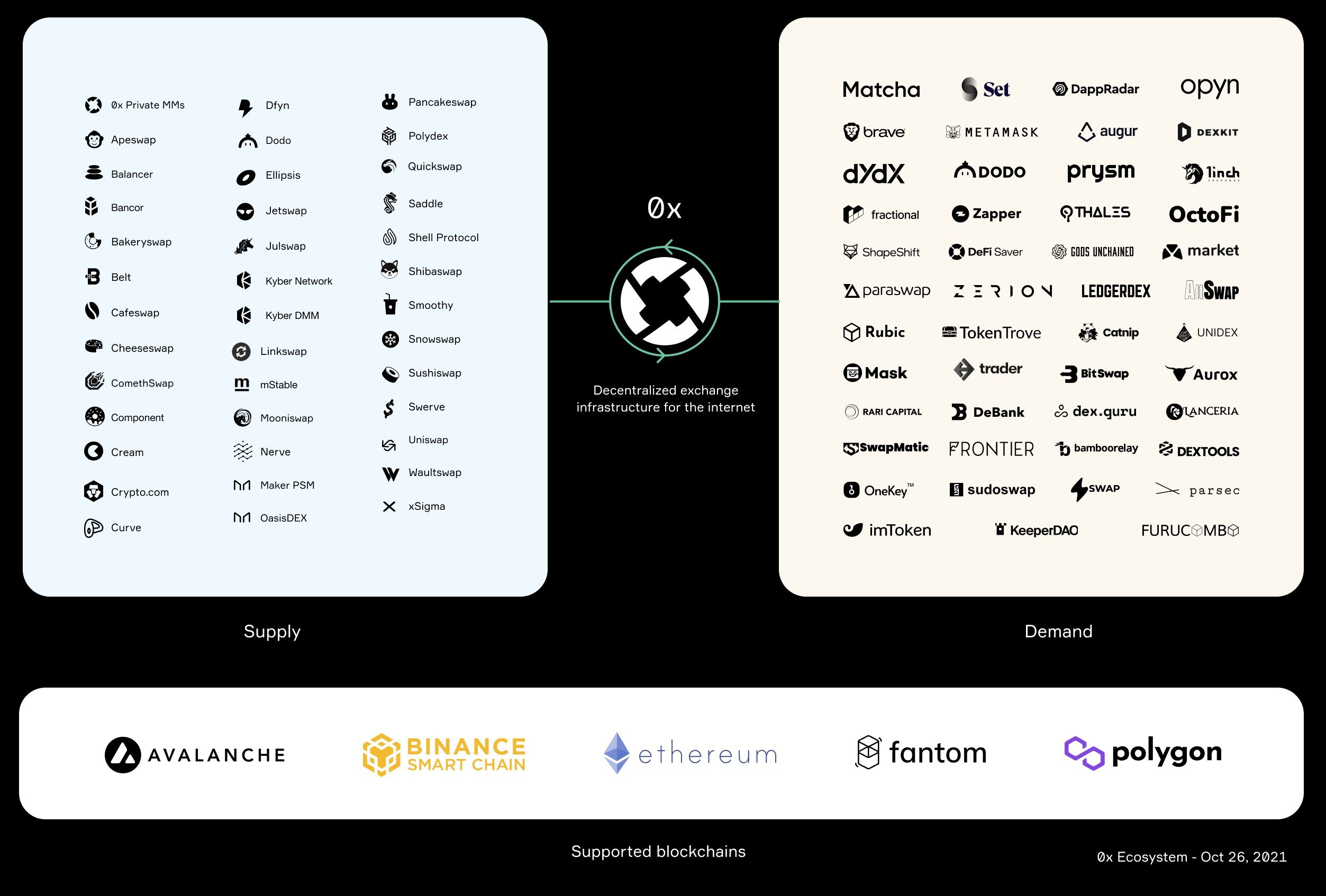

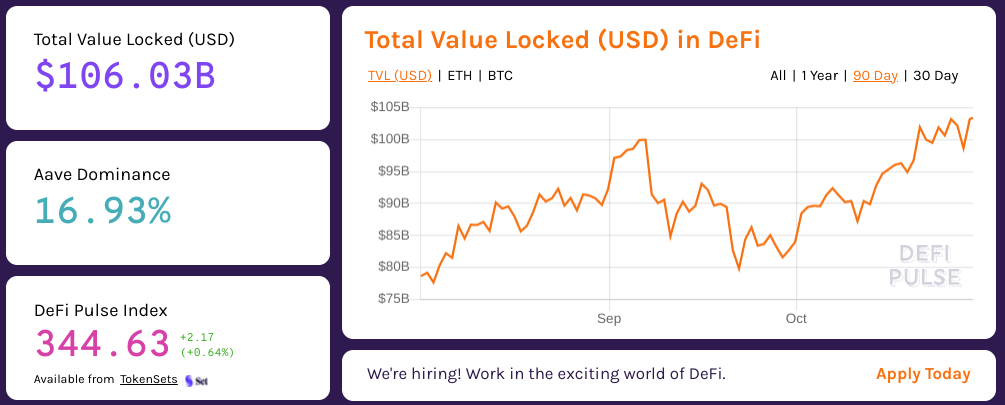

This week, Osmosis DEX announced a $21 million fundraise, led by Paradigm. Funds will support development of the Osmosis protocol on Cosmos, where the Osmosis DEX allows users to trade without being impacted by MEV and provides greater flexibility for developers to innovate with DeFi. Osmosis DEX also enables Superfluid staking, whereby users can stake their LP tokens directly with Osmosis to earn OSMO rewards.   Project Serum, the on-chain liquidity routing protocol for Solana DeFi applications, announced a community vote approval to offer liquidity mining rewards worth $100 million, paid in SRM tokens to liquidity providers on protocols that interact with Serum, beginning with Atrix Finance.   0x Labs announced a partnership with decentralized financial data distributor Pyth network to provide real-time crypto pricing data from the 0x network. Pyth already aims to bring real-world financial trading data to its decentralized network, and the addition of crypto pricing should make Pyth another formidable oracle data provider. And NEAR protocol announced a huge $800 million funding initiative to support developers and accelerate growth on the four-year old blockchain. Funds will be available to developers throughout the ecosystem, with a particular emphasis on DeFi. NEAR also shared loose guidance that $100 million will be allocated for startups, $250 million will go towards helping existing projects scale up, and $100 million will be split among regional funds in Asia, Europe, and the US.   When I first started working on This Week in DeFi, just about all the good stories, innovation, and capital were connected to the Ethereum ecosystem - it’s the birthplace of DeFi, and work done there in the months and years leading up to 2020’s DeFi Summer has been essential to the success of DeFi in the public conscious and on all the other infrastructure to which it spread. But this week, practically no headline stories for DeFi on Ethereum at all! It’s not to say that major development isn’t still taking place there, and much of the mature ‘inflection point’ innovation is within the Ethereum ecosystem. And to be sure, counting Eth L2 solutions, the Ethereum network is capturing a sizable majority of activity and developer interest. But unlike just one or two years ago, we’re no longer in a one horse race for prizes like ‘most innovative’, ‘most adopted’, and ‘best developer environment’. Ethereum has little competition in the ‘most decentralized’ category, but it’s less and less clear, at least in the medium term, how much such technical aspects will truly impact user adoption and user experience. Outside money keeps pouring in, but as ETH and BTC push for new all-time highs, old guard crypto foundations holding those tokens could see their firepower balloon as well. When there’s a big party there’s almost always a big hangover to follow, but right now is truly one of the most exciting times to be in the crypto space in history. Decisions and bets made today will play out years or decades into the future, and the biggest constraint is how much information you can stand to drink from the fire hose while the taps are open. This time next year, they could be closed. Don’t take it for granted! Thanks to our partner: Nexo – Unlock the power of your crypto with up to 12% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: BlockFi at 8.50% APY, Nexo Lend at 8% APY Cheapest Loans: Compound at 4.62% APY, Aave at 5.72% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: Celsius at 8.88% APY, Nexo Lend at 8.00% APY Cheapest Loans: Aave at 7.86% APY, Compound at 7.10% APY Top StoriesIntroducing Forex Yield Farming with Jarvis NetworkNEAR Integrates with The Graph For Better Web3 Support0x API: Leading DeFi DEX Aggregation Service Launches on FantomAvalanche Integrates Ampleforth to Boost DeFi EcosystemStat BoxTotal Value Locked: $106.03B (up 27.12% since last week) DeFi Market Cap: $155.18B (up 14.30%) DEX Weekly Volume: $23.44B (up 63.23%) Total DeFi Users: 3,704,900 (up 2.78%) Bonus Reads[Owen Fernau – The Defiant] – OlympusDAO’s Success Inspires Dozens of Forks [Brooks Butler – Crypto Briefing] – Beginner’s Guide: How to Hedge Your Crypto Portfolio [Samuel Haig – The Defiant] – First Uniswap ETP Goes Live as Institutional DeFi Products Proliferate [Brian Hoffman – Bankless] – Ultra Scalable Ethereum [Anthony Sassano – The Daily Gwei] – Security Conscious - The Daily Gwei #366 If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - October 22

Friday, October 22, 2021

This week, Polygon pays $2m bug bounty, Jupiter Exchange launches and Synchrony raises $4.2m for Solana, and Mudrex indexes DeFi for retail

This Week in DeFi - October 15

Friday, October 15, 2021

This week, Sushiswap goes mobile with Celo, Morningstar Ventures invests $15m in Elrond, and pNetwork and Alchemix gear up for V2s

This Week in DeFi - October 1

Sunday, October 10, 2021

This week, Fireblocks wants in on Aave Arc, Polygon users overtake Ethereum, R3 is building for DeFi, and SocGen bank wants DAI for bonds

This Week in DeFi - October 8

Sunday, October 10, 2021

This week Fei launches V2, DominantFi comes to Polygon, Visor Finance colab with Perp Protocol, and Stripes gets $8.5m for interest rate swaps

You Might Also Like

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏