DeFi Rate - This Week in DeFi - January 7

This Week in DeFi - January 7This week, Aave Arc is live, Serum's IEF raises $100 million, Yearn Finance governance lockups and rewards, and Goldfinch raises $25 million

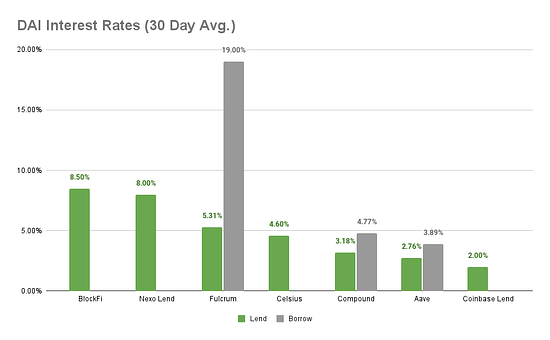

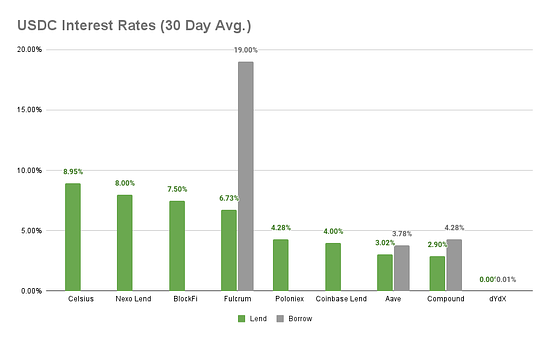

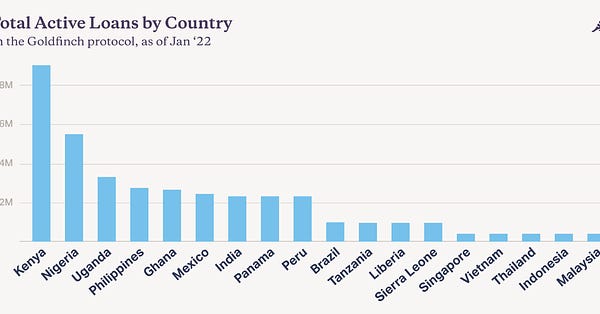

To the DeFi community, This week, Aave and Fireblocks announced the launch of the Aave Arc permissioned DeFi marketplace, allowing KYC’d institutional customers to be whitelisted into a walled garden of other verified institutional users.   The Incentive Ecosystem Foundation, a community-led group focused on developing the Serum network ecosystem on Solana announced a $100m fundraise to support growth and development from a combination of traditional finance and digital asset firms. The Yearn Finance community passed a vote that will require YFI to be locked to participate in governance, with the benefit of receiving staking rewards. The tokenomics design is inspired by the Curve Finance design, with higher annualized rewards for those who choose to lock tokens for longer.  And Goldfinch Finance, focused on bringing undercollateralized loans to DeFi, announced a fundraise of $25 million led by a16z. Funds will be controlled by the newly formed Goldfinch Foundation, and will go towards supporting improving the protocol and helping more customers get DeFi loans.   Two opposite ends of the market are getting a better deal in DeFi this week; institutions get access to one of the first true tastes of the power and efficiency of smart contracts on blockchain infrastructure via Aave Arc, and Goldfinch adds resources to continue leveraging the power of the community to underwrite and unlock undercollateralized DeFi loans on a large scale for the first time. While the implications for the medium-term addressable market are weighted to the institutional side, the ideal and promise of decentralized finance are deeply embodied in the mission and implementation being pursued by Goldfinch. What’s more, in the long term, the potential to unlock and generate wealth for a bigger slice of the world population is likely far greater in the bottom-up approach to financial access being pursued by the Goldfinch team. At its heart, credit has always been grounded in community, and it’s exciting to see the intersection of community input and governance combined with the huge reduction in overhead DeFi enables being used to make access to capital more equitable across the globe. There are many experiments in flight today exploring the capabilities, resilience, capacity for intelligent decision making and staying power of different communities, organized in different ways. But for my money, the real opportunity to make DeFi a force for good in the world is that presented by giving the global community something the West has enjoyed easy access to for generations - a partnership with an engaged organization focused on helping customers achieve commercial success through access to fair financing. DeFi is for dreamers! Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: BlockFi at 8.50% APY, Nexo Lend at 8.00% APY Cheapest Loans: Aave at 3.89% APY, Compound at 4.77% APY MakerDAO Updates DAI Savings Rate: 0.00% Base Fee: 0.00% ETH Stability Fee: 2.00% USDC Stability Fee: 0.00% WBTC Stability Fee: 2.00% USDCHighest Yields: Celsius at 8.95% APY, Nexo Lend at 8.00% APY Cheapest Loans: dYdX at 0.01% APY, Aave at 3.78% APY Top StoriesWonderFi to buy parent company of Canadian crypto platform BitbuyGrayscale DeFi Fund and Grayscale Digital Large Cap Fund Announce Quarterly Rebalancing of FundsSolana DeFi Project Exotic Markets Raises $5MBinance Labs Led $12M Investment Round for WOO NetworkCrypto Infrastructure Firm Pocket Network Raises $10MStat BoxTotal Value Locked: $94.05B (down -5.54% since last week) DeFi Market Cap: $140.88B (down -8.11%) DEX Weekly Volume: $21.38B (up 18.84%) Total DeFi Users: 4,317,600 (up 0.97%) Bonus Reads[Timothy Craig – Crypto Briefing] – What Is NEAR Protocol? The Sharded Layer 1 Blockchain Explained [Jack Melnick – The TIE] – Small-Price Fallacies, Regulation, and Semi-Hidden Alpha [Anthony Sassano – The Daily Gwei] – Proof of Revenue - The Daily Gwei #412 [Lucas Campbell – Bankless] – The Ultimate Guide to GMI [Vishal Chawla – Crypto Briefing] – U.S. Congress Reportedly Set for Hearing on Bitcoin's Carbon Footprint If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week in DeFi - December 31

Friday, December 31, 2021

This week, Centrifuge and Aave bring real world assets to DeFi, DeBank raises $25 million, and SOS and GAS airdrops for (almost) all

This Week in DeFi - December 24

Friday, December 24, 2021

This week, Rari and Fei merge, the Eth Kintsugi testnet is live, Transak on-ramps for Arbitrum and Optimism, and new security for Compound

This Week in DeFi - December 17

Friday, December 17, 2021

This week, Balancer taps Aave to boost yields, Optimism opens to all devs, Perp Protocol brings LP rewards, and DeFi access via Coinbase

This Week in DeFi - December 10

Friday, December 10, 2021

This week, 0x protocol and Celo allocate $4.5m, Pods Finance comes to Arbitrum, Woo Network launches on Avalanche, and DPI comes to Polygon

This Week in DeFi - December 3

Friday, December 3, 2021

This week, 1inch raises $175 million, DeversiFi is the latest airdrop, Bancor announces V3, and IDEX rewards on Polygon

You Might Also Like

Cardano’s Charles Hoskinson reacts to White House crypto summit snub

Thursday, March 6, 2025

Hoskinson focuses on legislative progress, unfazed by his absence from Trump's crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Monthly Update on Blockchain Technology: Pectra testnet activation, zero-knowledge gossip, BNBChain roadmap

Thursday, March 6, 2025

Written by: GaryMa, WuBlockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Reminder: White House Schedules First Ever Crypto Summit

Thursday, March 6, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏