Coin Metrics' State of the Network: Issue 139

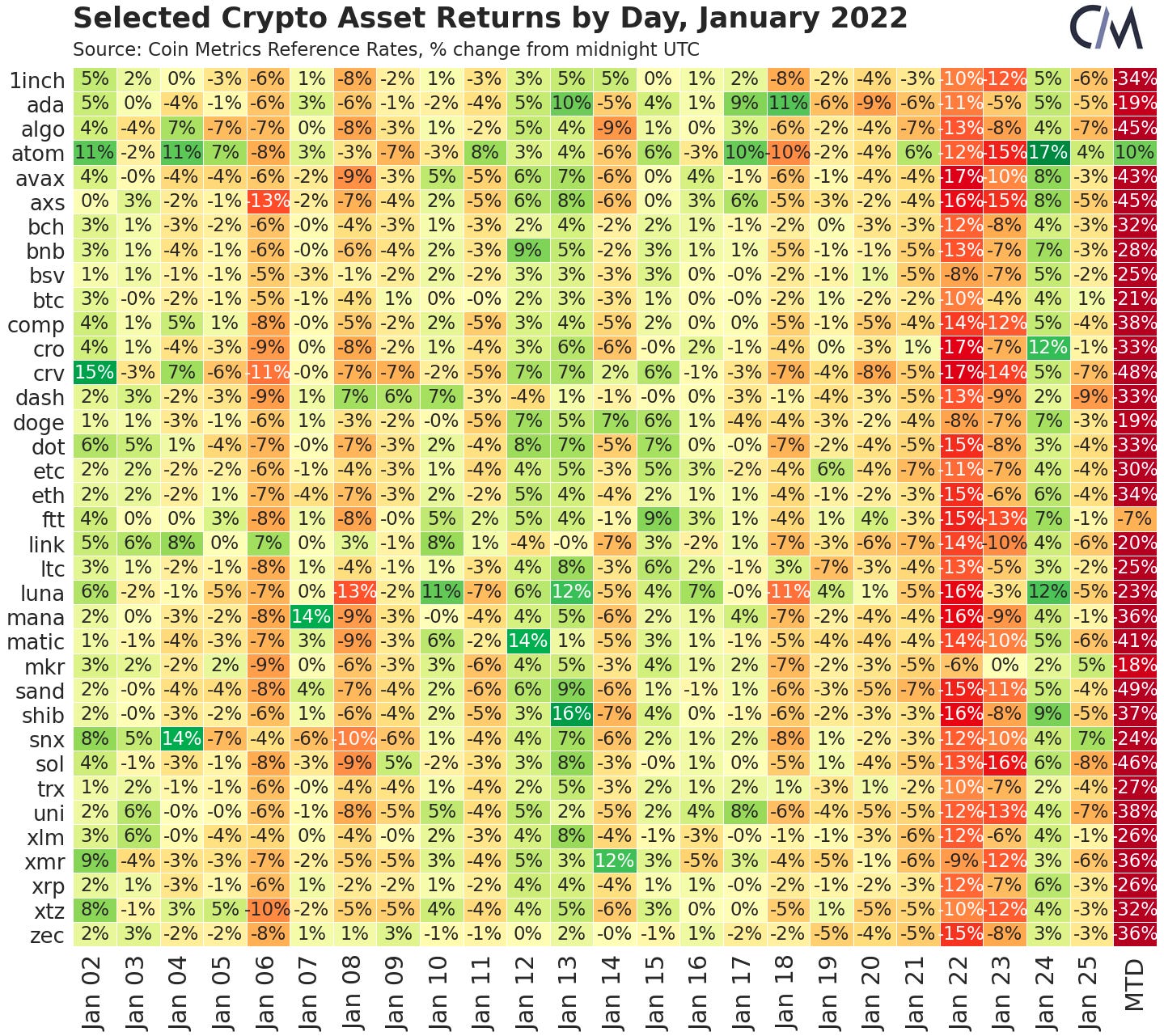

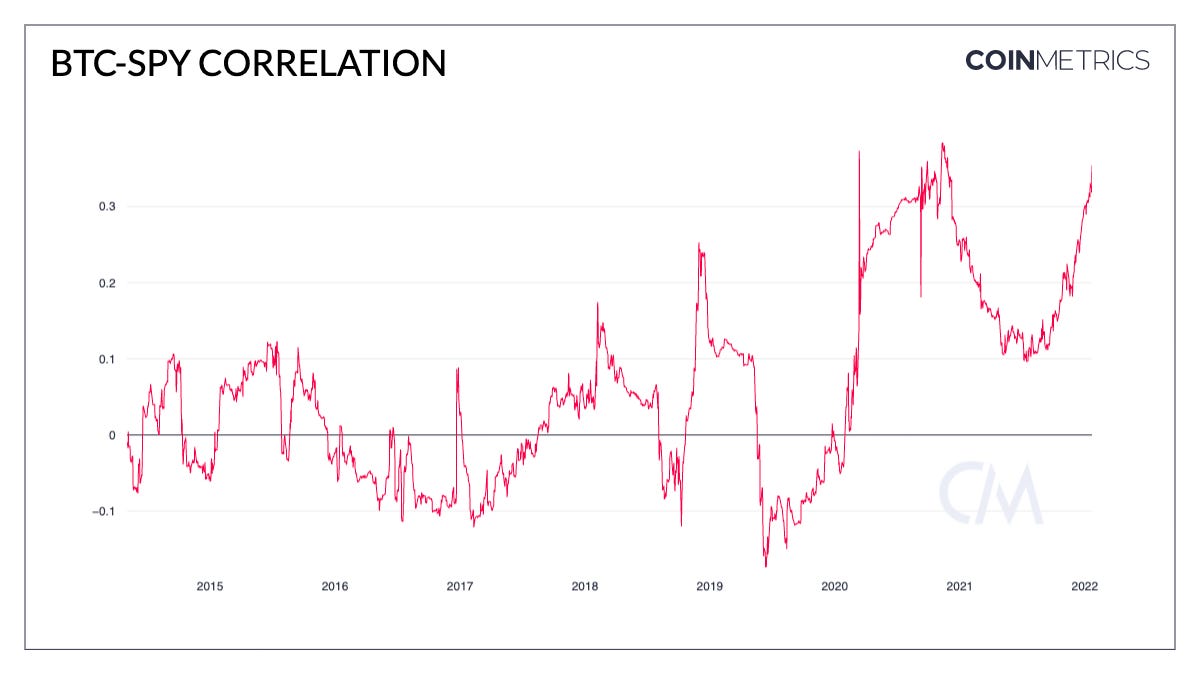

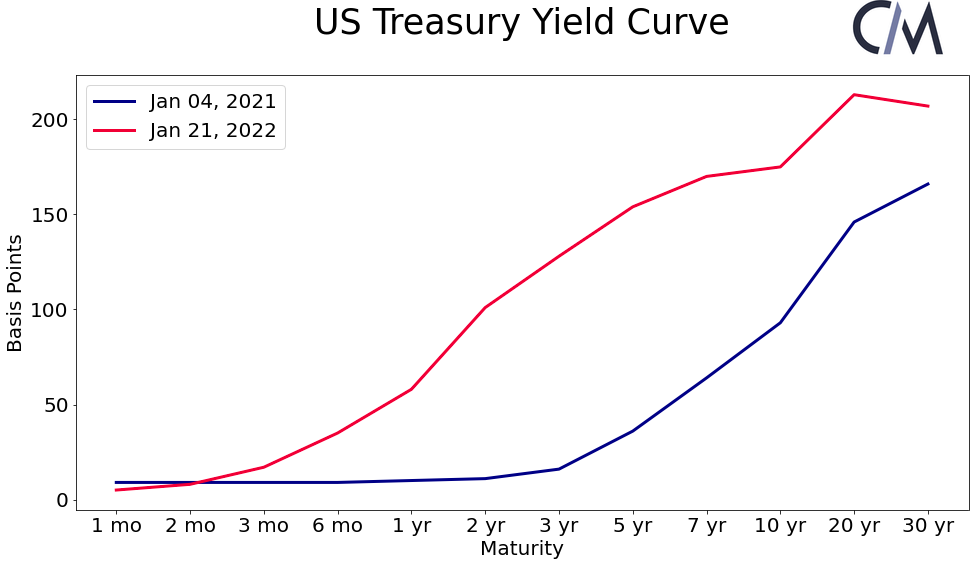

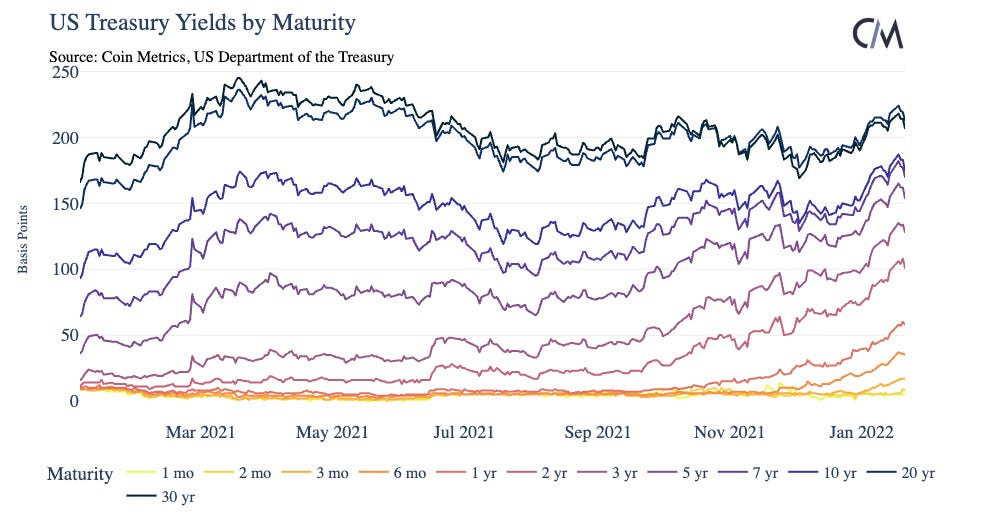

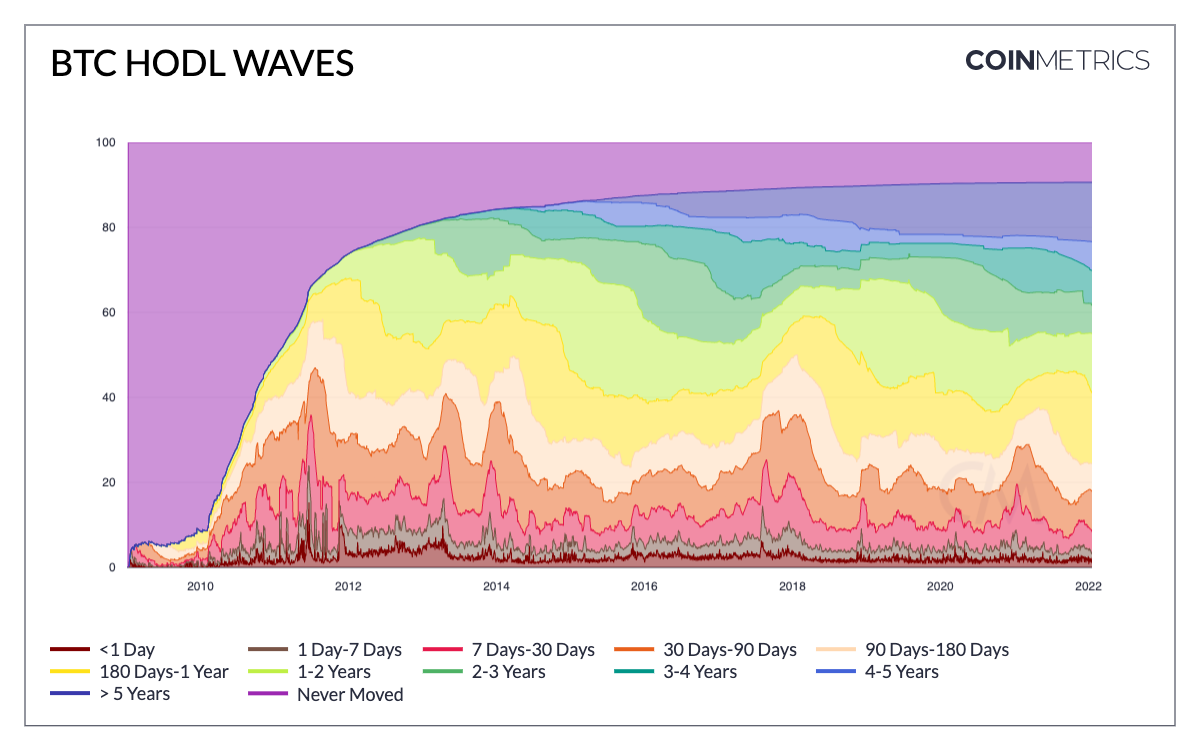

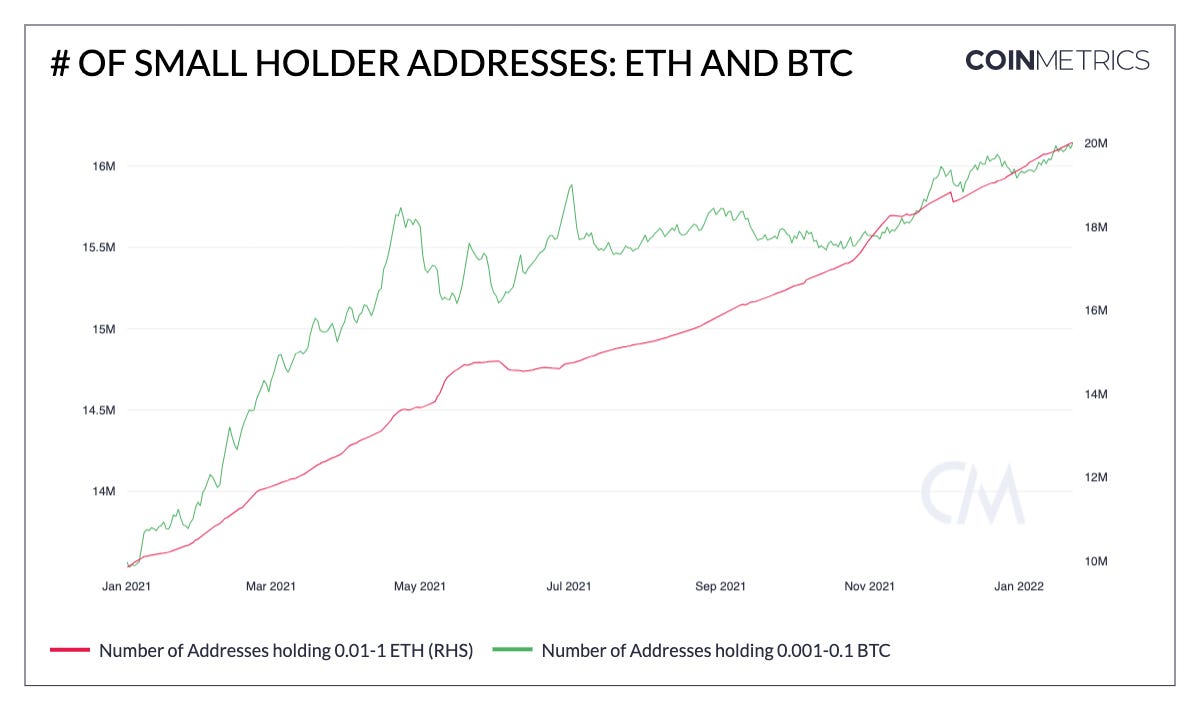

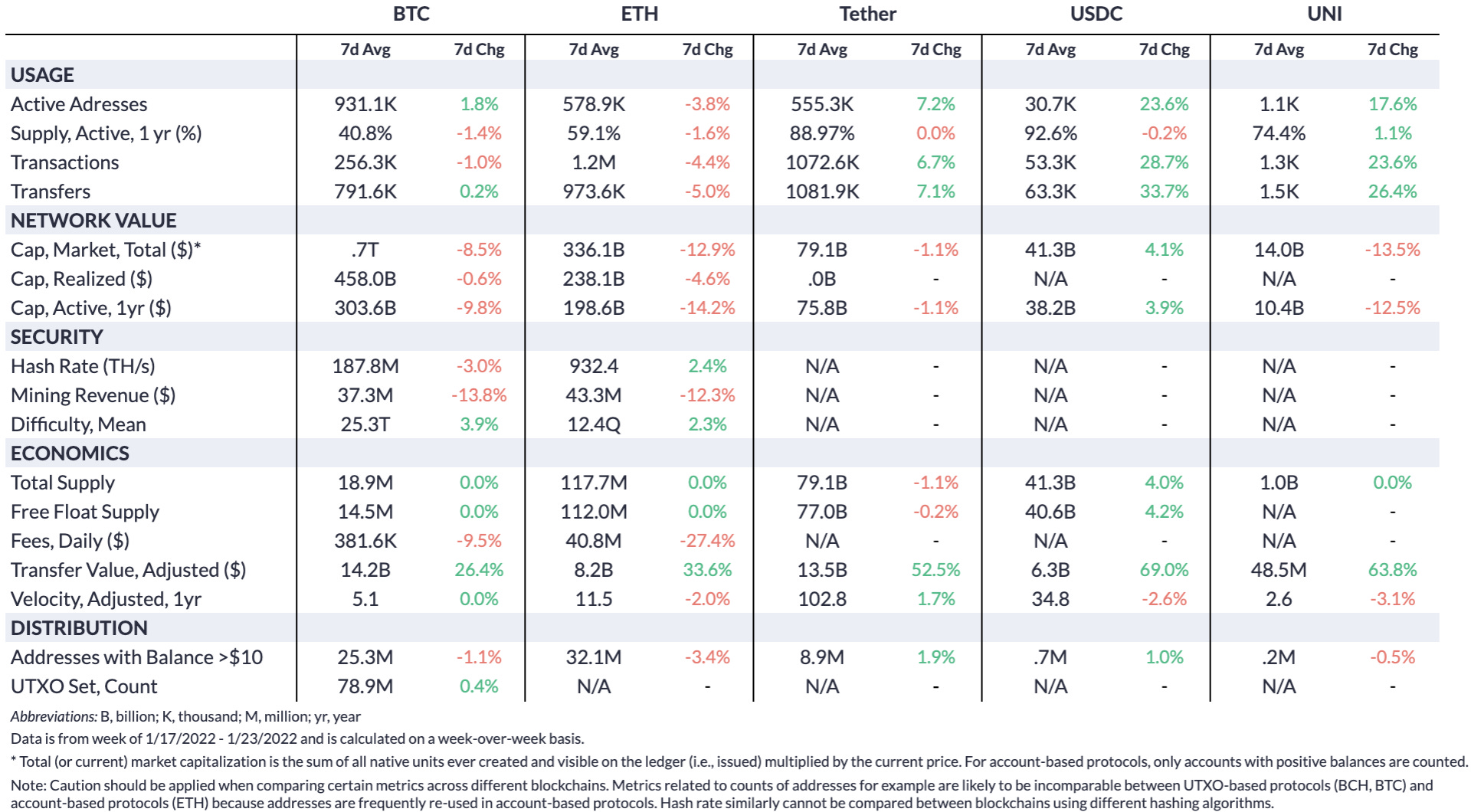

Get the best data-driven crypto insights and analysis every week: Crypto Follows Global Markets Lower to Start 2022By Kyle Waters and Nate Maddrey At the beginning of 2021, bitcoin (BTC), ether (ETH), and the broader crypto market were riding high buoyed by institutional adoption and accommodative macroeconomic trends. However, one year later and in a different macro environment, January 2022 has started off in the opposite direction for most crypto assets. Source: Coin Metrics Reference Rates Given the timing in January, it might be tempting to compare this recent bout of volatility to previous cycles in crypto assets’ history such as 2018. Yet, over the last year the macro environment has changed significantly and crypto assets are increasingly tied to price movements of other assets, such as stocks. Stocks have fallen along with crypto assets as global markets adjust to the Federal Reserve’s more aggressive stance. As of market close Monday, the NASDAQ Composite Index stood at around 13,855, falling close to 12.5% in 2022 so far. Mechanically, higher interest rates tend to dampen demand for riskier assets that have an uncertain future payout that must be discounted back to the present like high-growth tech stocks. Looking at returns for the S&P 500 Index and BTC over the last 6 months, the two have been tracking very closely with a correlation coefficient nearing an all-time high at 0.35. The change in the macro environment has had a negative impact on virtually all major markets, and assets perceived as high-risk such as tech stocks and crypto have been particularly hard hit. This differs from the 2018 crypto crash, which did not coincide with a major crash of tech stocks or other equities. Source: Coin Metrics’ Correlation Charts Subtly, markets tend to react not to interest rate increases themselves but to expectations about the future course of policy. As the Fed has shifted its language and announced quicker-than-expected plans for raising rates, markets are incorporating this new information. At best, this might mean the worst has already been priced in, all else being equal. Interest rates on US Treasuries have shifted higher, reflecting the Federal Reserve’s intentions to raise interest rates and fight off inflation. One of the best ways to visualize changes in interest rates is looking at the yield curve. The yield curve shows the available interest rate for bonds at different maturities. The chart below shows the yield curve for US Treasuries on two different dates: January 4th, 2021 and January 21st 2022. Interest rates, especially in the shorter term, have moved up compared with last year as markets have reacted to the Fed’s announcements surrounding likely rate hikes in the near future. Source: US Department of the Treasury Most of the shift upward has come in the last few months, as the Fed started adjusting its stance to the public. Source: US Department of the Treasury But while the macro picture darkens, some on-chain indicators are reaching points that historically have signaled market-cycle lows. One historically helpful on-chain indicator is market value (free float market capitalization) to realized value (realized capitalization) which is commonly referred to by its acronym of MVRV. To read more about on-chain indicators and how to better interpret MVRV, check out our on-chain indicators primer here. A MVRV of over 3 has generally marked local highs while a value under 1 has tended to coincide with low points in past market cycles. BTC’s MVRV now stands at a relatively low 1.16. However it’s important to note that an indicator’s past success does not guarantee its future reliability. Additionally, there have been several occasions where MVRV has dropped well below 1.0, including March 2020. Source: Coin Metrics’ Formula Builder In another potentially positive sign, much of Bitcoin’s supply has remained untouched in recent months, likely indicative of long-term holders’ conviction through downward price movements. BTC age distribution bands, also known as “HODL waves,” help to show this by grouping BTC’s supply by the time since it last moved on-chain. HODL waves give a macro view of how BTC’s supply has shifted over the years. Just about 60% of BTC supply has been dormant over the last year, having last moved over one year ago (light green band of 1-2 years up to coins that have never moved in purple). Source: Coin Metrics’ Formula Builder But outside of indicators, there are other signs on-chain that crypto adoption is still humming along, undeterred to short-term price deviations. The number of addresses holding relatively small amounts of BTC and ETH continues to push higher. The count of addresses holding between 0.01 and 1 ETH (charted on the right-hand side below) recently crossed a milestone of 20M, as activity related to NFTs continues to surge on the network. This is more than 2X the 9.8M such accounts on January 1st, 2021. Similarly, Bitcoin addresses holding between 0.001 and 0.1 BTC have increased from ~13.5M to ~16M since the beginning of 2021. Source: Coin Metrics’ Formula Builder Finally, it is important to note that builders are pouring into the crypto ecosystem, with recent data collected from GitHub pointing to thousands of new entrants to crypto research and development in recent months. With projects moving forward on exciting developments in areas such as layer-2 (L2) solutions, 2022 is still poised to be a breakout year for crypto adoption and growth regardless of short-term price action. To follow the data used in this piece and explore our other on-chain metrics check out our free charting tool, formula builder, correlation tool, and mobile apps. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro On-chain usage fluctuated over the past week as the crypto markets continued to tumble. ETH transactions declined by 4.4% week-over-week. But adjusted transfer value grew by 33.6%, likely due to an increase in trading volume. BTC transfer value also had a significant bump up, growing by 26.4%. Stablecoin activity increased across the board as more investors moved to safety - USDC active addresses increased by 23.6% week-over-week compared to a 8.8% increase for Tether (USDT). Network HighlightsCheck out our network highlights below:   Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. Check out the Coin Metrics Blog for more in depth research and analysis. © 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. If you liked this post from Coin Metrics' State of the Network, why not share it? |

Older messages

Coin Metrics' State of the Network: Issue 138

Wednesday, January 19, 2022

Wednesday, January 19th, 2022

Coin Metrics' State of the Network: Issue 137

Tuesday, January 11, 2022

Tuesday, January 11th, 2022

Coin Metrics' State of the Network: Issue 136

Tuesday, January 4, 2022

Tuesday, January 4th, 2022

Coin Metrics' State of the Network: Issue 135

Tuesday, December 28, 2021

Tuesday, December 28th, 2021

Coin Metrics' State of the Network: Issue 134

Tuesday, December 21, 2021

Tuesday, December 21st, 2021

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏