DeFi Rate - This Week in DeFi - December 17

This Week in DeFi - December 17This week, Balancer taps Aave to boost yields, Optimism opens to all devs, Perp Protocol brings LP rewards, and DeFi access via Coinbase

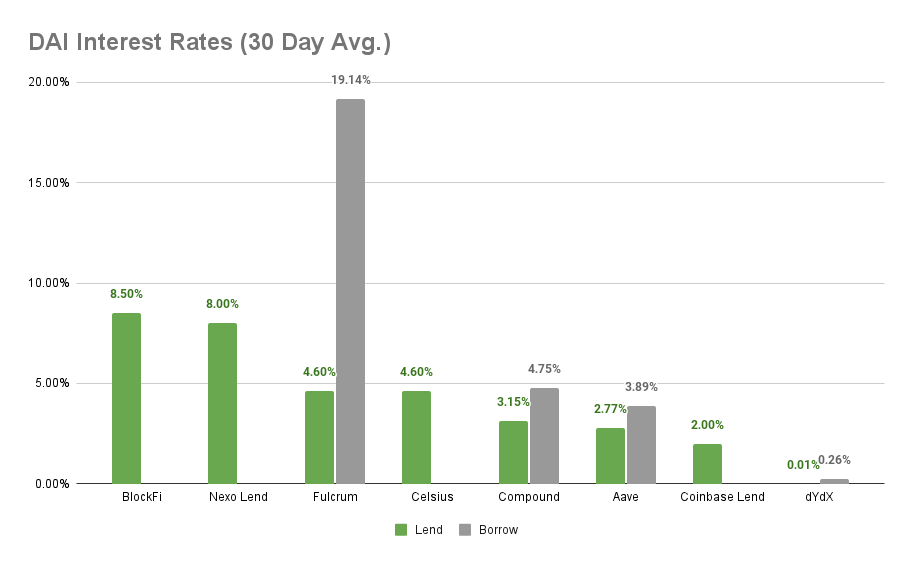

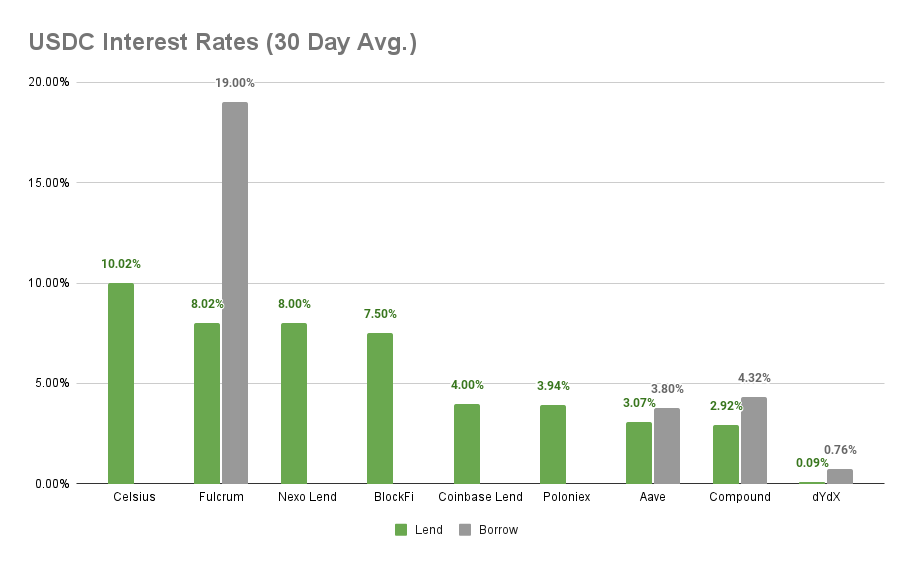

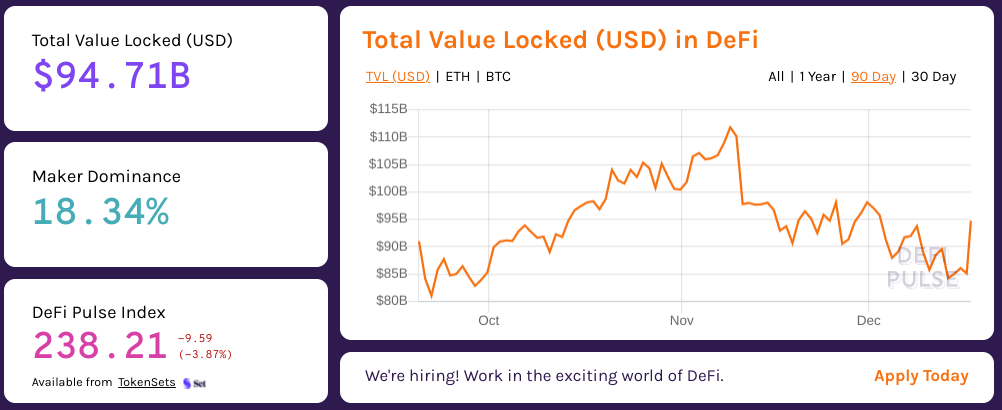

To the DeFi community, This week, Balancer announced a new integration with Aave, allowing unused liquidity from trading pools to be locked in Aave to earn additional Yield. Boosted pools will increase capital efficiency, and connections to other lending protocols will be rolled out over time to LPs additional options.  Balancer Labs @BalancerLabs The moment we’ve all been waiting for... 📢 Increased yields, greater capital efficiency, deeper liquidity. Aave Boosted Pools are here 🚀 @AaveAave https://t.co/o6PbGsp7ajOptimism, the Ethereum L2 scaling solution first employed by Uniswap has deprecated their developer whitelist, allowing a wide swathe of new talent to start experimenting with and deploying contracts on Optimism. While still controlled by a group of developers, Optimism has plans to become fully decentralized in the future.   Perpetual Protocol announced new liquidity mining rewards for LPs on Perp v2 on Optimism. The program is retroactive to all LPs who have provided liquidity since the launch of Perp v2 with total weekly rewards starting at 10,000 PERP. And Coinbase announced new ways to access DeFi for retail users - outside of the US. Coinbase will allow users in more than 70 countries to opt-in to the program, where DAI held on Coinbase is routed to the Compound protocol to earn variable interest. Coinbase will also cover transaction fees for users, leading to potentially substantial savings for market participants below whale size.  Although we focus on the positives and the builders here, DeFi can and has been a messy space since coming into the spotlight just a bit less than two years ago. It’s an industry that requires constant new learning, challenging of preconceptions and open-mindedness about what the future might hold. It has also brought the opportunities and challenges of a world with crypto into focus for policymakers and financial professionals in a way nothing else could. Some notable US policymakers have become increasingly vocal in opposition to seemingly the very idea of DeFi, and the BIS recently released a scathing take that questions many of the fundamental tenets of the nascent industry. But unlike much of what we see being developed in DeFi, this is not a new phenomenon. In the early days of the internet, policymakers were similarly suspicious, often pushing for levels of control well beyond reason simply for lack of understanding of an emergent technology - there was a time when license requirements for publishing a website were real considerations. So as we move through another holiday season, it’s worth keeping in mind that if you’re here now, you are still incredibly early, wrapping your head around developments and concepts that would have been unimaginable just five years ago. Family and friends, just like policymakers, need sober discussions about the importance and development of truly decentralized entities and frictionless transfer of value on the internet more than they need to know how much your portfolio is up (or down) or the size of the latest rug. Education is key, and it’s clear we have a long way to go before DeFi can truly deliver on the global promises of better money and finance we’ve been making since the beginning. Let’s do our part to onboard the next wave of users, and help them understand the issues their representatives will be making decisions on sooner than later. Thanks to our partner: Nexo – Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: BlockFi at 8.50% APY, Nexo Lend at 8.00% APY Cheapest Loans: dYdX at 0.26% APY, Aave at 3.89% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: Celsius at 10.02% APY, Fulcrum at 8.02% APY Cheapest Loans: dYdX at 0.76% APY, Aave at 3.80% APY Top StoriesEthereum Scaling Solution Aztec Raises $17MThe Graph Foundation Awards $48M Grant to The Guild to Join The Graph as a Core DeveloperCircle Launches USDC on Avalanche to Accelerate DeFi AdoptionHubble Protocol Raises $3.6M to Boost DeFi on SolanaStat BoxTotal Value Locked: $94.71B (down -5.24% since last week) DeFi Market Cap: $133.67B (down -2.45%) DEX Weekly Volume: $24.43B (down -31.4%) DAI Supply: 8.87B (down -0.45%) Total DeFi Users: 4,182,200 (up 1.07%) Bonus Reads[Hisham Kahn – The Defiant] – DeFi Needs to Simplify Design to be Truly Accessible to the Masses [Chris Powers – Dose of DeFi] – The Five Memes that Defined DeFi in 2021 [Kevin Owocki – Bankless] – The Internet of Jobs is coming [Anthony Sassano – The Daily Gwei] – Distributing Web3 - The Daily Gwei #401 [Fabian Klauder – DeFi Times] – Will Ethereum Be Flipped in 2022? If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - December 10

Friday, December 10, 2021

This week, 0x protocol and Celo allocate $4.5m, Pods Finance comes to Arbitrum, Woo Network launches on Avalanche, and DPI comes to Polygon

This Week in DeFi - December 3

Friday, December 3, 2021

This week, 1inch raises $175 million, DeversiFi is the latest airdrop, Bancor announces V3, and IDEX rewards on Polygon

This Week in DeFi - November 26

Friday, November 26, 2021

This week, Elrond $1.29 billion LP incentives, Nansen adds Arbitrum dashboards, 0xMaki to advise Tokemak, and Botto integrates Olympus Pro

This Week in DeFi - November 19

Friday, November 19, 2021

This week, Paraswap airdrops PSP tokens, Injective starts $120m in LP rewards, Pendle LP rewards on Avalanche, and $1.5m for synths on Solana

This Week in DeFi - November 12

Friday, November 12, 2021

This week, Raydium and Serum announce LP rewards, Wormhole support for Polygon, Polkadot's Acala raises $400m, and Maple permissioned DeFi

You Might Also Like

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏