Rich Bitcoin HODLer vs Poor Bitcoin Trader

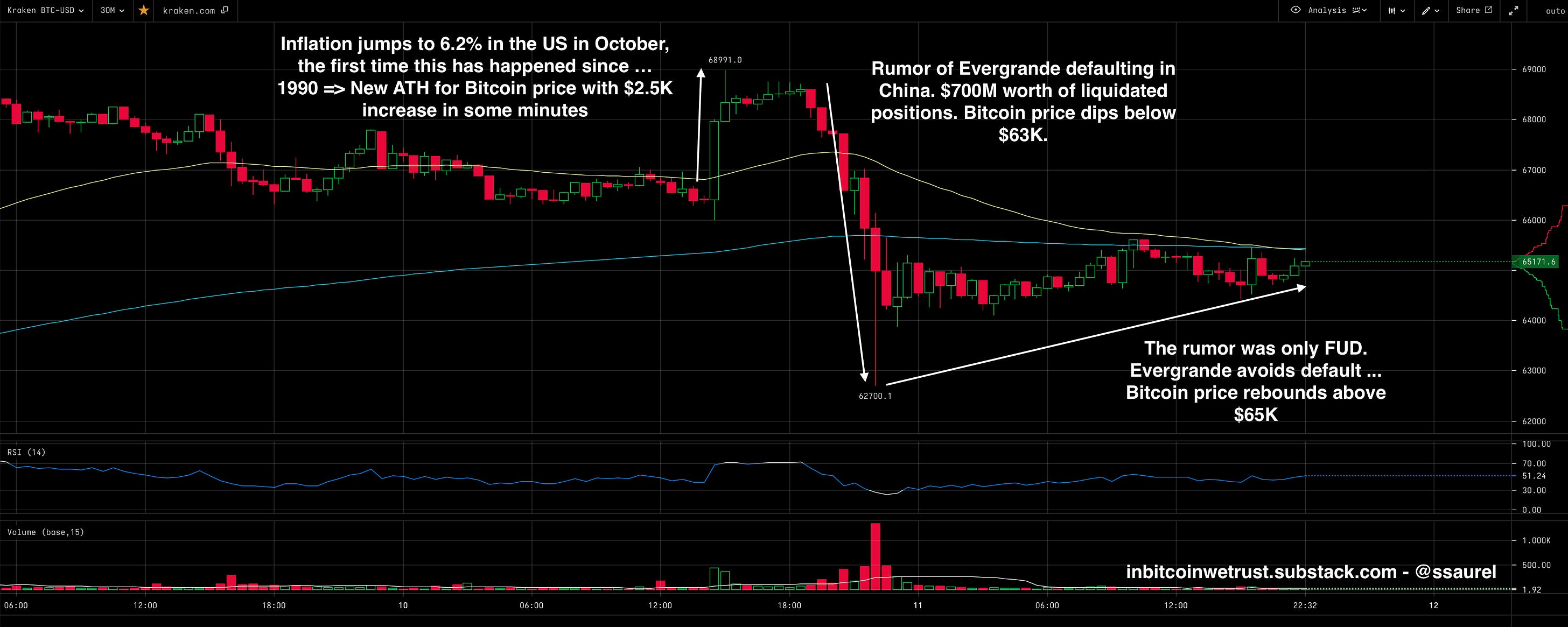

Rich Bitcoin HODLer vs Poor Bitcoin TraderNovember 10, 2021, is here to remind you why HODL Bitcoin is much safer for most people.Written by Sylvain Saurel - In Bitcoin We Trust The lure of profit is what drives most people to buy Bitcoin for the first time. There is nothing wrong with this since most of today's Bitcoiners were once those people who came into the Bitcoin world attracted by the juicy profits it allows. Bitcoin's NgU ("Number Go Up") feature is necessary and even virtuous. It plays a key marketing role in bringing the general public into this alternative system that aims to give the people back the power over money. The important thing is that you then make the effort to understand why Bitcoin is important so that you can be on the right side: the Bitcoin HODLers. After reading this, some people will say that I'm preaching to the choir by trying to convince my readers to buy Bitcoin. This is not the case. I share my opinions and ideas as always. Then you are free to use this information in any way you wish. I am only here to help you open your eyes to what I believe is the best way to take full advantage of the incredible monetary revolution that is Bitcoin. November 10, 2021, gave us yet another example of why HODL Bitcoin is the best strategyOn November 10, 2021, we had another perfect example of why the HODL Bitcoin no matter strategy is best for 99% of people. Unfortunately, many people don't seek to understand the why of Bitcoin and will try to become Bitcoin Traders. Trading is a discipline in its own right that requires very specific skills that only a tiny minority of people possess. Those who improvise themselves as traders in the Bitcoin market will face competition that is probably far more experienced and knowledgeable than they are. The result will be that these apprentice Bitcoin traders will lose a lot of money, but also a lot of time. Trying to time the Bitcoin market is the worst thing you can do. This lesson applies to the world of traditional finance, but also all areas of life, as the fable of “The Tortoise and the Hare” shows us so well, from which we can draw several very relevant lessons for the Bitcoin world. What happened on November 10, 2021, can be summarized in 3 steps: The price of Bitcoin has experienced high volatility up and down in a few hoursWhile the Bitcoin price was consolidating after beating an ATH the day before, the inflation figures for October 2021 in America are released. They are worse than expected. Inflation reaches 6.2% in America ... the first time since 1990. Investors flock to Bitcoin, which is rightly seen as a hedge against inflation. The price of Bitcoin soars within minutes from $2.5K to a new ATH near $69K. The price of Bitcoin then remained at this level for a few hours before a rumor from China completely changed the psychology of the market. Several media outlets reported that Evergrande would default on a debt payment, which would lead the Chinese real estate giant into bankruptcy. The market goes wild and more than $700 million in long Bitcoin positions are liquidated within minutes. The price of Bitcoin collapses by nearly $7K from the $69K area to a low of $62.1K. A substantial -10% drop in the price of Bitcoin on a single FUD rumor. There's a reason I keep telling you that you need to apply 6 rules to beat FUD if you want to take full advantage of Bitcoin. After some research, it turns out that Evergrande will not default on this payment. No immediate bankruptcy for Evergrande, nor potential contagion to the entire Chinese real estate market. Investors are coming to their senses and the price of Bitcoin is rebounding above $65K. This is the current price of Bitcoin as I write this article. Nonetheless, market sentiment shifted in a matter of moments from extreme euphoria to extreme fear on a single FUD rumor. It's pretty incredible, but that's how things work in a free market like Bitcoin. Volatility is part of the game. It's a feature, not a bug. Traders risk losing money with these market movements, while HODL Bitcoin protects you from this inherent volatility of BitcoinAspiring traders must have lost a lot of money in those few hours on November 10, 2021. First by rushing to buy Bitcoin when the Fed figures came out, and then by selling at a loss when the price of Bitcoin started to fall rapidly due to the liquidation of long positions. So they probably sold at a loss for fear of losing money. And then they had to watch in amazement as the price of Bitcoin rebounded. And I can already tell you that this rebound is just the beginning. The fundamentals of Bitcoin have not moved, and the $75K-$80K area remains as relevant as ever for the end of November 2021. All Bitcoin HODLers have been able to look back on this and remain calm. That's the whole point of taking a long-term view with Bitcoin. Volatility doesn't affect you. You may not even experience it, because on larger timeframes it will be very quiet. This is the best way to appreciate this incredible monetary revolution. It's the one I recommend for the simple reason that over 99% of the people who follow this strategy are in profit with Bitcoin. So there's no need to make it difficult for yourself by looking for complex strategies. Bitcoin is a technology that should allow you to take back the power over your money. To profit from Bitcoin, you simply need to believe in the system and be patient. As you can see, your time in this market will be a natural advantage. It's up to you to make full use of it. In Bitcoin We TrustLearn how to earn…Become part of our community.Follow our socials.Subscribe to our podcast.Subscribe to this publication.

If you liked this post from Cryptowriter, why not share it? |

Older messages

EOSweekly: ENF, Pomelo, dfuse, Hypha, Upland, Voice, Bullish

Sunday, November 7, 2021

ENF founders look for their shadows (in China). Less than 24 hours before Pomelo accepts its first grant proposal. Hypha and dfuse making waves again; this time looks like a big one on the horizon.

SAND Rises +320% in a Few Days — Discover More on The Sandbox Which Promotes an Open Metaverse

Friday, November 5, 2021

This vision is the opposite of Mark Zuckerberg's proprietary and closed metaverse.

Three Truths and a Lie About Bitcoin and Altcoins - Truth #1

Friday, November 5, 2021

You want altseason?

Could improve EOS main-net Defi be the key to Greater Adoption?

Friday, November 5, 2021

Defi in case you didn't know, is the abbreviation of decentralize finance, in most people that have been involved in the crypto world for any length of time, would probably agree with the statement

Built-on-DAPP: ZEOS Privacy Coin

Thursday, November 4, 2021

The #BuiltOnDAPP blog series continues to spotlight exceptional projects and teams building scalable, decentralized applications which utilize the DAPP Network universal middleware of services. This

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏