The eCoinomics Team - November 2021, #1

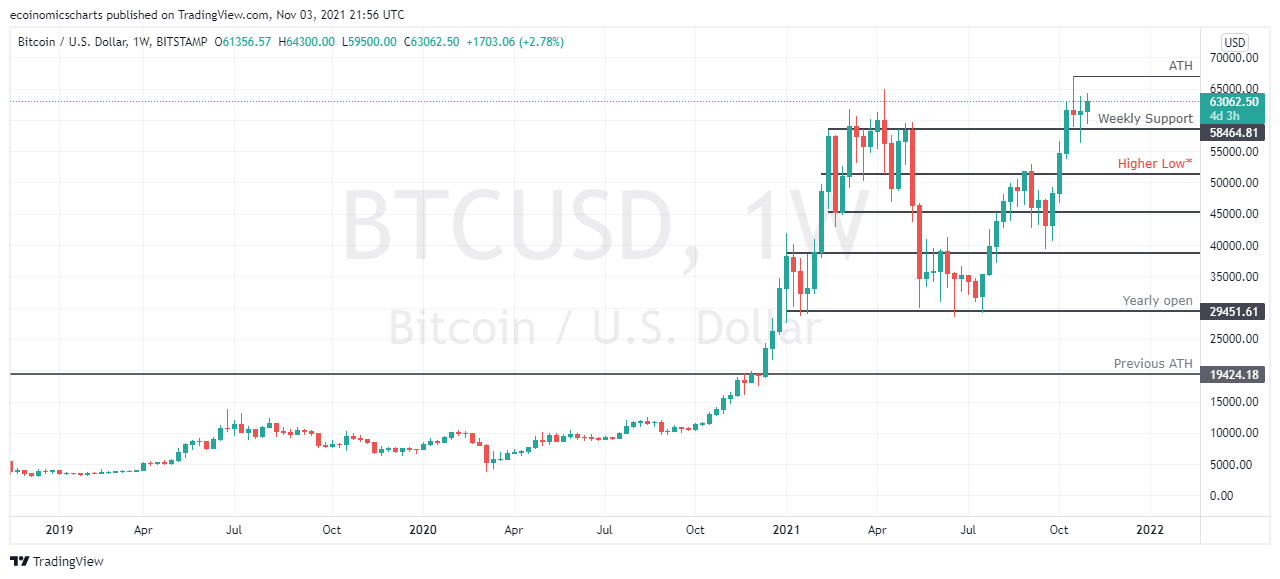

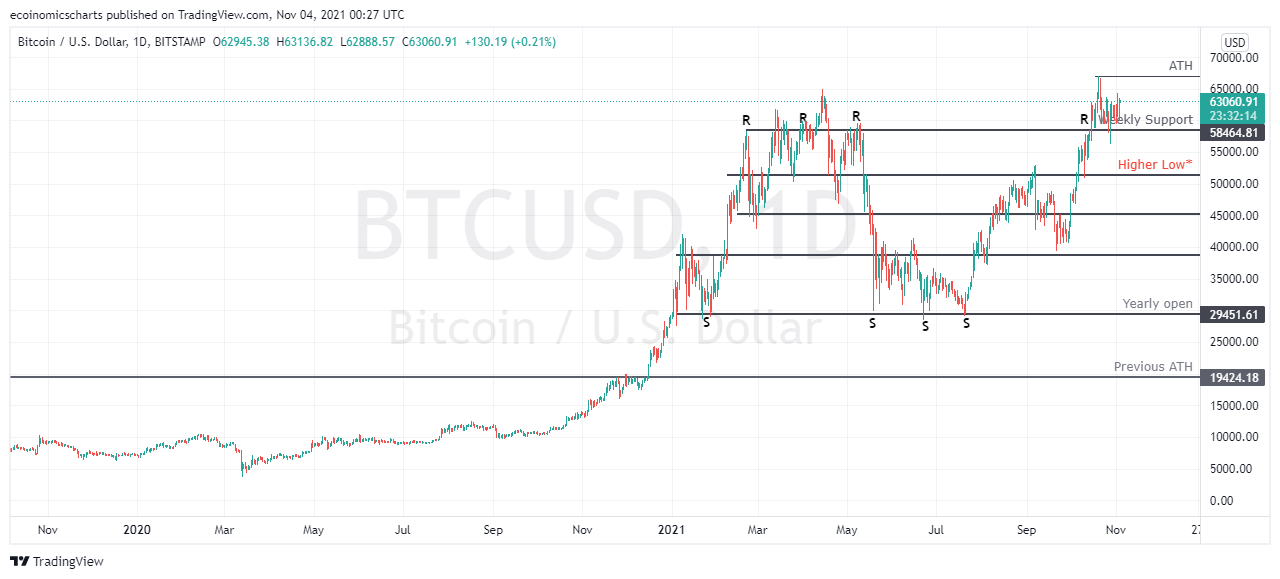

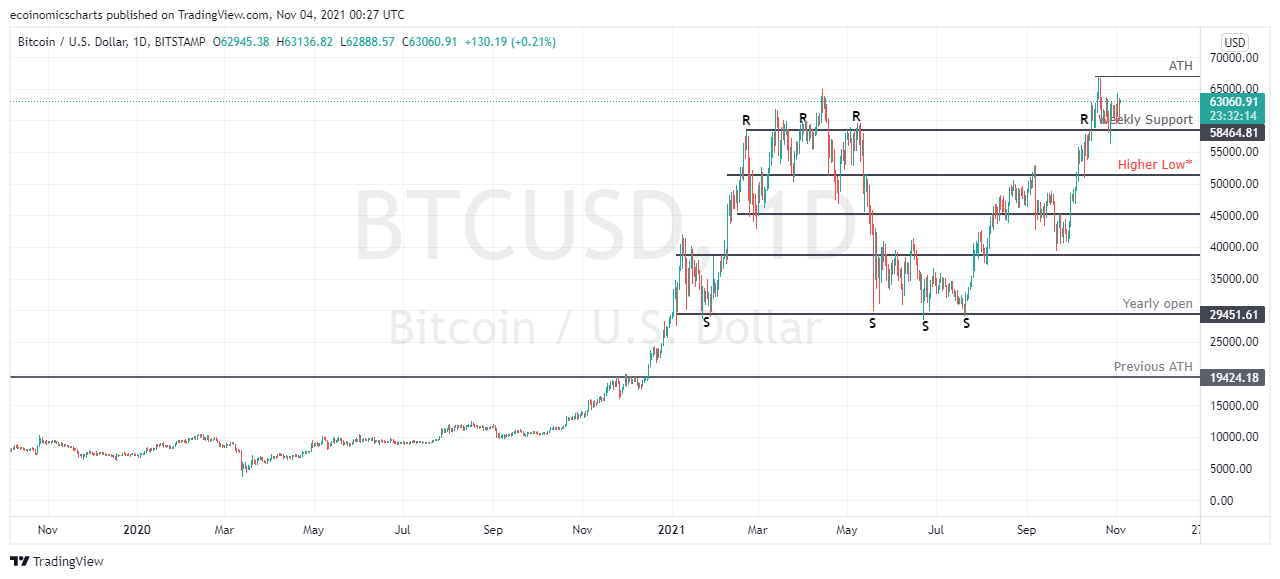

November 2021, #1This week we discuss Bitcoin PA, ETH/BTC, a crash course on trading support and resistance and attempt the question of what is the Metaverse?This Week. 1. Bitcoin consolidates. Ethereum/Bitcoin price analysis. 2. Crash course on support and resistance. 3. What is the Metaverse? 4. Zoom-Out. Dear reader, Thank you for subscribing to eCoinomics. We appreciate your readership and hope you are here with us for many more issues. When we thought about writing a weekly newsletter, we weren’t thinking about an audience. It was more about reminding ourselves to stay the course and not act against our sober minds once money was on the line. It’s a reminder not to FOMO or be afraid to take a trade because we fear price might dump past what would have been a good entry. So in a way, that’s exactly what you get by reading eCoinomics. We discuss macro technical and fundamental analysis away from low time frame noise that helps build a long-term trading mentality. You also get news and we discuss the projects we are looking at for the week in the Zoom-In section. These are essentially letters to ourselves and we hope you can gain some useful insights every time you read them. You may contact us for any reason at ecoinomicsweekly@gmail.com. We host a twitter spaces session called #CryptoRoundUpAfrica with some of our best buds on Twitter every Thursday at 10 PM WAT. Follow us @avogroovy, @oloye__ If you missed any of the Twitter live sessions, check out the podcast at https://linktr.ee/cryptoroundupafrica The eCoinomics team. 1. Bitcoin consolidates above weekly support.There’s not much to say about Bitcoin that hasn’t already been said already. Bitcoin from all technical indications looks like it’ll take flight from here which is not great news for most alts. Bitcoin has been consolidating above its support all week making a weekly low of $59500. At some point, sellers either get tired and it sends, or buyers wait to buy lower, higher low structure is confirmed and it sends. Here’s how we’d like to play it. Laddering bids down to confirmation of a higher low at $50000 in case we get a wicked wick is not a bad bet. Oloye will be placing bids between $50000-$60000. The only risk associated is that the bids don’t get filled. In that case, Oloye will buy a break of ATH price and hopefully catch the rest of the move to whatever the new ATH may be. We are predicting $73000 based on Fib extension. What does this mean for alts? Bitcoin in price discovery has been good to many alts as they made new highs. Bitcoin regaining momentum would mean reallocation back into Bitcoin which translates into Bitcoin Dominance (BTC.D) increasing and most alts will likely go into choppy sideways action. That being said, there’ll be outliers that will most likely fall in the same market segment so we’ll keep an eye on that. Summary: Buy confirmation of higher low at $50000 or buy ATH breakout. ETH/BTCThis pair as we predicted has been a good indicator for the mini alts season we have had. This is why we have focused on it all of last month. Ethereum made a new all-time high v its USD pair. Market rotation finally came into play. Pre ATH, Ethereum action looks somewhat similar to Bitcoin price action now. It maintained its support structure while chopping sideways before finally printing new green candles. Ethereum looks strong (obviously), but we expect it to stay in the 0.0655-0.0756 BTC for now especially if Bitcoin rips, it may trade closer to the support than resistance. As long as it keeps this range, alts are good. If the lower range were to be flipped into resistance, then most likely alts will bleed while Bitcoin rips. So, that’s something to keep in mind as it’ll signal the end or at least a pause of alts season. 2. A crash course on trading support and resistance. Part1Most successful traders will tell you they trade based on S/R. It’s arguably the most underrated tool probably due to its simplicity. New traders often feel the need to overcomplicate the trading process and pack their screens full of conflicting indicators to overcompensate for their lack of understanding. If you learn how to trade S/R coupled with the understanding of risk: return ratio, you are on your way to making good profits in this market. S/R simply is a supply or demand area where sellers/buyers are most likely to step in. For example, study how historical Bitcoin price has reacted to S/R. Those black lines are what are referred to as support and resistance based on where the price is above it (support) or below (resistance). Resistance= Sellers>Buyers. Support= Buyers> Sellers. When there are more buyers, the price goes up, when there’s more supply, the price goes down. Drawing S/R line. Zoom out on your time frame and draw a horizontal line that touches as many lower/higher price points a possible. You shouldn’t work too hard to recognise these price points as they stand out from the rest of the price action. Your line doesn't have to be perfect, some candles will cut through it. Think of it as a zone, not a specific price point. After a resistance is broken, the next price zone this horizontal line cuts across becomes the new resistance and old resistance is judged to become support if the price breaks through it successfully. If sellers step in above and force the price back down, it’s known as a rejection. We’ll try to break it down further later. Concluding part of this next week… Please leave a comment below if there is any technical indicator you’d like for us to include in this series. 3. Welcome to the Metaverse.Facebook CEO Mark Zuckerberg recently announced that Facebook will be rebranding and changing its corporate name to Meta in line with its vision to reposition its business model and products into the next digital frontier - Metaverse. Everyone has a different definition and imagination of the Metaverse. The Metaverse is still a relatively new concept, therefore there’s no consensus on the definition of what it is. However, we’ll attempt to conceptualize it per our own imagination. The Metaverse is the virtual reality realm. It will enable us to live in subcultures transferred from the physical world or created within the Metaverse. The Metaverse in itself could be a self-created nation-state with other participants or sovereign states. How? Facebook (now Meta) ideally will become a virtual state unto itself with its own community of Facebookers (now Metas.) It will have its own leader(s), mission statement, rules and regulation and monetary system (Novi) which Meta is developing. There’ll be boundaries just like physical lands. We imagine there will be many sovereign states in the Metaverse made up mostly of corporations and DAO’s (Decentralised Autonomous Organizations) from within the crypto community with their own currencies, agenda, ideology and belief system. As illustrated by Mark Zuckerberg, it will include augmented and virtual reality. The Metaverse is beyond peer to peer gaming, it is the digitization of everything. It will be an extension of our current digital life but more immersive and interconnected than now. RealVision CEO, Raoul Pal describes it as seamless digital integration. Crypto projects like Decentraland (MANA) and Sandbox (SAND) are pioneering digital land ownership within the Metaverse and this has led to the surge in Metaverse token prices as the race to purchase digital land heats up. MANA briefly surpassed a $7.5 billion market cap on Saturday. We expect other tech giants like Google and Apple to announce similar initiatives in the coming months. It is still hard for the average person to imagine what the Metaverse will look like. We can only hope that it’s awesome. Count Oloye out if you die in real life when you die in the Metaverse though. 😂 4. Zoom-Out

These are the tokens we are watching this week. The contents herein are for educational, informational and entertainment purposes only. It should not be considered financial or investment advice. We are not financial advisers and have no experience in the field. Please talk to trained finance professional before making any investment decisions. If you liked this post from eCoinomics Newsletter, why not share it? |

Older messages

October 2021, #4

Thursday, October 28, 2021

This week we discuss BTC/USD and ETH/BTC price action, Bitcoin ETF explained, and Zoom-In on The Graph (GRT) and Akropolis (AKRO)

October 2021, #3

Thursday, October 21, 2021

This week we discuss the Bitcoin and Ethereum price action, part 3 of our trading system series, why alts are losing momentum to Bitcoin and spotlight Binance coin (BNB) and Polkadot (DOT)

October 2021, #2

Thursday, October 14, 2021

This week we discuss the Bitcoin and Ethereum price action, part 3 of our trading system series, why alts are losing momentum to Bitcoin and spotlight Binance coin (BNB) and Polkadot (DOT)

September 2021, #5

Thursday, October 7, 2021

We discuss price action and expectations for Bitcoin and Ethereum, part 1 of trading systems, how the China FUD is different this time, and Zoom-In on Axie Infinity (AXS) and Fantom (FTM)

October 2021, #1

Thursday, October 7, 2021

This week we discuss the Bitcoin rally, Ethereum price action, part 2 of trading systems, E-naira postponement and Zoom-In on FTX Token (FTT) and Curve DAO Token (CRV)

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏