| Dear friends, In JC’s Newsletter, I share the articles, documentaries, and books that I enjoyed the most in the last week, with some comments on how we relate to them at Alan. I do not endorse all the articles I share, they are up for debate. I’m doing it because a) I love reading, it is the way that I get most of my ideas, b) I’m already sharing those ideas with my team, and c) I would love to get your perspective on those. If you are not subscribed yet, it's right here! Share 💡JC's Newsletter If you like it, please share about it on social networks.

💡Must-read👉A Costco deep-dive (Every) (Medium) (25iq) (MasterInvest) (Join Colossus) ➡️ I have done a massive deep dive into Costco. I hope you’ll like it. I’m a huge fan of their model, and Costco is an inspiration to me for Alan. Concept: Simply put, they buy packaged goods in mass quantities and mark everything up at a standard 12% to 13%, which is back solving really for an 11% gross margin. And if you compare that to a typical retailer at 25% to 35% gross margins.

“The retail concept is as follows: customers pay an annual membership fee which provides entry to the stores for a year, and in exchange, Costco operates an every-day- low-pricing strategy by marking up 14% on branded goods and 15% on private label with the result that prices are very, very low. This is a very simple and honest consumer proposition in the sense that the membership fee buys the customer’s loyalty (and is almost all profit). and Costco in exchange sells goods while just covering operating costs. In addition by sticking to a standard markup, savings achieved through purchasing or scale are returned to the customer in the form of lower prices, which in turn encourages growth and extends scale advantages. This is retail’s version of perpetual motion and has been widely adopted by Walmart among others.” Nick Sleep, 2002

➡️ Very similar to what we have been trying to push with insurance + membership fee. ➡️ I don’t think it applies to us. And we have discriminating members. It's kind of a cool place. Rich people shop at Costco. Everybody likes to get a good deal. And I think we've earned that through a focus on quality and being more than just a grocery store and kind of the treasure hunt of items that you find that you would be doing like Callaway golf clubs or Montblanc pens, high-end items that you wouldn't expect to find in a discount format.

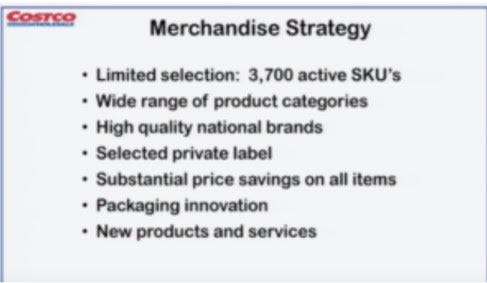

➡️ You can be of high quality and low cost! Everybody likes a good deal! Merchandising strategy: “Our operating mission is very simple, ‘constantly strive to bring goods and services to market at the lowest possible price’. We look at every item and we judge it on that basis. When you have less than 4,000 items you can spend a lot of time doing that. Where a typical retailer might look at an item selling at $29 and say ‘I wonder if I can get $31 for it’, we look at and say, ‘I’m selling it at $20, how do we get it to $18 and then $16’. We really focus on that constantly, everybody works on that.”

To put that into perspective, Target or Walmart, which have essentially the same categories of merchandise that we do, they have about 140,000 items. We really preselect the products we’re selling and trying to get the best value that we can in every single category. They are generally high quality national brands augmented by our private label.”

➡️ Costco reduced the number of items to have more volumes. I’m wondering what we could keep doing on the healthcare supply to keep reducing prices while increasing outcomes for our members. Bulk sizes are the norm at Costco. They sell mayonnaise by the gallon, 10lb packs of meat, an annual supply of mouthwash, etc.

For customers, the benefit is obvious: buying in bulk is much cheaper on a per-unit basis. But Costco benefits too. Bulk sizes make people spend more. The genius of bulk sizes is that it gets people to spend more, while convincing them they're saving money. Because the prices are so low per unit, people wind up buying far more than they normally would.

➡️ What is the equivalent for us? Customers Save on Every Item “We have to be able to show a savings on everything we sell. If we can’t show a savings we won’t carry it. We’ve had situations, like in Portland, where for about two years we didn’t carry sugar because every supermarket was selling sugar below cost. We couldn’t save our customers any money. Our attitude was if they came in and see we couldn’t save them any money on the sugar, they have every reason to believe that maybe our pricing isn’t so hot on Michelin Tyres or a television. It’s a chink in the armor and we won’t engage in that”.

➡️ What segments we don’t go to because we can’t show value? Margin : “Although we are all interested in margin, it must never be done at the expense of our philosophy. Margin must be obtained by better buying, emphasis on selling the kind of goods we want to sell, operating efficiencies, lower markdowns, greater turnover, etc.

Increasing the retail prices and justifying it on the basis that we are still ‘competitive’ could lead to a rude awakening as it has with so many. Let us concentrate on how cheap we can bring things to the people, rather than how much the traffic will bear, and when the race is over Fed-Mart will be there”. [The best summary of the business case for scale economics shared we have come across].

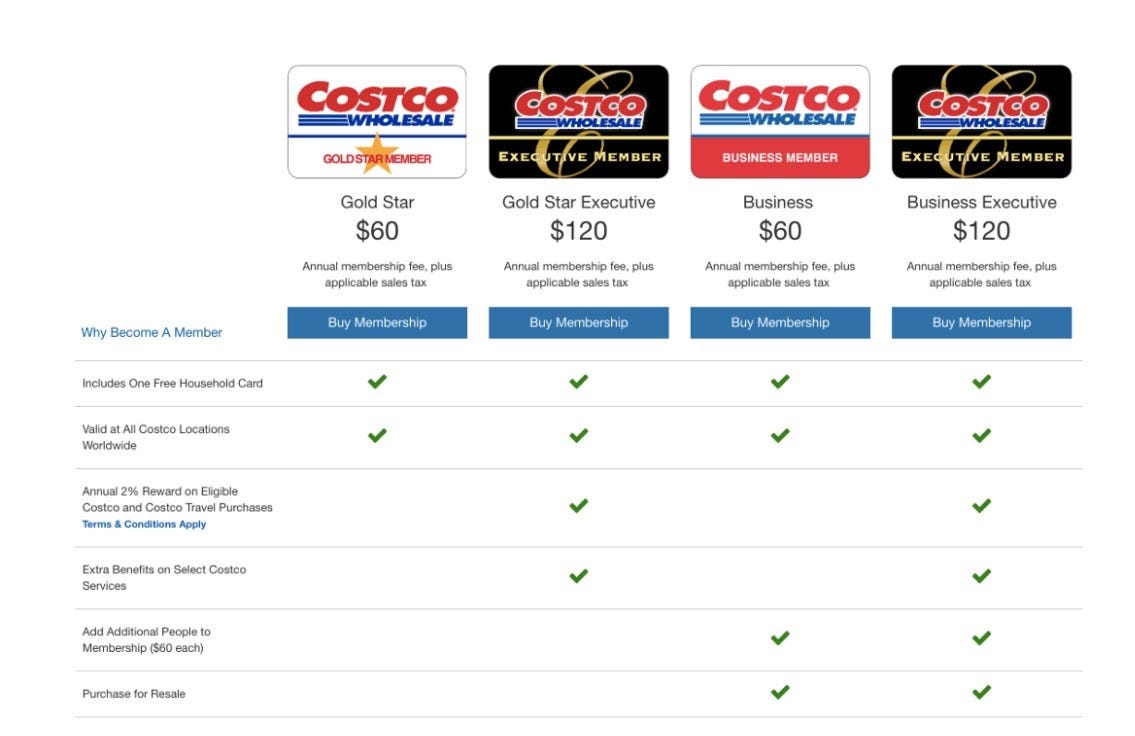

➡️ I love it! Membership model: ➡️ there are 4 levels of membership for Costco members. ➡️ Should we take the membership fee yearly? I think we increased the membership fee when we think the value is there to do that. And it depends on the market. When we went through that experience, I think there was some concern going into it. What was the drop-o going to be? Are we going to lose members? It was a blip. There was no impact. People happily paid, I think, it was $5. And that was probably the third time in the last 15 years it has been done. So people infer from that, that every five years, they're going to increase it. I don't think that's really the case. It's going to be based on conditions on the ground. I think that the company prefers a membership fee increase to increasing prices. Increasing prices is an estimate to Costco people.

➡️ How they increase the membership fee. Once every 5 years, while having increasing value significantly. I love the patience. The Costco experience: “This is almost like show business. I mean, every day you’re opening up and it is show time.” The “treasure hunt” aspect of shopping at Costco is intentional. Some people get a dopamine rush when they find the unexpected treasure as they wander the aisles at Costco. The feeling of walking out of Costco having spent more than you imagined going into the warehouse is common. Charlie Munger puts it this way: “If you get hooked on going to Costco with your family, you’ll go for the rest of your life.”

➡️ I love the notion of variable rewards (the book “Hooked” by Nir Eyal is super interesting on the topic). No Advertising : We are working on margins that do not allow us to spend 1 or 2 percent on advertising. Also, advertising becomes like a drug. I use the expression: It’s like heroin, once you start doing it, it is very hard to stop. We feel that the most successful type of advertising is word of mouth. When people are saying good things about you, it is much more important than when you say them about yourself. Word of mouth is the most effective type of advertising.”

➡️ I like being independent of advertising. Verticalisation : So one of my favorite concepts is the rotisserie chickens that are in the back of the store that I think they sell for $5 or something and that price hasn't changed forever. And apparently, there's something about the size of the chickens from Tyson getting too big and so they're like, "Hell, just invest hundreds of millions of dollars and grow our own chickens from egg all the way through to spicket so that our customers can keep their value prop."

➡️ They will do anything to keep their value prop Kirkland: How Costco Convinces Brands to Cannibalize Themselves Kirkland’s success defies our intuition and experience. Shouldn’t lower prices lead to lower quality products? How can they offer rock-bottom prices but still have some of the best products around? The answer is this: they get the best manufacturers in the world — who already have products on Costco shelves — to make Kirkland products. Yeah, you read that right. While customers might not know it, Kirkland products are often made by the same manufacturers who make the branded products that sit next to them on the shelves. Costco is one of the largest sales channels in the world and brands can still profitably sell their products under the Kirkland brand. And if a brand can weave their way into becoming one of the , SKUs in a Costco warehouse (compared to one of , in a Walmart) it gives them access to one of the highest volume sales channels in the world. The upside is so large that brands don’t mind having an unbranded version of their product sitting next to their branded product. Consider supplier incentives. For CPG companies, customer acquisition (especially through retail) is one of the most important problems. As long as it’s profitable, these brands are willing and excited to manufacture products for Kirkland.

➡️ Costco distribution is so powerful that they manage to get the best brands to sell under the Costco brand. Ancillary businesses: Provide ancillary goods or services to sustain the sales of primary goods or services: we all like to talk about optimizing our business operations. However, at times to make money, you need to lose money on something else. In a way, this is a variation of the razor and blade business strategy.

On the one hand, you sell a service where you don’t make money, while on the other side you sell a complementary good or service where you have high margins. This strategy can be applied pretty much to any business. For instance, imagine the case of a digital agency that sells a website design at a meager price by making it no profit on that. It will sell complementary digital marketing services that instead have a high-profit margin. Ancillary businesses within or next to our warehouses provide expanded products and services, encouraging members to shop more frequently. These businesses include our gas stations, pharmacy, optical dispensing centers, food courts, and hearing-aid centers.

➡️ Very similar to insurance for us. Once we are in contact with customers, we become the health one-stop-shop.

🏯 Building a company👉How to nail your referral scheme (Sifted) Give your referral programme a lot of love. We put a pretty all-round marketer on our programme full-time, gave them tech resources and did lots of experiments to test and optimise — and that grew it 5x or so. Tell your customers about it — a lot. We now prompt them on the website or app too, which was a big change for us. Only 30% of people are going to open emails, but everyone’s using the app. Incentivise your referrers, but not as much as your potential customers. We’ve found that the person who is referring wants to know that their friend is getting a good deal. Run more campaigns. Once every quarter or so, we run a limited special offer where we double the incentive to £30 to create a sense of urgency. We also follow up whenever people give up on a referral halfway through. Let people know what their friends are up to. People like to know whether their friend has done it, or not done it. So now, if their friend hasn’t taken up the offer, the referrer gets a nudge. Introducing some element of fun is good as well. Freetrade has a referral scheme where when you refer a friend, each of you get free shares in a particular company — but you don’t know what it is. Just get started, ASAP. This is one of the cheapest customer acquisition channels. It’s cheaper than ads on Facebook, and you’re using a great selling team — your existing customers. How to be more Morning Brew. The newsletter’s referral programme has been a huge success; it’s driven 35% of its subscribers. Remember Monzo’s golden tickets? Founder Tom Blomfield told Mashable back in the day that the strategy drove 45% of signups in any given week.

🗞In the news📱Technology👉Enterprise Metaverses, Horizon Workrooms, Workrooms’ Facebook Problem (Stratechery) 👉 Rise of the Super App (The Verge) There are now more than two-dozen mini-apps in Snapchat, though the company hasn’t disclosed overall usage of them yet. There are about three million mini-apps in WeChat and about 1 million in Alipay.

👉 The markets (The ICONIQ Weekly) 🏥 Healthcare👉Transforming Tata (Not Boring) Healthcare: Tata is in the final stages of acquiring online pharmacy 1mg. Tata’s ability to roll out the rst CRISPR-based COVID test, along with its relief efforts, should give it some credibility in the medical space among Indian consumers. India still only spends 3.6% of GDP on healthcare, lagging the US (16.9%), Germany (11.3%), and China (5%).

👉The Rise of Big Data Psychiatry (WallStreetJournal) Our smartphones measure our movements with accelerometers, our location with GPS and our social engagement with the number of calls and texts we send. A person’s recent Google search history, it turns out, is a better predictor of suicide than their clinician’s most recent notes. Speech and facial recognition technologies could be used to precisely measure a patient’s expression, the words they use and the intonation of their voice. Such tools could be used to recognize the subtle changes that occur when a patient is about to become floridly manic, or analyze how they respond to treatment. A recent study by Cheryl Corcoran published in the journal World Psychiatry showed that elements of speech such as coherence and the frequency of possessive pronouns (words like his, her, my or mine) can predict, with an accuracy of 83%, whether someone at risk for psychosis will actually become psychotic. Such data is created at every clinical encounter, but it is far too subtle for a doctor to detect.

➡️ I did not check the paper and it might be an exaggeration, but interesting trends.  | |  |

If you liked this post from 💡JC's Newsletter, why not share it? | |