The Daily StockTips Newsletter 02.02.2022

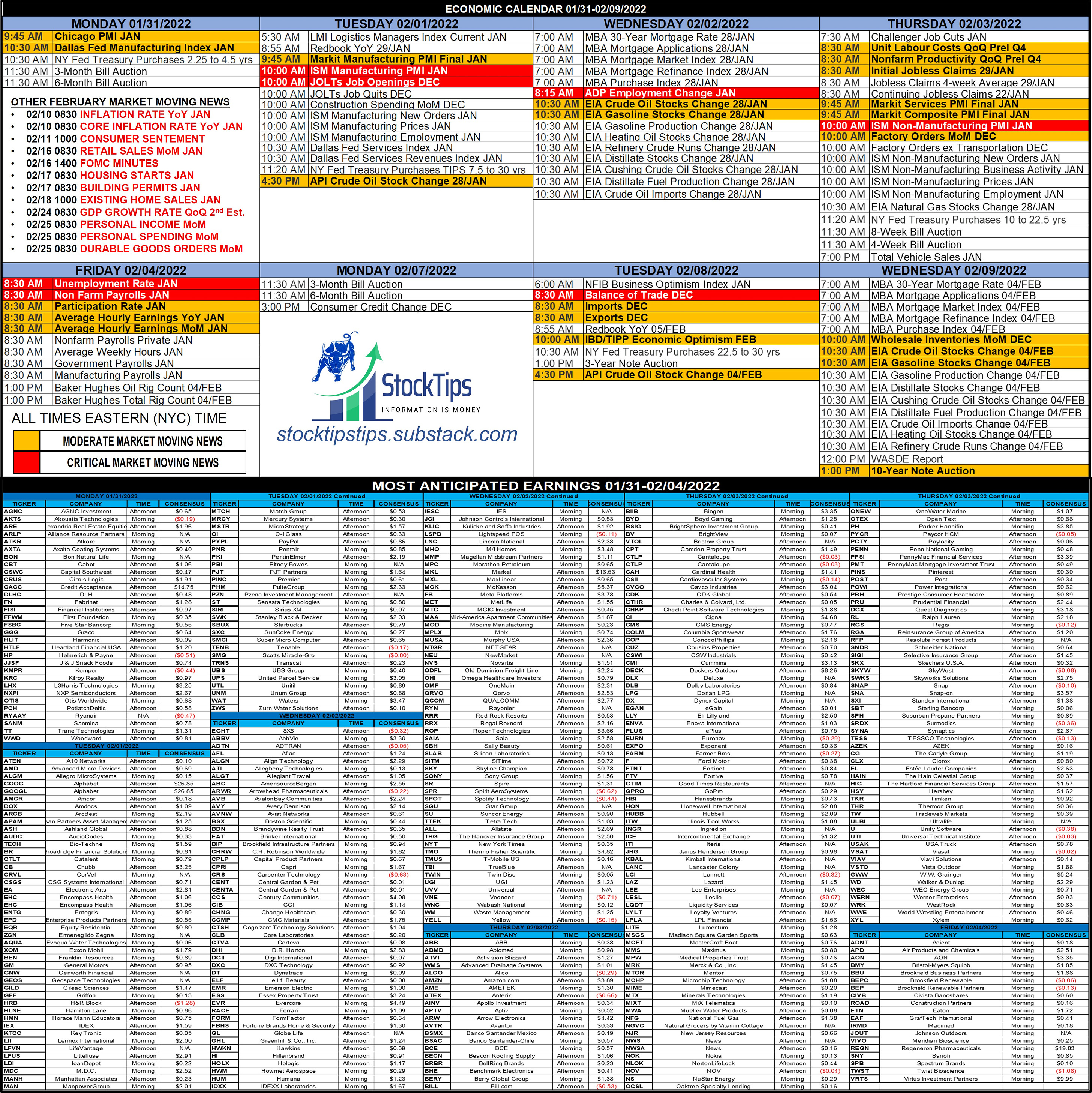

The Daily StockTips Newsletter 02.02.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red Indicates an Earnings Loss [Not Miss] Consensus), Yesterdays Insider Buys & Yesterdays Unusual Call Options Volume.INDISER BUYS / UNUSUAL CALL VOLUME / UNUSUAL PUT VOLUME TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! Earnings are Lagging: Last night I did a deep dive on earnings so far this quarter. Bullish sectors include agricultural inputs, some chemical companies, semiconductors, freight/shipping, banks (based on future Fed rate hike expectations), energy/oil, & there is some anecdotal evidence that apparel did well but its too early to tell. Profitable tech is roughly 50/50. Most everything else is underperforming. Revenues are often up, but EPS is down. Inflation is to blame. The cost of labor, energy, & inputs continue to be a barrier to increased profitability & earnings beats. Supply Chains are Still Gummed Up: Supply chains continue to be an issue. The cost of shipping goods have absolutely skyrocketed. While getting my vehicle serviced I met a fella who complained that it would take a month to get a new radiator for his Jeep. I also read a recent report that building materials can take a month or two to arrive after the order is placed … (February is usually the busiest time of year for building materials as builders stock up for the Spring/Summer seasons). Indeed there is little doubt in my mind that the rapid increase in the money supply is the largest contributor of inflation, however the supply chain crisis also doesn’t help. Also you would be surprised how little attention is given to high demand & increased cost of shipping in the media. In late December we were made to believe that it was all working itself out. Stories on shipping difficulties began to decline after the holiday season but prices remain at near all time highs. Headwinds Ahead: I have a responsibility to warn my subscribers that bullish companies are going to be increasingly hard to find in this environment. I therefore owe it to you to scrutinize my picks more than ever as a result of REAL headwinds. The quick turnarounds we were accustomed to in the past are simply not going to happen in this economy. A swing that may take a month or two last year may take a quarter or two this year. Therefore I think it prudent to buy in slow & only average down when it hurts. I think it best to warn of these conditions amid the distraction of outstanding Google earnings. While everyone else is monitoring the shiny object, now is the time to plan ahead & adjust accordingly as stocks rebound. Indeed I expect markets today to be lifted by Google, but the uncertainty of general market is warranted. Most companies remain profitable, but an adjustment in long term valuations & expectations are necessary. Buy List Update: Two companies on the BUY LIST reporting earnings today IMPORTANT REMINDER: INFLATION DATA TO BE RELEASED ON 02/10/2022 AVERAGE STATS ON ALL STOCKS ON THE BUY LIST AS OF MARKET CLOSE 01/27/2022 (FINVIZ & YCHARTS)

Significant News Heading into 02.02.2022:

PAID CONTENT IN THE PAYWALL BELOW:

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 01.25.2022

Tuesday, January 25, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 01.19.2022

Wednesday, January 19, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 01.04.2022

Tuesday, January 4, 2022

IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give

The Daily StockTips Newsletter 01.03.2022

Monday, January 3, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET)

The BUY List

Monday, January 3, 2022

All Buy List Additions Will Be Added Here (Additions Updated when Added, All Templates Updated Weekly)

You Might Also Like

🇨🇳 The US is out, China is in

Tuesday, March 11, 2025

Citigroup's forecast for US and Chinese stocks, Lego stacked bricks, and Boeing's investigation | Finimize Hi Reader, here's what you need to know for March 12th in 3:10 minutes. Citigroup

The Under-the-Radar Threat to Your Retirement

Tuesday, March 11, 2025

Nearly half of older adults are burdened by bad debt ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

15 Years Since We Bought Our Toxic Asset

Tuesday, March 11, 2025

In a new Planet Money plus episode, former Planet Money hosts David Kestenbaum and Chana Joffe-Walt look back at a pioneering series that sought to explain a major source of the 2008 financial crisis.

👋 Investors ditched the S&P 500

Monday, March 10, 2025

The US president didn't rule out a recession, but TSMC eased some of investors' other worries | Finimize Hi Reader, here's what you need to know for March 11th in 3:07 minutes. TSMC's

💳 Find a new credit card

Monday, March 10, 2025

Let's get those rewards ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Text and Telos

Monday, March 10, 2025

Plus! Diff Jobs; Scaling; Retail Investors; Comparative Advantage; Transaction Costs and Corporate Structure; DeepSeek Governance Text and Telos By Byrne Hobart • 10 Mar 2025 View in browser View in

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏