The Liberty Complex: Cash Flow Today, Taxes Eventually

You're on the free list for The Diff. This week was Conglomerates Week at The Diff, with a look at some of the best capital allocators of the last few decades. Posts included:

Thanks again for reading The Diff. If you'd like full access, sign up today. Next week will feature some more company profiles, including a recent IPO and two interesting startups. And a programming note: The Diff will be off for the rest of the year after December 24th, back on Monday, January 3rd. The Liberty Complex: Cash Flow Today, Taxes EventuallyPlus! Portal and Technology Prosthetics; Browsers as a Shopping Tool; BNPL Rules; John Kelly and YOLO Stocks; News Post-Trump

Welcome to the Friday edition of The Diff! This newsletter goes out to 25,451 subscribers, up 109 from last week. In this issue:

This piece marks the end of The Diff's series on conglomerates. The other case studies involve a single parent company, perhaps one that periodically spins off assets. Liberty is more complicated; it's a set of interlocking companies, with varying levels of independence. And it's an organization that has vigorously spun off various companies for a long time. The middle of the Liberty constellation, Liberty Media, is traded as three separate stocks that track its various holdings. (One, Liberty Braves, was previously written up in The Diff ($). Liberty is also a unique approach to structuring businesses and rearranging them without getting burned by taxes. The company sometimes sets up complicated puzzles when it restructures, which can either make them vast amounts of money or blow them up. Basically a stock picking version of Squid Game. Need more Liberty content? I'm doing a Callin show with Andrew Walker of Yet Another Value Blog tomorrow. The Liberty Complex: Cash Flow Today, Taxes EventuallyThe form of Liberty doesn't quite match other conglomerates, but the spirit certainly does: the Liberty companies are all about allocating cash to high-return opportunities. Their particular brand of financial engineering focuses on leverage and spinoffs, which both share the interesting trait that they're a way to pay taxes later. The companies are a collection of media assets, including cable (Liberty Global, Liberty Latin America), satellite radio (Sirius), tickets (Live Nation), and cable content (Qurate, i.e. QVC and HSN, as well as Discovery). Liberty Media consists of tracking stocks covering SiriusXM and Live Nation, the aforementioned Braves, and Formula One. The Liberty world also includes several companies that exist mostly to hold appreciated stakes in other business (more on this later), like Liberty Broadband (which owns 26% of Charter, and some other miscellaneous assets), Liberty TripAdvisor (23% of TripAdvisor), and dearly-departed friends like Liberty Expedia (same idea). The existence of this complicated form is not arbitrary: some of the entities exist as separate publicly-traded stocks because investors may care more about one unit than the other; it's possible to be bullish on satellite radio and bearish on baseball, for example. But others exist because Liberty has gotten very, very good at delaying taxes, which is equivalent to saying that the companies are partly financed by a series of interest-free loans that can be renewed almost indefinitely at the cost of some paperwork and complexity. There are two common threads in the Liberty story, going back to before there was a company called Liberty:

They've changed how they accomplish these goals, generally staying a step ahead of disruptions in the media industry. But they haven't changed the overall approach. So following Liberty is a sort of corporate Platonism, where the same fundamental idea can get expressed in buying up local cable systems one year, in spinning off stakes in cable networks later on, in buying out an entire media category in 2009, and buying an entire sport in 2016. Origin Stories: TCI's Tax ShieldEarly TV was one of the greatest growth businesses in history: the installed base of television sets went from 14,000 in 1947 to 172,000 in 1948. TV penetration went from roughly zero then to 50% of households in 1954, 90% in 1962, and 98% by 1978. Depending on what counts as the starting gun, this is arguably faster than the Internet, and certainly had a similar impact on culture and politics, albeit not on economics.¹ The cable TV business is a reminder of several business truths: every high-growth tech startup will eventually, if it's lucky, turn into some kind of utility; there is such a thing as economies of scale; and media disruption is incredibly hard to predict. In its earliest days, the cable industry was not about giving people access to unique shows: it was about connecting remote parts of the country to regular broadcast television. This made it a very common community-focused small business; a small town far from a big city will probably have a local auto repair shop, a local bank, and, by the 1950s, a mom-and-pop cable operation that bought a large receiver and wired houses to receive a TV signal. In 1973, Tele-Communications, Inc. was a collection of several such systems. The company was publicly traded, but financially shaky, and needed both an operator and a dealmaker who could a) keep revenue coming in, b) keep the banks from taking the company over, and c) ideally, convince those same banks to lend the company more money to expand. It's worth thinking about the economics of one of these early cable systems in detail, because similar ones can show up in a variety of industries:

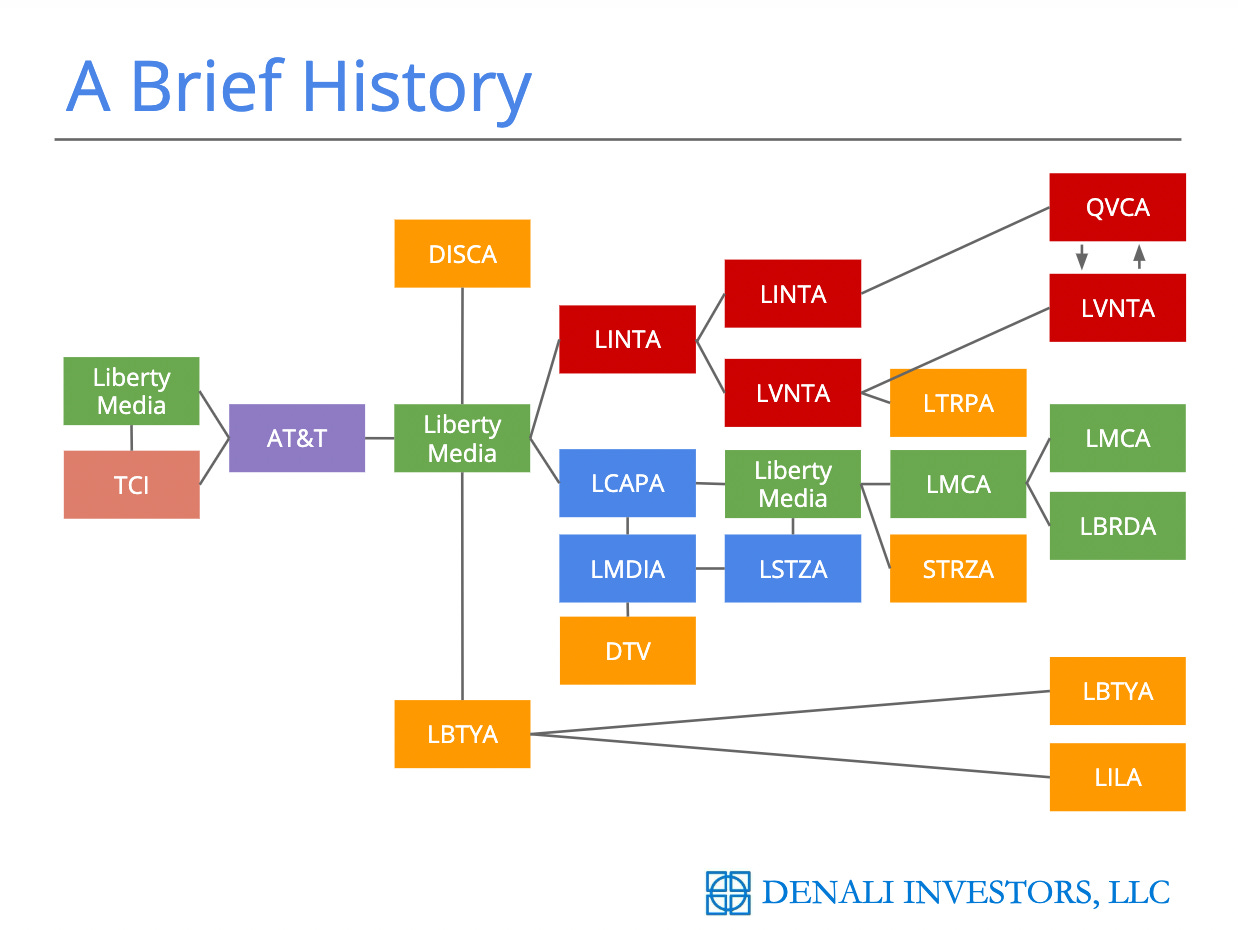

Put all this together, and it means that a brand new cable system produces a big tax shield in the form of depreciation, while a more mature one can finally earn enough to exceed depreciation (to make up some numbers, imagine that cable rates rise 5% annually and revenue starts at 3% of the original upfront cost; for the first ten years, depreciation is higher than revenue, so ignoring all other costs the first decade's revenue is tax-free). This creates a nice growth equation: as long as a cable operator keeps buying fresh systems, it's buying enough depreciation to continue to shield the returns from its more mature systems. If a cable company grows fast in terms of revenue and assets, its after-tax cash flow grows even faster. Malone as an operator had a fearsome reputation for being adversarial both to competitors and regulators. (As an example of the latter, in this 1994 Wired interview he suggests that Al Gore shoot the chairman of the FCC, and, when asked directly, refuses to say whether or not he's joking.) The company negotiated hard for acquisitions; TCI would close a deal every two weeks from 1973 through 1989, and there's nothing like a long list of backup options to help a buyer maintain pricing discipline. And that competitive aggression extended to other areas, too. In 1971, cable entrepreneur Charles Dolan conceived of a subscription service that would allow cable households to view new movies, major league sports, and other programming. As cable expanded, the business made a fairly smooth transition from offering broadcast content to people who couldn't otherwise receive it to offering exclusive content to subscribers willing to pay a premium for it. As more of these networks came into existence, TCI negotiated with them: it would carry them, but they'd sell a stake back to TCI. This is an interesting transaction, because at one level it's basically Paul Graham's equity equation, where TCI adds value to the network (by increasing the number of households it reaches, and thus giving it critical mass for both subscriptions and advertising), and in exchange TCI gets equity that is a) worth something to TCI, but b) worth less than the value being added. On the other hand, you can also look at this strategy as a market-dominating company charging a higher price than everyone else in the industry, and being able to drive that premium higher as it gets more scale. In fact, if you're really paranoid you can imagine a world where TCI has more channels to offer than anyone else, pays less for them than anyone else, and, just in case it misunderstood the long-term economics, gets a piece of all the content upside through its equity. How this behavior is judged depends in part on the reputation of the person engaged in it. And Malone had been referred to as "Darth Vader" by national politicians. In negotiations with Jefferson City over the cost of the cable franchise there, Malone had sued the city, run ads in the local paper attacking the government, and withheld franchise fees. A TCI employee threatened to ruin the reputation of a cable consultant who worked for the city if he didn't recommend that TCI keep the franchise (he was fired, but it certainly didn't make TCI look good). If you're running a vertically integrated company that's perceived to engage in anticompetitive behavior, you have some choices: you can try to do a big PR campaign, but that's an uphill battle; you can stop engaging in that behavior; or you can become a different kind of company. TCI eventually chose the latter: it packaged together its investments in content and spun them off as a separate company, Liberty Media, in 1991. It was a complicated deal. The prospectus is 700 pages long, including five pages just devoted to enumerating all of the terms that will be defined in it. Most of Liberty's assets were stakes in other companies, which, per accounting rules, were held at book value rather than market value. The company also had debts, so it wasn't generating accounting earnings. Investors had to choose to participate in the spinoff, and if they didn't, fewer shares would be sold. As a result, most investors ignored it; a few smart ones participated, one of whom was Malone: he invested $42m in Liberty, much of it borrowed from TCI, and a few years later those shares were worth $600m. Liberty was only the beginning. Subsequent transactions created a whole zoo of special-purpose vehicles:

All this activity couldn't be slowed down even when TCI itself was finally sold to AT&T for $48bn. In that acquisition, Liberty was kept as an AT&T tracking stock, but in 2000 it was fully spun off as an independent company. With assets that were mostly stakes in other companies rather than physical assets it owned itself, Liberty turned into a sort of general platform for media dealmaking. Making and Keeping Money in the Media BusinessMany kinds of investment return can be broken down into factor bets, whether those are industries, valuation buckets, momentum, or something else. You can think of media returns as being partly driven by idiosyncratic returns (Malone says TCI grew its market penetration 1% overnight when Jaws came to HBO), and partly based on a few macro factors:

The content cycle is particularly powerful, and there are many examples of it:

Liberty is very adept at riding these trends, both in the sense that it times them well and in the often more important sense that it sells once they're no longer outperforming. "Selling" can be a vague term, though; if you're indifferent to taxes, selling can just mean exchanging an asset for an appropriate quantity of cash and paying taxes on the difference. Liberty is emphatically not indifferent to taxes, and has learned all sorts of artful ways to spin off appreciated assets without making them taxable, borrow against them rather than realizing taxable profits, construct hedges and other structures to keep that borrowing (fairly) safe, and otherwise defer taxes indefinitely. The company is unapologetic about this: they joke a lot about avoiding taxes in their investor communications. The company does note that it's engaged in tax deferral, not avoiding taxes altogether; at some point, if you make enough money, you will probably end up realizing a taxable gain. In some ways, the company is trustworthy on this because Malone is ideologically opposed to high taxes; he's a libertarian-leaning Republican. Some companies engage in circumlocutions about why they optimize around taxes—amazing that the highest-quality labor is so often located in low-tax jurisdictions!—but Liberty can come right out and say things like "We wouldn't be Liberty if we didn't talk about taxes" or referring to any time they pay more taxes than they hypothetically could have as "tax leakage." They can talk about lining up realized capital gains with interest payments, so they're only selling appreciated investments at a time when they can pay zero taxes to do so. It's instructive to compare the Liberty companies to another voracious buyer of trophy assets, Sumner Redstone. In some ways there are deep parallels: both Redstone and Malone started out owning distribution, later focused more on content, and were adroit investors. Redstone's family business was a theater chain, National Amusements, which remains the entity in control of the rest of the empire. Redstone first started getting attention as a media player when he used his box office data and movie industry connections to make timely bets on movie studio stocks in the 70s and 80s—at a time when movie studios were publicly-traded pure-play companies without much exposure to home entertainment, being the first person to figure out that Star Wars was a big deal could create lots of alpha. Redstone used some of these profits, and a fair amount of leverage, to take over Viacom (MTV, Nickelodeon) in the 80s, and Paramount in the 90s. Malone and Redstone were both good buyers, but Redstone was a terrible seller, holding on to some assets almost indefinitely, and sometimes getting rid of them in inopportune ways.² In some industries, being a great buyer can be all it takes, but in media the equation shifts all the time, as different kinds of distribution make a given category of content more or less worthwhile. Being able to sell means never being stuck in categories that stop performing for long periods.³ There are good buyers, but they end up holding assets that age out of being able to produce high returns. There are good sellers, but they run out of assets to sell, and while skill at selling businesses can come in handy in investment banking, bankers tend to accumulate far less capital than owners. And there are people who are good at buying and selling, but do both a bit too much and end up facing the dreaded tax leakage. Liberty's long-term returns are the product of getting all three factors right. The Sirius Deal as an ExemplarThere are plenty of well-documented Liberty deals to choose from, but the SiriusXM bailout is one that works well as a demonstration of the company's ability to structure the right bet on the right company at the exact right time. Sirius Satellite Radio and XM Satellite Radio were both founded around the same time (1990 and 1988), both with the same model: use satellites to offer a larger number of radio channels to a broader audience, and then find a way to monetize. This is a classic high fixed-cost, low marginal-cost business, and both companies were able to raise money from lenders and public markets to fund it. Unfortunately for them, since they were competing for exactly the same market, they a) engaged in a great deal of duplicative spending, and b) competed for some of the same on-air talent. The companies limped along in the 2000s, generating revenue but burning massive amounts of cash. But they were able to show growth in revenue; Sirius did $13m in revenue in 2003, and got that number up to $637m in 2007, although EBITDA losses rose over that period. In 2008, the two companies merged, but two deeply indebted companies merging just ahead of the financial crisis does not mean they've solved their problems. By February 2009, they were hiring bankruptcy lawyers and preparing for a restructuring. The share price had fallen to a nickel; down from $1.55 when the merger closed. Enter Liberty. Liberty lent Sirius enough money to pay off a loan due literally the same day, in exchange for 15% interest and the option to convert to 40% of Sirius' equity. Greg Maffei, Liberty's CEO, described it as a financial transaction rather than a strategic one. This is because satellite radio is a medium that was in the middle of a transition: distribution ceased to be a relative advantage for one company or another because there was only one player in the market, and the combined companies could afford to invest less in growth without worrying that they'd cede market share. Meanwhile, the economics of the business supported very high-margin growth, since the incremental cost of subscribers is so low. So SiriusXM's economics suddenly veered in a completely different direction: instead of breakneck growth and heavy losses, the business was suddenly growing in the low teens to high single digits, and its EBITDA margin floated up from negative to the mid-30s. Since the company had years of heavy losses in its history, that EBITDA converted nicely into free cash flow. (The company has been generating over $1bn in annual free cash flow since 2014, most recently hitting $1.7bn in 2020. Its market cap at the low was under $200m. Timing matters a lot here. The business was right at the cusp of transforming from a cash burner to a cash creator, and needed just enough financing to get to that point. Early 2009 was also a great time for buying distressed assets in general. And the deal got better literally day by day as the deadline for SiriusXM's loans approached. Someone who bought Sirius at the 1994 IPO made annualized returns of 1.2%. From the date of the Liberty deal, it's been 36.2%. Malone doesn't characterize himself as a stockpicker, but in interviews he's suspiciously keen to explain how different populations of investors think about value. One reason it was hard for TCI to sell itself to AT&T or the Baby Bells was that those companies were valued based on their ability to pay a steady dividend, and a capital-intensive cable business threatened that. (The dividend fixation has existed for a long, long time; it might date back to the Great Depression, when AT&T kept up its $9/share dividend despite the economic collapse.) Understanding that can mean understanding how to buy assets, but also how to realize their value. Today, investors can buy shares of Sirius, but they can also own shares of The Liberty SiriusXM Group, a Liberty tracking stock that follows the performance of Liberty's stake in SiriusXM and some other holdings. The tracking stock is sort of like a sale—it means Liberty investors who aren't enthusiastic about the satellite radio market don't have to be exposed to it—but it didn't trigger capital gains taxes. Deferring taxes is basically a form of leverage: it's money owed that can be paid later on. And the company has never shied away from actual leverage, either. Liberty is a testament to the fact that if debt is structured in the right way, there can be a lot more of it without seriously interfering with company operations, and that extra leverage can turn a decent track record into an extraordinary one. It looks hard to have an edge in a company that's famous for making good investment calls, and for doing deals that are complex but have some kind of caveat that makes them immensely profitable to savvy readers of SEC filings. There is a Liberty fan club. The company has just the right combination of openness about what they're trying to do and opacity in how they do it that makes them a fun puzzle for investors, and buyers-and-holders have done well over time. So there's a book. There's even a song. There's limited alpha in figuring out what Liberty itself is up to; plenty of competition, and someone smart on the other side of the trade. But there's a lot of value in understanding how they think about what they do, and how it can apply elsewhere. There are other businesses that go through transitions where one layer of the supply chain stops earning superior profits and another starts to, and there are definitely other industries where cheap assets present themselves and the opportunity to realize their value without paying taxes on it can come along later. So the interesting question is how many cases there might someday be of Liberty-But-Not-Media. Further reading: There's abundant material here. Cable Cowboy, mentioned above, is great. Liberty holds annual investor days, with Q&A, which are quite illuminating. I found this Malone interview useful, and this one of Greg Maffei is also informative. This Wired interview is old, but interesting. This negative Fortune article from 1997 is a great reminder that good track records still have drawdowns. Fintwit is also a good resource. If you want to talk to people who like Liberty a whole lot, tweet something negative about Liberty Media Formula One shares and they'll give you the Liberty bull case. If you want to hear the negative case, just tweet about how Liberty Latin America looks cheap. A Word From Our SponsorsHere's a dirty secret: part of equity research consists of being one of the world's best-paid data-entry professionals. It's a pain—and a rite of passage—to build a financial model by painstakingly transcribing information from 10-Qs, 10-Ks, presentations, and transcripts. Or, at least, it was: Daloopa uses machine learning and human validation to automatically parse financial statements and other disclosures, creating a continuously-updated, detailed, and accurate model. If you've ever fired up Excel at 8pm and realized you'll be doing ctrl-c alt-tab alt-e-es-v until well past midnight, you owe it to yourself to check this out. ElsewherePortal and Technology ProstheticsAn occasional Diff theme is the growth of technology prosthetics—ways tech companies' products allow people with disabilities to do things that would otherwise be difficult or impossible for them. Some of these are entirely accidental; online ordering has been a massive boon for people with anxiety, for example, even though that wasn't its original purpose, and e-commerce in general makes a big difference to people with mobility issues. Sometimes, though, it's quite deliberate: Meta is incorporating federally-funded sign language interpreters into its Portal video call service. There are two interesting notes here:

Browsers as a Shopping ToolChrome has added a feature that keeps track of items in shopping carts, and can alert users to discounts. Shopping cart abandonment rates are shockingly high, and the new-tab screen for Chrome is very valuable real estate, quite suitable for addressing an economic opportunity of this magnitude. It's notable that Microsoft (disclosure: I'm long) is also using the browser to drive commerce, through automatically suggested promo codes and a buy-now-pay-later service. Companies used to try to own the browser as a defensive measure, because they didn't want their browser-based products to be beholden to somebody else's platform, but now that the browser wars seem more or less settled, both sides can spend more time monetizing them instead. BNPL RulesAnd speaking of buy-now-pay-later, the Consumer Financial Protection Bureau has asked five major BNPL companies to share information on how they operate ($, FT). It's an industry that looks highly suspicious, both because it's making some subprime consumer loans and because some of the loans look like close to a free lunch for borrowers. The non-obvious economic dynamic is that the real economics come from how the loans benefit merchants, which can make some credit losses affordable. Affirm has tried to get in front of this by suggesting better regulations, and any new lending product will eventually have rules written around it. If anything, this is fortunate for the BNPL companies: better to have the rules written preemptively during a boom than to have them written after there aer horror stories from borrowers during a recession. John Kelly and YOLO StocksThe WSJ suggests that traders betting on Gamestop, AMC, etc. should make bets with small positions ($, WSJ) on the grounds that if their enthusiasm pays off, the net winnings will still be big. The piece is partly tongue-in-cheek and partly a tutorial on the Kelly Criterion, but it's worth taking seriously enough to ask why traders don't diversify in this way. The main two reasons are closely related:

News Post-TrumpThe WSJ has a look at how the Washington Post has fared in the last two years ($), with lots of internal documentation. Much of this piece revolves around how hard it is for news sites to get traffic now that Trump isn't a reliable source of headlines. But this bit is also interesting:

Print has skewed old for a long time, but digital versions of print publications also seem to. Some of this is just the natural cadence of the news business; older people have always followed news more closely, on average, than younger people. But that's an extreme skew. At one level, it shows that newspapers that move online can continue to sell to their prior audience, which is also a lucrative audience to advertise to, especially with abundant first-party data. But it implies that the question of how to monetize news is a long way from being solved. Diff JobsLooking for a new role? We're connecting Diff readers to companies that are looking for talent. Some of the current openings:

1 TV manufacturers, networks, cable companies, etc. captured about a third of the world's waking hours, at least according to Nielsen stats, but certainly haven't captured a third of the incremental profits generated by TV ads. A service like Facebook or Google can relentlessly capture more of that economic upside, through better ad targeting and attribution. Their share of GDP won't hit their share of time spent, but can come a lot closer than CBS or ABC could manage. 2 For those who really want to know: Viacom merged with Blockbuster Video in 1994, while acquiring Paramount, because Blockbuster generated lots of cash flow and was priced cheaply because investors were worried about competition from pay-per-view. In 2004, Viacom spun off Blockbuster, but because of some tax rules that no longer seem as strict, they couldn't buy back stock for a year after the spinoff. So the company couldn't support its stock price with buybacks during 2004, and Redstone, apparently bored, bought up most of Midway Games instead. He ended up getting a margin call on it. If Viacom had been able to buy back stock, it's possible that this wouldn't have happened. 3 The other part of forced selling is that the media business seems to attract a disproportionate number of people who find themselves involved in various scandals; there may be a correlation between the personality type that leads someone to launch a hostile takeover for a movie studio and the personality type that ends up causing a divorce or three. A non-negligible contribution to Malone's lifetime alpha is that he's been married to the same person since 1963. Divorce can entail losing half one's assets plus legal bills, and it's not good for returns on the remainder, either. The Redstone family's various troubles have been extensively documented and are not worth going into here, except to note that they can't be ignored when comparing track records of buying and selling media assets. You’re a free subscriber to The Diff. For the full experience, become a paid subscriber. |

Older messages

Longreads + Open Thread

Saturday, December 11, 2021

Replit, The Wall, Supply Chains, Effort, Crypto and Hedge Funds, The 60s, Conglomerates

Drone Delivery: Accelerating to Inevitable

Friday, December 10, 2021

Plus! Media/Software Synthesis; The Working Capital Accelerant; Klarna Fills in the Gaps; Younger SPAC Targets; Consumer-Facing DeFi

Longreads + Open Thread

Saturday, December 4, 2021

Ride Hailing, Portnoy, Bridging Finance, Insecure Chips, Bad Trades, Failing GPA

BuzzFeed and the Platform Squeeze

Friday, December 3, 2021

Plus! The Great Unclogging; The First-Party Data Gold Rush; Open Data; Bitcoin Loans; The Arms Race; Diff Jobs

Longreads + Open Thread

Saturday, November 27, 2021

Japan, Altman, COBOL, China, Factors, Geoengineering, LTV, Mistakes

You Might Also Like

A Page From Uber's Playbook: Disrupting Social Media Marketing

Friday, January 10, 2025

Read the whole story here ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Design Your Dream European Getaway

Friday, January 10, 2025

Enter to win a chance to win a $20000 trip to Europe for free. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📉 Bonds saw a selloff

Thursday, January 9, 2025

Global investors dumped government bonds, UK shoppers got a break for Christmas, and Encylopedia Britannica became an AI company | Finimize Hi Reader, here's what you need to know for January 10th

Could private student loans help you?

Thursday, January 9, 2025

Find out if you qualify and compare rates today. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🏆 The Demi Moore of it all

Thursday, January 9, 2025

Plus, workshops on estate planning and taking control of your money. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦾 Anthropic looks jacked

Wednesday, January 8, 2025

Claude's AI startup flexed a new valuation, China sought to nudge shoppers, and a wild plot to smuggle drugs | Finimize Hi Reader, here's what you need to know for January 9th in 2:57 minutes.

3 reasons to buy life insurance

Wednesday, January 8, 2025

Make 2025 the year you protect your loved ones Why you should get life insurance now A decreasing bar chart Affordable rates Life insurance premiums typically increase with age or changes in health.

Eight days in and things are already changing

Wednesday, January 8, 2025

plus Tomdaya + birdwatching ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🤩 Nvidia takes the stage

Tuesday, January 7, 2025

Nvidia headlined in Vegas, the Pentagon added to its companies blacklist, and an unexpectedly amazing beach destination | Finimize Hi Reader, here's what you need to know for January 8th in 3:11

It’s time to get rid of debt

Tuesday, January 7, 2025

Here's how to find the right debt solution for you ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏