The eCoinomics Team - November 2021, #3

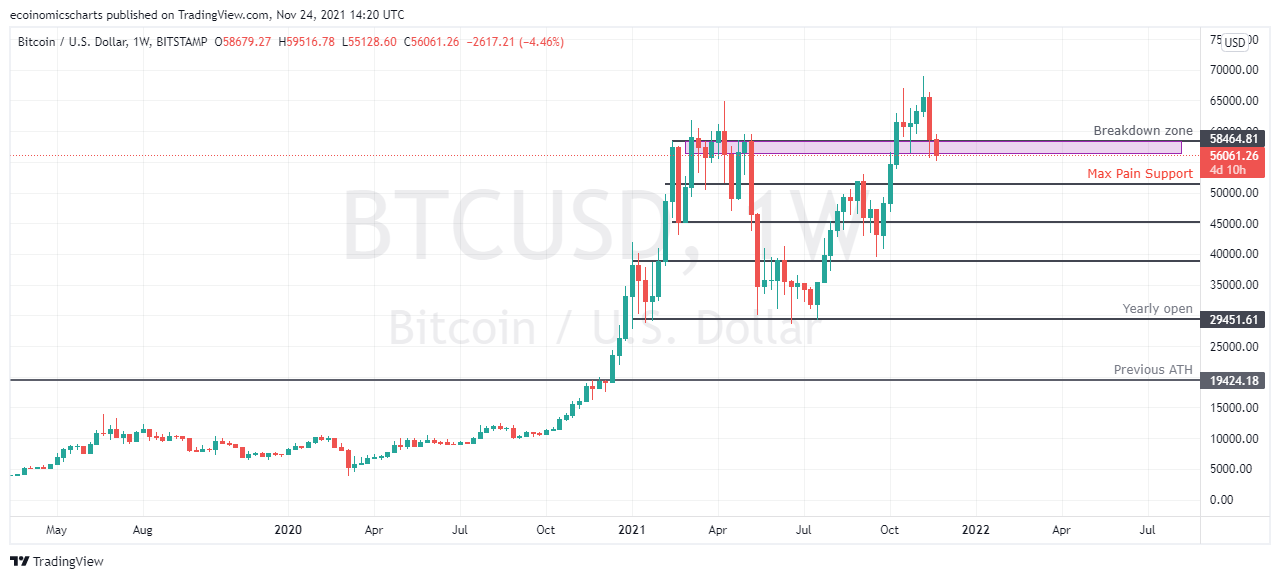

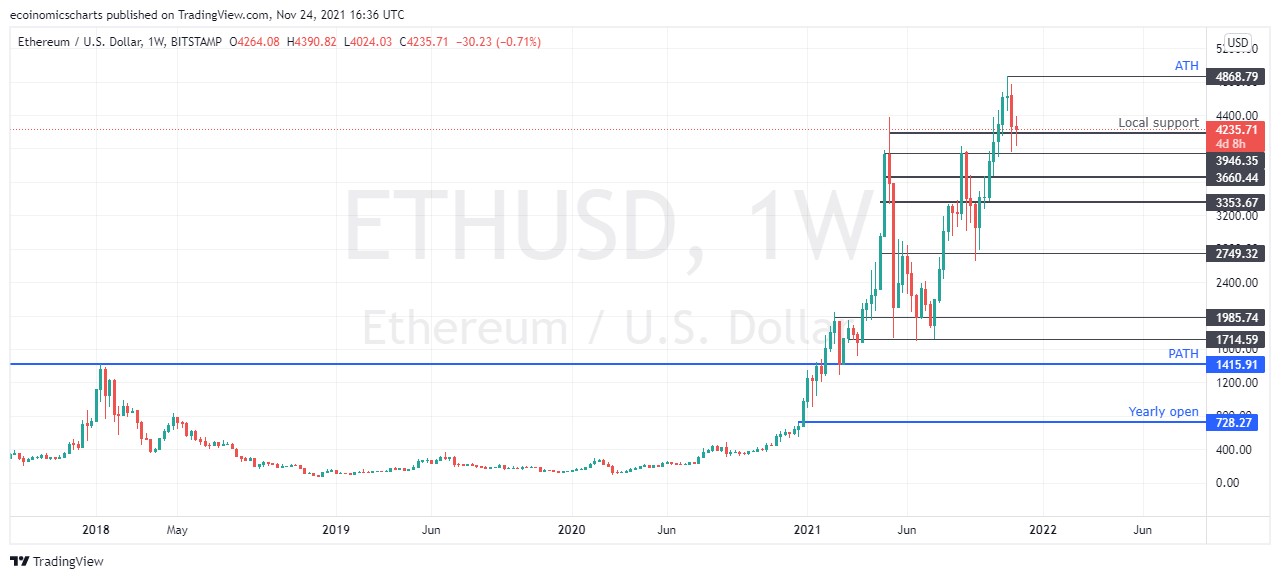

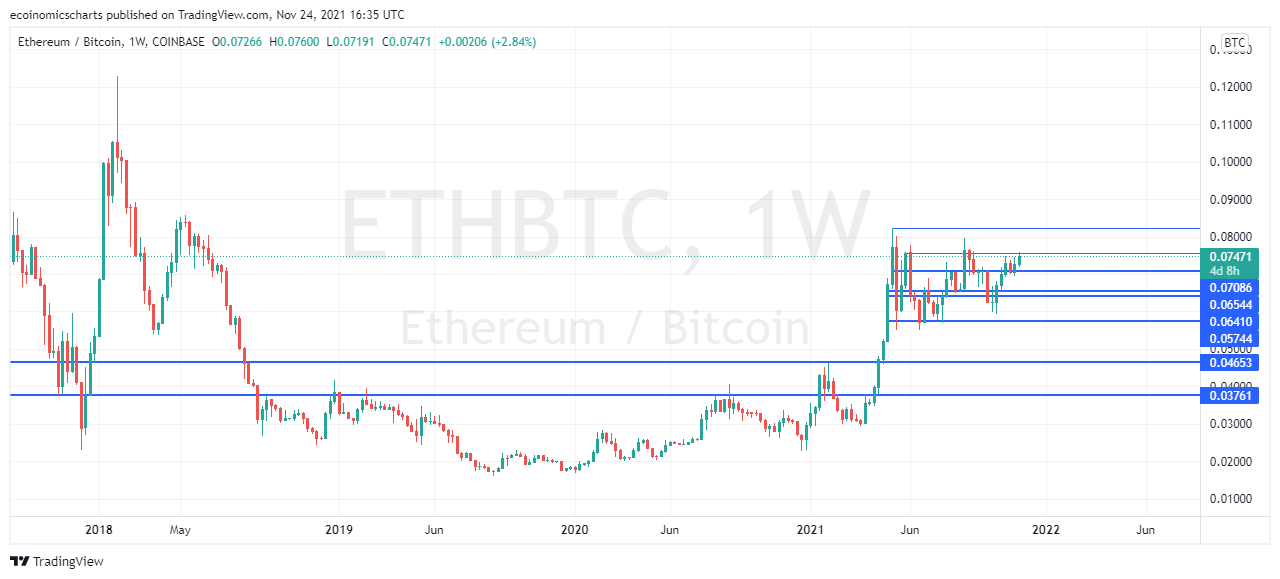

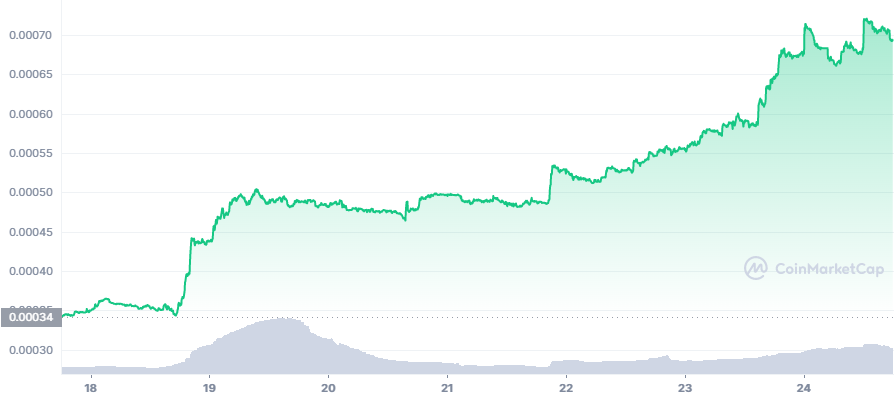

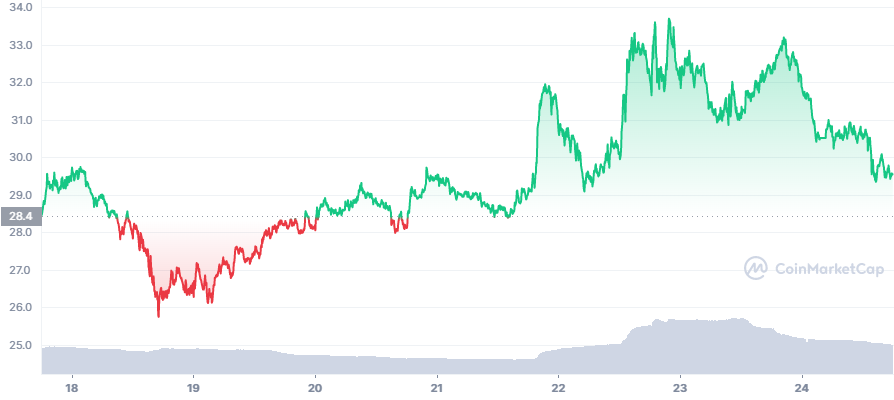

November 2021, #3This week we discuss Bitcoin/USD close breakdown, Ethereum show relative strength, introduction to Diagon.io, a super casual p2e platform, and Zoom-In on the sectors we think will outperform in 2022.This Week. 1. Bitcoin at an inflection point. Ethereum/Dollar musical chairs. 2. Africa’s first Play2Earn (P2E) platform. Diagon.io/event 3. Zoom-In: BAO Finance (BAO) and COSMOS (ATOM) Dear reader, Thank you for subscribing to eCoinomics. We appreciate your readership and hope you are here with us for many more issues. When we thought about writing a weekly newsletter, we weren’t thinking about an audience. It was more about reminding ourselves to stay the course and not act against our sober minds once money was on the line. It’s a reminder not to FOMO or be afraid to take a trade because we fear price might dump past what would have been a good entry. So in a way, that’s exactly what you get by reading eCoinomics. We discuss macro technical and fundamental analysis away from low time frame noise that helps build a long-term trading mentality. You also get news and we discuss the projects we are looking at for the week in the Zoom-In section. These are essentially letters to ourselves and we hope you can gain some useful insights every time you read them. You may contact us for any reason at ecoinomicsweekly@gmail.com. We host a twitter spaces session called #CryptoRoundUpAfrica with some of our best buds on Twitter every Thursday at 10 PM WAT. Follow us @craspaces, @avogroovy and @oloye__ If you missed any of the Twitter live sessions, check out the podcast at https://linktr.ee/cryptoroundupafrica The eCoinomics team. 1. Bitcoin at an inflection point.Bitcoin can do two things right now and both will be fast and quick. It can break down towards $50000 or it can reclaim $60000. “Bitcoin can go up or down. No s#*t.” Unfortunately, the charts don’t leave us with much more than that. The market cannot seem to make up its mind on the direction. If the bull run does end now, it’ll have been a short-lived one. Many blue-chip defi tokens that lost more than 50% of their value still haven’t recovered. The usual rotation hasn’t played out. Maybe this is why the market can’t decide on if to give up, sell and buy lower or to keep defending this inflection point. A breakdown below $58000 was the first haymaker. There have been several jabs at $55000. Bulls throw in the towel at a close below $52000-$50000. Our sentiment also shifts bearish at that point. OR Bitcoin can continue trading in this range giving alts room to pump through our re-allocation theory. We just don’t like that the range it has chosen has a lower range below $58000. Which is micro-bearish. Eth is outperforming Bitcoin. But that’s usually not good news for a long time. Bitcoin either joins the party or it’s a game of musical chairs. TL;DR: Levels we are watching (Above: a reclaim of $60000. Below: Breakdown to $50000 and it better holds. It’s a do or die situation.) 1.1 Ethereum leading game of musical chairs.Ethereum has held its support on ETH/USD ($4000) and retesting the 0.075BTC resistance on its Bitcoin pair. The case for Ethereum is simpler. In so far Bitcoin doesn’t shit the bed and maintains its range, Ethereum will retest and most likely create a new ATH on its USD pair. If Bitcoin dumps, chances are it’ll drag everything else down with it. Bitcoin has to come to the party soon if it doesn’t and alts pump, we’ll regard that as an exit liquidity grab and act accordingly by taking chips off the table. If Bitcoin continues to trade in this range, it’ll provide enough time to derisk on alts and take profit. Levels we are looking at for alts is a retest of range high around $4600, below the current price, we expect Eth to hold the $4000 support. 2. Africa’s first Play2Earn (P2E) platform. Diagon.ioDiagon is a super casual PlayToEarn platform where you can earn money playing games like Table tennis, Car race and Archery on your mobile phone or PC. We are proud to inform you that the team behind this are 100% Africans. The quality of the platform and super ease of usage we believe rivals any other PlayToEarn platforms out there. You can also become one of the 3 lucky people to win up to $1500 worth of tokens by participating in their casual gaming challenge this Friday. Check here for more info. You can also join us on our Twitter spaces discussion this Thursday as we speak to Jay Onojah, Founder and CEO of Diagon to discuss more on the benefits of getting onboarded on a project like this. Use the link here. 3. Zoom-In BAO Finance (BAO) and Cosmos (ATOM)This week, most of the crypto market is in choppy and sideways price action territory except for a few metaverse tokens that are witnessing immense growth stemming from adoption and favourable narratives in recent times. Our spotlight this week is on Bao Finance (BAO), and Cosmos (ATOM). BAO has remained range-bound for a while and accumulating. After a long consolidation period, it has broken out of its current range in an attempt to test the range high resistance from where it broke down previously. BAO looks strong with good volume and bullish momentum even in current market conditions. Price currently sits at 0.0005900USD and resistance is at the 0.0009500USD. Price will have to break this region that has served as resistance on multiple occasions for continuation. ATOM is currently sitting below daily and weekly open at $29.50. Major resistance is at $38 which doubles as monthly open. This is an area many traders will be looking to take profit. If the price is rejected due to current market conditions, $29 is a good zone with confluence to punt a long/buy. Cosmos is a fundamentally solid project with great technology but the price has not reflected this yet. Probably due to the fact that it is not in a popping sector like Metaverse and NFTs. When will price and technology converge? We’ll see on the chart and how the market reacts. It is important to note that the altcoin market is still mostly dependent on what bitcoin does and the overall state of the market. If bitcoin remains relatively stable then we expect the spotlighted coins to perform well. The contents herein are for educational, informational and entertainment purposes only. It should not be considered financial or investment advice. We are not financial advisers and have no experience in the field. Please talk to trained finance professional before making any investment decisions. If you liked this post from eCoinomics Newsletter, why not share it? |

Older messages

November 2021, #2

Wednesday, November 17, 2021

We discuss BTC and ETH PA, we complete our crash course on trading R/S, how to DYOR and briefly discuss market sectors we think will outperform others in 2022.

November 2021, #1

Thursday, November 4, 2021

This week we discuss Bitcoin PA, ETH/BTC, a crash course on trading support and resistance and attempt the question of what is the Metaverse?

October 2021, #4

Thursday, October 28, 2021

This week we discuss BTC/USD and ETH/BTC price action, Bitcoin ETF explained, and Zoom-In on The Graph (GRT) and Akropolis (AKRO)

October 2021, #3

Thursday, October 21, 2021

This week we discuss the Bitcoin and Ethereum price action, part 3 of our trading system series, why alts are losing momentum to Bitcoin and spotlight Binance coin (BNB) and Polkadot (DOT)

October 2021, #2

Thursday, October 14, 2021

This week we discuss the Bitcoin and Ethereum price action, part 3 of our trading system series, why alts are losing momentum to Bitcoin and spotlight Binance coin (BNB) and Polkadot (DOT)

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏