Not Boring by Packy McCormick - Not Boring Capital: 2 Fund, 2 Boring

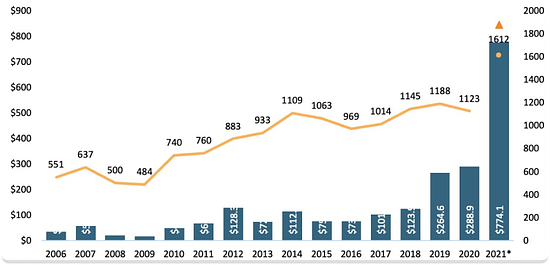

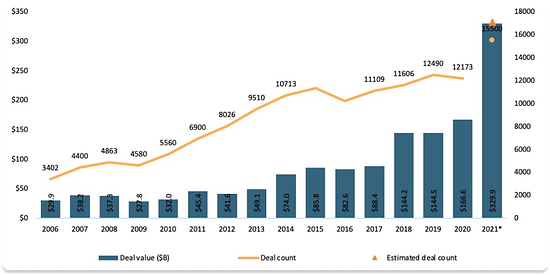

Not Boring Capital: 2 Fund, 2 BoringNot Boring Capital's $30M Fund II and the Value of Weird InvestmentsWelcome to the 1,294 newly Not Boring people who have joined us since last Monday! Join 97,780 smart, curious folks by subscribing here: 🎧 To get this essay straight in your ears: listen on Spotify or Apple Podcasts (soon) This week’s Not Boring is brought to you by… Okay, Computer. If you like reading Not Boring, you'll love listening to Okay Computer Podcast. Every Wednesday, CNBC Fast Money's Dan Nathan is joined by a murderers row of tech investors, thinkpeople, and operators, Katie Stanton, Rick Heitzmann, Meltem Demirors, Cleo Abram, Sally Shin, Jarrod Dicker, and yours truly, Packy McCormick. We break down the biggest headlines and trends in tech investing, in public and private markets, web2 and web3, and offer our insights into how we are investing our capital. Kind of like today’s post. This Wednesday, 01 Advisors' Adam Bain, former Twitter COO, and the guy that Kara Swisher recently referred to as "the nicest man in tech" joins his former colleague Katie, Dan, and me to discuss his outlook for 2022 and offer his take on the web2/web3 Twitter wars. Let’s make this thing bigger than All-In. Join me and the gang by subscribing here: Hi friends 👋, Happy Monday! Every quarter, I send an update to the people who invested in Not Boring Capital to update them on the fund’s performance and how I see the market. Yesterday, I sent my third update. I’ve shared each of the first two, and I wanted to share this one, plus a little extra color on VC and getting weird, plus plus an opportunity to invest in Not Boring Capital. Let’s get to it. Not Boring Capital: 2 Fund, 2 BoringHi friends 👋, Happy Monday! We’re going to be talking enough about me today, so… Let’s get to it. Not Boring Capital: 2 Fund, 2 BoringFirst things first: Not Boring Capital is back for Fund II, a $30M fund. The strategy for Fund II is similar to the strategy for Fund I: invest in the best companies across verticals – web2 and web3, bits and atoms – at any stage, with a heavier concentration in earlier stages, and help them tell their stories. Maximize winners, don’t minimize losers. The average check size will just be bigger. I picked an interesting first year to do VC. While the funding environment seems a little wild – with average valuations across stages at all-time highs, and more companies getting funded than ever before – I firmly believe that the market is a reflection of the massive opportunities still ahead, the huge number of insanely talented people starting companies, and the larger outcomes tech companies are achieving. Take this chart, from Pitchbook and NVCA’s Q4 2021 Venture Monitor: Frothy funding market, huh? Well, maybe, but that’s not what this chart is showing. That’s actually a chart of exits by year. Total exit value grew 168% from the previous best year ever in 2020 to $774 billion in 2021… and Stripe, Bytedance, and SpaceX haven’t even IPO’d yet. Venture funding has jumped, too, to $329.9 billion in 2021, but not by nearly as much as exits. In fact, the 2.3x exit value to deal value ratio is the highest in any year since 2006, except for 2012, the year that Facebook went public. Investors and employees are pulling more money out than they put in by the second-widest margin ever. Obviously, that might just mean that, fueled by low interest rates and an active money printer, the public markets are behaving as irrationally optimistically as the private ones. As rates rise, like it looks like they might, it will be interesting to see what happens to private valuations and exit opportunities. But you need to play the game on the field. Some Not Boring Capital funds will invest in bull markets, and I’m sure that others will invest through bear markets. I can’t wait. The long-term thesis – that tech will compound to unimaginable heights – remains the same in any market environment until proven otherwise, and bear market prices will be cheaper. The trick is staying alive and being able to raise funds in any environment. To that end, I’m incredibly lucky to be backed by many of the same investors as Fund I, including many of you, along with some great new investors. The Not Boring Capital family is growing, and I want more Not Boring people involved. The SEC imposes limits on that – like the (absurd but unfortunately hard) accredited investor rule and the rule that says you can either raise more than $10M with fewer than 100 Limited Partners (LPs, the people who invest in funds) or raise less than $10M from up to 249 LPs. For Fund I, we hit the $9.9M cap with 133 LPs - a lot for a small fund, but not as many as I’d like! After deploying the $9.9M Fund I in six months, I wanted to go bigger for Fund II: more money to invest, and more LPs. So I worked with the one and only Jenn Jordache at AngelList to set up a parallel fund structure – which puts all of the Qualified Purchasers ($5M+ in invested assets) in one fund and leaves more room in the $10M / 249 person fund for accredited investors. Having that room is really important to me. I’ve asked LPs who wanted to write bigger checks to keep them smaller and turned down introductions to people who aren’t Not Boring readers. I’ve said it before and I’ll say it again: there wouldn’t be a Not Boring Capital without all of you reading and sharing and giving feedback on Not Boring. So I want you in the fund. You can read the memo I wrote to raise Fund II here: The reaction for Fund I was overwhelming, and in case it is for this one too, I don’t think I’ll be able to fit everyone in, but I’ll do my best. As with last time, I’m prioritizing women and minorities traditionally underrepresented on fund cap tables, long-time Not Boring readers, and people who have backed Not Boring Syndicate deals, in that order. Note: putting your wife’s name and your own email address to qualify as a woman will get you automatically disqualified haha. I didn’t think I’d need to say this, but over a dozen people did it last time. Kind of a Catch-22: you wouldn’t want to let anyone dumb enough to fall for that invest your money, would you? If you’re interested in participating, and you’re an accredited investor (we need this damn rule to change), you can submit your interest here. If you’re in, I’ll get back to you ASAP. I likely won’t be able to get back to everyone (there were 750+ submissions last time), but know that I really appreciate the trust and support. Regardless of how many people we can get in, the other purpose of this email is to pull back the curtain on raising and running a fund. A couple of years ago, when I worked at a venture-backed startup, I thought there was some magic Venture Capitalist (VC) knowledge that some very smart Stanford people had that the rest of us didn’t or couldn’t possess. I remember waiting for board meetings to let out so we could learn what our VCs thought about our quarter like Moses waiting for god to chisel those tablets. Turns out, we were all pretty much the same level of idiot. But like any industry, VC has a vocabulary and shared understanding that, once you learn them, demystify the whole thing. Which is why I want to share as much of this journey as possible. In July, in Introducing Not Boring Capital, I shared the memo that I wrote to raise the fund and my first LP Update. In October, in Playing Solo Games, I shared my second LP Update and went deep on Not Boring Capital’s strategy as a small solo GP (one person investing the money) fund. Today, we’ll cover two things:

Without further ado… Not Boring Capital, LP Update IIIHi Not Boring LPs 👋, Happy new year and welcome back for Not Boring Capital, LP Update III! There are a lot of familiar faces here, and some new ones – welcome! This update is going out to LPs in both Fund I and Fund II. Not Boring Capital makes the most sense when you think about it as one (hopefully long) line of connected funds. Let’s kick this update off with some good news, and some bad news. First, the bad news: we’ve slowed down our pace. After making 59 investments in Q3, we only made 48 investments out of Fund II in Q4 😉 We invested $8.4 million for an average $175k per investment. This seems to be about the right pace for Not Boring Capital. As you’ll see below, we’ve been able to keep our bar high while investing bigger checks in more companies, even as we’ve moved our mix a little bit earlier. Over time, I expect the average check to get a little bigger (the committed pipeline for Q1 averages $290k) and the proportion of follow-ons to increase, which will keep the number of new companies in each fund from ballooning too high. Now the good news: we’ve already had our first Fund II liquidity event! [REDACTED] $250k [REDACTED]. Our position is currently worth $3.8 million, up 15x for an IRR of around 6.7 billion % (haha, but actually). Note: I unfortunately can’t share details on this one yet. This one seems like a weird outlier, and it is, but I think it’s also a really good representation of the fund strategy in action. I’ll explain further below. December was the most active month in Not Boring Capital’s long and storied nine month history. If this pace holds, we will end up deploying the fund in closer to 9 months than 12 months. Expect the capital call for the second 50% in February. In today’s update, we’ll cover:

To learn more about the Fund I portfolio, early Fund II investments, some of our web3 investments, and why I want to make even weirder and riskier bets… How did you like this week’s Not Boring? Your feedback helps me make this great. Loved | Great | Good | Meh | Bad Thanks for reading and see you next week, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

The Laboratory for Complex Problems

Monday, January 3, 2022

web3 as a simulation

The Best is Still Yet to Come

Monday, December 13, 2021

The Last Not Boring of 2021

Replit: Remix the Internet

Thursday, December 9, 2021

Replit Raises $80M Series B to Bring the Next Billion Software Creators Online

The Pareto Funtier

Monday, December 6, 2021

More fun making money, and more money having fun

Idea Legos

Monday, November 22, 2021

Ideas compound and compose just like interest and software

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month