DeFi Rate - This Week in DeFi - November 26

This Week in DeFi - November 26This week, Elrond $1.29 billion LP incentives, Nansen adds Arbitrum dashboards, 0xMaki to advise Tokemak, and Botto integrates Olympus Pro

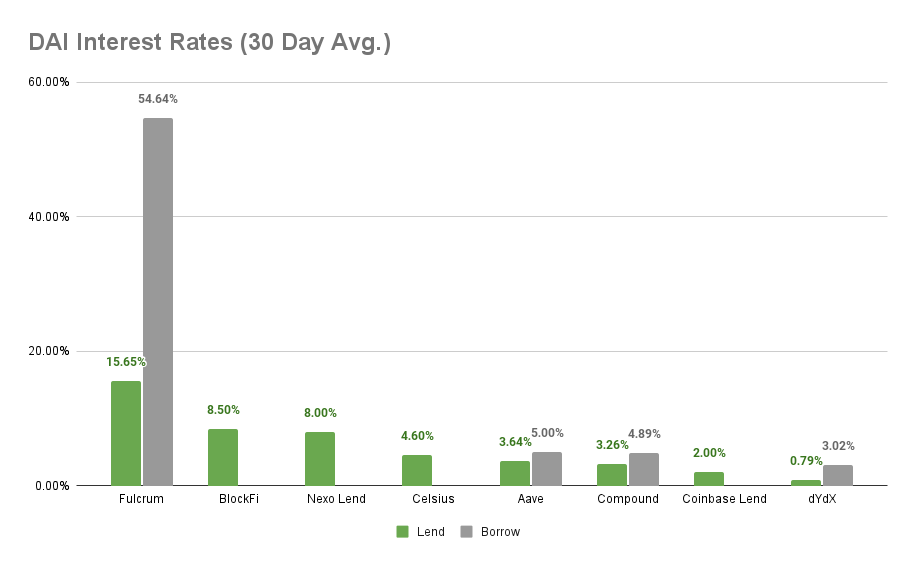

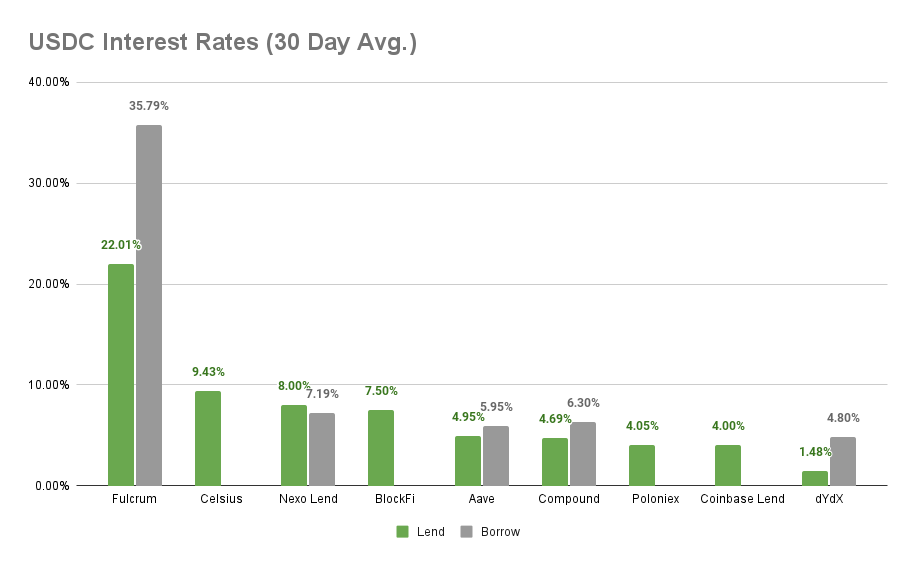

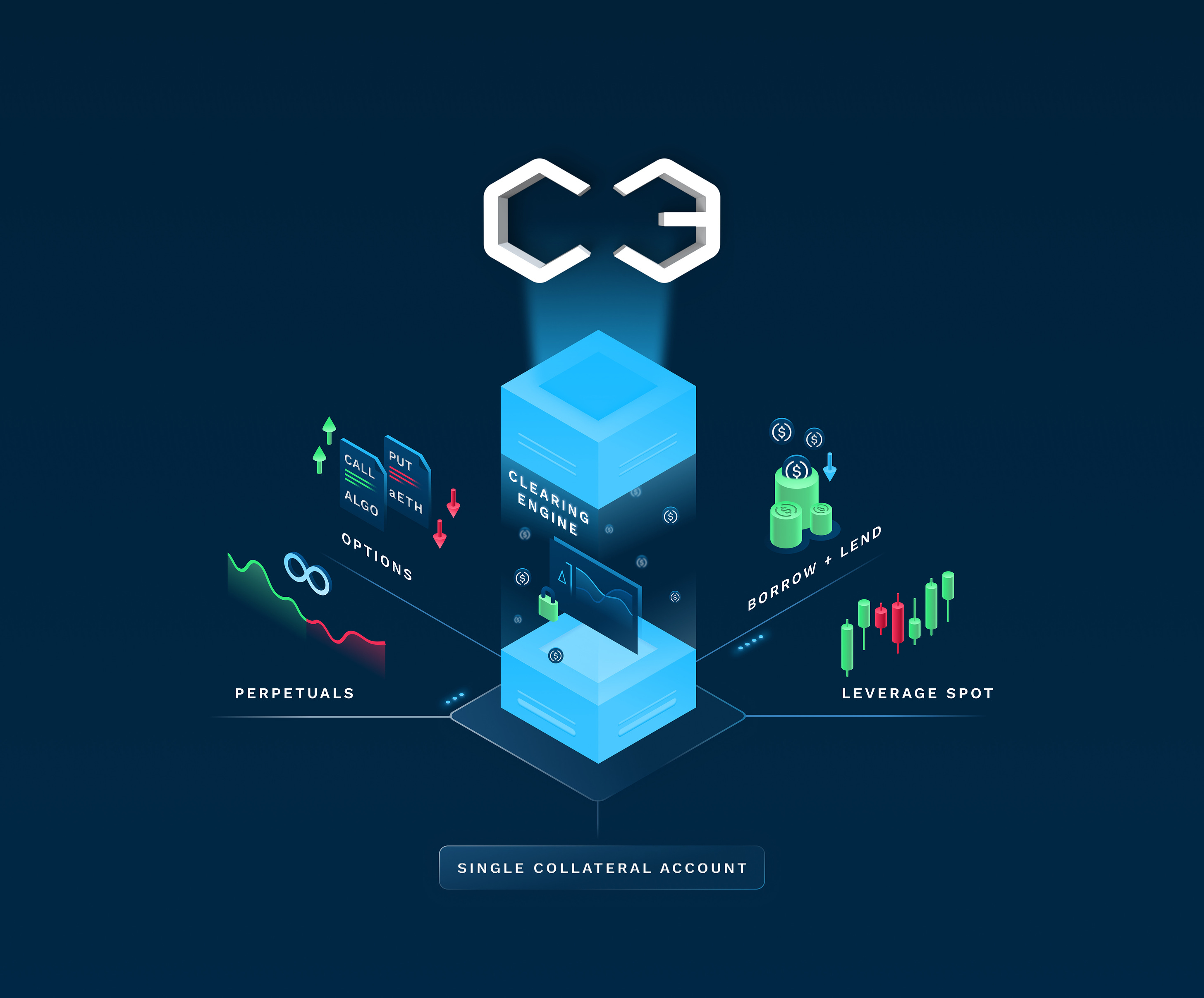

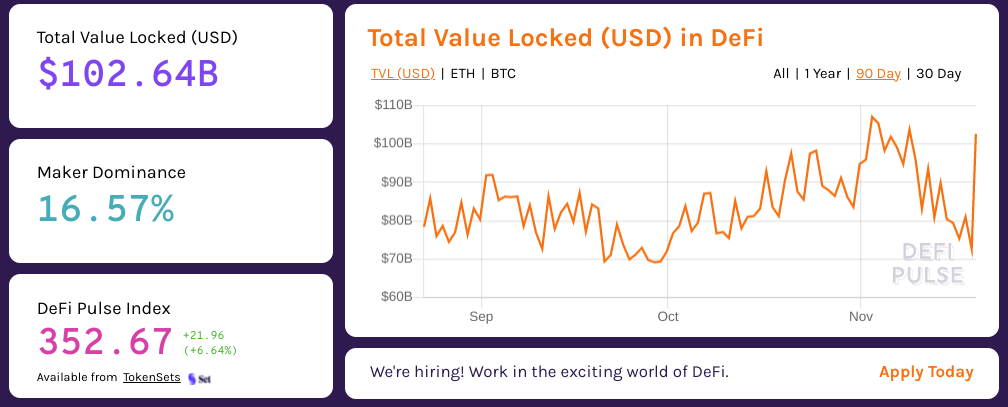

To the DeFi community, This week, DeFi-focused L1 Elrond announced a massive $1.29 billion liquidity mining program for the Maiar DEX denominated in the MEX token. The program will also include a follow-up incentive program for users of currently leading DEX including Uniswa, Pancakeswap and Sushiswap.   Analytics provider Nansen announced deeper engagement with the Arbitrum Ethereum L2 solution, releasing a comprehensive research report and adding new dashboards for data exploration. It seems like Nansen is throwing their weight behind Arbitrum as the most likely choice for the most successful L2 solution as the wait for Eth sharding continues.  NansΞn @nansen_ai We're pleased to announce that @arbitrum ecosystem dashboards are now live on Nansen! Our research analyst @YasmineKarimi_ studies different blockchain scaling solutions & explains why Arbitrum will lead #Ethereum scaling in the near future: https://t.co/k52ylEAshg A thread🧵0xMaki, the Sushiswap savior who stepped back from that protocol in recent months announced he will join decentralized liquidity provision and market maker Tokemak as Chief Strategy Advisor. 0xMaki was instrumental in building up Sushiswap in the early days, and may have a similar effect on the upcoming launch of Tokemak.   And Botto announced integration with Olympus Pro, the next evolution of DeFi incentives for long-term protocol growth. Botto allows community members to help guide the development of AI generated art and has provided incentives via DEX like Uniswap to ensure liquidity for the BOTTO token. Now, Botto will buy liquidity tokens from users with Olympus-style bonds, collecting value for the protocol over time while also gaining control over DEX liquidity. The adoption of Olympus Pro by Botto is an exciting moment this week, as one of the first real world examples of a non-DeFi protocol understanding and implementing the powerful innovation in short-term bonds and buying liquidity rather than simply incentivising it. As the Olympus forks continue to proliferate, it’s fun to see innovation taking off in real time, and to see projects in the crypto industry validating the premise of protocol owned liquidity. It’s also an interesting trend to watch as more and more L1 competitors and even some protocols continue to launch their own liquidity incentive programs. With nearly all done in the ‘old-school’ style of simply renting liquidity for mercenary providers, it should be interesting to see if these massive incentive programs are altered over time to reflect the rapid evolution in understanding and economics of bootstrapping not just functionality, but a community and staying power of protocols and applications. It wouldn’t be a huge surprise to see a mid-program shift from buying to renting liquidity - and while such a change would likely be the ringt long term decision, it should be fascinating to watch the response from both small community members and the large liquidity providers with substantial weight to throw around to make their voices heard. Stay tuned! Thanks to our partner: Nexo – Unlock the power of your crypto with up to 12% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: Fulcrum at 15.65% APY, BlockFi at 8.50% APY Cheapest Loans: Compound at 4.89% APY, Aave at 5.00% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: Fulcrum at 22.01% APY, Celsius at 9.43% APY Cheapest Loans: Aave at 5.95% APY, Compound at 6.30% APY Top StoriesC3 Protocol raises $3.6m for cross-margining layer led by Arrington Capital and Jump CapitalDeFi privacy project Panther raises $22M in 1.5-hour public saleNew Layer 2 Boba Leapfrogs Optimism and Races Past $1B in TVLEIP-1559 Has Burned 1 Million EthereumStat BoxTotal Value Locked: $103.29B (up 0.63% since last week) DeFi Market Cap: $144.78B (down -5.06%) DEX Weekly Volume: $25.96B (up 8.01%) Total DeFi Users: 4,040,100 (up 1.52%) Bonus Reads[Fabian Klauder – DEFI Times] – Why the ETH Debate is Bullish For Crypto as an Asset Class [Juan Pellicer – The Defiant] – Concentrated Liquidity Increases Risk of Impermanent Loss, Bancor and IntoTheBlock Found [Anthony Sassano – The Daily Gwei] – Probably Nothing - The Daily Gwei #386 [Lucas Campbell – Bankless] – The Best Barbell Strategy for Crypto Natives [Brooks Butler – Crypto Briefing] – "Parody" Token Struck Down by Estate of J.R.R. Tolkien If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - November 19

Friday, November 19, 2021

This week, Paraswap airdrops PSP tokens, Injective starts $120m in LP rewards, Pendle LP rewards on Avalanche, and $1.5m for synths on Solana

This Week in DeFi - November 12

Friday, November 12, 2021

This week, Raydium and Serum announce LP rewards, Wormhole support for Polygon, Polkadot's Acala raises $400m, and Maple permissioned DeFi

This Week in DeFi - November 5

Friday, November 5, 2021

This week, Aave governance approves V3, ENS to launch a DAO and airdrop, Avalanche announces $220m dev fund, and Stellar gets a native AMM

This Week in DeFi - October 29

Friday, October 29, 2021

This week, Osmosis DEX raises $21m, Serum announced LP rewards, 0x brings crypto prices to Pyth, and NEAR announces $800m for developers

This Week in DeFi - October 22

Friday, October 22, 2021

This week, Polygon pays $2m bug bounty, Jupiter Exchange launches and Synchrony raises $4.2m for Solana, and Mudrex indexes DeFi for retail

You Might Also Like

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏