Surf Report - Surf Report: Printer Is Coming

You’re getting this email because you signed up for Surf Report, my weekly take on economics, investing, Bitcoin, and business. I really appreciate you being here, but if you’d like to leave, simply scroll to the bottom to unsubscribe. Hi everyone—I’m so glad to have you here. What a week. The government has boxed itself in. On Wednesday, with inflation at a 39-year high, the Federal Reserve released data that painted a hawkish picture:

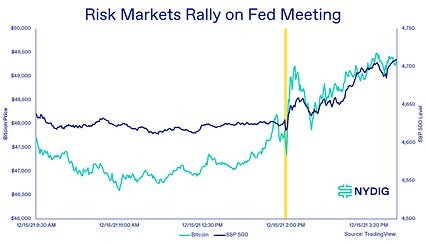

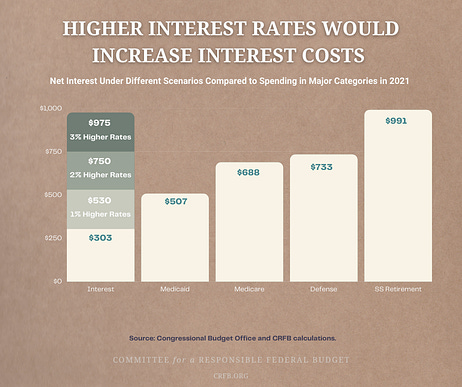

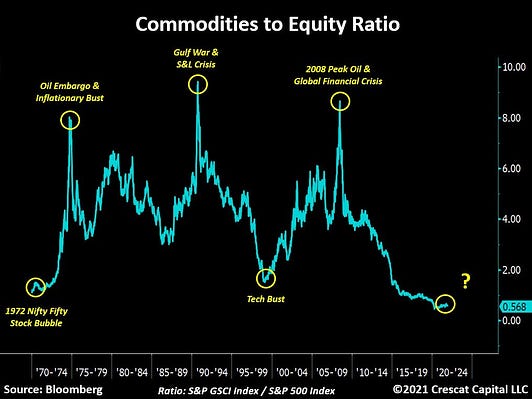

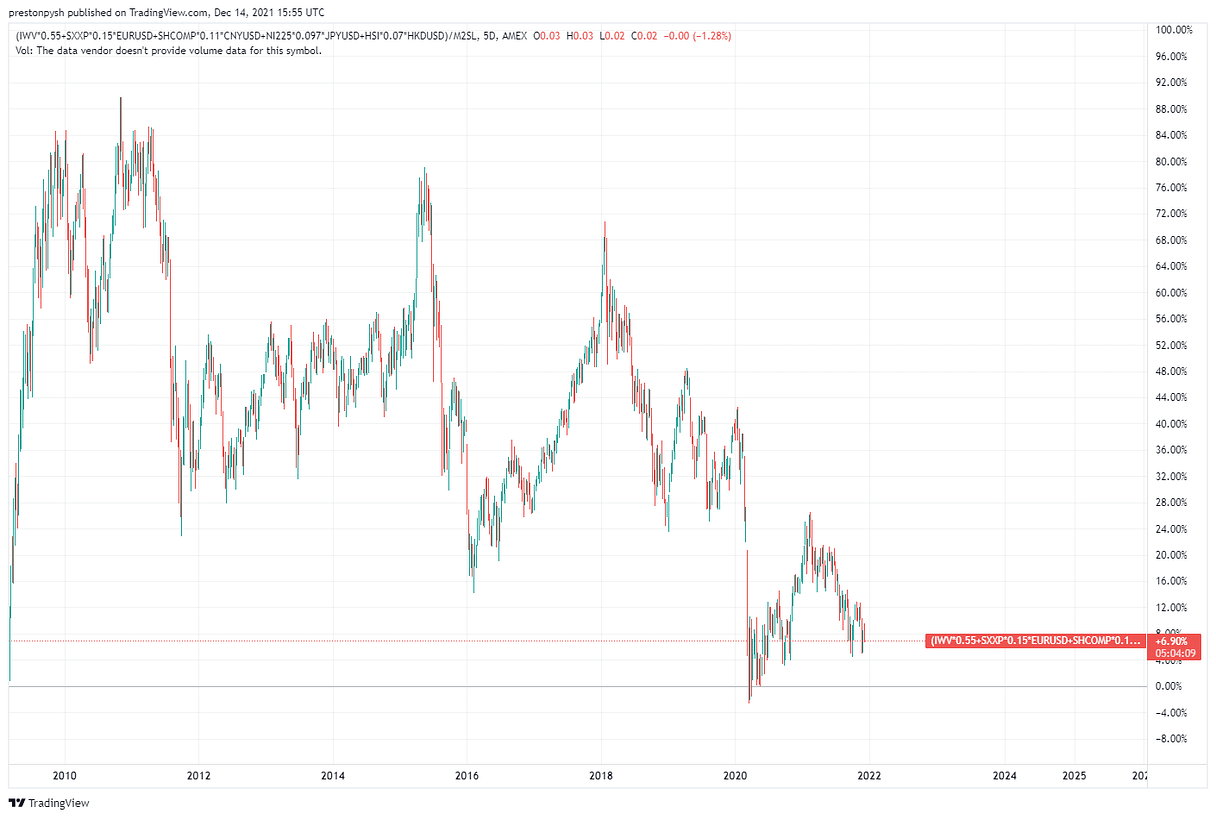

They’ve had to admit that all the inflation they created is not transitory (whatever they intended that to mean lol) and is only getting worse, so putting an end to cheap credit and free dollars for citizens should probably happen sooner than later. Rather than continue artificially suppressing interest rates through June 2022 as was their previous plan, now they may be trying to end the program as early as March in order to raise rates sooner and get people to stop taking out loans and spending all the money they gave away. None of this was welcome news for bond investors in the “risk-off” fixed income market, but was great news for equity and commodity traders in “risk-on” markets. Bond prices dropped as their rates rose, signaling the higher risk of holding those assets, while the S&P 500 was up 1.6% and bitcoin rallied 3.0%. You may be thinking, “Why all this talk of risk? They’re gonna stop with the nonsense and raise interest rates to try to slow inflation. How is that risky? Isn’t this good?” I’ll show you why it’s risky. And no, it’s not good. But here’s the thing: they have no choice. It’s important to remember what interest rates are: debt. Money owed to people. Raising interest rates means US Treasury rates go up too, and that means the government has to pay more interest on all the federal debt (bonds) that are out there. Do you know what the number one line item expense is likely to be for the government by 2024? Not defense anymore. Interest payments. Just a tiny increase in rates has a huge impact on the cost to run the government: Saifedean Ammous has said that the history of fiat is the history of government-run financial institutions managing defaults, and I’m inclined to agree. At this point, raising interest rates will eventually bankrupt America. But not raising interest rates will let the inflation circus continue. And I’ll tell you what, inflation is a shitty circus. Though it does have clowns: The solution to this conundrum isn’t “raise taxes” either. If every American citizen paid 100% income tax for the next 100 years the United States could still not pay off its deficit. So that leaves one recourse: print more money to pay for all of it and keep the circus open. You might think that the Fed raising interest rates to slow their QE program would be bearish for safe haven store-of-value assets like precious metals and bitcoin in the short term, since it would signal alternative, more conventional financial instruments in which to protect purchasing power. But remember that higher interest rates mean higher risk. You’re getting that rate because it’s a riskier asset to hold. That’s the tradeoff. Earn higher interest but take on more risk. That’s why brand new banks have attractive offers (they’re unproven), and junk bonds often generate double-digit yield (they’re junk). This is why people are more inclined to buy bitcoin over bonds. The pendulum always swings between commodities and financial assets, and it’s looking like the pro-commodity inflection point is here. Only this time, as famed investor Paul Tudor-Jones has said, “Bitcoin is the fastest horse in the race.” Macroeconomics is the geological plate tectonics of financial strategy. Things happen on a large scale, gradually, and over long stretches of time. Your accountant might not need to care about it much, but your retirement account does. And there’s an important expression in debt market circles: risk happens fast. This usually means that the warning event is also the event itself, and it happens during the day when you’re working or picking up the kids, or overnight in Asian markets while you’re asleep in Mexico. You don’t have time to run and contact your bank and wait for them to liquidate your S&P index fund during normal business hours while the systems aren’t undergoing maintenance and hold times are short. By the time risk becomes obvious and market participants begin reacting, it’s too late. The cascade is underway. Right now the conditions are set for something innocent to set off something serious. This is fragility. What matters isn’t whatever specific event triggers the earthquake, but rather the fact that the conditions are set for an earthquake to be triggered. The stock market continues to grind out new all-time highs like some deranged fiat sausage factory cranked to the hilt, but it’s a mirage. When you look at the performance of all the major stock indexes across the world since 2009, measure them in the same currency (USD), adjust for the massive M2 money supply increases of USD since 2009 which has debased its value, and then market weight each index so each is a true reflection of its share of the overall economy, we see that for the past 20 years global stock market investors have actually yielded a true return of… 6.5%:

Last week’s official CPI print reported inflation at 6.8%. This is why these days it feels like everyone is just running to stand still. Your unit of account is compounding against you. (The real inflation rate for most people is much higher than the official reported figures, since inflation is different for everyone depending on what each individual buys and owns.) Meanwhile the government has already extended itself another line of credit worth $2.5 trillion dollars. (The total debt ceiling now totals $31.4 trillion.) To put this into context: the entire UK economy is $2.7 trillion dollars. The U.S. is printing an entire economy's worth of spending power like magic, because it says it’s good for it. So it’s only going to get worse. The printing will continue. Here’s the thing: some people (myself included) may have you believing that ALL of the inflation we’re seeing today today is caused by the money printer, but it’s not. It’s just the most obvious example of the real cause, so it’s become the scapegoat for the underlying issue.

The real enemy here isn’t the money printing per se but rather all the manipulation—the hubris of policymakers to believe they can continuously engage in top-down control of a complex, dynamic system without generating massive unforeseen consequences and dangerous ripple effects, and that all they need to do to fix the problems they created but never saw coming is to tweak the interest rates. The money supply in a fiat system is just one of the easiest and most obvious things to manipulate, so it’s usually the first.

Look, at this point I’d probably be making the same choices if I were in the shoes of Powell or Yellen or some other meddler. I’d have to. I’d have no choice right now. The government has gotten itself into a real pickle over the course of decades, so the die is cast. The alternative is a U.S. default and a depression the likes of which we’ve never seen. You think I’d want that to happen on my watch, and tarnish whatever legacy I’d gathered by gladhanding the Washington rungs up to a position of power and influence? The type of people who climb that ladder are not the type of people who ignore what people will think of them in years to come. They will save face no matter the cost to the rest of us. Luckily, I am not them and I do have a choice. We all do. And the choice has always been the same through history: participate in their plan and submit, or opt out and resist. As Sartre famously put it: Freedom is what you do with what's been done to you.

Until next time 🤙, Recommended Resources For Plan ₿Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨ Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨ Thanks for subscribing to Surf Report. If you liked this post, consider sharing it with someone else who might appreciate it! |

Older messages

Surf Report: Structural Integrity

Sunday, December 12, 2021

Listen now (11 min) | Issue 54: 12.12.21

Surf Report: Volcanoes & Volatility

Sunday, December 5, 2021

Listen now | 12.05.2021

Surf Report: Good Night & Good Luck

Tuesday, November 9, 2021

Issue 52: 09.19.2021

You Might Also Like

Topic 30: Everything You Need to Know about Knowledge Distillation

Wednesday, March 5, 2025

This is one of the hottest topics thanks to DeepSeek. Learn with us: the core idea, its types, scaling laws, real-world cases and useful resources to dive deeper

😎 Bustin' out budget benchmarks

Wednesday, March 5, 2025

Benchmark data by industry plus free budget templates View in browser Masters in Marketing You know that riddle that goes around the tubes now and then? “The poor have it. The rich need it. And if you

🦅 I should've done this sooner

Wednesday, March 5, 2025

Experimenting is good. Working with people that know there stuff is better | Practical ways to convert leads through cold outreach

$120k/Year with a small audience?

Wednesday, March 5, 2025

If you're wondering how to build a thriving business while staying authentic and leveraging the power of SEO and YouTube... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Founder Weekly - Issue 675

Wednesday, March 5, 2025

March 05, 2025 | Read Online Founder Weekly (Issue 675 March 5 2025) Welcome to issue 675 of Founder Weekly. Let's get straight to the links this week. Mr. Wonderful Lost Out on $400 Million… Will

How advertisers unlock measurable outcomes for performance-based campaigns

Wednesday, March 5, 2025

Scaling performance advertising beyond search and social

Your Practical Path to Marketing Automation

Wednesday, March 5, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo We're halfway through the week, Reader, how's your marketing strategy

Maybe We Are Getting A Bitcoin-Only Strategic Reserve After All

Wednesday, March 5, 2025

Listen now (3 mins) | Today's letter is brought to you by Osprey Funds! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🕵️♂️ The “Write to Your Former Self” Growth Hack

Wednesday, March 5, 2025

PLUS A referral growth loop that fuels itself and a funnel that actually converts.

Communities Are The Rage

Wednesday, March 5, 2025

With centralized social media showing many of us how NOT to build community, people and brands are turning to community platforms to build out their own slice of the Web. Marketing Junto | News &