Coin Metrics' State of the Network: Issue 135

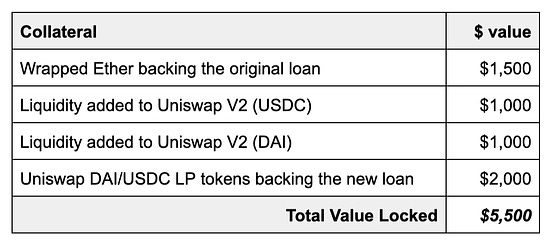

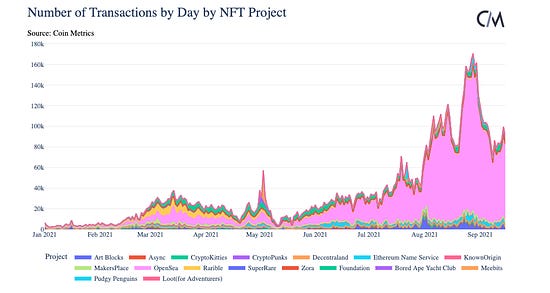

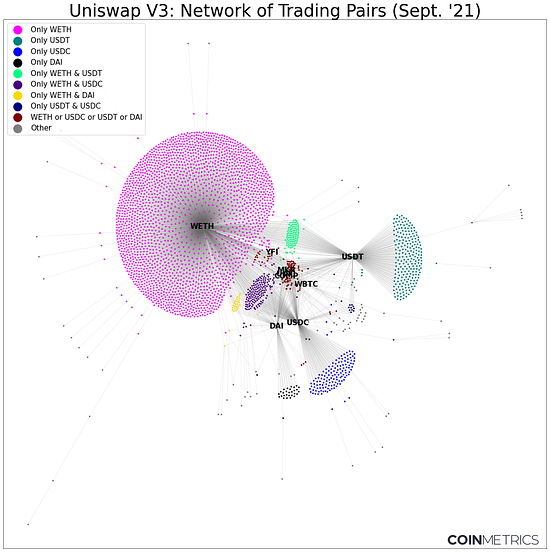

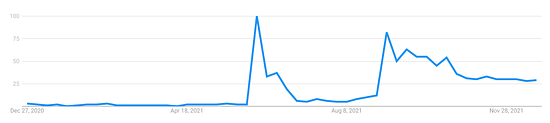

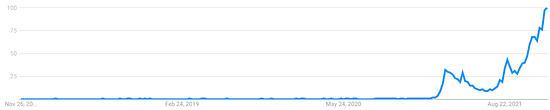

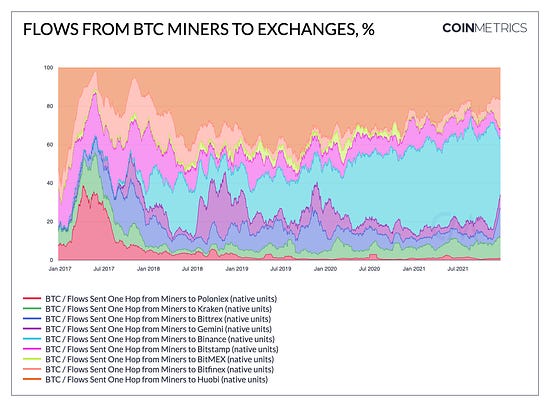

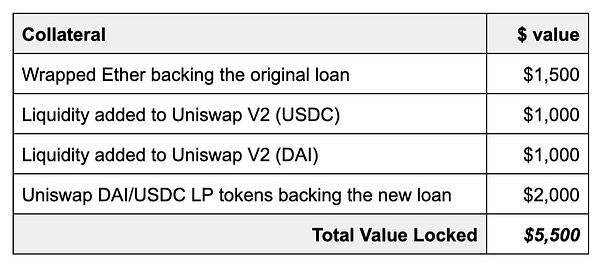

The Best of State of the Network in 2021By The Coin Metrics Team Get the best data-driven crypto insights and analysis every week: In this special edition of State of the Network, we look back at some of the best issues in 2021. This year, we’ve asked members of the Coin Metrics team to share their favorite issues from the past year. We're excited to share their input! First, a quick macro-level look at State of the Network in 2021. We crunched the numbers and found that we wrote over 65K words this year. Condensing all of these words down into a word cloud, we get a fascinating summary of our most-discussed topics over the past year. Top-Mentioned Words in State of the Network in 2021Thanks for reading in 2021. We’re excited to continue delivering the best data-driven crypto research to you all in 2022. Nic Carter, Cofounder, Board ChairmanFavorite: State of the Network Issue 113: Understanding Total Value Locked   Decentralized finance (“DeFi”) has experienced exponential growth over the last few years. Today, the most popular metric to measure DeFi adoption is called “Total Value Locked”, or TVL. TVL has become one of the most requested metrics at Coin Metrics. In Issue 113, we shared some of the challenges preventing an accurate calculation of TVL, as well as the critical shortcomings when using this metric to evaluate DeFi protocols. Total Value Locked is a deceptively complicated metric hiding under a benign name, with each word bringing its own set of unique challenges. 1. Protocol variety: the myth of “Total”“Total” means tracking all the versions of a protocol which can exist on multiple chains (Ethereum, Binance Chain) as well as L2s/sidechains like Polygon or Fantom. 2. Collateral type variety: the myth of “Value”“Value” means finding a robust price for each of the thousands of assets that can be used as collateral. 3. Rehypothecation: the myth of “Locked”“Locked” is a misnomer as liquidity can be added or removed quite quickly in most protocols. It also means untangling the links between each asset to avoid double or triple counting. This is the most subtle yet important challenge in understanding the makeup of assets used as collateral. DeFi enables the creation of asset derivatives that rehypothecate collateral. In brief, some assets used as collateral in DeFi applications are derivatives that represent existing claims on other collateral, like in the theoretical example below: As an industry, it is important to converge on better methodologies to contextualize and caveat growth in DeFi applications. This will be a collaborative process, and Coin Metrics looks forward to contributing to better metrics in 2022, and learning from the community as a whole. Antoine Le Calvez, Lead Data EngineerFavorite: State of the Network Issue 114: Analyzing Tether and USDC Usage Patterns Stablecoins had an enormous 2021, with the total supply of stablecoins surpassing 100B by May and now quickly approaching 150B. But as we showed in Issue 114, an increase in total supply was not the only change that was noticeable on-chain. Daily usage patterns of Tether issued on Ethereum (USDT_ETH) shifted in 2021. Historically, the bulk of Tether activity has mostly occurred during Asian business hours. But over the course of 2021 the distribution of activity by hour shifted later in the day towards European/US market hours. Source: Coin Metrics Network Data Pro There are several potential contributing factors. In addition to Ethereum, Tether is issued on many other blockchains that typically offer lower fees including Tron and Solana. As average fees on Ethereum rose in 2021, lower-value transfers likely moved elsewhere. Additionally, the miner and investor migration out of China due to new government regulations may be causing a drop in Asia-based Tether activity. Nate Maddrey, Senior Research AnalystFavorite: State of the Network Issue 121: The Rise of NFTs: A Data-Driven Overview of Non-Fungible Tokens NFTs have become one of the most dynamic sectors of the burgeoning cryptoeconomy. With thousands of different NFT projects and more launching every day, NFTs now represent a material percentage of all activity on Ethereum. The daily number of ERC-721 transfers increased by more than 10x from the beginning of 2021 to today, with over 24M transfers recorded YTD. To give a better sense of how this activity is broken down we selected a universe of NFT projects on Ethereum to study. Looking at the daily number of transactions by project it is apparent that most of the increased activity can be attributed to the rise of OpenSea as the top marketplace to buy, sell, and mint NFTs. The chart and analysis above was a part of our data-driven research report covering the rise of NFTs. Access the full report here. Kyle Waters, Research AnalystFavorite: State of the Network Issue 122: Digging into Uniswap DEX Data In Issue 122, we dove into decentralized exchanges (DEXs) focusing on the largest DEX on Ethereum today: Uniswap. First launched in Nov 2018, Uniswap had a big 2021 with the protocol’s third iteration, Uniswap V3, releasing in May. The network graph we created below shows all 3,085 tradable tokens on Uniswap V3 and how they can be traded against each other. Each dot in the graph represents a token and a line between two dots means a market (Uniswap V3 pool) exists between the two assets. WETH (the ERC-20 compliant version of ETH) is by far the most popular quote asset, and many tokens only trade against ETH (in pink), likely reflecting ETH's role as a versatile and highly liquid native asset to the Ethereum DeFi ecosystem. Uniswap recently set a new 24H volume record of $4.8B amid the recent uptick in crypto market volatility, and also launched a version of the protocol on Polygon, a PoS chain interoperable with Ethereum. As DEXs continue to capture a larger share of economic activity across DeFi, Coin Metrics will be exploring new ways to contextualize their growth and measure their economic significance on public blockchains. Anthony Mandelli, Community ManagerFavorite: State of the Network Issue 133: Introducing Coin Metrics’ Bitcoin Wallet Metrics One of Coin Metrics’ goals is to determine the economic significance of public blockchains. We try to achieve this by building metrics that empower people to make informed crypto financial decisions. Among the most interesting features to track for public blockchains is the number of individuals using them. As part of our Network Data Pro 5.1 release this past month, we published wallet metrics for Bitcoin which help in understanding how many people use Bitcoin. At Coin Metrics, we strive to transparently and thoroughly explain the methodology behind the metrics we construct. As such, Issue 133 walks through the heuristics we used to build wallet metrics, what they tell us about Bitcoin use and ownership, and their limitations and potential improvements. Victor Ramirez, Data ScientistFavorite: State of the Network Issue 112: Crypto Google Search Trends Analysis Google search trends can be an insightful proxy for gauging public curiosity in crypto keywords around the globe. For example, in July’s issue we highlighted how interest for “bitcoin” spiked in El Salvador after the June announcement that bitcoin would be accepted as legal tender. Looking at an updated chart, interest also jumped in Sept. when bitcoin officially became legal tender in the country. Google search interest for “bitcoin” in El Salvador over the last 12 months Google search trends can also help quantify shifts in the zeitgeist. We revisited our analysis of one of crypto’s most significant adoption vectors in 2021: NFTs. Interestingly, people are searching for NFTs more than ever right now. Worldwide Google search interest for “nft” since Nov. 2017, roughly when Cryptokitties was released We also showed how Google Trends can be useful for comparing interest between different crypto topics. In another sign of this year’s NFT boom, search interest for “nft” is now comparable to “bitcoin” and “ethereum”. In fact, “nft” has had a higher fraction of worldwide searches than “ethereum” over the past few months and roughly twice more in the last few weeks. NFTs have undoubtedly seeped into the public consciousness in a big way this year, attracting their own share of controversy, yet unlocking new forms of memetic energy that can onboard millions more into crypto. Regardless of their perception, NFTs have brought new cultural relevance to crypto as a whole, and we wouldn’t be surprised if the public’s curiosity in them continues to grow. Kendall Weihe, Frontend Software EngineerDeep market liquidity is an important feature of any mature financial market. In Issue 124, we investigated if BTC and ETH spot market structure is showing signs of maturation. Looking at Coin Metrics’ order book snapshots, market depth is strengthening & stabilizing. Source: Coin Metrics Market Data Feed The y-axis in the charts above shows the daily average value (in USD) of the top 100 buy orders (+) and sell orders (-) in the order book for each exchange, while the color scale measures how far the prices of those orders are from the best bid or ask price. Christine Lee, Senior Data ScientistFavorite: State of the Network Issue 120: Measuring Crypto Usage and Adoption Crypto usage can be tricky to measure. Although all transaction data is public, it can be difficult to tell how many unique users are behind the transacting addresses. A single Bitcoin or Ethereum address may be owned by many individuals, such as an exchange address or multisig wallet. But an individual may also own many addresses for security, privacy, or other purposes. ‘Monthly active users’ (MAU) is commonly used to track the amount of 30-day unique users of apps and social media networks. Most apps require an email login (or equivalent) so are able to get a relatively accurate measurement of the unique number of users. Although due to its pseudonymous nature crypto doesn’t have an exact equivalent, our monthly active addresses metric serves as an interesting proxy. Monthly active addresses measures the amount of unique addresses that either sent or received a transaction over the previous 30 days. In Issue 120, we analyzed unique monthly active users of large-cap cryptos and the major stablecoins. Parker Merritt, Customer Success ManagerFavorite: State of the Network Issue 91: Analyzing Miner to Exchange Flows Miners are often considered natural sellers of bitcoin (BTC). Their revenue is earned from block rewards and transaction fees which are paid out in BTC. But their costs, like electricity and rent, are paid using fiat currencies. Miners therefore need to sell a certain amount of their BTC to cover costs and stay profitable. Miner-exchange flows give an interesting look into miners’ on-chain behavior. The chart below breaks down the amount of BTC sent one hop from miners to exchanges (all addresses that have received payment from addresses that were on the receiving end of coinbase transactions). Binance and Huobi are the two biggest recipients. Source: Coin Metrics’ Network Data Charts Exchange flows are also an interesting way to potentially infer the geographical location of miner activity, as miners will tend to use exchanges that have a strong presence in their locale. In the graph above, we can see that China-based Huobi’s share of inflows from miners has been decreasing in 2021. This likely reflects China’s dwindling share of global Bitcoin Hash Rate following the crackdown on mining in the country and subsequent mass migration of activity. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. You can see previous issues of State of the Network here. Check out the Coin Metrics Blog for more in depth research and analysis. © 2021 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is’ and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. If you liked this post from Coin Metrics' State of the Network, why not share it? |

Older messages

Coin Metrics' State of the Network: Issue 134

Tuesday, December 21, 2021

Tuesday, December 21st, 2021

Coin Metrics' State of the Network: Issue 133

Tuesday, December 14, 2021

Tuesday, December 14th, 2021

Coin Metrics' State of the Network: Issue 132

Tuesday, December 7, 2021

Tuesday, December 7th, 2021

Coin Metrics' State of the Network: Issue 131

Tuesday, November 30, 2021

Tuesday, November 30th, 2021

Coin Metrics' State of the Network: Issue 130

Tuesday, November 23, 2021

Tuesday, November 23rd, 2021

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏