The Daily StockTips Newsletter 12.23.2021

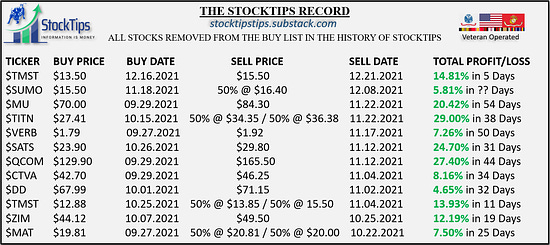

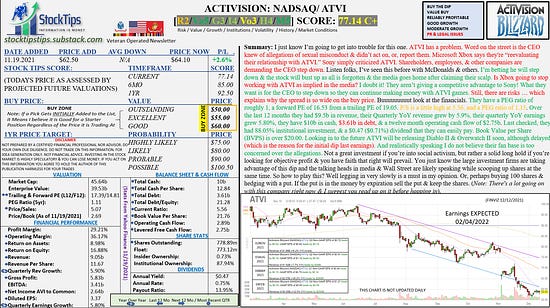

The Daily StockTips Newsletter 12.23.2021I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET)Below you will find a list of stocks researched, hand picked & watched by me. I grade, organize, & rank the plays taking into account Risk (R), Value (Va), Growth Potential (G), Intuitional Ownership (I), Volatility (Vo), Earnings History (H), & Market Conditions (M). I then score them, set price targets, & provide a quick thesis about the company. I do not throw stocks up until I thoroughly research them. The way I figure it, I ought not be drawing attention to stocks I'm not confident enough to buy myself. The Stock Tip Report is NOT investment advice, it is strictly to assist you in your own idea generation, & you should always do your own DD. Please read the "Important Disclaimer" at the Bottom of this Page.IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.TODAYS OVERVIEW: 14 Stocks near/at/above the Buy Zone (Waiting to Swing). 4 Stocks (Profiting) Above the Buy Zone. 41 Stocks on the Price Based Assessment Watchlist. 12 Stocks on the Stocks Under $20 List (Read the Warning/Disclaimer). 2 Stocks on the Highly Speculative Highly Volatile List (Read the Warning/Disclaimer). WE’RE ON YOUTUBE NOW! See HERE & HERE All profit & loss removed from the list will forever be posted below. Please note that the numbers only reflect the difference between the INITIAL buy price & the sell price without credence to the effects averaging down, which I often do. Gains can therefore look much less than what was actually achieved by 1-10%.An average of nearly 15% realized profit per stock sold so far in an average of 31 Days per stock sold! (Note these numbers will change as a result of recent market turmoil … but we are still beating SPY!) Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red Indicates an Earnings Loss [Not Miss] Consensus) Commentary: Well its near the end of the year & it seems the stock market is rallying on the news that the Omicron variant will not result in the shutdowns, hospitalizations, & deaths that everyone feared. While I could not predict the scientific aspects of the new variant I could predict that the political will to shutdown the economy was virtually nonexistent. This bodes seriously well for our buy list, as most of you paid subscribers can certainly see. As I specialize in finding reliably profitable companies trading at a value on a pullback of little to no consequence, it seems Omicron turned out to be of little consequence. Now our stocks are roaring back just in time for the new year. But lets not count our chickens before they hatch yet! With the new year generally comes a bunch of portfolio adjustments as large investment firms & big money attempts to place themselves in an advantageous position for tax purposes. Nothing new or unusual here. Happens every year. Expect no different this year. Still there are economic numbers coming out today that we ought to pay attention to. Personal Income/Spending, Durable Goods Orders, New Home Sales, Jobless Claims, the PCE Price Index, Consumer Sentiment are all due out today. In short, there is a lot that can go wrong on what is traditionally a low volume trading day. Nevertheless, as we are so close to Christmas, it would take some serious misses to dramatically move the markets in one direction or the other. Note that yesterdays GDP numbers came in higher than expected which aided yesterdays rally. If you made equally sized (In value) positions in each of the stocks added to the buy list since the market began to dump in late November & copied my plays to the letter, you would be up roughly 2% right now …& all while SPY was slightly negative in the same time frame. If you waited until my plays were red to leg in you would have made much more. Given the extremity of the market turmoil I’d call this a victory by any standard. The picks below have survived ugly inflation numbers, GDP downgrades, the Omicron variant, shutdown fears, crappy holiday retail sales, supply chain bottlenecks, debt ceiling uncertainty, & a failed build back better bill. Ladies & Gentlemen I AM PROUD OF HOW THE STOCKTIPS BUY LIST HAS PREFORMED!!! Now I want you to slow down & reflect for a second. I want you to think about the wave of emotion & fear you experienced over the past month. Think of all the anxiety & second guessing you made as to the holdings on this list. Reassess all of this & then see where we are today. In doing so you will truly gain a lot of perspective on how far remaining cool, calm, & collected can benefit you amid times of steep uncertainty. Trust the financials folks! So as long as you buy quality, time & discipline often heals all wounds. Merry Christmas! Stock of the Day: ATVI Isn’t it amazing how a solid market dump can send investors desperately looking for value & growth anywhere they can find it? ATVI was in the media dog house well below $60.00. Now she’s coming back strong on a market rebound, decent assessed holiday sales, & quite a few catalysts ahead. Sure there is still a mountain of controversy surrounding this company but bearish market sentiment threw investors into this one as they desperately searched for safe bets amid high market uncertainty. Significant News Heading into 12.23.2021:

Yesterday’s Insider Buying Activity: NOT Awards, NOT Compensation, but BUYING! PAID CONTENT BELOW:

Remember: I Search for Historically/Reliably Profitable Companies, Trading at a Sector/Industry Relative Value, on a Pullback of Little to No Negative Consequence, Favored by Institutions, & Under Favorable Assessed Future Economic Conditions. The reason the below section is paid content is these gems are really tough to find & take quite a bit of research to justify addition to the list! I’m a very picky fella & I don’t like to lose! . ... Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 12.22.2021

Wednesday, December 22, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET)

The Daily StockTips Newsletter 12.16.2021

Thursday, December 16, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET)

StockTips 7 Day Free Trials are Ending on the 13th of December

Saturday, December 11, 2021

Ladies & Gents I regret to inform you that I am ending my 7 day free trials. It seems many have taken advantage of this offer by repeatedly signing up & cancelling their trials, only to sign up

The Daily StockTips Newsletter 12.09.2021

Thursday, December 9, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET)

The Daily StockTips Newsletter 12.07.2021

Tuesday, December 7, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET)

You Might Also Like

🇨🇳 The US is out, China is in

Tuesday, March 11, 2025

Citigroup's forecast for US and Chinese stocks, Lego stacked bricks, and Boeing's investigation | Finimize Hi Reader, here's what you need to know for March 12th in 3:10 minutes. Citigroup

The Under-the-Radar Threat to Your Retirement

Tuesday, March 11, 2025

Nearly half of older adults are burdened by bad debt ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

15 Years Since We Bought Our Toxic Asset

Tuesday, March 11, 2025

In a new Planet Money plus episode, former Planet Money hosts David Kestenbaum and Chana Joffe-Walt look back at a pioneering series that sought to explain a major source of the 2008 financial crisis.

👋 Investors ditched the S&P 500

Monday, March 10, 2025

The US president didn't rule out a recession, but TSMC eased some of investors' other worries | Finimize Hi Reader, here's what you need to know for March 11th in 3:07 minutes. TSMC's

💳 Find a new credit card

Monday, March 10, 2025

Let's get those rewards ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Text and Telos

Monday, March 10, 2025

Plus! Diff Jobs; Scaling; Retail Investors; Comparative Advantage; Transaction Costs and Corporate Structure; DeepSeek Governance Text and Telos By Byrne Hobart • 10 Mar 2025 View in browser View in

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏