DeFi Rate - This Week in DeFi - December 31

This Week in DeFi - December 31This week, Centrifuge and Aave bring real world assets to DeFi, DeBank raises $25 million, and SOS and GAS airdrops for (almost) all

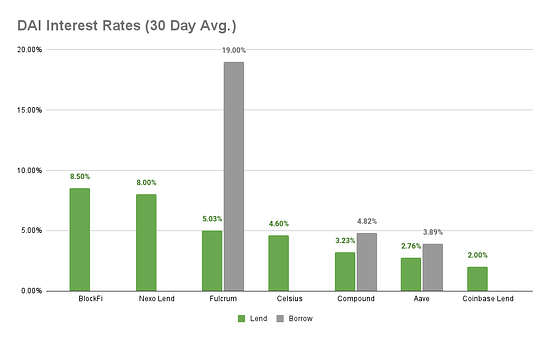

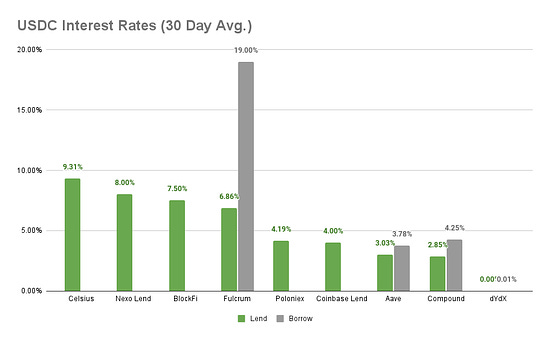

To the DeFi community, This week, Centrifuge and Aave launched the Real World Assets (RWA) market, allowing users to borrow tokens against non-crypto collateral including trade receivables, cargo and freight invoices, and more.   DeFi data aggregator and portfolio analysis tool DeBank raised $25 million at a valuation of $200 million in a round led by Sequoia Capital. DeBank supports nearly 800 protocols across 15 blockchains,allowing users to track DeFi positions across a wide swathe of the fractured ecosystem. And airdrops have been in overdrive in the final week of 2021, with OpenSea users receiving SOS tokens based on their activity and amount spent on NFTs, and active Ethereum users receiving GAS tokens based on transaction fees accumulated on the Ethereum network. Both tokens are independent of the project their distribution is based on, and only time will tell if they develop utility or staying power in the highly competitive crypto markets.  Free money is always exciting, but it’s worth considering if the spirit of airdrops is starting to trend more towards the first examples seen in the 2017 era, when the mechanism was used almost exclusively as a marketing tactic to raise awareness for a given project. In almost every instance, the tokens rapidly lost all value (if they had any to begin with) and left more clutter in wallets and little appreciable impact. That’s part of the reason airdrops from the likes of Uniswap and ENS felt so exciting; instead of a shotgun strategy to all addresses on the chain, these tokens came from well established players already providing value and working hard to increase it. The addition of treasuries funded by these tokens also vastly expanded the potential to impact the future growth of a protocol, adding real economic considerations to the trading and allocation of protocol tokens. Now we’re seeing a divergence in which projects like Paraswap tighten requirements for receiving an airdrop so severely that the community sees little growth and utility is for some in question, and others like GAS are distributed so widely and sold so quickly that they’re hardly worth the fees to claim and generate little interest in their nascent projects. As we enter a new year, some reflection might be in order on why airdrops became popular in the first place; as a means of capturing and ultimately retaining the limited attention of users in the crypto ecosystem. Free money is nice, but creativity and a real product to believe in will be more rewarding for all in the long run. Happy New Year! Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: BlockFi at 8.50% APY, Nexo Lend at 8.00% APY Cheapest Loans: Aave at 3.89% APY, Compound at 4.82% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: Celsius at 9.31% APY, Nexo Lend at 8.00% APY Cheapest Loans: dYdX at 0.01% APY, Aave at 3.78% APY Top StoriesEth2's Rocket Pool reaches $350M TVL and 635 node operators in five weeksUmee Buckles Down for Mainnet With $32M Token Sale on CoinListBank of Mexico Planning to Introduce CBDC by 2024Gnosis DEX CowSwap May Be Readying an AirdropStat BoxTotal Value Locked: $99.57B (down -2.19% since last week) DeFi Market Cap: $153.31B (down -3.26%) DEX Weekly Volume: $17.99B (down -14.9%) DAI Supply: 8.92B (down -0.56%) Total DeFi Users: 4,276,000 (up 1.45%) Bonus Reads[Owen Fernau – The Defiant] – Layer 2s Showed Their Utility But TVL Growth Lagged [Stefan Stankovic – Crypto Briefing] – Sberbank Launches Russia's First Blockchain-Focused ETF [Anthony Sassano – The Daily Gwei] – Good vs Evil - The Daily Gwei #405 [Stefan Stankovic – Crypto Briefing] – DeFi Blue Chips Tanked Against Ethereum in 2021 If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - December 24

Friday, December 24, 2021

This week, Rari and Fei merge, the Eth Kintsugi testnet is live, Transak on-ramps for Arbitrum and Optimism, and new security for Compound

This Week in DeFi - December 17

Friday, December 17, 2021

This week, Balancer taps Aave to boost yields, Optimism opens to all devs, Perp Protocol brings LP rewards, and DeFi access via Coinbase

This Week in DeFi - December 10

Friday, December 10, 2021

This week, 0x protocol and Celo allocate $4.5m, Pods Finance comes to Arbitrum, Woo Network launches on Avalanche, and DPI comes to Polygon

This Week in DeFi - December 3

Friday, December 3, 2021

This week, 1inch raises $175 million, DeversiFi is the latest airdrop, Bancor announces V3, and IDEX rewards on Polygon

This Week in DeFi - November 26

Friday, November 26, 2021

This week, Elrond $1.29 billion LP incentives, Nansen adds Arbitrum dashboards, 0xMaki to advise Tokemak, and Botto integrates Olympus Pro

You Might Also Like

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏