The Daily StockTips Newsletter 01.25.2022

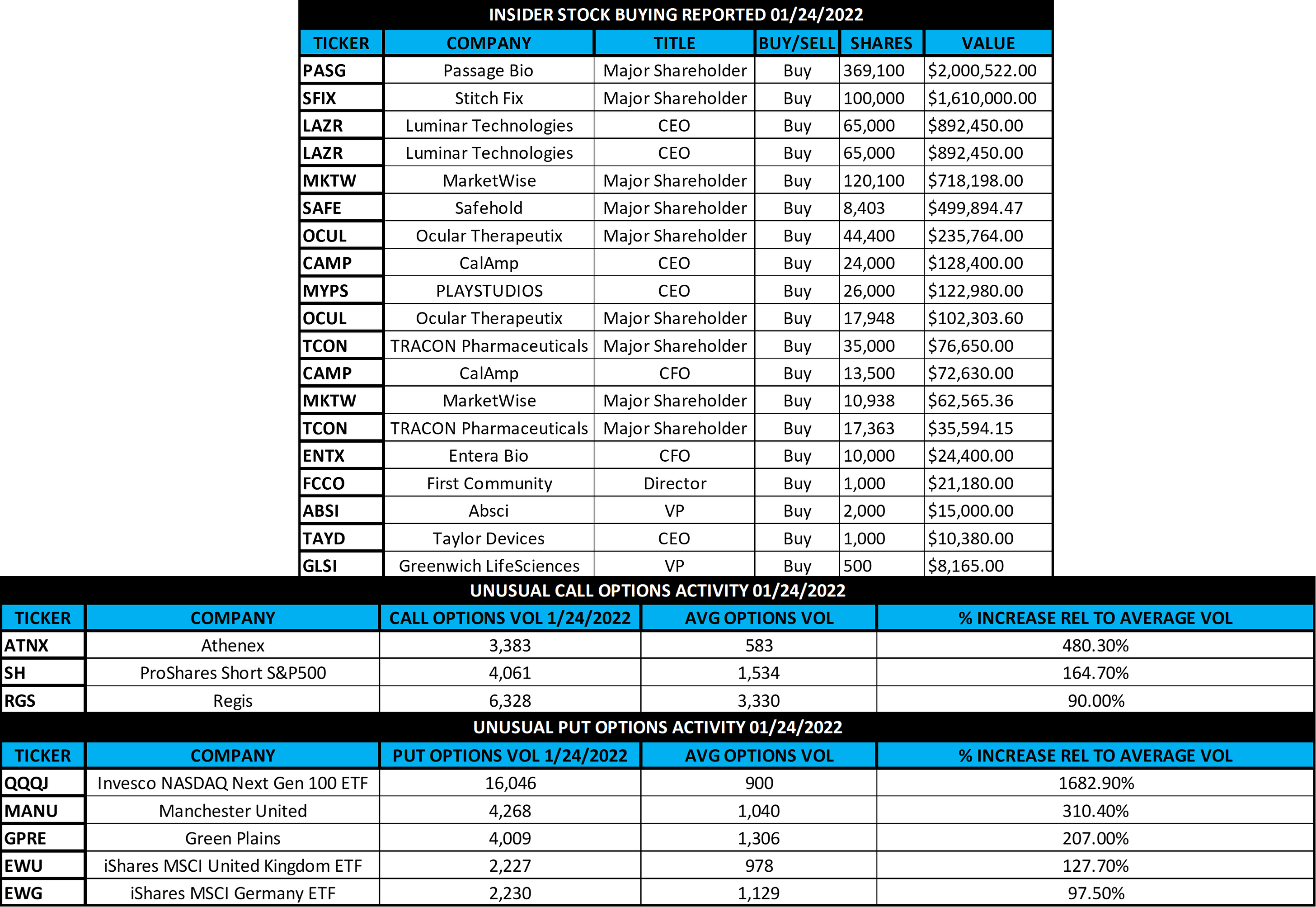

The Daily StockTips Newsletter 01.25.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. Past performance does not guarantee future results. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.STOCKTIPS MISSION STATEMENT’S:1) PAID SUBSCRIBERS: Relentlessly Searching for Historically / Reliably Profitable Companies, Trading at a Sector/Industry Relative Value, on a Pullback of Little to No Negative Consequence, Favored by Institutions, & Under Assessed Favorable Current / Future Economic Conditions, in an Effort to Help Generate Trade Ideas for Paid Subscribers that Maximize Profits & Limit Losses. CLICK HERE TO SEE THE STOCKTIPS RECORD 2) FREE SUBSCRIBERS: StockTips will Alert Free Subscribers of Impending Known Market Moving Economic News Dates while Delivering Insightful Commentary, Trade Strategies / Ideas, Insider Buying, Unusual Options Activity, Upcoming Earnings, & Market Moving News, in an Effort to Educate Free Subscribers while Helping them Navigate the Markets, Develop their Own Actionable Trade Strategies / Ideas, & Help Limit Time Spent Researching Underlying Market Trends & Conditions. WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red Indicates an Earnings Loss [Not Miss] Consensus), Yesterdays Insider Buys & Yesterdays Unusual Call Options Volume.TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! Today: At the time of typing this, Asian markets are down, European markets are down, U.S. futures are down, & the Fed interest rate decision will be announced at 2:30PM ET tomorrow. Of course, war fears are still dominating the headlines & home prices will be announced today. I’m ignoring the noise & paying attention to the earnings. There’s certainly a lot of companies that are either/both related to our holdings and/or providing some solid insight into the various sectors/industries, whose earnings we ought to be paying attention to. That’s the great thing about market noise. Everyone pays attention to the obvious threat in front of them, not the indicators of future great opportunities. As I learned in the infantry, if you’re distracted by the IED placed visibly obvious in the middle of the road while on convoy, you aren’t as keen to notice the ambush set up to eat your lunch when you stop. So in such situations you DO NOT STOP! You switch lanes, make adjustments, carry on, & call it in, … lest you let your enemies determine whether you get to proceed with the mission or not. And if you stop to stare at the bomb, your immediate mission will become a MEDEVAC. So what’s the point? Don’t let the market noise distract you from finding & realizing trends in earnings that can help you identify solid value. Earnings are the one time you get to confirm your industry/sector analysis. It’s best to do it while everyone else is distracted. WHAT THE HELL WAS THAT!!?: Yesterday the markets immediately sold off in the morning. I tuned out the markets comforted in the value & fundamentals of my picks. It was one of those rare moments where I found myself caught up by lunch so I worked on my resume (I’m making a transition in careers, if you guys know of any solid private sector employers looking for the skills of a very seasoned former intel analyst, comment below). I applied for one job after completing the resume & then looked at my picks. My eyes widened & I immediately knew that the markets we’re either in a rally, or there was a shift to value. Perhaps a little of both. I can understand sentiment changing on a dime, but I haven’t seen a swing this wild since that massive 1000 point swing in the DOW in early 2020. Should we trust that this will stick? I’m certain that there will be more bait & switch days but should we care if we’re getting stocks at a steal valuation? I think not. Wild Swings Explained: When markets dump on uncertainty it’s usually kicked off by an institution or two controlling a very large amount of money. In their mind, they want to the be the first to dump before everyone else does. All they need is a catalyst, & inflation combined with increasing bond yields, turmoil in international markets, possible war in the Ukraine, & the upcoming Fed interest rate decision provided all the catalysts needed. Upon going short & selling, the street gets wise & the sentiment quickly spreads. Indeed professional trading firms pay close attention to order flow. So others follow suit, taking profit & going short. As in any market dump, prices can only go so low before intuitions & firms cannot resist the value. Just like the firms that wanted to be the first do dump, there is usually just as much money out there that wants to be the first to buy, often in the effort of averaging down. When you get enough order flow on the buy side, word spreads quick, shorts panic cover, & the market violently shoots up … classic. Remember we can’t control how people trade, but we can control the value & quality of what we buy. Corrections Always Overcorrect & Why I Ignored the Dump: Just as stocks get overbought, they also get oversold. You can find two stocks in particular on my BUY LIST that are deeply oversold. Why in Gods name am I still holding them you may ask? Well, corrections based on uncertain catalysts are derived from fear, not the actual underlying conditions … panic is often devoid of the underlying conditions. I’m not saying things are peachy, but rather the market makes negativity seem worse than it actually is, particularly if you’re investing your own money. The market is a very impatient beast; indeed, folks want their money yesterday, & if they don’t get it, they’ll accept the loss in search of another stock to lose money on. I don’t do business that way. I trust my analysis, I trust the fundamentals, & I trust my own economic assessments. I only choose stocks that, if the trade turns against me, I assess a high probability that holding over a reasonable time will result in an eventual gain. It is an extra layer of security on an already great trading strategy of buying reliably profitable value on a pullback of little to no consequence under favorable economic conditions & with solid institutional investment. Therefore, I may average down on a dump, but pending no change in my personal assessment, there is no need for me to sell a good company! As a result I have come to be excellent at ignoring market dumps. I leave the freaking out to others. Time is too precious to worry about how others are bugging out …. And that’s exactly what you’re doing when you ignore the fundamentals & fall prey to the sentiment of others. You forget about the value you have for fear of how others will trade. I’m certain you see the flaw in this reasoning. If the markets dump tomorrow I will continue on as I always have. Could I live to regret it? Certainly. But I like what I got & I can always buy more. Could there be More Market Dumping?: Yes, I wrote about this Yesterday. How Far can a Reliably Profitable Value Buy Sell Off?: Well we’re finding out. There is a lot of confusion in the market. Many stocks that were trading many multiples beyond fair value are getting slaughtered. However check this creamy goodness out! Prior to market open yesterday my BUY LIST had an assessed average Forward Price to Earnings (PE) ratio of 11.10 while the S&P had a forward PE of 25.85 (Good Lord). The average Price to Sales (PS) ratio on my BUY LIST is roughly 1.07 (S&P 500 is 2.85) while the average Price to Earnings Growth (PEG) ratio (of those that can be properly assessed on my buy list) is assessed as 0.56 with an average Price to Book (PB) ratio of 1.70 (S&P is 4.38). All of the stocks on my BUY LIST except for 2, are trading with their Market Cap below their Enterprise Value. The average current ratio of the stocks on the BUY LIST is 2.22, meaning they can pay their debts. Ladies and Gent’s, that’s some solid value, that’s some solid growth, & I’m happy to let the market throw a fit. The lower the market dips the better the PE/PS/PEG ratios become. That should get big money’s attention! It also gives me some solid comfort. Significant News Heading into 01.25.2022:

PAID CONTENT IN THE PAYWALL BELOW:

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 01.19.2022

Wednesday, January 19, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 01.04.2022

Tuesday, January 4, 2022

IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give

The Daily StockTips Newsletter 01.03.2022

Monday, January 3, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET)

The BUY List

Monday, January 3, 2022

All Buy List Additions Will Be Added Here (Additions Updated when Added, All Templates Updated Weekly)

The Daily StockTips Newsletter 12.31.2021

Friday, December 31, 2021

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET)

You Might Also Like

🇨🇳 The US is out, China is in

Tuesday, March 11, 2025

Citigroup's forecast for US and Chinese stocks, Lego stacked bricks, and Boeing's investigation | Finimize Hi Reader, here's what you need to know for March 12th in 3:10 minutes. Citigroup

The Under-the-Radar Threat to Your Retirement

Tuesday, March 11, 2025

Nearly half of older adults are burdened by bad debt ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

15 Years Since We Bought Our Toxic Asset

Tuesday, March 11, 2025

In a new Planet Money plus episode, former Planet Money hosts David Kestenbaum and Chana Joffe-Walt look back at a pioneering series that sought to explain a major source of the 2008 financial crisis.

👋 Investors ditched the S&P 500

Monday, March 10, 2025

The US president didn't rule out a recession, but TSMC eased some of investors' other worries | Finimize Hi Reader, here's what you need to know for March 11th in 3:07 minutes. TSMC's

💳 Find a new credit card

Monday, March 10, 2025

Let's get those rewards ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Text and Telos

Monday, March 10, 2025

Plus! Diff Jobs; Scaling; Retail Investors; Comparative Advantage; Transaction Costs and Corporate Structure; DeepSeek Governance Text and Telos By Byrne Hobart • 10 Mar 2025 View in browser View in

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏