Maybe We Are Getting A Bitcoin-Only Strategic Reserve After All

Today’s letter is brought to you by Osprey Funds!The Osprey BNB Chain Trust (OBNB) is the first U.S. tradable ticker for BNB and provides secure exposure to BNB right from your brokerage account—no custodial wallets or private keys required. Due to its unavailability on centralized exchanges in the U.S., OBNB offers one of the only paths for U.S. investors to access BNB exposure via USD. To investors, Rumors continue to circulate about the White House Crypto Summit planned for this Friday in Washington DC. This will be the first time industry leaders meet in a public setting with the President’s working group to discuss key issues related to bitcoin and the cryptocurrency industry. One of the main topics of conversation leading up to this meeting has been the Strategic Bitcoin Reserve. President Trump promised on the campaign trail that he would implement a bitcoin-only reserve, but more recently posted online that a crypto-related reserve would include altcoins like ETH, SOL, XRP, and ADA. The backlash on the proposed bait-and-switch was loud and swift. Most people in the crypto industry, including those who hold some of the altcoins mentioned, agreed the country’s strategic reserve should be bitcoin only. As I wrote earlier this week, there is nothing strategic for the US with the altcoins. But it looks like the administration understands this point. Commerce Secretary Howard Lutnick gave an interview earlier today and explicitly called out the different treatment of bitcoin. He shared the following statement with The Pavlovic media outlet:

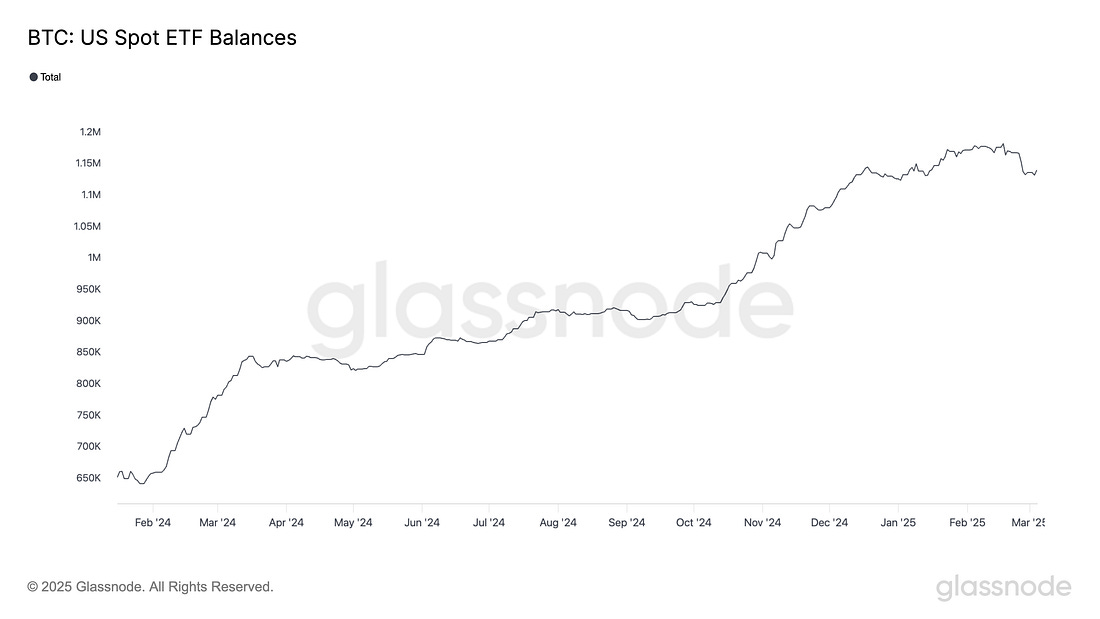

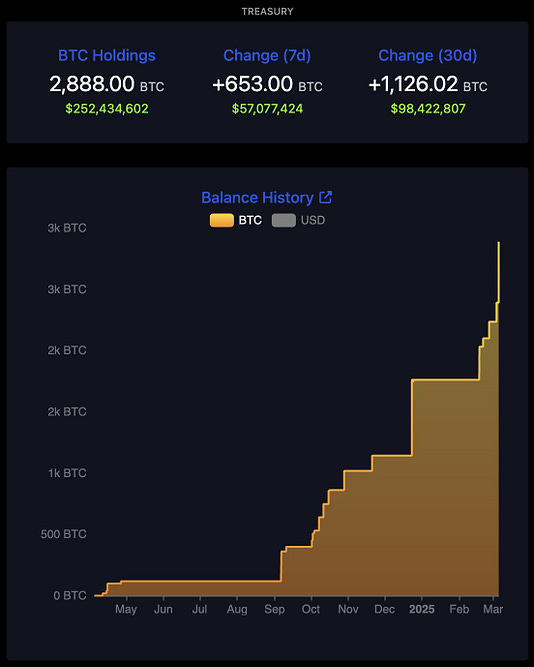

This is an important development in the broader conversation. If the United States creates a strategic bitcoin reserve, without the altcoins, then most bitcoiners will feel like Trump delivered on his campaign promise. Does that mean he will be abrasive towards the other coins? No, not at all. He can be supportive of other coins without putting them in the country’s strategic reserve. My guess is that is where we end up, but we will learn more on Friday. In the meantime, there are a few trends worth paying attention to across the bitcoin network. For example, the balances on exchanges continues to plummet, which suggests bitcoin holders are unwilling to sell their bitcoin at these levels. Prices will have to substantially increase in order to unlock more liquidity from the long-term holders. What could drive that substantial increase in price? More buying from various sources. You can see here the ETFs continue to accumulate more bitcoin regardless of the price action. The collective funds started with approximately 650,000 bitcoin in January 2024 and today hold nearly 1,140,000 bitcoin for various investors. The ETFs are not the only buyers either. Take a look at Japan’s Metaplanet. They continue to acquire as much bitcoin as possible for their balance sheet, including 497 bitcoin in the last 24 hours. That number 497 is important because that means one company bought more than 100% of all the new bitcoin that was created yesterday and put into circulation. It doesn’t take a genius to realize the price has to go up if people and companies are buying more bitcoin each day than what is being created. Supply and demand is one hell of a concept. This brings us back to the White House Crypto Summit on Friday — if the United States announces a strategic bitcoin reserve that includes the nation buying more bitcoin, all bets are off on what could happen to the digital assets’ price. There will be a lot of speculation between now and Friday. But something tells me we are going to get fireworks in DC to close out the week. Hope you all have a great day. I’ll talk to everyone tomorrow. - Anthony Pompliano Founder & CEO, Professional Capital Management Darius Dale Explains Why The Government May Be Crashing The Market On Purpose Darius Dale is the Founder & CEO of 42Macro. In this conversation we talk about global liquidity, what’s going on with inflation expectations, why the government may be tanking the market for a foundation of strength, and how this impacts asset prices. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. Invite your friends and earn rewardsIf you enjoy The Pomp Letter, share it with your friends and earn rewards when they subscribe. |

Older messages

The Age of Economic Chaos

Tuesday, March 4, 2025

Listen now (7 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What I Think About The Crypto Strategic Reserve

Monday, March 3, 2025

Listen now (8 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin industry insiders aren’t worried about the price correction

Friday, February 28, 2025

Today's letter features a guest post from Phil Rosen, the co-founder of Opening Bell Daily, an independent financial media company. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

From the Desk of Anthony Pompliano

Thursday, February 27, 2025

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Can The US Eliminate Federal Income Tax?

Thursday, February 27, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Topic 30: Everything You Need to Know about Knowledge Distillation

Wednesday, March 5, 2025

This is one of the hottest topics thanks to DeepSeek. Learn with us: the core idea, its types, scaling laws, real-world cases and useful resources to dive deeper

😎 Bustin' out budget benchmarks

Wednesday, March 5, 2025

Benchmark data by industry plus free budget templates View in browser Masters in Marketing You know that riddle that goes around the tubes now and then? “The poor have it. The rich need it. And if you

🦅 I should've done this sooner

Wednesday, March 5, 2025

Experimenting is good. Working with people that know there stuff is better | Practical ways to convert leads through cold outreach

$120k/Year with a small audience?

Wednesday, March 5, 2025

If you're wondering how to build a thriving business while staying authentic and leveraging the power of SEO and YouTube... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Founder Weekly - Issue 675

Wednesday, March 5, 2025

March 05, 2025 | Read Online Founder Weekly (Issue 675 March 5 2025) Welcome to issue 675 of Founder Weekly. Let's get straight to the links this week. Mr. Wonderful Lost Out on $400 Million… Will

How advertisers unlock measurable outcomes for performance-based campaigns

Wednesday, March 5, 2025

Scaling performance advertising beyond search and social

Your Practical Path to Marketing Automation

Wednesday, March 5, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo We're halfway through the week, Reader, how's your marketing strategy

🕵️♂️ The “Write to Your Former Self” Growth Hack

Wednesday, March 5, 2025

PLUS A referral growth loop that fuels itself and a funnel that actually converts.

Communities Are The Rage

Wednesday, March 5, 2025

With centralized social media showing many of us how NOT to build community, people and brands are turning to community platforms to build out their own slice of the Web. Marketing Junto | News &