DeFi Rate - This Week in DeFi - December 3

This Week in DeFi - December 3This week, 1inch raises $175 million, DeversiFi is the latest airdrop, Bancor announces V3, and IDEX rewards on Polygon

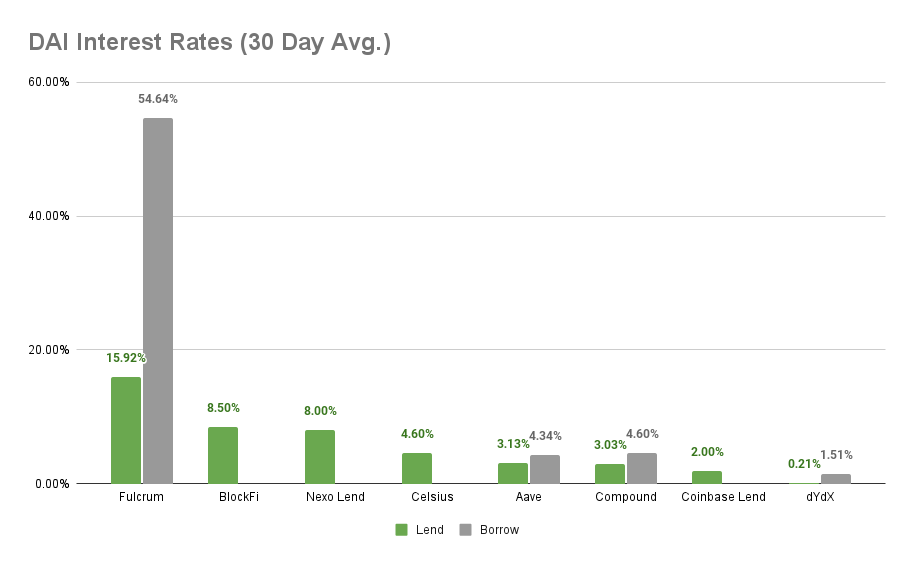

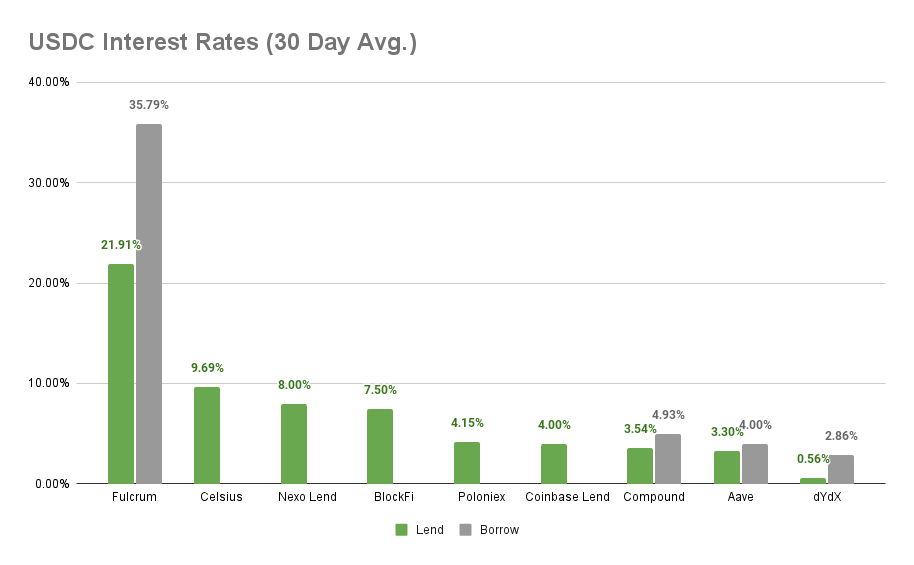

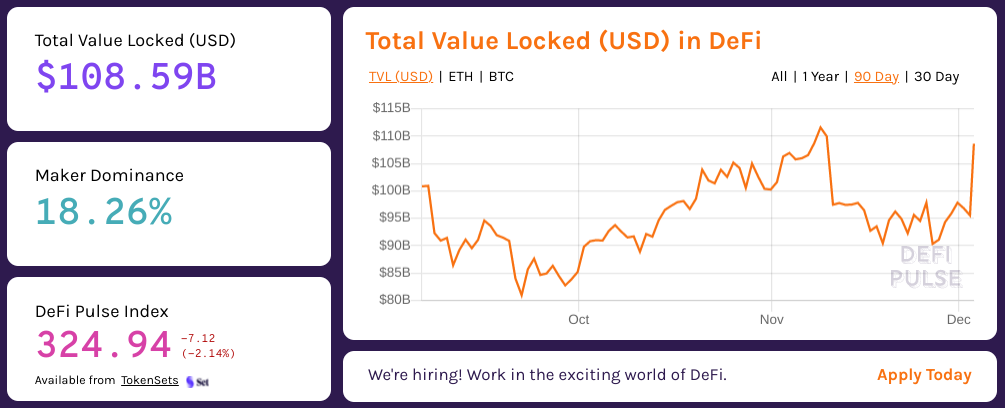

To the DeFi community, This week, 1inch announced closing a $175 million Series B funding round, led by Amber Group. The AMM aggregator will spend the additional capital scaling up the development team and developing new protocols to serve as an access point to DeFi for institutional investors.   L2 non-custodial exchange DeversiFi announced an airdrop of its DVF tokens. Similar to the Paraswap airdrop, DeversiFi focused on active users measured by volume and weekly activity and used on-chain analytics to stop airdrop distributions to multi-account gamers, while making some additional provisions for early DVF holders.   DeversiFi 🥷 @deversifi Is it a bird? 🐦 Is it a plane? ✈️ No, it's DVF! 🪙 It's time to look up because the retro-active DVF airdrop is parachuting 🪂 down into your accounts now! Read more about the drop and methodology here 👇 https://t.co/8s7a1A2rGR https://t.co/R3SEato3EWBancor announced V3 of the feature-laden AMM protocol, bringing improvements to order routing efficiency and significant new impermanent loss protections, now available from day one on single sided liquidity provisions. Liquidity mining rewards are also now auto-compounding, and third-party projects can offer LP incentives on their pools.  Bancor @Bancor Introducing Bancor 3 https://t.co/TuIyUnN13UAnd hybrid AMM IDEX has come to Polygon, offering protection from common DeFi issues like front running and sandwich attacks that can lead to failed transactions and added cost. IDEX on Polygon will also offer a host of incentives, including liquidity mining and trading rewards, as well as a free weekly MATIC faucet and a ‘first trade’ bonus from users who have previously used Quickswap or Sushiswap on Polygon.   A week of exchange announcements, and incentives continue to pile up as competition grows ever fiercer for liquidity depth on different AMM platforms. Each has something unique to offer, but the open-source nature of DeFi and the entire crypto industry naturally lead to a highly fractured, even decentralized landscape of different trading options. There’s some time left on the clock, but in the event of a rollover in the broader crypto market, it seems unlikely all players will be able to sustain their growth and development if and when liquidity starts to dry up. As 1inch joins Compound, Aave, and others in seeking to craft DeFi products for institutions, far deeper liquidity may well find its way into DeFi before much longer - but with a catch. All of these solutions rely on some form of walled KYC garden to give institutions the assurance they need to transact in this experimental new space. That means that to get access to what will likely end up as the best rates in DeFi will also require putting an identity to a wallet address, anathema to a subset of the crypto space. Ultimately, though, DeFi and all but the cutting edge of crypto are almost certain to be consumed by national and international regulatory frameworks, even as they help shape those frameworks with new technology and greater access to capital and value than ever before. KYC is not a big deal for thousands of small business owners that need cheap financing to grow their operations, or for relatives waiting in home countries that need an easier way to receive remittance payments. In the long term, deeper liquidity means greater access, and deeper liquidity requires better understanding of parties involved to eliminate fraud and manage risk. DeFi is for the many, not the anonymous few, and we’ll need to play ball with regulation before everyday users can truly reap the benefits of global liquidity and instant access. Let’s get ready for the next billion users! Thanks to our partner: Nexo – Nexo - Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: Fulcrum at 15.92% APY, BlockFi at 8.50% APY Cheapest Loans: dYdX at 1.51% APY, Aave at 4.34% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: Fulcrum at 21.91% APY, Celsius at 9.69% APY Cheapest Loans: dYdX at 2.86% APY, Aave at 4.00% APY Top StoriesStarkNet Alpha, Now on Mainnet!Tornado.Cash Deployment Proposal On ArbitrumPARSIQ brings its Real Time Monitoring Solutions to the Polygon NetworkBorderless Capital Debuts $500M Fund for DeFi, NFT Investments Built on Algorand BlockchainStat BoxTotal Value Locked: $108.59B (up 5.13% since last week) DeFi Market Cap: $161.9B (up 11.82%) DEX Weekly Volume: $26.32B (down -6.13%) Total DeFi Users: 4,094,000 (up 1.33%) Bonus Reads[Jack Melnick – The TIE] – Olympus DAO: DeFi’s Answer to Mercenary Liquidity [Samuel Haig – The Defiant] – Yellen Waives Non-Custodial Crypto Protocols From New Reporting Standards [William Peaster – Bankless] – How to hop between chains [Anthony Sassano – The Daily Gwei] – Yelling at Clouds - The Daily Gwei #392 [ChainLeft – Bankless] – Is Proof of Stake a Rich get Richer Scheme? If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - November 26

Friday, November 26, 2021

This week, Elrond $1.29 billion LP incentives, Nansen adds Arbitrum dashboards, 0xMaki to advise Tokemak, and Botto integrates Olympus Pro

This Week in DeFi - November 19

Friday, November 19, 2021

This week, Paraswap airdrops PSP tokens, Injective starts $120m in LP rewards, Pendle LP rewards on Avalanche, and $1.5m for synths on Solana

This Week in DeFi - November 12

Friday, November 12, 2021

This week, Raydium and Serum announce LP rewards, Wormhole support for Polygon, Polkadot's Acala raises $400m, and Maple permissioned DeFi

This Week in DeFi - November 5

Friday, November 5, 2021

This week, Aave governance approves V3, ENS to launch a DAO and airdrop, Avalanche announces $220m dev fund, and Stellar gets a native AMM

This Week in DeFi - October 29

Friday, October 29, 2021

This week, Osmosis DEX raises $21m, Serum announced LP rewards, 0x brings crypto prices to Pyth, and NEAR announces $800m for developers

You Might Also Like

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏