Surf Report - Surf Report: Fact from fiction

You’re getting this email because you signed up for Surf Report, my weekly take on economics, investing, Bitcoin, and business. I really appreciate you being here, but if you’d like to leave, simply scroll to the bottom to unsubscribe.

Hi everyone—I’m so glad to have you here. What a week. This week was packed with stories:

And get this: for the first time in the history of the 60/40 portfolio, the NASDAQ has been down more than 6% in a month while bonds have also been down. Bonds have traditionally been used as the “safe” cushion to hedge stock plunges like this. Something is deeply wrong. (One theory: “The lack of bidding you’re seeing in the bond market is because people don’t trust the currency.”) Meanwhile, in the world of the censorship-resistant, decentralized, peer-to-peer global monetary network with a fixed supply and rules kept out of the irresponsible paws of money manipulators:

It all reminds me of another story: Catch-22. The main thrust of the plot of this classic novel, and how “catch-22” became a colloquial expression for a paradoxical pickle to find oneself in (damned if you do, damned if you don’t) is this: the main character fears his commanders more than the enemy because the commanders increase the number of required combat missions before a soldier may return home, and retroactively raise that number as soon as it’s reached. The more missions he flies, the more missions he has to fly. This futile loop of manipulated metrics and ever-increasing difficulty just to stay alive sounds an awful lot like our runaway inflation problem, doesn’t it?

The thing to remember about the cartel of unelected bankers known as the Federal Reserve—which is neither a Federal institution nor holds any reserves—is that the political pressures they would face from raising interest rates are much, much larger than a tiny percentage increase in CPI inflation. “It's far easier to lie with CPI than to destroy the financial system by raising rates and putting a lot of banks out of business." As investor and macro analyst Lyn Alden put it: when push comes to shove, whenever the choice has been between crashing the market or printing more money, they print. They are businesspeople conducting business, and we’re caught in the middle.   Thomas Mann—Nobel prize-winning author of the novels Death in Venice, Magic Mountain, Doctor Faustus, and more—had much to say about the topic of inflation, being himself a German who saw firsthand the impact of hyperinflation in the Weimar Republic following the aftermath of WWI in 1923. He explored this topic in his 1925 novella Disorder and Early Sorrow. In this piece from The Review of Austrian Economics (which I plan to delve into in more depth on here in the future), Paul Cantor argues that Mann hit on an important insight on the relationship between truthful fictions and false realities—that inflation is a kind of reality-distortion mechanism that alters and subverts people’s ability to know what’s going on at all.

Notice that he’s not talking about lies per se, but rather the increasing unreliability and falseness of indictors that were previously used to judge reality, and the distrust that accumulates in a society or a system when people can’t believe anything they see, hear, or are told anymore. Things like: markets at all-time highs and charts showing The Best Economic Performance Since 1984™ while home prices remain out of reach, used car prices are skyrocketing, supply chains remain backed up, and the country is saddled with historically high levels of debt. This is what best economic performance in decades looks like? Nineteen Eighty-Four is right: “the novel examines the role of truth and facts within politics and the ways in which they are manipulated.”

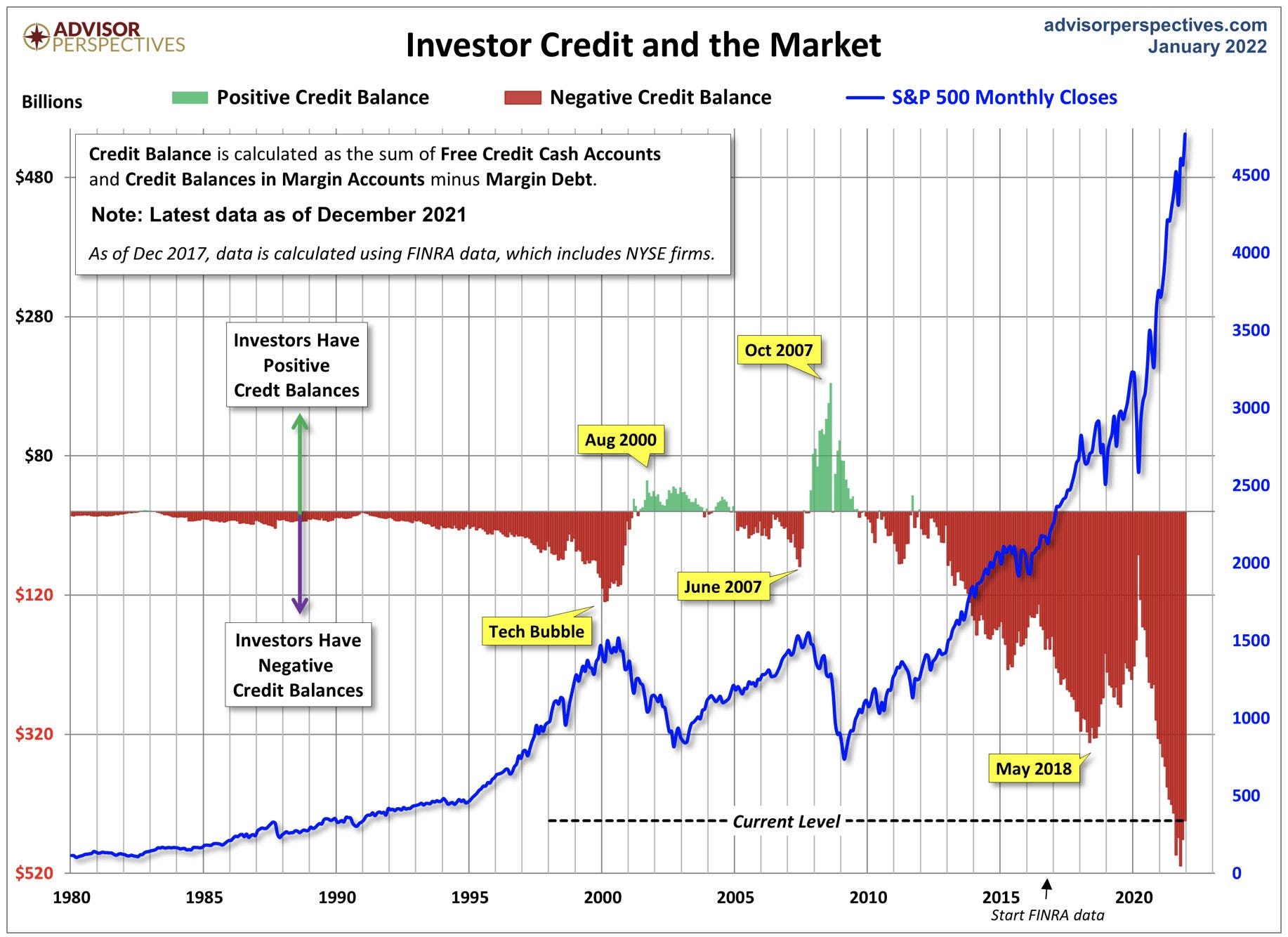

Not to beat a dead horse or state the painfully obvious, but the stock market being at historic highs while investors are holding historic amounts of debt is, historically, not a great place to be. To be super clear, and to return to the reason why the traditional 60/40 portfolio of stocks/bonds is completely broken:

A classic catch-22. Eventually stocks are expected to see a “repricing event” back down to more realistic fundamentals-based valuations, which would likely plunge us into a recession or depression… but only if the government allows it. They can always try to print, stimulate, and fake their way into more bailouts and universal basic income checks like last time. But can they? Again? Stranger things have happened. Or so I’ve read.

Until next time 🤙, Recommended Resources For Plan ₿Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨ Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨ Thanks for subscribing to Surf Report. If you liked this post, consider sharing it with someone else who might appreciate it! |

Older messages

Surf Report: Do you see what happens?

Sunday, January 23, 2022

Listen now | Issue 60: 01.23.22

Surf Report: The part & the whole

Sunday, January 16, 2022

Listen now (12 min) | Issue 59: 01.16.2022

Surf Report: Healthy and painful truth

Sunday, January 9, 2022

Listen now | Issue 58: 01.09.2022

Surf Report: Lessons of history

Sunday, January 2, 2022

Listen now (10 min) | Issue 57: 01.02.22

Surf Report: Naughty & Nice

Sunday, December 26, 2021

Listen now | 12.26.2021

You Might Also Like

$120k/Year with a small audience?

Wednesday, March 5, 2025

If you're wondering how to build a thriving business while staying authentic and leveraging the power of SEO and YouTube... ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Founder Weekly - Issue 675

Wednesday, March 5, 2025

March 05, 2025 | Read Online Founder Weekly (Issue 675 March 5 2025) Welcome to issue 675 of Founder Weekly. Let's get straight to the links this week. Mr. Wonderful Lost Out on $400 Million… Will

How advertisers unlock measurable outcomes for performance-based campaigns

Wednesday, March 5, 2025

Scaling performance advertising beyond search and social

Your Practical Path to Marketing Automation

Wednesday, March 5, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo We're halfway through the week, Reader, how's your marketing strategy

Maybe We Are Getting A Bitcoin-Only Strategic Reserve After All

Wednesday, March 5, 2025

Listen now (3 mins) | Today's letter is brought to you by Osprey Funds! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🕵️♂️ The “Write to Your Former Self” Growth Hack

Wednesday, March 5, 2025

PLUS A referral growth loop that fuels itself and a funnel that actually converts.

Communities Are The Rage

Wednesday, March 5, 2025

With centralized social media showing many of us how NOT to build community, people and brands are turning to community platforms to build out their own slice of the Web. Marketing Junto | News &

Musk takes an L

Wednesday, March 5, 2025

Judge shut down his legal move... but the fight's not over yet!

Primer: From Software to Schools

Wednesday, March 5, 2025

Watch now (47 mins) | To fix the school system, build schools ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Private funds pick their shots

Wednesday, March 5, 2025

PitchBook buys portfolio monitoring startup; AI's effects on emerging tech; humanoid robotics startup could hit $40B valuation Read online | Don't want to receive these emails? Manage your